Double cut again! The stock god's tenth reduction of BYD's desire.?

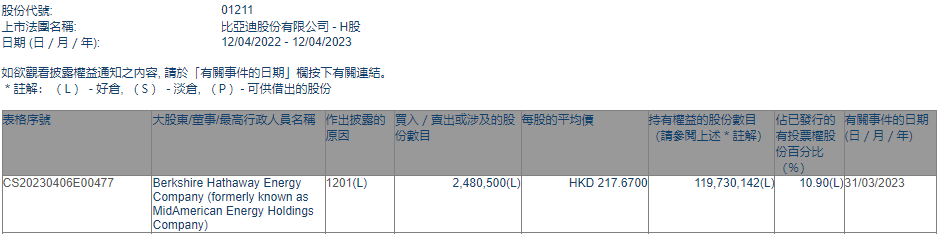

According to the Hong Kong Stock Exchange on April 11 disclosure documents show that on March 31, the stock god Buffett's Berkshire Hathaway (Berkshire Hathaway) again sold 2.48 million shares of BYD shares。

According to the Hong Kong Stock Exchange on April 11 disclosure documents show that on March 31, the stock god Buffett's Berkshire Hathaway (Berkshire Hathaway) sold a total of 2.48 million shares of BYD shares, with an average price of 217 per share..HK $67, a total of 5.HK $3.9 billion, with shareholding falling to 10% after reduction.90%。

Wang Chuanfu was injured again?Buffett cuts BYD for fourth time this year

As a "benchmark" for value investors, Buffett attracts market attention with every move.。This is the fourth time this year that HKEx has disclosed that Berkshire Hathaway has reduced its holdings of BYD's H shares, and the tenth time since August 2022 that the company has disclosed its reduction.。According to statistics, since the first reduction, Berkshire Hathaway has now reduced its holdings of BYD H shares by about 1.05 billion shares, positions have been reduced by nearly 50%。

Buffett's successive reductions have also caught the attention of BYD.。On March 29, at BYD's 2022 results conference, Wang Chuanfu had said that Buffett is a very important shareholder and supporter, equity changes are shareholders' own rights, no matter how much the reduction is still grateful to the other party's support.。He also said that BYD will also do its own business in the future, and believes that the reduction will have less impact on the company.。

BYD's recent good news is frequent. This reduction is more like controlling positions.

The market was somewhat surprised by the HKEx's disclosure of the reduction, after all, in February this year, Berkshire Hathaway Vice Chairman Charles Munger (Charles Munger) also said at the annual investor event held in the Daily News that BYD was one of its most successful venture capital cases ever.。He said no company has a return on investment that exceeds BYD's。

In terms of performance, BYD's performance in March continued to be strong, with a strong momentum in both domestic and overseas markets.。

On April 2, BYD announced this year's March production and sales express。According to the data, BYD sold 207,080 new energy vehicles in March 2023, with cumulative sales of 552,076 vehicles this year, up 92.81%。Among them, BYD's dynasty brand sales of 147,443 vehicles, marine brand sales of 48,248 vehicles, Tengshi brand sales of 10,398 vehicles。Overseas, BYD sold a total of 13,312 new energy passenger vehicles overseas in March 2023, and the total installed capacity of new energy vehicle power batteries and energy storage batteries in March was about 9.891GWh, with a cumulative total installed capacity of approximately 26 in 2023.991GWh。

In addition, domestic new energy production and sales data also continue to improve, BYD this year is still sitting on the top of domestic new energy sales.。

According to data from the China Automobile Association, in March this year, the production and sales of new energy vehicles completed 67.40,000 and 65.30,000 units, up 44% year-on-year.8% and 34.8%, the market share reached 26.6%。From January to March, the production and sales of new energy vehicles completed 1.65 million and 158, respectively..60,000 units, up 27.7% and 26.2%, the market share reached 26.1%。

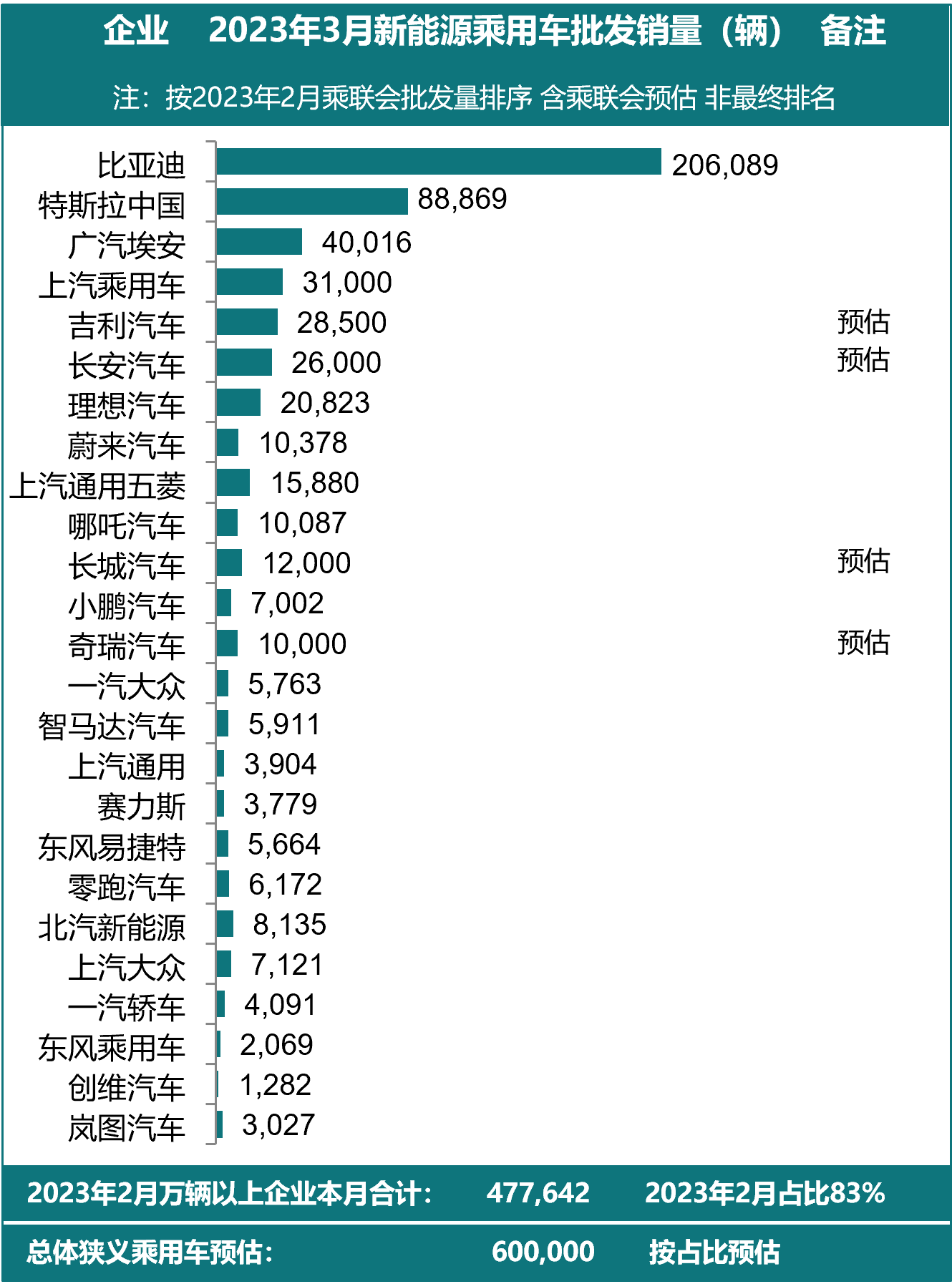

It is worth noting that BYD last year has won the new energy sales crown, this year, BYD once again ranked first with strong sales。According to the March new energy sales data released by the Federation, BYD again firmly ranked first in March with a sales advantage of over 200,000 vehicles, leaving Tesla China in second place for nearly 2.About 5 times。

BYD, there is also good news。

Just the day before yesterday, BYD just released its new energy-exclusive intelligent body control system-Yunxuan。The intelligent body control system is self-developed by BYD's full stack, which also marks BYD's becoming a Chinese car company that can independently master the intelligent body control system。The cloud-product matrix includes cloud-C, cloud-A, cloud-P and other products, which will greatly improve consumers' driving experience from the dimensions of comfort, handling, safety, and off-road。

However, the most eye-catching thing at this press conference is its cloud-X system. This system is a combination of the above three systems of C, A, and P. It is mainly equipped on the super sports car looking up at the U9. It can use lidar, The camera and other sensors predict the road conditions in advance and actively adjust the suspension, which is not inferior to Mercedes-Benz's magic control system.。

Wang Chuanfu, chairman and president of BYD, also said that Yunxuan is the first body system to systematically solve body control problems in the vertical direction。The system can perceive the state of people, vehicles, and roads in real time, which can make the vehicle remain comfortable under complex road conditions。

As we all know, BYD's investment in scientific research is very large.。This breakthrough will undoubtedly boost market confidence.。BYD has previously revealed that the company has reached the domestic leader in terms of secondary rechargeable batteries。In addition, the company is also actively promoting the listing plan of BYD semiconductor。

Last year, under the pressure of upstream costs, BYD is relying on technological innovation, through self-supply battery technology, firmly grasp the initiative in their own hands, only bright performance。

At the cloud press conference, Wang Chuanfu revealed that in the 20 years since entering the new energy vehicle track, BYD has invested hundreds of billions of yuan in research and development funds, with 6.A team of 90,000 people and 2.80,000 patents granted。

From the stock price point of view, so far, BYD shares rose nearly 16% during the year, the performance is not bad, the Berkshire reduction is also at the recent high of BYD shares.。It can be argued that this Berkshire Hathaway reduction should have nothing to do with the sell-off and is more likely to control the position。

Earlier, Munger had said that BYD's price-to-earnings ratio has reached 50 times, the price is already high, it is expected to still record more than 50% growth this year。He also said that we are not selling BYD, we have sold some BYD shares before, mainly because BYD's share price is already very high, and now BYD's market value has exceeded the market value of Mercedes-Benz.。That doesn't mean you don't like it anymore. BYD is a great company.。

In addition, as there is a view in the market that the moment is the end of the Fed's rate hike, there are also analysts who are cautioning against a risk pullback。Michael Hartnett, chief strategist at Bank of America, advised clients on Thursday to reduce or sell stocks as the Fed nears the end of its rate hike.。Hartnett is known as Wall Street's most prospective analyst, and his team successfully predicted that U.S. stocks would plunge last year。

Institutions are optimistic about BYD's market outlook BYD shares fell under pressure in the day.

In addition, the recent brokerage institutions have also issued research reports, have been optimistic about BYD。

IFC Securities Research Report believes that this year BYD will further cash out of the sea potential, sea growth certainty increases。BYD exported 15,002 vehicles in February this year, up 44 from the previous month..1%, close to the traditional offshore car company SAIC, achieving explosive growth。

Three factors are expected to continue to drive BYD's high growth, according to Anxin Securities。First, the company continues to achieve brand strength through high-priced products and precision marketing, service and other measures to achieve a sustained upward trend, Han, Seal and other models have gained a firm foothold, Tengshi, Yangwang and other high-end brands have been released, long-term help to form a significant product premium;。

China Post Securities said BYD's full-year car sales are expected to exceed 2.5 million units in 2023, and BYD will also launch a number of new products such as Seagull, Sea Lion, Frigate 05, Destroyer 07, Look U8, F brand first model, which is expected to contribute to the company's continued growth.。

BYD shares down 2 per day as of press time.11%, at 223.00 Hong Kong dollars。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.