August Report Card for EV Companies: BYD Leads, Huawei Transfers "AITO" Trademark

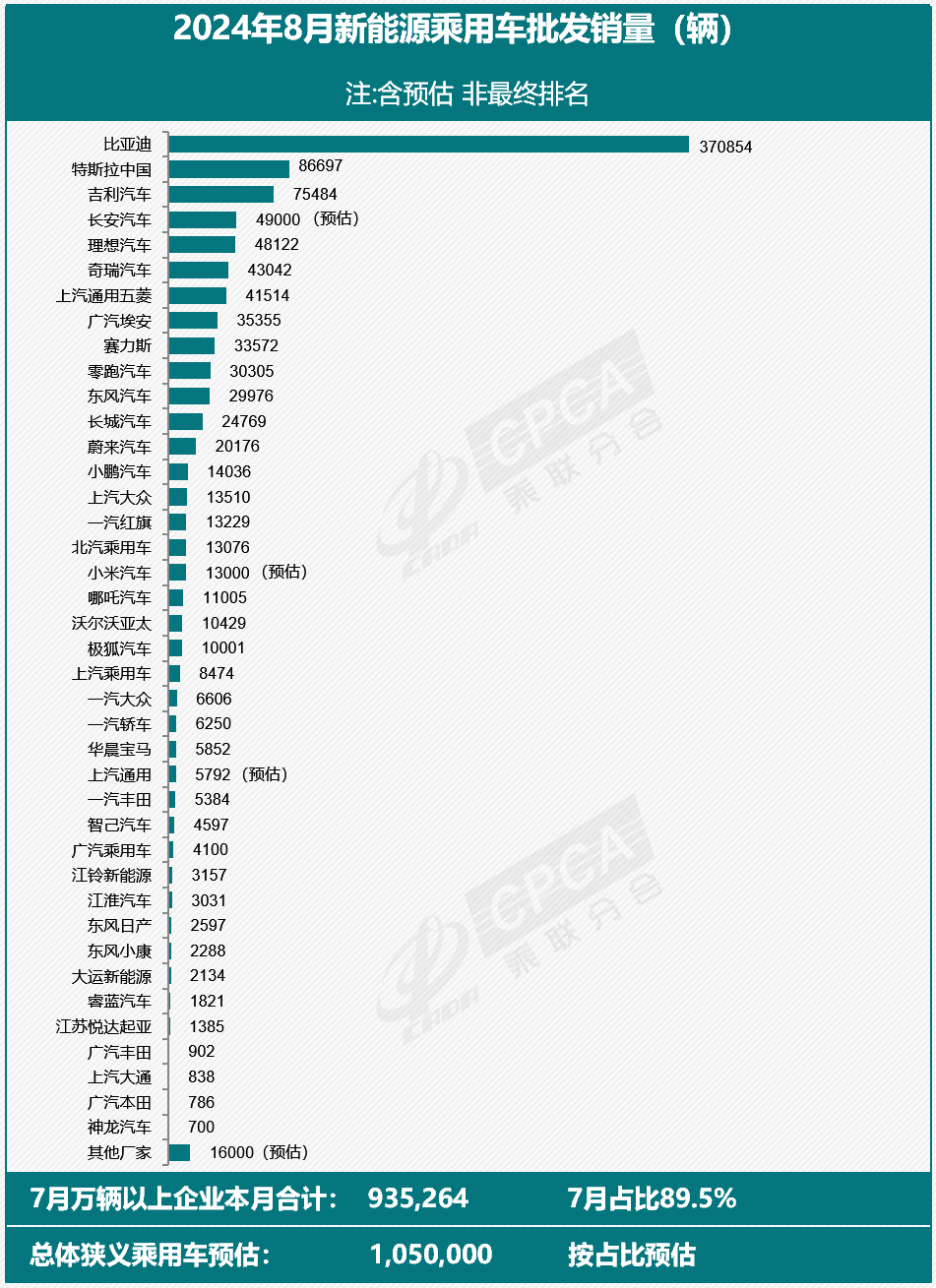

According to CPCA's comprehensive estimate of preliminary monthly data, the national wholesale sales of new-energy passenger car manufacturers in August amounted to 1.05 million units, up 32% year-on-year and 11% sequentially.

According to CPCA's comprehensive estimate of preliminary monthly data, the national wholesale sales of new-energy passenger car manufacturers in August amounted to 1.05 million units, up 32% year-on-year and 11% sequentially. Meanwhile, CPCA forecasts national wholesale sales of new-energy passenger vehicles to be 1.05 million units in August, which is the first time that monthly sales have exceeded 1 million units this year.

CPCA said that according to the relevant documents issued by the National Development and Reform Commission and the Ministry of Finance on July 25, the subsidy standard for the scrapping and renewal of domestic automobiles has been further increased. After the increase, the subsidy for the purchase of new energy passenger cars is 20,000 yuan, and the subsidy for the purchase of fuel passenger cars with a displacement of 2.0 liters or less is 15,000 yuan.

Due to the subsidy advantage of 5,000 yuan more for new energy passenger cars over fuel vehicles, the new energy vehicle market has been further stimulated by consumer enthusiasm, with strong growth in the entry-level pure electric vehicle and narrow plug-in hybrid markets.

According to CPCA, in recent months, the number of scrapping and renewal declarations has increased significantly from the previous year, fully reflecting the encouraging effect of the scrapping and renewal policy, and the terminal sales of new energy vehicles in August showed the trend of “off-season”, with the incremental consumption of new energy vehicles contributing a lot.

BYD and Tesla both achieved growth

BYD's August sales volume of 373,083 units, an increase of 36% year-on-year, an increase of 9%, a record high. Among them, 370,854 passenger cars were sold, up 35.3% year-on-year. Among them, BYD's plug-in hybrid vehicles (PHEVs) sales amounted to 222,384 units, the sixth consecutive record high, an increase of 73.1% year-on-year and 5.5% sequentially; and pure electric vehicles (BEVs) amounted to 148,470 units, an increase of 1.95% year-on-year and 14.2% sequentially. Plug-in hybrids remain the mainstay of BYD's growth.

In terms of overseas exports, BYD exported a total of 31,451 passenger cars in June, up 25.7 percent year-on-year and resuming growth of 4.8 percent sequentially.

Look specifically at the sales of BYD's various brands.

The Dynasty and Ocean series remain BYD's mainstay of sales, with a total of 355,679 units sold in August, up 35.5 percent year-on-year. DENZA, the joint venture brand between BYD and Mercedes-Benz, sold a total of 9,989 units in August, down 3% year-on-year. on August 20, BYD released the DENZA Z9/Z9 GT, with a pre-sale price of 339,800 yuan, which exceeded the market's expectations, and the total number of pre-sale orders had already exceeded 20,000 units by the end of August.

In the high-end series, the FangChengBao sold 4,876 units in August, a 165 percent jump from a year earlier, driven by a price-cutting campaign, while the Yangwang brand fared a bit worse, selling 310 units in a single month, a 29 percent decline from a year earlier.

Last week, BYD announced its first-half financial results. In the first half of the year, BYD's revenue was 301.127 billion yuan, up 15.76 percent year-on-year. Net profit of 13.631 billion yuan, up 24.44%. In addition, BYD's gross profit margin for automobiles, automobile-related products and other products in the first half of the year was 23.94 percent, an increase of 3.27 percentage points year-on-year.

BYD said in the report that despite increasingly fierce competition in the market in the first half of the year, the brands drove the group's sales to steady growth. Looking ahead to the second half of the year, policy and industry resonating upward will help new energy penetration continue to grow.

In addition, for the 2024 sales target, BYD hopes to achieve more than 20% growth on the basis of 3.02 million units in 2023. In the first eight months of this year, BYD has sold a total of 2.328 million vehicles, which is close to 80% of last year's sales.

For Tesla, deliveries at Tesla's Shanghai Superfactory totaled 86,697 units in August, up about 3 percent year-on-year and 17 percent sequentially, according to CPCA.

In terms of sales, Tesla sold more than 63,000 units in China in August, up 3% year-on-year and 37% sequentially, a new sales high so far this year. In terms of models sold, Model Y sales exceeded 45,000 units in August and Model 3 sales reached 18,000 units.

GAC Aion posts seventh consecutive month of negative yoy growth

According to official data from Geely Auto, Geely sold a total of 181,229 new vehicles in August, up 21 percent year-on-year. Among them, 47,042 pure electric vehicles were sold, up 56 percent year-on-year, while 28,442 plug-in hybrid vehicles were sold, up 82 percent year-on-year.

On the export front, Geely's August vehicle export sales amounted to 45,045 units, up 98 percent year-on-year.

Geely's much-hyped all-electric vehicle brand ZEEKR delivered 18,015 vehicles in August, up 46 percent year-on-year and 15 percent sequentially.

According to officials, ZEEKR's model matrix will receive a new model. Its first luxury five-seat SUV, the ZEEKR 7X, has opened for pre-sale with a starting price of 239,900 yuan. The vehicle is expected to be officially launched on September 20 and deliveries will begin at the end of September, which is expected to be a catalyst for ZEEKR's next sales.

On August 21, ZEEKR released its 2024 second quarter financial results. ZEEKR revenue in the second quarter exceeded 20 billion yuan, an increase of 58% year-on-year, a single-quarter record high, gross margin of 17.2%, profitability steadily improved. Revenue for the first half of the year was nearly 35 billion yuan, an increase of over 60% year-on-year.

As of the end of August, ZEEKR has entered more than 30 international mainstream markets around the world. Currently, ZEEKR has 458 open stores worldwide, of which, 424 are domestic and 34 are overseas.

In addition, the cooperation between ZEEKR and Waymo, a U.S. self-driving cab company, has made new progress. According to ZEEKR's official disclosure, its exclusively customized model for Waymo, equipped with Waymo's sixth-generation self-driving system, has been officially opened for road testing in the U.S. in August, and the U.S. will be put into commercial operation in the future.

According to CPCA's estimated data, Changan Auto sold 49,000 new energy passenger cars in August. As the most popular autonomous brand under Changan Auto, DEEPAL performed well in August, delivering 20,131 units in a single month, up 37% year-on-year and 20% sequentially.

GAC Aion's sales continued to be under pressure in August. According to official data, global sales of 35,355 units in August were essentially flat sequentially and down 32% year-on-year. So far this year, GAC Aion's sales performance has been lackluster. Starting from February this year, GAC Aion's single-month sales have been negative year-on-year for seven consecutive months.

For SAIC, it sold more than 86,000 new energy vehicles in August, and its cumulative sales of new energy vehicles from January to August totaled 619,000 units, up about 11% year-on-year.

Competition among “New forces in car manufacturing” intensifies

●Li Auto

Li Auto continued to occupy the No. 1 position among the “new forces” in August.

Officially, Li Auto delivered 48,122 new vehicles in August, up 37.8 percent year-on-year, and down 5.6 percent from the record 51,000 vehicles delivered in July. The company's low-priced SUV, the Li L6, has sold more than 20,000 units for the third consecutive month, holding up almost half of monthly sales.

Last week, Li Auto reported its second quarter 2024 financial results. The data showed that Li Auto's revenue for the second quarter rose 10.6 percent year-on-year to 31.7 billion yuan, with growth slowing again. Adjusted net income was $1.5 billion, down 44.9% year-on-year. Meanwhile, gross margin was recorded at 19.5 percent, down from 21.8 percent a year ago and 20.6 percent in the first quarter of this year. The company said it expects gross margins to improve in the third quarter, or rebound to the upper 20 percent range.

Li Auto's market share in the 200,000 yuan-and-above NEV (new energy vehicle) market rose to 14.4 percent in the second quarter from 13.6 percent in the first quarter, according to data revealed by company executives.

In its earnings report, Li Auto expects deliveries in the third quarter to be between 145,000 and 155,000 units. Now that the delivery figures for July and August are out, Li Auto will only need to deliver more than 45,878 units in September to reach the lower end of the company's target.

●HIMA

In August, HIMA (Harmony Intelligent Mobility Alliance) delivered 33,699 new cars across the board, a decline of about 24% from the previous month. The AITO series, the mainstay of HIMA's sales, delivered 31,216 new vehicles in August, down 25% sequentially.

The year-on-year decline in the AITO series also affected the performance of SERES, the brand launched by SERES in partnership with Huawei, which accounts for the majority of SERES' sales. According to the August 2024 production and sales snapshot released by SERES, its new energy vehicle sales stood at 36,181 units, surging 479.55% year-on-year, but slipping 14% sequentially.

Notably, the latest public information shows that Huawei's transfer of the AITO trademark to SERES has been completed.

Early last month, SERES Automotive had announced that it intended to use 2.5 billion yuan to acquire 919 registered or pending applications for AITO, AIITO, AITOAUTO, AITO SELECT and other series of word and graphic trademarks held by Huawei and its affiliates, as well as 44 automotive design patents.

Officially, the market value of the subject assets expressed on May 31, 2024, the appraisal base date, is 10.233 billion yuan, according to the appraisal. This means that the transaction price of SERES and Huawei is 2.5 percent off compared to the market price.

Regarding the transfer of the trademark, Huawei explained that the move was made due to the requirements of national regulations, which require that brand owners and manufacturers must be one and the same, and the brand must be owned by the manufacturer. Therefore, Huawei is now in accordance with the requirements of the national regulations, the brand let the producer own.

In accordance with these regulations, Huawei has also transferred the Luxeed and STELATO trademarks to partner automakers such as Chery Auto and Baic Bluepark New Energy, respectively.

●Leapmotor

In August, Leapmotor's deliveries surpassed the 30,000 mark, overtaking NIO to become the third-ranked new carmaker.

According to official data, Leapmotor delivered a total of 30,305 units in August, becoming the third new car-making force to break the 30,000 monthly sales mark, with a year-on-year growth of more than 113.5% and a year-on-year growth of more than 37.1%.

On August 15, Leapmotor Auto released its financial report for the first half of 2024. in the first half of 2024, Leapmotor Auto's operating income was RMB 8.85 billion, a year-on-year increase of 52.2%. Deliveries amounted to 86,696 units, an increase of 94.8% year-on-year. Leapmotor's gross margin was 1.1% in the first half of the year, a significant year-on-year improvement, thanks to the scale effect brought about by the increase in sales volume and continued cost control; gross margin improved to 2.8% in the second quarter, and the company expects better gross margin performance in the second half of the year.

●NIO

NIO's performance remained steady in August.NIO Automotive said it delivered 20,176 electric vehicles in August, up 4.4% year-on-year and down a modest 1.6% sequentially, marking the fourth consecutive month of 20,000-plus sales for NIO.

In addition, NIO Motors' new mainstream sub-brand Onvo has opened 105 stores. new Onvo L60 vehicles arrived in stores and deliveries will begin later in September.

●Xpeng

Xpeng Auto delivered 14,036 units in August, up 3% year-on-year and 26% year-on-year, marking the sixth consecutive month of year-on-year growth.

On Aug. 27, Xpeng Auto officially launched the Mona M03, a car that benchmarks the Tesla Model 3 but is much cheaper than the Model 3, with a starting price of 119,800 yuan.

Officially, the M03 captured 50,000 orders within three days of its launch. Yang Guang, product manager of the Xiaopeng MONA M03, revealed that the company's goal is for the M03 to sell more than 10,000 units a month, or even more. Analysts also expect that MONA M03 is expected to be a catalyst for Xpeng Auto's sales.

●NETA

Official data showed that NETA Auto delivered 11,005 units of its entire lineup of vehicles in August, down 9 percent year-on-year and basically flat sequentially. It is worth noting that NETA Auto's sales have declined year-on-year for six consecutive months since February this year. How to further increase sales has become a pressing issue for the company.

●Xiaomi

According to official data, Xiaomi Auto's deliveries exceeded 10,000 units in August, with sales exceeding 10,000 for three consecutive months.

On August 22, Xiaomi released its second quarter earnings report. The financial report mentioned that in the second quarter, Xiaomi's innovative business segment such as intelligent electric vehicles had a revenue of 6.4 billion yuan, and the gross profit margin of the segment was as high as 15.4%. Xiaomi's first time building a car, the delivery of the first quarter of the gross margin achieved double-digit, the performance is very bright.

The company expects to achieve its target of 100,000 cumulative new vehicle deliveries of Xiaomi's SU7 series in November 2024 ahead of schedule, and the company will also sprint towards its new target of 120,000 cumulative new vehicle deliveries for the whole of 2024.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.