Buffett reduced his holdings of BYD to less than 5% without further disclosure in the future

Buffett and Munger have held BYD for 14 years and sold below 5% in less than two years.

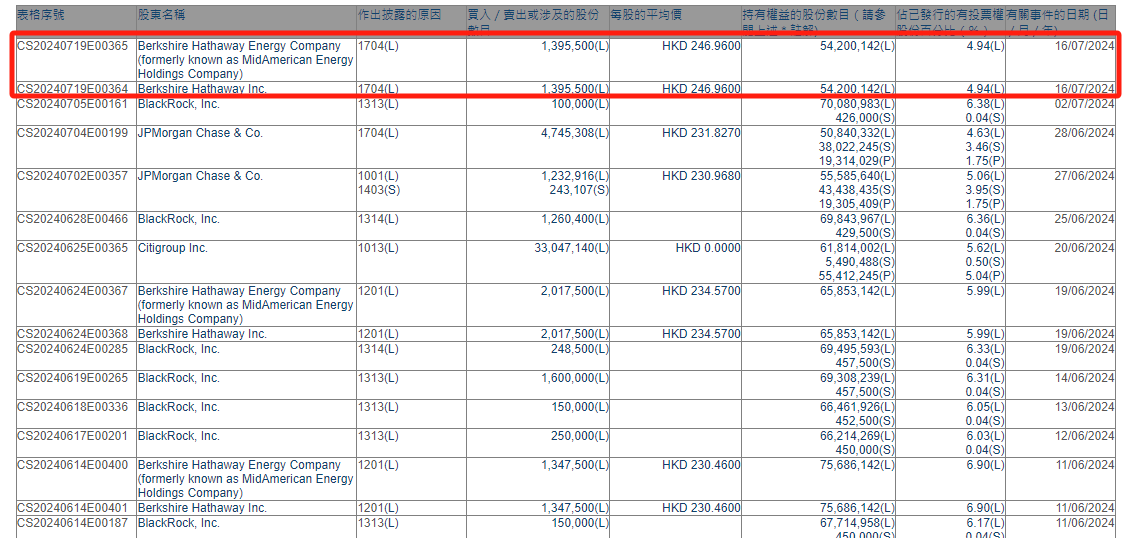

On July 22, according to HKEX documents, "Oracle of Omaha" Warren Buffett once again reduced his holdings in BYD, decreasing his stake from 5.06% to 4.94%. Since Berkshire Hathaway's current holding ratio in BYD has fallen below 5%, the company will no longer need to disclose any future divestment actions.

HKEX documents show that Berkshire Hathaway sold over 1.39 million BYD H-shares on the 16th of this month, with an average share price of HKD 246.96, cashing out HKD 345 million. Because this divestment crossed a whole percentage point (5.06% to 4.94%), it needed to be disclosed to the HKEX.

In September 2008, Berkshire Hathaway first subscribed to 225 million BYD H-shares at a price of HKD 8 per share, opening the prelude to its investment in BYD. That year, the "gods of stock" duo - Charlie Munger and Warren Buffett - both highly favored BYD Chairman Wang Chuanfu, and their cooperation has been passed down as a good story. Munger once commented on Wang Chuanfu: "He is simply a combination of Edison and Welch, he can solve technical problems like Edison, and at the same time, he can solve corporate management issues like Welch." In February 2018, Buffett mentioned in an American interview that Wang Chuanfu of BYD was one of the four CEOs he most admired.

The cooperation between the two sides lasted for many years until the Berkshire Hathaway shareholders' meeting in 2021, when Munger expressed concerns about the over-hype of some electric vehicle stocks. Although BYD's stock price rose, Charlie Munger did not reduce his holdings in BYD until a year later, on August 24, 2022, when Berkshire Hathaway first reduced its holdings in the stock.

At that time, BYD's stock price had increased 30 times from 14 years ago, and due to the continuous buying over these years, Berkshire Hathaway's holding ratio before the reduction was as high as 19.92%. When asked about the reason for Buffett's reduction, he cited the example of Ford's rise and fall to prove the ruthlessness of the automotive industry. Munger continued to "be both kind and firm," stating in an interview: "Based on the current stock price, BYD's market value is higher than that of Mercedes-Benz, which is not a cheap stock. But on the other hand, it is a very outstanding company."

Since then, Berkshire Hathaway has embarked on a long road of reduction. As of last month, Berkshire's holding ratio in BYD has been reduced from the initial 19.92% to the current 6.9%, and the number of shares held has decreased from 225 million to 75.6861 million, with a total reduction of about 149 million shares. Buffett and Munger have held BYD for 14 years, and it took less than two years to sell to below 5%.

Regarding the reason for Buffett's reduction, BYD said it is communicating with the other party. As for the question of whether the company's valuation is too high, BYD emphasized that its operating conditions are good, and both sales and profits are growing.

Public information shows that in 2023, BYD's operating income reached 602.315 billion yuan, a year-on-year increase of 42.04%; net profit was 30.041 billion yuan, a year-on-year increase of 80.72%. In terms of sales, BYD sold more than 3 million new energy vehicles in 2023, a year-on-year increase of 61.9%, becoming the first new energy vehicle company to exceed an annual sales volume of 3 million.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.