Buffett reduced his stake in Activision Blizzard, nearly 70% of the stock god again arbitrage success.?

As of June 30, Buffett's Berkshire Hathaway held about 14.7 million shares of Activision Blizzard, according to public information..9%。In contrast, the shareholding ratio at the end of March this year was 6.3%, and the shareholding at the end of 2022 is 6.7%, Berkshire's position has been cut by nearly 70%。

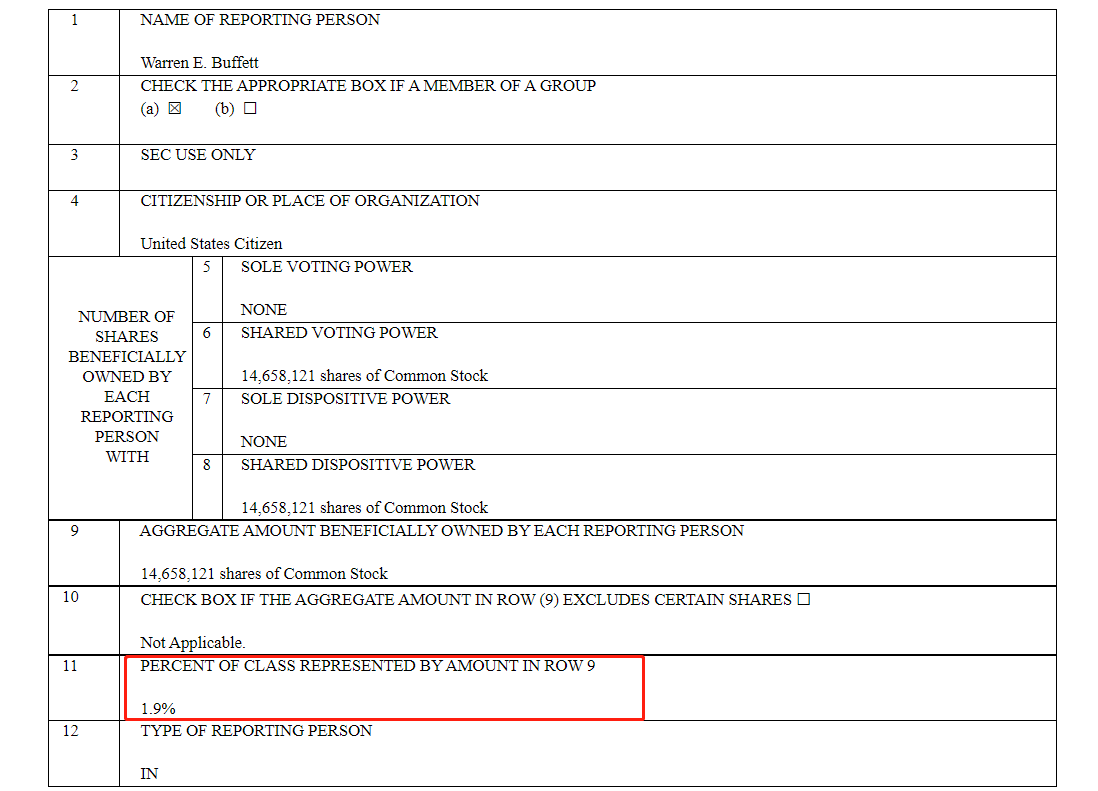

On July 17, local time, according to documents disclosed by the U.S. Securities and Exchange Commission (SEC), as of June 30, Warren Buffett's Berkshire Hathaway (Berkshire Hathaway) held about 14.7 million shares of Activision Blizzard, a shareholding of 1..9%, worth 12.$400 million。In contrast, the shareholding ratio at the end of March this year was 6.3%, and the shareholding at the end of 2022 is 6.7%, Berkshire's position has been cut by nearly 70%。

The filing did not specify the price at which the shares were bought and sold, nor did it disclose whether Berkshire bought or sold Activision Blizzard shares in July.。

Berkshire Hathaway first bought a stake in Activision Blizzard worth about $1 billion long before Microsoft announced the acquisition in 2021.。Buffett said the purchase of Activision Blizzard was made under the guidance of his two investment lieutenants, Todd Combs or Ted Weschler, at a cost of about $77 per share.。

After Microsoft announced the acquisition, Buffett thought the deal would work, prompting him to up the ante。Buffett raises stake to nearly 10% in 2022。

Berkshire currently holds 4,658,121 shares of Activision Blizzard, which is exactly the same size as before Buffett began to enter the market, which makes Buffett's investment in Activision Blizzard more like an "arbitrage" trade, and now is the time for him to "exit."。

Buffett chose to arbitrage Activision Blizzard because he believes investors are too pessimistic about regulators approving Microsoft's deal to buy Activision Blizzard。At Berkshire's annual meeting in April 2022, Buffett told shareholders he didn't know whether regulators would back the acquisition, valuing Activision Blizzard at $95 per share, but "one thing we do know is that Microsoft is not bad for money."。He added: "If the deal is successful, we can make some money, and if the deal is not successful, who knows what will happen."。"

Microsoft offered to buy Activision Blizzard for $95 in January 2022, and as of today, Activision Blizzard's closing price is 93.21美元。

The deal had previously faced filibuster from regulators in the US and UK, but made significant progress last week.。On July 11, a U.S. federal judge ruled that the FTC had not provided evidence to prove its claim that the acquisition would hurt competition in the gaming industry and said that Microsoft's acquisition of Activision Blizzard could go ahead.。Now the deal only leaves "hurdles" on the part of UK regulators。

Microsoft president Brad Smith said the company was seeking to amend its deal "in a way that is acceptable to the UK Competition and Markets Authority (CMA)."。

DA Davidson & Co analyst Franco Granda said: "Microsoft and CMA do seem to be able to reach an agreement in the coming weeks.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.