Shareholding ratio less than 7%! Buffett again reduces his stake in BYD to cash out more than HK $300 million

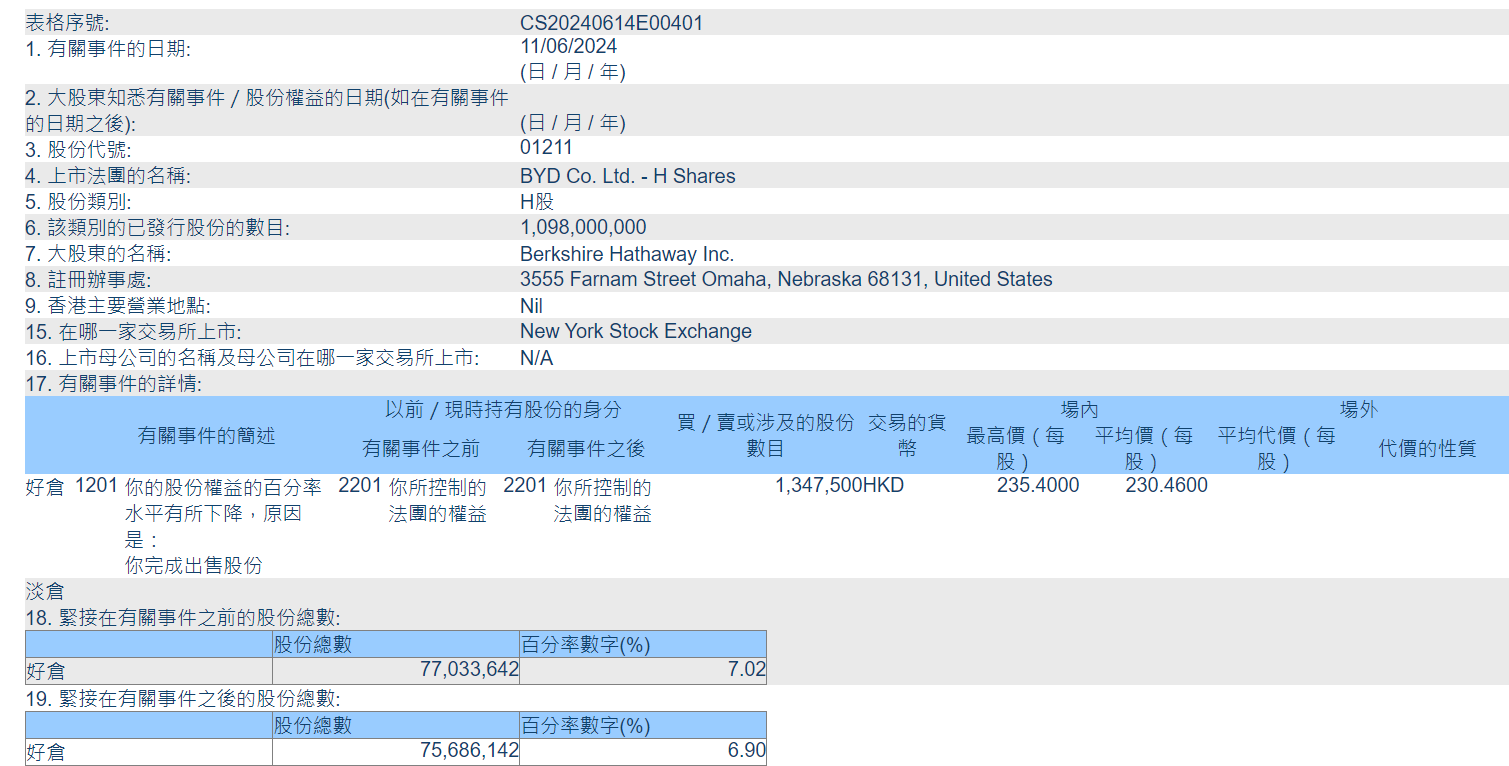

On June 11th, Buffett's Berkshire Hathaway continued to reduce its holdings in BYD, selling a total of 1.3475 million BYD H-shares at an average price of HKD 230.46 per share. The transaction involved a total of HKD 310 million, with the shareholding ratio dropping from 7.02% to 6.9%.

According to information disclosed by the Hong Kong Stock Exchange, on June 11th, Berkshire Hathaway Inc., a subsidiary of Buffett, continued to reduce its holdings in BYD, selling a total of 1.3475 million H-shares of BYD at an average price of HKD 230.46 per share. The transaction involved a total of HKD 310 million, and the shareholding ratio decreased from 7.02% to 6.9%.

After this reduction, Berkshire Hathaway still holds 75.6861 million BYD H-shares.

Investing in BYD is one of Buffett's few investments outside of the United States. In September 2008, at the suggestion of the late Charlie Munger, Berkshire purchased up to 225 million shares of BYD for HKD 1.8 billion at a price of HKD 8 per share.

Since then, BYD's stock price has experienced several major declines, and Berkshire's holdings have remained steadfast until 2022. During this period, BYD's H-share price reached a peak of HKD 326.4.

On August 24, 2022, Berkshire reduced its holdings of BYD for the first time, and over the following two years, it reduced its holdings more than ten times. Berkshire's shareholding ratio has also dropped from its peak of 19.92% in August 2022 to its current 6.9%. According to statistics, Berkshire has cumulatively reduced its holdings in BYD and cashed out more than HKD 22.2 billion.

It is worth noting that on the second day of Berkshire's reduction of its stake in BYD shares (June 12), the European Union announced a temporary countervailing duty on pure electric vehicles imported from China, with a temporary countervailing duty of 17.4% on BYD's electric vehicles. Currently, the EU import tariff for electric vehicles in China is 10%. The combination of the two means that in the future, BYD's export tariffs for electric vehicles to Europe will reach 27.4%.

However, as BYD has the lowest proportion among the car companies subject to temporary anti subsidy tariffs and basically meets market expectations, its stock price has not reacted negatively to the news. Even the day after the news was announced, BYD's stock price jumped by 7% at one point, with a closing increase of over 4%. In the following trading days, BYD's stock price continued to steadily rise.

UBS believes that the additional 17.4% tariff imposed by the European Union may have a controllable impact on BYD, as it has a significant cost advantage compared to its peers, although the additional tariff will weaken its cost advantage.

Lyon also mentioned that the EU's 17.4% tariff on BYD's car exports is more moderate than market expectations.

Lyon's channel survey of local dealers shows that BYD may respond to tariffs by raising prices, reducing dealer rewards, and losing profits. Lyon estimates that the direct impact of tariffs on BYD's 2024 profits is approximately RMB 500 to 1 billion, accounting for approximately 1% to 3% of its net profit forecast for BYD.Currently, BYD is building its first European electric vehicle factory in Seged, Hungary. Once the factory is put into operation, it will significantly reduce the impact of tariffs.

Morgan Stanley also mentioned that due to the tariffs mainly targeting pure electric vehicles, there may be more Chinese made plug-in hybrid vehicles (PHEVs) entering Europe, which is good news for BYD.

According to BYD's data in May, its passenger car sales reached 330488 units, a year-on-year increase of 38.2%. Among them, the sales of PHEVs were 184093 units, a year-on-year increase of 54.07%; There were 146395 pure electric vehicles (BEVs), a year-on-year increase of 22.4%. This indicates that BYD's main sales force is still PHEV, and this trend is still maintained at present.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.