"Stock god" stocks also lose money?Berkshire Q3 net loss 127.$6.7 billion

In the third quarter, Berkshire's cash growth reached new heights: 7% growth in a single quarter, bringing the total size to a staggering $157 billion, breaking the previous record of $149 billion also set by Berkshire in late 2021.。

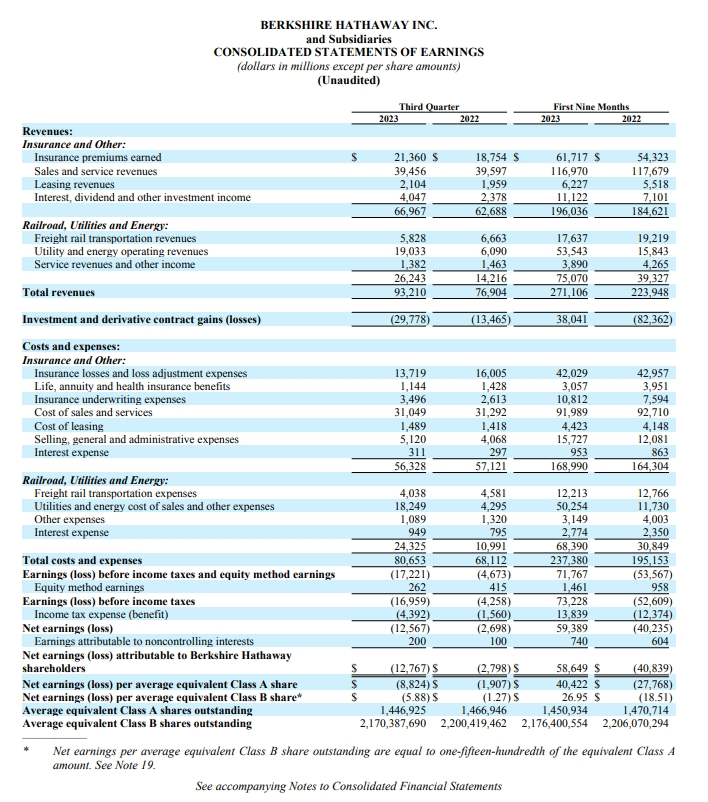

On November 4, local time, Buffett's company, Berkshire Hathaway, released its third-quarter 2023 results。Data show that Berkshire's total revenue during the reporting period amounted to 932.$100 million, beating market expectations from 769.$04 billion; net loss to parent widened to 127.$700 million, compared to 27.$9.8 billion; cash reserves hit a new high of $157.2 billion。

"Stock God" Stock Market Losses US $24.1 Billion?

In terms of investment activity, which the market is more concerned about, Berkshire underperformed in the third quarter, with a huge investment loss of $24.1 billion on investment income from equity securities positions.。In terms of Berkshire's holdings, the market value of Berkshire's holdings as of September 30 was 3,186.At $2.1 billion, the top five heavyweights accounted for 78% of the position, namely Apple ($156.8 billion), Bank of America ($28.3 billion), American Express ($22.6 billion), Coca-Cola ($22.4 billion), and Chevron ($18.6 billion).。In the third quarter, four of the five major stocks recorded declines, with Apple down 11.61%, Bank of America fell 3.77%, American Express fell 14.06%, Coca-Cola fell 6.3%, only Chevron up 8.19%。

In response, Berkshire said that since investment income measures only the book value of Berkshire's stock, almost none of those book losses materialized in the third quarter。According to the earnings report, Buffett and his team bought only $1.7 billion worth of shares in the third quarter, but the amount sold was worth about $7 billion and the net sale was a mere $5.3 billion, figures that compare to the market value of Berkshire's holdings.。Berkshire said, "The amount of investment gains / losses in any given quarter is usually meaningless, and the net income (loss) per share figures provided can be extremely misleading to investors who know little or nothing about accounting rules."。"

If you look at Berkshire's operating profit (excluding investment losses), Berkshire's operating profit reached 107 in the third quarter..600 million U.S. dollars, up 40 percent from the same period last year..1%, an excellent performance, mainly due to the excellent performance of Berkshire's insurance business in the third quarter.。

Among them, the third quarter insurance underwriting operating profit reached 24..$200 million, up 94% month-on-month; insurance investment operating profit of 24.$700 million, up 4.3%; operating profit from other holding operations and operating profit from non-holding operations were 33.$400 million and 2.$2.6 billion。Separately, Pilot Travel Centers, a truck stop business that Berkshire acquired earlier this year, also contributed 1.$8.3 billion。

Buffett's cash hoard is nowhere to be put.

In the third quarter, Berkshire's cash growth reached new heights: 7% growth in a single quarter, bringing the total size to a staggering $157 billion, breaking the previous record of $149 billion also set by Berkshire in late 2021.。

Berkshire can hoard so much cash in a quarter for three reasons。

First, Berkshire has a large amount of U.S. Treasuries in its hands.。Over the past period of time, Buffett and his team have been converting the proceeds of stock sales, as well as the cash flow generated by Berkshire's many businesses, directly into cash and U.S. Treasuries, which has led to Berkshire's hoarding of large amounts of U.S. Treasuries yielding at least 5 percent, making it a significant beneficiary of rising U.S. interest rates。The group had $126.4 billion worth of such investments at the end of the third quarter, compared with about $93 billion at the end of last year, according to the earnings report.。

Second, Berkshire has slowed the pace of share buybacks significantly this year as share prices climb。According to the results, throughout the third quarter, Berkshire spent only $1.1 billion on deploying stock buybacks, a figure that was even about $300 million less than the buybacks in the second quarter and only a quarter of the $4.4 billion it repurchased in the first quarter.。The reason is also obvious: Berkshire's stock price rose about 13 percent in the six months to September, which significantly raised Berkshire's share buyback costs。According to Buffett and Munger's deployment, the company will only start the buyback process if Berkshire's share price is grossly undervalued。

Third, Berkshire's deep cuts at the spending level this year。From last year's data, Berkshire's total stock investment reached a record $68 billion, with a net investment of $34 billion.。Not only that, but last year Berkshire bought insurer Alleghany for $12 billion and conducted an $8 billion share buyback.。However, judging by this year's data, even if Berkshire spends a majority stake in Pilot and Cove Point LNG and buys back $7 billion worth of stock, it still can't match last year's spending.。

The sharp expansion in the size of cash has also helped Berkshire's total assets climb rapidly.。According to the earnings report, Berkshire's total assets reached a staggering 10,199 at the end of the third quarter..$3.3 billion, since Berkshire's total assets exceeded the trillion dollar mark for the first time in the second quarter to 10,415.After $7.3 billion, it remains above the trillion-dollar mark again.。

In this regard, Everbright Bank financial analyst Zhou Maohua said, from the trend, the United States high inflation, high interest rates, the United States financial system risk has not yet been fully released, the United States and the global economic outlook is slowing, the United States corporate earnings outlook under pressure, the valuation of high U.S. stocks are facing greater potential pressure.。Zhou Maohua also said that Buffett's sell-off of stocks and increased cash flow may be related to the sharp rebound in the U.S. stock market since the second quarter.。With high valuations, high interest rates and an uncertain economic outlook making it more difficult to invest in the stock market, he is wary of future volatility in the United States。

There are also U.S. stock researchers who say Berkshire has been facing a cash glut in recent years and has no investable targets, with open market valuations keeping him from finding acquisition targets.。The researcher said: "In the absence of quality targets, superimposed on the 'cash is king' environment brought about by persistent interest rate hikes, holding cash assets can also make Berkshire 'eat', now increase cash flow, both to avoid certain risks, but also to eat cash dividends, if the overall market fluctuations, but also to quickly get low-priced quality chips, why not?"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.