Q1 Turnaround Xiaomi: Car building is progressing well and won't be a generic big model like OpenAI.

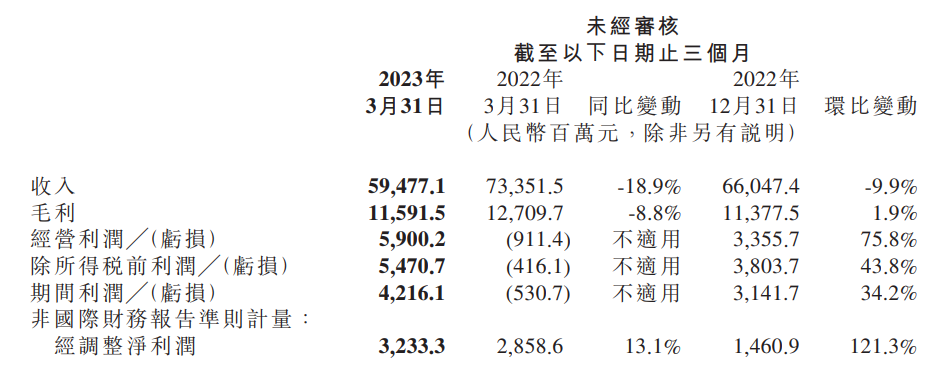

On May 24, Xiaomi Group released its first quarter 2023 performance report。Performance data show that the first quarter of millet's total revenue reached 594.7.7 billion yuan, down 18.9%; operating profit turned around to RMB 5.9 billion; adjusted net profit was 32.RMB 3.3 billion, up 13% YoY.1%, up 121% month-on-month.3%。

On May 24, Xiaomi Group released its first quarter 2023 performance report。Performance data show that the first quarter of millet's total revenue reached 594.7.7 billion yuan (RMB, the same below), down 18.9%, down 9.9%; operating profit was $5.9 billion, compared with a loss of $0.9 billion in the same period last year..1.1 billion yuan, up 75% month on month.8%; adjusted net profit of 32.3.3 billion yuan, up 13.1%, up 121% month-on-month.3%。

Xiaomi Q1 smartphone business declines, smart home appliance revenue rises against trend

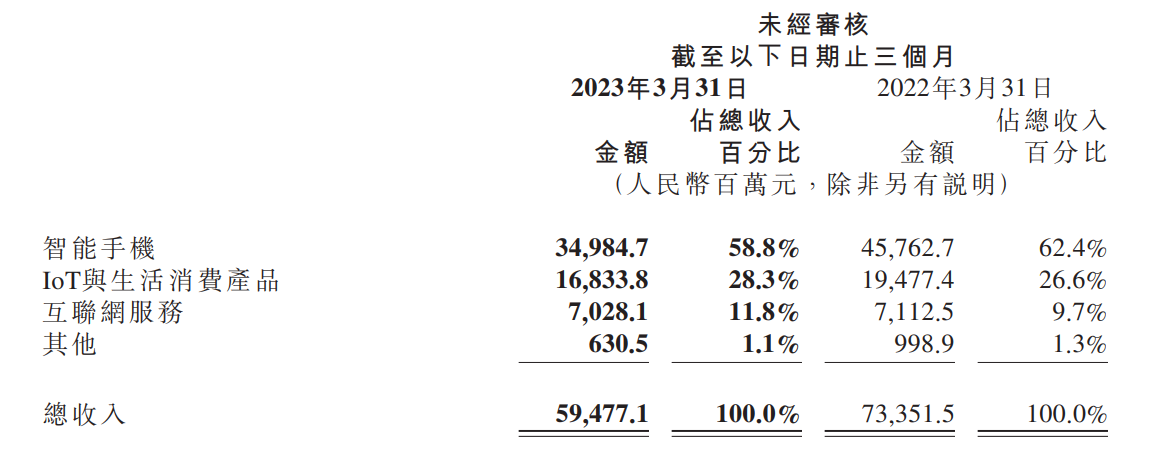

Let's take a look at the performance of Xiaomi Q1 by business sector.。

In the smartphone business, revenue in the first quarter was $35 billion, down 23% YoY, due to a decline in smartphone shipments and ASPs..6%, a decrease of 4.6%。Smartphone shipments in the first quarter were 30.4 million units, down 21.1%, a decrease of 7.1%, mainly affected by the decline in global smartphone shipments。The ASP for smartphones is 1,151 per phone.6 yuan, a decrease of 3.1%, mainly due to increased efforts to clear inventory in offshore markets, partially offset by an increase in ASP due to the contribution of high-end smartphone shipments in mainland China。Despite the decline in revenue from mobile phones, Xiaomi remained third in global smartphone shipments in the first quarter, with a market share of 11, according to Canalys..3%。

On the one hand, Xiaomi continues to promote the high-end mobile phone strategy。It is reported that after the release of Xiaomi 13 series and other high-end models, Xiaomi ranked first among Android manufacturers in terms of smartphone sales in the 4,000-5,000 yuan price segment in mainland China, with a market share increase of 7% year-on-year..7 percentage points to 24.1%。At the same time, the proportion of high-end smartphone shipments in overall shipments increased by 4.0 percentage points。On the other hand, Xiaomi continues to implement the dual brand strategy。Xiaomi brand collaborates with Leica to launch Xiaomi 13 Ultra, market sales far exceed expectations。The Redmi Note 12 Turbo launched by the Redmi brand is not only equipped with the world's first second-generation Snapdragon 7 + mobile platform, but also co-branded with "Harry Potter."。

In terms of IoT and consumer products, first-quarter revenue was $16.8 billion, down 13% year-on-year..6%, down 21.5%。This decline in revenue was mainly due to lower sales of smart TVs and laptops and certain consumer products in overseas markets.。Revenue from this segment was $4.7 billion in the first quarter, down 24% year-over-year, due to a decline in both smart TV and laptop shipments and ASP..2%, a decrease of 27.6%。

What is striking this quarter is Xiaomi's smart home appliance category。In the first quarter, Xiaomi's revenue from smart home appliances grew by more than 60% year-on-year, maintaining a strong momentum of development, mainly due to a significant increase in shipments of smart air conditioners and refrigerators.。Its air-conditioning product shipments grew more than 60% year-on-year in the first quarter, while refrigerator shipments more than tripled from the same period last year.。

In the "mobile phone x AIoT" business, as of March 31, the number of IoT devices connected to the AIoT platform reached 6..1.8 billion, up 29.2%。In March 2023, the number of monthly active users of Mijia APP increased by 18.8% to 78.1 million。

In terms of new retail, according to third-party data, Xiaomi's market share of offline smartphone shipments in mainland China was 7% in the first quarter..9%, up 1.4 percentage points。The cumulative payment amount (GMV) of the channel under the smartphone product line increased on a month-on-month basis.。

In terms of Internet services, first-quarter revenue was $7 billion, down 1.2%, primarily due to lower revenue from the fintech business and advertising, partially offset by higher revenue from gaming operations。Xiaomi's gaming revenue grew 16% year-on-year in the first quarter..3% to $1.3 billion, with seven consecutive quarters of year-on-year revenue improvement.。In addition, offshore Internet services also performed well, recording revenue growth of 16% year-on-year in the first quarter..4%, reaching $1.8 billion, accounting for 25% of overall Internet service revenue..7%, up 3% YoY.9 percentage points。

In the first quarter, Xiaomi's global Internet users continued to expand。By March, the number of monthly active users of MIUI (rice pomelo) worldwide reached 5.9.5 billion, up 12.4%。Among them, the number of monthly active users of MIUI in mainland China reached 1.4.6 billion, up 7.8%。

The car is progressing well and will go on sale in the first half of next year as planned! Xiaomi claims it won't make a big GM model like OpenAI

In terms of car building, Xiaomi said that the progress is still very good and will be listed in the first half of next year as originally planned.。This year, Xiaomi will also conduct summer and winter tests.。Xiaomi said that innovative businesses such as smart electric vehicles invested about 1.1 billion yuan, accounting for 26% of R & D spending (4.1 billion yuan) in the same period..8%。The personnel and capabilities of its self-driving team basically come from the original AI team.。

For AI, the company said that at this stage, its AI team has more than 1200 people, including AI laboratory, small love students, cameras and autonomous driving and other aspects of research.。

OPPO announced on May 12 that it would stop all of its self-developed chip business and disband the Zeku (ZEKU) team, without disclosing the reasons, which immediately attracted outside attention.。Lu Weibing, President of Xiaomi Group, said that he regretted the recent chip problems of his friends and respected the brave attempt.。He believes that the purpose of the chip is to enhance the competitiveness of end products, user experience。He said that Xiaomi's determination to invest in self-developed chips will not waver, and that it is necessary to be fully aware of the long-term and complex nature of chip investment, respect the development law of the chip industry, and be prepared for a protracted war.。

It is reported that since 2017, Xiaomi has released a number of self-developed mobile phone chips, including SoC chip surging S1, self-developed imaging chip surging C1, charging management chip surging P1, battery management chip surging G1 and so on.。

In terms of large models, Xiaomi mentioned in its earnings report that it will actively embrace a new round of technological changes brought about by artificial intelligence, and announced that in April this year, Xiaomi formally established a large model team for AI laboratories.。But unlike other large domestic factories that have been working on big models one after another, Xiaomi said it would not do a general-purpose big model like OpenAI, but would combine the big model with the depth of the business and use AI technology to improve internal efficiency.。"All the modeling companies in the industry, we may also invest in one or two companies, we have been looking at this opportunity。"

On the issue of inventory, Xiaomi said that its inventory level in the first quarter was at a very healthy level, a low point in the past five quarters.。Last year, Xiaomi's inventory reduction target was basically completed in this quarter.。"Overall, the supply chain is still in a downward trend in costs, and future cost reductions are very positive, and we will adopt different stocking strategies depending on the needs of different devices."。"

Xiaomi revenue weak but profit rebounds, Daiwa expects smartphone shipments to pick up gradually

Bank of China International released a research report that even though Xiaomi's revenue was weak in the first quarter, down 19% year-on-year, its adjusted net profit recorded a significant rebound to RMB 3.2 billion, 18% higher than market expectations, mainly due to the rebound in smartphone gross margins and good operating expenditure control.。

The report also said that the company's market outlook remains uncertain due to new negative factors such as the appreciation of the US dollar and weak advertising spending, but believes that management's commitment to improving profitability and high-end products will help offset these effects.。The bank remains bullish on sales of the group's Xiaomi 13 in domestic and overseas markets, which will boost average selling prices and profit margins.。The bank set Xiaomi's target price from 16.3 HK $down to 15.HK $5, Reiterates "Buy" Rating。

Daiwa, on the other hand, said that Xiaomi Group's first-quarter results were basically in line with expectations.。Despite weak shipments of smartphones, TVs and laptops, which pressured revenue, gross profit and operating margin improved due to lower parts and logistics costs and efficiency optimization efforts。Core operating margin (excluding investments in artificial intelligence and other new initiatives) increased from 4% in the first quarter of 2022..9% to 7% in the first quarter of 2023.1%。

Daiwa expects Xiaomi's smartphone shipments to pick up gradually, as destocking has been completed and new models are being launched.。The bank expects the year-over-year decline in quarterly revenue from the IoT business to narrow from the second quarter of 2023.。The bank maintains its "outperform" rating on Xiaomi Group and maintains a price target of HK $12 based on a price-to-earnings ratio of 20x average EPS for 2023-2024.。

Today, Xiaomi Group-W shares open higher and lower, as of press time, at 10.HK $5, up 0.1%。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.