Baidu Q1 net profit turnaround Wen Xin one word big model performance improvement 10 times! Follow-up will be integrated with other businesses

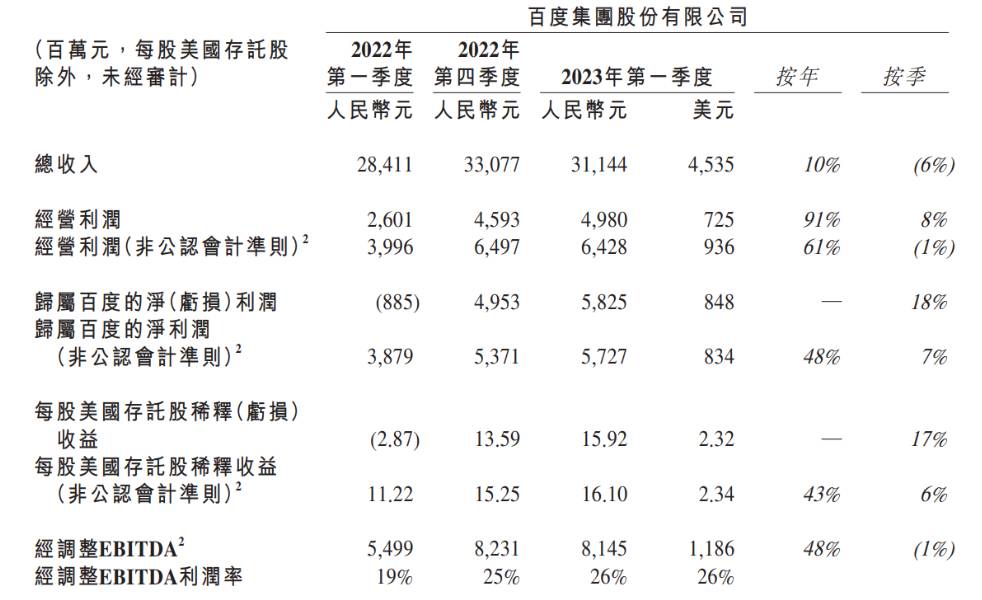

On the evening of May 16, Baidu released its first quarter 2023 earnings report.。Performance data show that Baidu's total revenue in the first quarter reached 311.RMB4.4 billion, up 10% YoY; operating profit of 49.800 million yuan, up 91% year-on-year; net profit was 58.2.5 billion yuan, compared with a loss of 8 in the same period last year..8.5 billion yuan, up 18% month-on-month。

On the evening of May 16, Baidu released its first quarter 2023 earnings report.。Performance data show that Baidu's total revenue in the first quarter reached 311.4.4 billion yuan (RMB, the same below), up 10% YoY and down 6% YoY; operating profit of 49.800 million yuan, up 91% year-on-year, up 8% month-on-month; net profit turnaround reached 58.2.5 billion yuan, compared with a loss of 8 in the same period last year..$8.5 billion, up 18% QoQ; diluted earnings per ADS were 15.92 yuan, -2 in the same period last year.87, up 17% month-on-month; adjusted EBITDA of 81.4.5 billion yuan, up 48% year-on-year, down 1% month-on-month。

Core business Q1 revenue up 8% year-on-year, managed page revenue accounts for half of online marketing business

Baidu's business revenue consists of Baidu Core and iQiyi.。Baidu's core revenue in the first quarter was 23 billion yuan, up 8% year-on-year; iQiyi's revenue was 8.3 billion yuan, up 15% year-on-year.。

Baidu's core business is mainly composed of online marketing and non-online marketing.。where the bulk of revenue is in its online marketing business。In the first quarter, the company's online marketing revenue was 16.6 billion yuan, up 6% year-on-year, accounting for 72% of the core business revenue.。And here, hosting pages accounts for 49% of online marketing revenue.。

Hosted pages were first mentioned in Baidu's Q3 2019 quarterly report, and since then the managed pages business has grown rapidly, accounting for half of online marketing revenue by the first quarter of this year。At present, Baijia, smart applets, and hosting pages form Baidu's three AI pillars。

According to the research report of Tianfeng Securities, the hosting page is equivalent to the mobile website displayed by enterprises in Baidu app, Baidu can provide merchants with a complete set of closed-loop solutions from rapid site construction to marketing, content display, merchandise sales, program optimization and customer management.。All this is "hosted" in Baidu station, businesses do not need to use their own server to build their own station, only need to mobilize their own components and modules in Baidu can be。

Baidu's "base wood fish" product is to help businesses build a station products, designed to help users and advertisers interconnection。

In addition, the hosting page can also provide advertisers with real-time full-chain data for reference, helping them to conduct quality testing before delivery, real-time monitoring during delivery, and provide data analysis guidance after delivery to optimize the page, further enhancing the ability to realize ads.。

The reasoning performance of Wen Xin's big model has been improved by nearly 10 times, and it will be integrated with other Baidu businesses in the future.

Since OpenAI released ChatGPT last year, it has set off a wave of global generative AI, which has put a lot of pressure on major domestic technology companies.。Baidu withstood the pressure and then released Wenxin, becoming the first technology company in China to release a ChatGPT-like product.。It's just used to benchmark ChatGPT, and Wenxin is too "immature" in a word.。

Although questioned as "hot," Baidu has been firmly investing in AI in recent years.。Baidu's R & D expenses in 2022 will be 233.1.5 billion yuan, accounting for about 19% of total revenue。The share fell slightly in the first quarter of this year, at around 17 per cent.。

Baidu founder, chairman and CEO Robin Li said he hopes to make further efforts in generative AI to help products and services and bring a better experience to users, "We have been investing in AI for the past decade, and now we have a strong foundation in this area and can get more value from generative AI.。"It is reported that after the release of Wen Xin's words, an internal test was conducted.。After more than a month of internal testing, the technology upgrade was completed four times, and the reasoning performance of the large model was improved by nearly 10 times.。

In addition, Baidu intends to integrate Wenxin Yiyan into all businesses for testing, using its capabilities to reshape the company's products and services for businesses and consumers.。

For example, Baidu developed a large model platform for enterprises, "Wenxin Qianfan."。According to media reports, "Wenxin Qianfan" will provide two kinds of enterprise services: first, with Wenxin Yiyan as the core, providing large model services to help customers transform products and production processes.。Second, as a large model production platform, enterprises can develop their own exclusive large models based on Wenxin Qianfan.。Up to now, more than 300 ecological partners have participated in the internal test of Wenxin Yiyan, and the test results have been achieved in more than 400 internal scenarios of enterprises.。

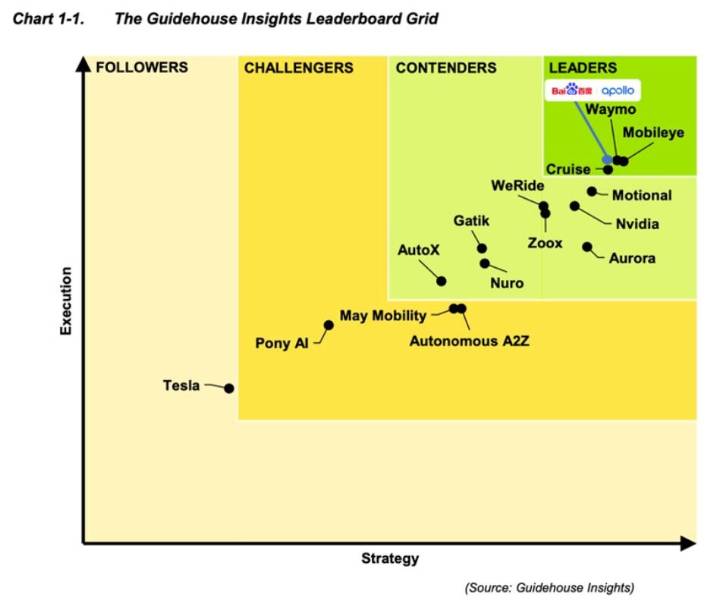

Radish fast-running orders up 236% year-on-year in first quarter, Baidu becomes self-driving leader

On the issue of automobiles, most of the people are now discussing new energy vehicles.。Whether it is domestic electric vehicles going to sea, or major manufacturers fighting a "price war" to compete for market share, everyone's attention is focused on electric vehicles, and the heat of autonomous driving has been much less.。But Baidu is still quietly pushing its self-driving business。

In the first quarter of 2023, Baidu's self-driving service Radish Fast Run supplied about 660,000 self-driving orders, up 236% year-on-year and 18% month-on-month.。

Guidehouse, a public and commercial consulting firm, recently released its latest report on the competitiveness of autonomous driving companies.。In the self-driving "leader" camp, Baidu Apollo, Waymo, Cruise have all realized the commercial operation of fully unmanned self-driving, of which Baidu Apollo has been in the global self-driving "leader" camp for many years, and is the only Chinese player on the list of leaders.。

At present, radish fast running has been opened in these cities: Beijing, Shanghai, Guangzhou, Shenzhen, Chongqing, Wuhan and other more than 10 cities to carry out operations。Baidu also intends to integrate Wenxin Yiyan with its self-driving business.。Li Yanhong said, "AI cloud, intelligent driving and generative AI and other technologies together, can bring us great opportunities, can become the entrance of the new generation of Internet。"

After the Q1 earnings report, a number of major banks updated their ratings and target prices on Baidu

According to a research report released by Daiwa, Baidu's first-quarter results, the AI cloud business recorded positive operating profit for the first time; Baidu's core earnings exceeded the bank's expectations by 22%, mainly due to higher marketing revenue。Based on a slightly better-than-expected recovery in marketing revenue, improved profitability in the cloud business and disciplined investments, the bank expects earnings growth in Baidu's core business to remain strong this year。The bank also believes that the advantages of the group's Wenxin Yiyan will begin to be reflected in its search and cloud business this year.。

The bank said it raised its revenue forecast for the group's 2023-24 fiscal year by 2%, while its earnings forecast rose by 2% to 10% to reflect a better-than-expected recovery in marketing revenue and profits from its cloud business, and raised its H-share target price from HK $200 to HK $210, maintaining a "buy" rating.。

Goldman Sachs, on the other hand, said Baidu's first-quarter revenue and profit exceeded expectations, with net profit per ADS 26% and 24% higher than the bank and market forecasts, respectively, and that the artificial intelligence cloud business was a surprise.。The bank said that although the commercialization time of the "Wen Xin Yi Yan" large language model will depend on the approval of regulators, Baidu has developed the relevant framework; in addition, the advertising business is expected to accelerate growth in the next quarter, and overall profit margins are also expected to continue to improve.。The bank maintained Baidu's "buy" rating, while its H-share target price fell slightly from HK $182 to HK $179.。

Baidu's first-quarter revenue exceeded market expectations, according to a research report released by CICC..5%; non-generic net profit exceeded market expectations by 29%, mainly due to the first profitable cloud business.。And Wen Xin's ability to speak out continues to strengthen, business prospects can be expected.。

CICC believes that Baidu's first quarterly cloud computing profit, new business profit release into the inflection point。Looking ahead to the next quarter, the base effect of user demand recovery is eliminated, and CICC believes that cloud revenue is expected to regain growth.。Due to the first quarter results exceeded expectations, the bank raised Baidu's full-year revenue forecast and non-general guidelines net profit forecast 1% and 15% to 138.7 billion yuan and 26 billion yuan, raised next year's revenue and non-general guidelines net profit 1% and 11% to 153.5 billion yuan and 29.5 billion yuan, maintaining the "outperform industry" rating, H-share target price of 167..HK $1。

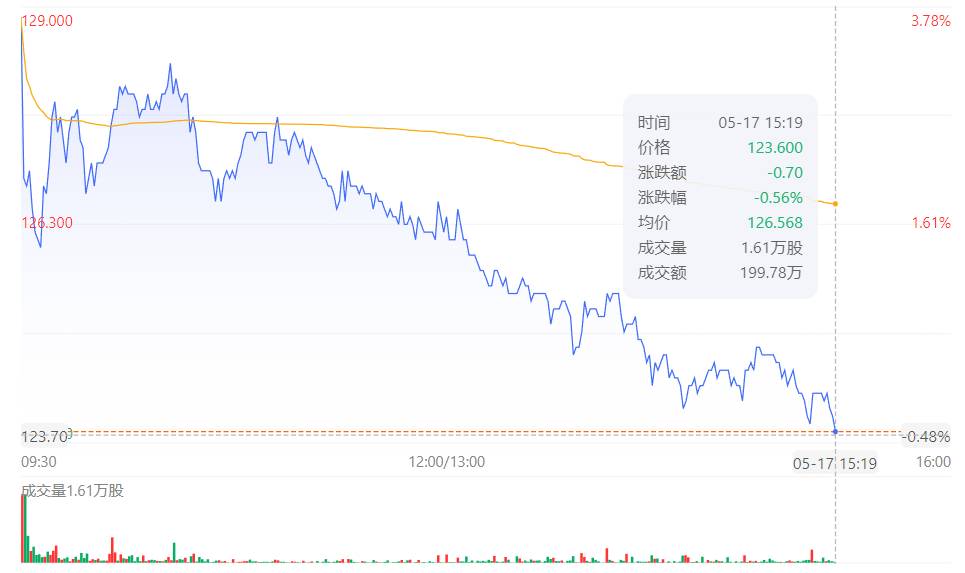

It is worth noting that, affected by performance, today Baidu Group-SW opened nearly 5% higher, and then all the way down, as of press time, Baidu Group-SW is now reported 123.HK $6, down slightly 0.56%。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.