Xiaomi Q1 global and domestic mobile phone shipments both declined, high-end models "applauded but not popular"?

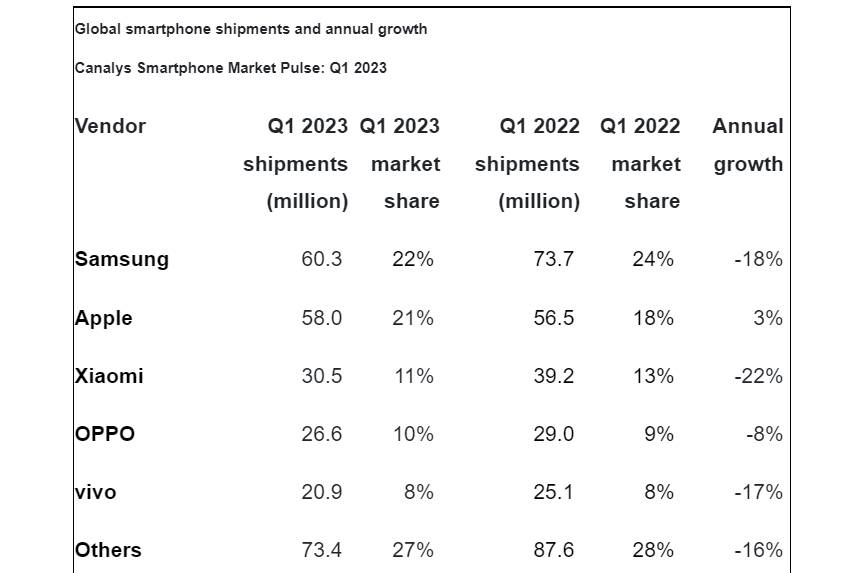

According to Canalys, global smartphone shipments fell 13% year-on-year in the first quarter of 2023 to 2.69.8 billion units。Xiaomi ranked third with 30.5 million units shipped, down 22% year-on-year。In the domestic market, Xiaomi ranked fifth with 8.5 million units shipped, down 20% year-on-year。

Recently, according to the latest data released by Canalys, global smartphone shipments fell 13% year-on-year in the first quarter of 2023 to 2.69.8 billion units。Xiaomi ranks third in global smartphone shipments with 30.5 million units, occupying 11% of the market.。Xiaomi's decline was the largest among the top five suppliers, reaching 22%。

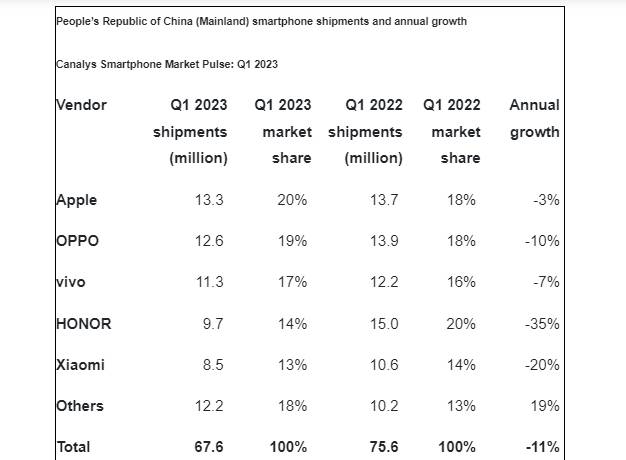

Meanwhile, Q1 shipments in mainland China's smartphone market also declined this year, falling 11% year-on-year to 67.6 million units, the lowest Q1 since 2013.。Among them, Xiaomi's smartphone shipments fell 20% year-on-year, ranking fifth with 8.5 million units shipped.。

Xiaomi mobile phone Q1 shipments fell about 20% year-on-year, high-end models "applauded but not popular"

The decline in Xiaomi's mobile phone shipments began as early as last year。Accordingly, in 2022, revenue from Xiaomi's mobile phone business declined year-on-year for four consecutive quarters, with an overall decline of between 11-28%。The decline in revenue from the mobile phone business, on the one hand, is due to Xiaomi's destocking plan through price cuts, which have driven the gross margin of its mobile phone business from 11% in 2021..9% down to 9%。For the company's inventory problems, Xiaomi Group President Lu Weibing said in the 2022 earnings call, the company's overall inventory is currently in a very controllable state, the problem inventory is not much, most of them are some inventory that can be solved, the first quarter of 2023 to inventory is nearing the end, performance is expected to improve quarter by quarter。

In addition to price cuts to inventory, Xiaomi's high-end smartphone strategy in recent years has not brought significant growth to its shipments.。Xiaomi mobile phones were first known for their high cost performance, but in the past three years, as the market stock has grown tired, many mobile phone manufacturers have begun to explore high-end, and Xiaomi is no exception.。In 2022 alone, Xiaomi successively launched the high-end models Xiaomi 12S Ultra and Xiaomi MIX Fold 2 in July and August, respectively, and in December it released the Xiaomi 13 Series 2。

Although Xiaomi's high-end models have gained a high user reputation, the market share is still low。In the fourth quarter of 2022, Xiaomi's high-end smartphone shipments in mainland China accounted for only 6.8%。High-end models have not yet brought new growth points to Xiaomi mobile phones.。But as Lei Jun said: "Quality is the lifeline of millet," perhaps such users in the use and mentality to adapt to the high-end millet mobile phone, the growth of its smartphone business or can usher in the "second spring."。

Not only to build cars! Xiaomi continues to lay out emerging industries

In terms of smart electric vehicles, in 2022, Xiaomi will invest RMB 3.1 billion in innovative business expenses such as smart electric vehicles.。As of the end of March 2023, the R & D team in its automotive business was approximately 2,300 people.。Xiaomi still maintains the target of official mass production in the first half of 2024.。

In addition to building cars, Xiaomi's layout in the field of domestic robots is also expanding.。According to the company, on April 21, Xiaomi invested in Beijing to set up Beijing Xiaomi Robot Technology Co., Ltd., with a registered capital of 50 million yuan.。Business scope includes: intelligent robot research and development; artificial intelligence industry application system integration services; artificial intelligence basic resources and technology platform; micro-motor and component manufacturing, etc.。From CyberDog (Bionic Robot Dog) to Cyberone (Bionic Robot), Xiaomi continues to increase its R & D and innovation in the field of robotics。

CITIC Securities Research Report believes that based on deep technology accumulation and past successful commercialization experience, it is the general trend for technology companies to enter the robotics industry.。Xiaomi's addition in the field of robotics will bring many opportunities to the entire industry, promote the development of robotics, product promotion and market development, enrich the market structure, and further expand the market scale.。

On the issue of ChatGPT, Lu Weibing had earlier responded that Xiaomi used a multi-technology route to explore the landing of AI models in parallel, and the success of ChatGPT gave Xiaomi a lot of confidence to verify the correctness of this direction.。At present, Xiaomi's little love classmate is a typical big model landing scene.。In the future, Xiaomi will continue to study large models and introduce more advanced large model capabilities, including exploring multimodal capabilities and improving the interactive experience of smart cockpits.。At present, Xiaomi AI team has more than 1200 people。

Q1 quarterly report is coming soon, a number of big banks said they are optimistic about Xiaomi's earnings

CICC released a research report saying it expects Xiaomi's adjusted net profit to increase by 6% year-on-year in the first quarter.8% to 30.5.2 billion yuan。Smartphone revenue is expected to fall 25% year-on-year to 343 in the first quarter..3.4 billion yuan。In terms of gross margin, considering the price reduction of upstream storage and other components, the gross margin of mobile phones is expected to rise by 1% year-on-year in the first quarter..1 percentage point to 11%。CICC expects Xiaomi's consolidated gross margin to rise 2% year-on-year in the first quarter.4 percentage points to 19.7%, mainly due to the increase in gross margins of all businesses, while the proportion of high-margin Internet business increased, which CICC believes reflects the company's strategy to improve profitability is beginning to show results.。In its report, CICC maintained its adjusted net profit forecast for this year and next year and maintained its H-share target price of 14.HK $5, rating "OUTPERFORM INDUSTRY"。

Daiwa released a research report that Xiaomi's smartphone shipments in the first quarter were lower than expected, however, profitability may surprise。The bank lowered the group's revenue forecast for 2023-2025 to between 5% and 10%, and lowered its earnings forecast for the period to between 1% and 11%, reiterating its "outperform" rating and lowering its H-share target price from HK $14 to HK $12.。The bank expects the group's first-quarter revenue to contract 19% year-on-year to RMB59.7 billion due to weaker-than-expected smartphone and Internet sales, but expects first-quarter net profit to grow 13% year-on-year to RMB3.2 billion, higher than market expectations of RMB2.1 billion, and will reverse the year-on-year contraction in net profit from the first quarter to the fourth quarter of last year.。

UBS released a research report saying it expects Xiaomi to make a non-GAAP net profit of Rmb2.9bn in the first quarter, unchanged from a year earlier。Revenue is expected to be 56.9 billion yuan, down 22% year-on-year, and the bank believes it should not be surprised by the sharp drop in revenue, as the company's earlier global smartphone destocking program has sent a clear message。Excluding new business investments, the bank estimates core net profit could approach RMB3.8 to RMB4 billion。UBS expects Xiaomi's global smartphone channel inventory to return to normal in the second quarter, with sales expected to grow 8% month-on-month to 32.5 million units。Full-year sales forecast remains 1.500 million units。Target price of HK $16 for H-shares, rated "Buy"。

Goldman Sachs says it expects Xiaomi to report first-quarter results in late May。The bank believes that gross margins and operating premium rates are likely to improve this year, but with slower growth in smartphone shipments and hardware sales, as observed under improved product mix and continued control of operating expenses.。The bank raised its target price for Xiaomi H shares from 13.HK $5 to 14.HK $2 to maintain "Neutral" rating。The bank forecasts Xiaomi's first-quarter revenue of RMB59 billion, down 20% year-on-year, and adjusted net profit of 31.600 million yuan, up 13% year-on-year。Goldman Sachs lowered Xiaomi's smartphone and Internet revenue forecasts for this year by 10% and 6% to RMB160 billion and RMB79 billion, respectively, or 4% and 1% year-on-year, but expects smartphone and Internet gross margins to rise by 2% year-on-year, respectively..6 percentage points and 1 percentage point, each to 11.6% and 15.4%。

Credit Suisse said in a research report that it expects Xiaomi's net profit to exceed expectations in the first quarter, with revenue or down 20% year-on-year to Rmb58 billion, but gross margin is expected to rise 2 percentage points year-on-year to 19.3%, while adjusted net profit is expected to rise 6% year-on-year to RMB3 billion, which is expected to exceed market forecasts.。The bank estimates that the average selling price of group smartphones fell year-on-year, mainly because overseas inventories are still being digested。The bank said it lowered the company's smartphone delivery forecast for 2023-2025 to 1.4.5 billion units, 1.5.3 billion units and 1.5.5 billion units to reflect continued weak demand。The bank raised the company's adjusted earnings per share for 2023-2025 by 4%, 2% and 2% to reflect forecasts of gross margin expansion and reduced expenses, while raising its H-share target price from HK $17 to HK $17..HK $2, maintaining its rating of "Outperform."。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.