Apple Q1 Shipments Drop 10% and Samsung regained first place

According to IDC data, Samsung's shipment volume in the first quarter of this year was 60.1 million units, a slight decrease of only 0.7% year-on-year.

On April 15th, International Data Corporation (IDC) released preliminary data for the global quarterly mobile tracking report.

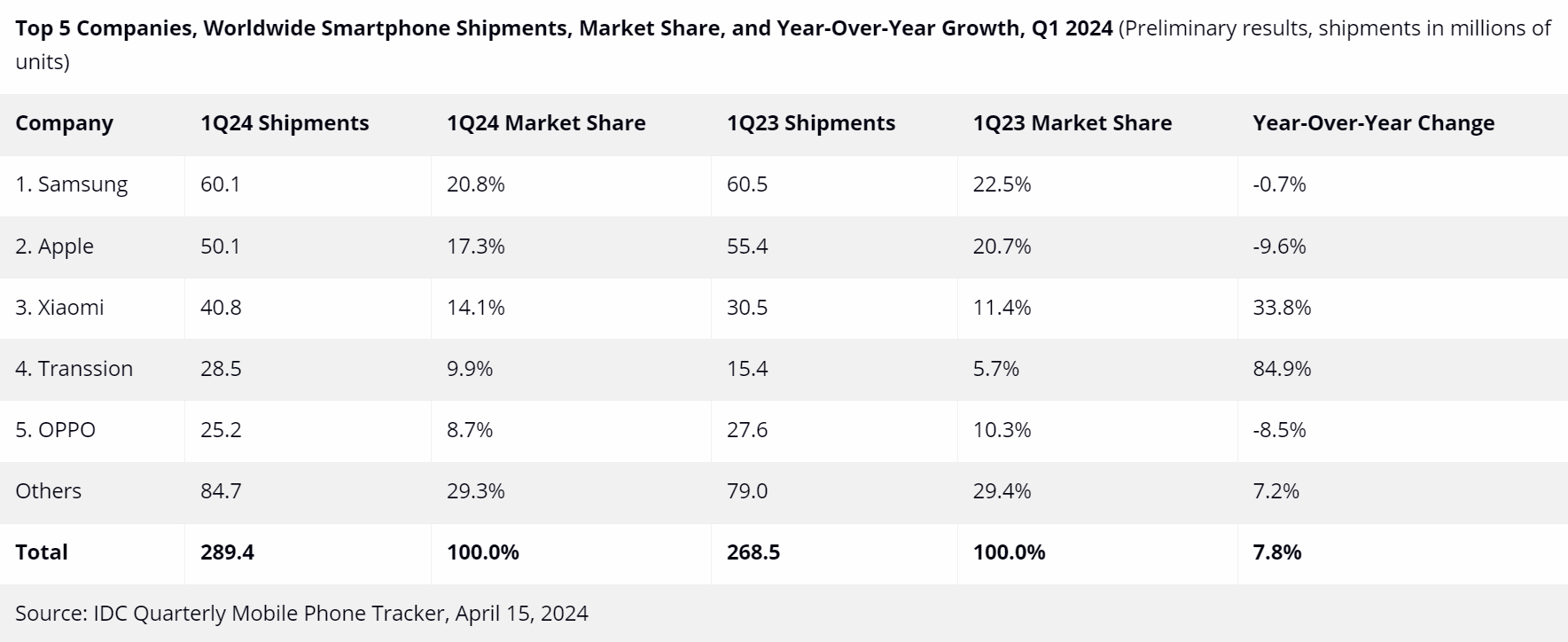

Data shows that in the first quarter of 2024, global smartphone shipments increased by 7.8% year-on-year to 289.4 million units. IDC believes that although the industry has not yet fully emerged from its predicament as many markets still face macroeconomic challenges, global smartphone shipments have grown for the third consecutive quarter, which strongly indicates that the recovery is proceeding smoothly.

"As expected, the smartphone recovery continues to advance, and market optimism is slowly forming among top brands," said Ryan Reith, Vice President of IDC Global Mobile and Consumer Device Tracking Group

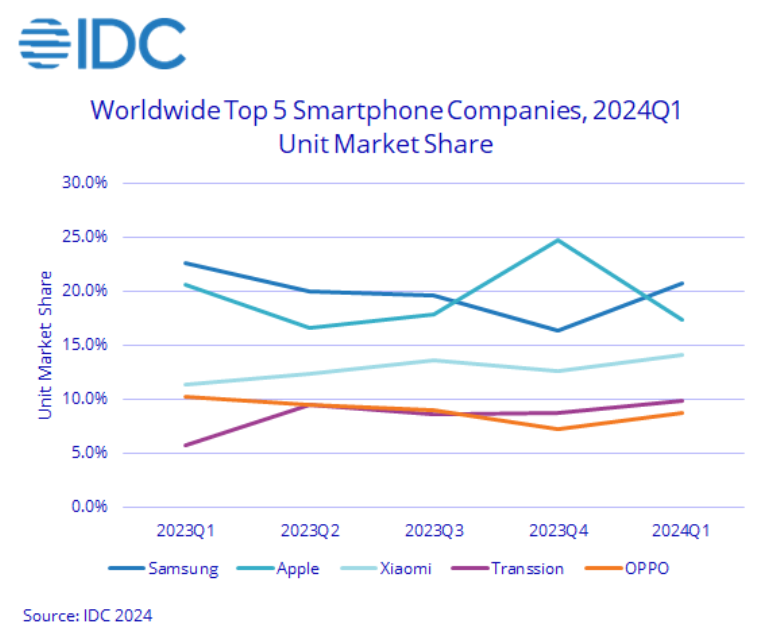

Samsung overtook Apple to regain the first place

In this report, the most striking is that Samsung overtook Apple and returned to the throne of the world's number one mobile phone manufacturer.

According to IDC, Samsung's shipment volume in the first quarter of this year was 60.1 million units, a slight decrease of only 0.7% year-on-year. In contrast, Apple's shipment volume in the first quarter was 50.1 million units, a significant decrease of nearly 10% year-on-year.

As a result, Apple's market share also decreased by 3.4 percentage points year-on-year to 17.3%. The market share with Samsung has once again increased. Samsung's market share in the first quarter of this year was 20.8%, a year-on-year decrease of 1.7 percentage points.

Nabila Popal, Research Director of IDC's Global Tracking Team, stated that although both Samsung and Apple experienced negative growth in the first quarter, Samsung's overall situation seems to be stronger than in recent quarters.

Samsung in South Korea launched its latest flagship smartphone series, the Galaxy S24 series, earlier this year. The selling point of Samsung's phone is the addition of AI functionality, which has to some extent driven the sales of this phone. According to previous statistics from another data provider, Counterpoint, global sales of the Galaxy S24 smartphone increased by 8% compared to the three weeks before the launch of the Galaxy S23 series last year.

By contrast, Apple's response is slower. Apple will hold the World Developers Conference (WWDC) in June this year. It is widely expected that Apple will not only introduce software updates for iPhone, iPad, and other devices, but also focus on Apple's progress in AI. Recently, there have been reports that Apple will release a new generation M4 chip on WWDC, which is expected to have AI processing capabilities.

Xiaomi, Transsion have risen sharply.

In this report, another highlight is that Xiaomi, ranked third, and Transsion, ranked fourth, both recorded double-digit growth.

In the first quarter of this year, Xiaomi's shipment volume was 40.8 million units, a year-on-year increase of 33.8%. The growth rate of Transsion is even stronger, with a year-on-year increase of 84.9% in shipment volume to 28.5 million units. With a significant year-on-year increase in shipment volume, the market share of both companies has further increased.

Xiaomi's market share in the first quarter was 14.1%, an increase of 2.7 percentage points year-on-year. The market share of Transsion increased significantly by 4.2 percentage points year-on-year to 9.9%.

OPPO, ranked fifth, performed poorly in the first quarter with shipments of 25.2 million units, recording an 8.5% year-on-year decline. The market share of OPPO decreased by 1.6 percentage points year-on-year and is now 8.7%.

Regarding the changes in brand rankings, Ryan Reith commented that although IDC expects Samsung and Apple to maintain their position in the high-end market, Huawei's significant growth in China, as well as Xiaomi, Transsion, OPPO/OnePlus, and Vivo, may lead the two OEM manufacturers to seek expansion and diversification in the field.

Reith said, "As the economy recovers, we are likely to see top companies expanding their share while smaller brands struggle to position themselves."

Nabila Popal said: "The strength of the top five companies has changed, and this change is likely to continue as market participants adjust their strategies after the economic recovery. Xiaomi is making a strong return from the sharp decline in the past two years, and Chuanyin has become a stable member of the top five companies through positive development in the international market."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.