Apple FY24Q3: iPad Beats Expectations, Sales Decline Only in Greater China

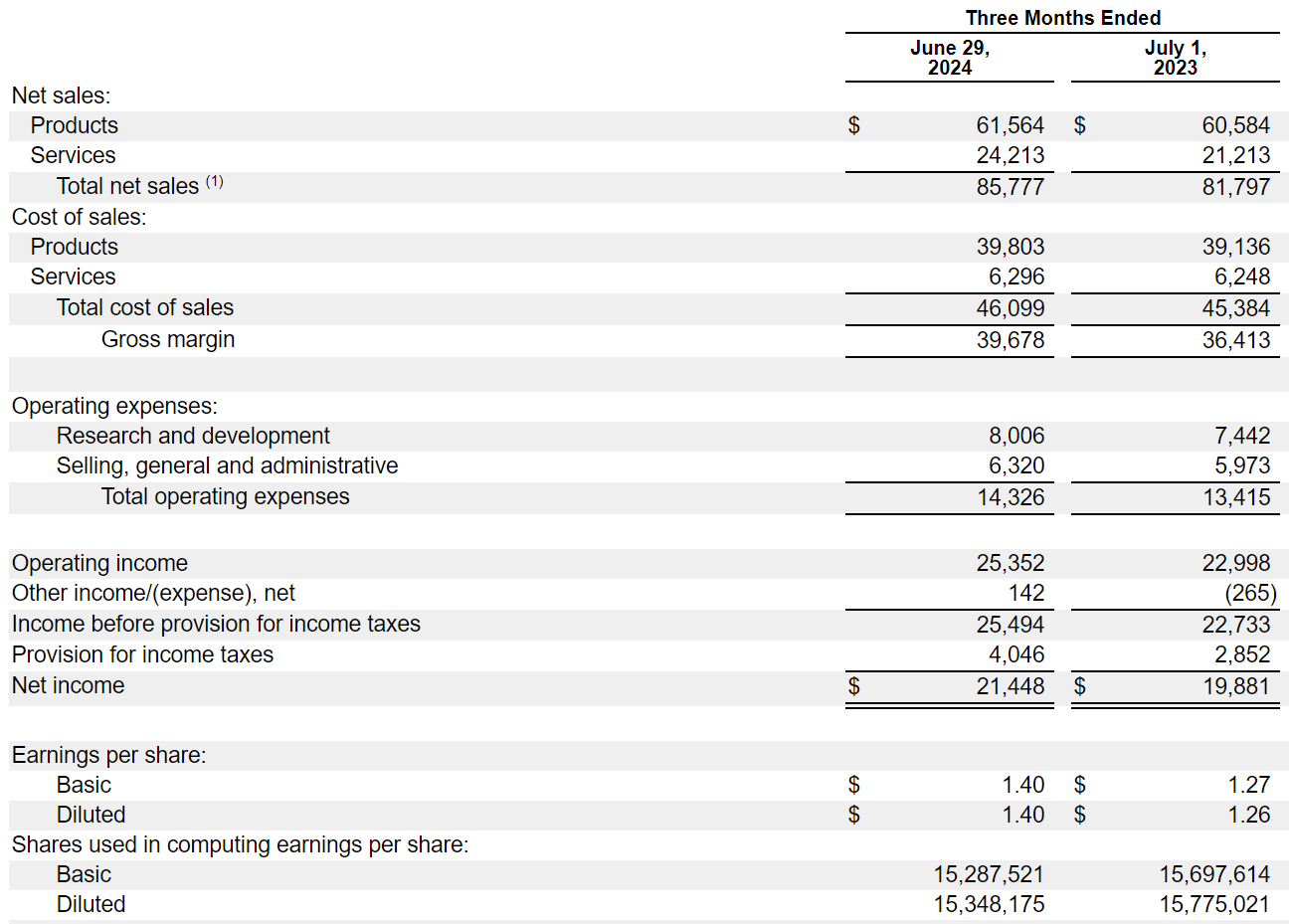

Apple's revenue reached $85.8 billion in its fiscal third quarter, up 5 percent year-on-year and above market expectations of $84.5 billion, according to the data.

On Thursday (August 1), after the U.S. stock market closed, Apple Inc. reported results for the third fiscal quarter of fiscal year 2024 ending June 29, 2024.

Revenue and Net Profit Beat Expectations, iPad performs brightly

Apple's revenue reached $85.8 billion in the fiscal third quarter, up 5% year-on-year and above market expectations of $84.5 billion, according to the data.

On the earnings front, net income rose 7.9 percent year-over-year to $21.45 billion. Earnings per share rose 11% year-over-year to $1.40, again beating market expectations of $1.35.

As of June 29, 2024, Apple held $26.635 billion in cash, cash equivalents, and restricted cash.

Separately, Apple CFO Luca Maestri said on a conference call that the company expects revenue growth for the quarter ending in September to be similar to the 5% quarterly increase just reported. On that basis, Apple's revenue for the next fiscal quarter will be about $94 billion, up from analysts' estimates of $93.4 billion.

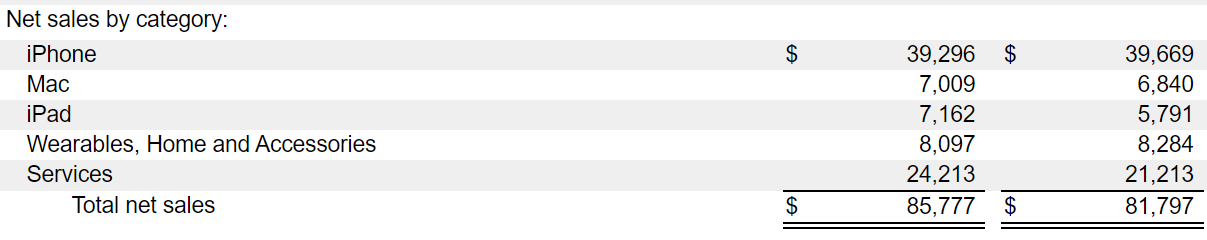

Turning to the sales figures for Apple's segmented businesses.

iPhone revenue fell 0.9% year-over-year to $39.3 billion in the fiscal third quarter, beating analysts' expectations of $38.95 billion. Notably, this is the second consecutive quarter that iPhone global sales have declined.

Mac revenue rose 2.5% year-on-year to $7.01 billion, beating analysts' expectations of $6.98 billion. iPad's performance was impressive, with revenue up 23.7% year-on-year to $7.16 billion, far exceeding analysts' expectations of $6.63 billion.

iPad business growth is closely related to the launch of new models. In May this year, Apple launched a new upgraded iPad series. The new products include iPad Pro with M4 chip and iPad Air with faster speed and bigger screen. iPad's strong growth has offset the impact of iPhone's revenue decline to some extent.

In addition, wearables, home, and peripherals revenue was $8.1 billion, down 2.3% year-over-year. Service revenue was $24.213 billion, up 14% year-over-year. Both figures were better than analysts' expectations.

Global sales fell only in Greater China

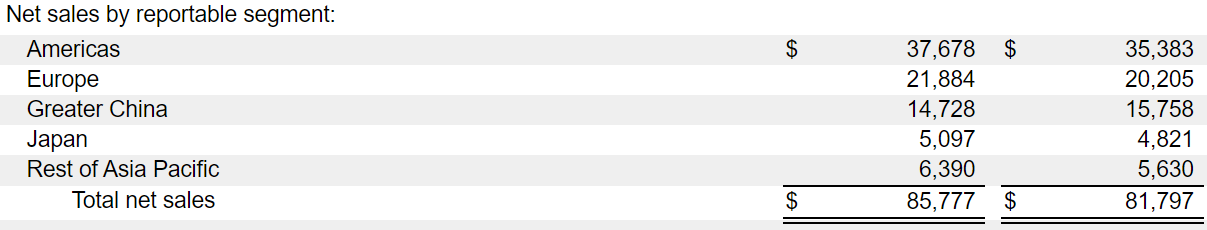

In its earnings report, Apple also announced sales figures for different regions.

In the third fiscal quarter, Apple's revenue in the Americas was $37.68 billion, up 6.5 percent year-over-year. The Americas region is Apple's largest market in the world. Revenue in Europe, the second largest market, was $21.88 billion, up 8.3% year-over-year.

Revenue in Greater China was the only one of Apple's major global markets to fall, with revenue down 6.5% year-on-year to $14.73 billion, below analysts' expectations of $15.26 billion.

Revenue in Japan was up 5.7 percent year-over-year to $5.1 billion. Other Asia-Pacific revenues were up 13 percent to $6.390 billion.

For the Greater China sales decline, Apple CEO Tim Cook (Tim Cook) said in a conference call, mainly by the impact of exchange rate factors.

Cook said: "This fiscal quarter our sales in Greater China fell 6.5% year-on-year; at constant exchange rates, our sales declined by less than 3%. From this data, we can see that in fact more than half of the sales decline is related to changes in exchange rates. From this perspective, this quarter's performance was better than the first half of the fiscal year."

Cook expressed confidence in the development of the Greater China region and shared several positive signals of the improving performance. For example, Greater China's iPhone install base and the number of users who upgraded and replaced their iPhones hit record highs in this fiscal quarter. Another example is that the latest Kantar survey data shows that iPhone was one of the top three selling smartphones in China this quarter. In addition, the iPhone 15 has outperformed the iPhone 14 series in the same number of weeks since its release last year.

Cook also mentioned that the company is seeing good growth in the number of new users in Greater China. "In mainland China, there are a lot of new users of Mac and iPad products, and a lot of new users who choose to buy Apple Watch. this fiscal quarter's data shows that iPad sales in Greater China are in line with the global performance, both showing a return to growth momentum."

"All in all, we are confident about the long-term opportunities in China. Of course, it's anyone's guess what the future holds, but in the long run, we're very optimistic about Apple's prospects in the Chinese market." So said Cook.

Will AI drive a new wave of switching demand?

Since Apple released its intelligent system - Apple Intelligence - at WWDC, several analysts have already predicted that it will trigger a wave of Apple users to switch their phones. This is because Apple has already stated that Apple Intelligence will only be available for the iPhone 15 Pro/Pro Max and new models released subsequently.

Cook responded to questions about the switching rate on the call. He said that Apple only just announced the system and chip requirements for Apple Intelligence fit in June, and so far it's been too short of a period of time, so it's too early to jump to conclusions.

"What I can share with you is that with the launch of Apple Intelligence, we're very excited about the value of the products we can deliver to our users, as well as confident." Cook added, "I'm confident that the value of our products will also be one of the key reasons why users choose to upgrade to a new device."

Additionally, Cook confirmed that Apple Intelligence will be rolled out in phases. Since Apple Intelligence will be deeply integrated into iOS 18, it will be gradually rolled out to users with the iOS 18 update.

Cook said that Apple started pushing some of Apple Intelligence's features to developers this week, and that only a portion of the features were pushed to developers in the early stages. Other features, such as Apple Intelligence adapted to other languages, will be rolled out during the year, and ChatGPT is expected to be integrated into Apple Intelligence by the end of this year.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.