Yum China Q1 net profit nearly doubled year-on-year! KFC "Crazy Thursday" is the number one contributor?

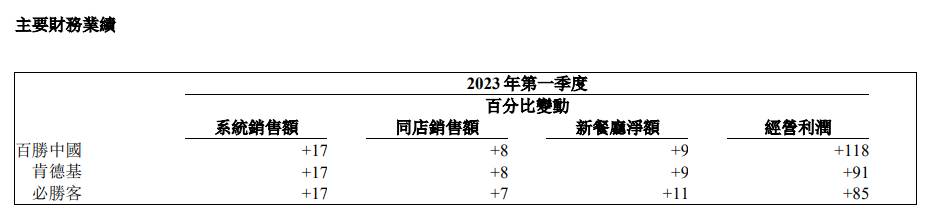

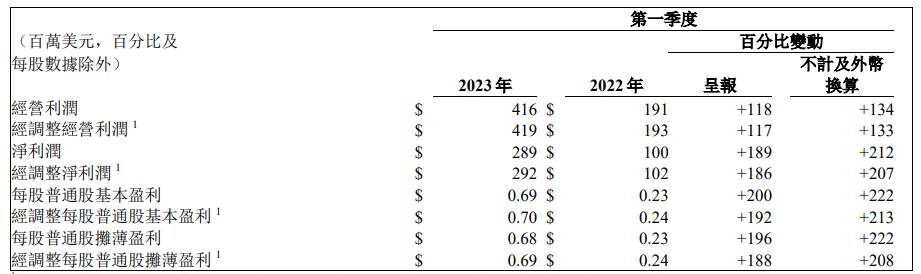

On May 3, catering giant Yum China released its first quarter 2023 financial report。Performance data show that the company's total revenue in the first quarter was 29.$200 million, up 9% YoY; operating profit of 4.$1.6 billion, up 118% YoY; net profit was 2.$8.9 billion, up 189%。

On May 3, catering giant Yum China released its first quarter 2023 earnings report。Performance data show that the company's total revenue in the first quarter was 29.$200 million, up 9% YoY; operating profit of 4.$1.6 billion, up 118% YoY; net profit was 2.$8.9 billion, up 189% YoY; adjusted net profit of 2.$9.2 billion, up 186%。At the same time, the company also disclosed that it repurchased approximately 1 million shares of common stock for a total of $62 million in the first quarter, at an average price of 60 per share..30美元。In addition, the company announced that it will pay a quarterly dividend of 0 per share on June 20..13美元。

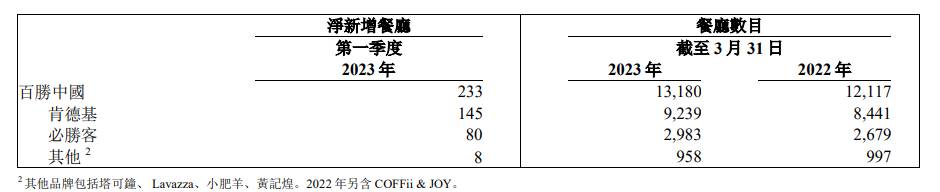

The rebound in consumption led to double growth in food and takeaways, boosting sales remains a top priority

Yum China is the franchisee of Yum! Brands in mainland China, with exclusive rights to KFC, Pizza Hut and Taco Bell in mainland China.。In addition, Yum China also exclusively owns Little Sheep and Huang Jihuang chain catering brands.。Among the above brands, KFC and Pizza Hut are the company's two largest business brands, contributing about 96% of the company's revenue in 2022.。As of March 31, 2023, the number of restaurants in KFC and Pizza Hut was as high as 92.73%。

At a time of weak consumption last year, Yum China saw both revenue and net profit decline。Yum China's total revenue in 2022 is 95.$700 million, down 3% YoY; full year net profit 4.$4.2 billion, down 55% YoY; adjusted net profit of 4.$4.6 billion, down 15% YoY。Since the end of last year, the epidemic prevention and control optimization, the beginning of this year, the national consumption ushered in a strong recovery, the catering industry also appeared a wide range of recovery。The bright performance of Yum China in the first quarter is also expected.。Despite the rebound in restaurant traffic, takeaway sales at KFC and Pizza Hut continue to grow。In the first quarter, takeaway sales accounted for about 36% of both restaurants' revenue, unchanged from the same period last year.。

Yang Jiawei, chief financial officer of Yum China, said: "Sales in the first quarter rebounded significantly year-on-year and month-on-month.。This is the result of our efforts to boost sales by seizing the opportunities presented by the easing of epidemic prevention and control, "" We are still in the early stages of recovery.。Sales during the Spring Festival were boosted by the release of tourism demand, but same-store sales after the Spring Festival are still a dozen percentage points lower than in 2019。Our top priority this year remains boosting sales。On the cost side, we expect inflationary pressures to gradually increase in the coming quarters and the benefits from temporary subsidies to gradually diminish.。The progress and pace of recovery remain uncertain as the macro environment remains challenging and the epidemic remains a potential risk。"

It is worth noting that, despite the overall trend of the Hong Kong stock market yesterday, but thanks to the strong earnings boost, Yum China H shares opened quickly pulled up to HK $512, up nearly 6%。It then began to fall back, after which it oscillated between HK $500-506 and then closed up 4% at HK $504.。

Q1 performance exceeded expectations, big banks have updated Yum China Hong Kong and U.S. stock ratings and target prices

According to a research report released by Macquarie, Yum China's first-quarter revenue rose 9% year-on-year, in line with expectations, and operating profit rose 117% year-on-year, exceeding market and bank expectations, mainly due to sales leverage, cost efficiency and government rent relief;.$9.2 billion, implying a compound annual growth rate of 9% from the first quarter of 2019 to the first quarter of this year。The bank said that even though it is optimistic about the company's optimization of its cost structure and its efforts to improve efficiency, it believes that the current price already reflects positive factors such as the reopening of the mainland economy and operating leverage.。Given the company's stronger-than-expected operating leverage performance, the bank raised its net profit forecast for this year and next by 11.6% and 29.3% and raised its H-share target price sharply from HK $345 to HK $416, maintaining its "outperform" rating.。

According to Nomura, Yum China's systems sales rebounded 17% year-on-year, same-store sales rose 8% year-on-year, and net point-of-sale information systems (POS) increased by 233; its restaurant margins improved to 20.3%, above pre-epidemic levels, reflecting management's flexibility。Nomura raises the company's earnings forecast for 2023-25 by 8.3% to 9.1%, while changing its H-share target price from 554.HK $6 raised to 582.HK $7, Maintain Buy Rating。

Goldman Sachs said in a research report that Yum China's adjusted operating profit and adjusted net profit rose 33% and 28% respectively in the first quarter, both higher than expected.。The bank said that even though Yum China's same-store sales in the first quarter still had a high single-digit growth gap compared to 2019 levels, restaurant margins amounted to 20.3%, almost an all-time high since going public, again demonstrating a well-planned cost reduction and an agile business model。Therefore, its H-share target price of 579 yuan, maintain a "buy" rating.。

In addition, some major banks updated their U.S. stock target prices and ratings。

Lyon believes that Yum China's first-quarter operating profit rose 134% year-on-year (excluding foreign exchange impact), surprising the market, with solid systemic sales growth, up 17% year-on-year。The bank believes that restaurant profit margins expanded 6 in the first quarter..5 percentage points to 20.3%, the peak since Q4 2018, which Lyon sees as another major positive performance。The bank noted that the company was opening more stores in lower tier cities, which allowed it to get cheaper lease contracts, and that its delivery orders became sticky after the control optimization reopened, which also reduced its average store size.。The bank raised its target price for U.S. stocks to 72 from $68..$5, maintaining its Outperform rating。

According to a research report released by Damo, Yum China's first-quarter results exceeded expectations, maintaining an "overweight" rating and giving U.S. stocks a target price of $70.。The bank believes that overall results outperformed the bank and market expectations due to better same-store sales at KFC and Pizza Hut, as well as higher margins from sales leverage, cost restructuring and temporary government help measures。The bank believes driving sales remains a top priority for Yum China this year as its same-store sales remain below 2019 levels after the Spring Festival peak season.。

Yum China's strong and record first-quarter results were driven by sales leverage and productivity and efficiency gains, offsetting higher promotional costs and rising wages。The bank believes that the first quarter results of this year demonstrate the Group's outstanding execution using its well-established platform and innovation capabilities, especially when KFC and Pizza Hut's same-store sales were 8% and 4% lower than in the same period in 2019, respectively, indicating the great potential of its sales leverage.。The company raised its earnings forecast by 2% to 6% and its target price for U.S. stocks from $67 to $75, giving it an "overweight" rating, and believes that the company should be a core shareholding in China's portfolio in the face of poor economic recovery prospects or lack of confidence in a strong macroeconomic rebound.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.