Outbreak gone, travel recovery China Southern Airlines Q1 still records net loss?

On the evening of April 28, China Southern Airlines and China Eastern Airlines released their Q1 2023 results.。China Southern Airlines Q1 Achieves Revenue 340.RMB 5.5 billion, net profit attributable to the parent company is -18.Rmb9.8bn; China Eastern Q1 achieves revenue of 222.RMB 6.1 billion, net profit attributable to the parent -38.03 billion yuan。

This year's May Day holiday domestic tourism market hot。According to the "voice of cultural tourism" official micro-blog news, 2023 "May Day" holiday, culture and tourism industry recovery momentum is strong, the national holiday market is stable and orderly。According to the data center of the Ministry of Culture and Tourism, the total number of domestic tourism trips nationwide is 2.7.4 billion person-times, up 70% year-on-year.83%, returning to 119 for the same period in 2019 on a comparable basis.09%; achieved domestic tourism revenue 1480.5.6 billion yuan, up 128% year-on-year.90%, returning to 100 in the same period in 2019 on a comparable basis.66%。

The May Day hot scene, there are signs before the festival。Air ticket prices have skyrocketed across the country, and it's hard to get a ticket for high-speed rail even if you add multiple trains.。In addition to domestic travel, outbound travel also saw a strong recovery。According to Ctrip data, the overall order volume of outbound travel in the mainland increased by nearly 700% compared with the same period last year, and outbound air tickets increased by nearly 900% compared with the same period in 2022.。But compared to the hot demand for passenger flights before May Day, some airlines' earnings are more flat。

China Southern Airlines still loses net profit in Q1, UBS cuts target prices for two carriers

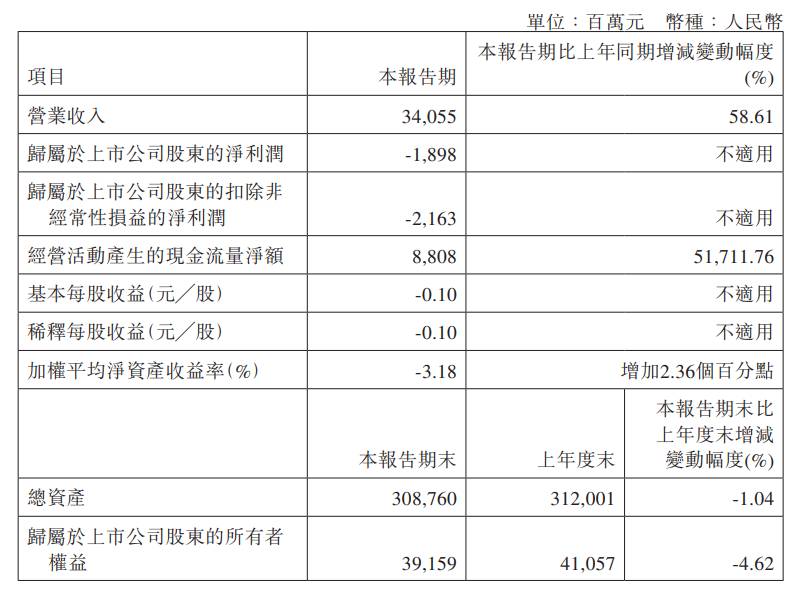

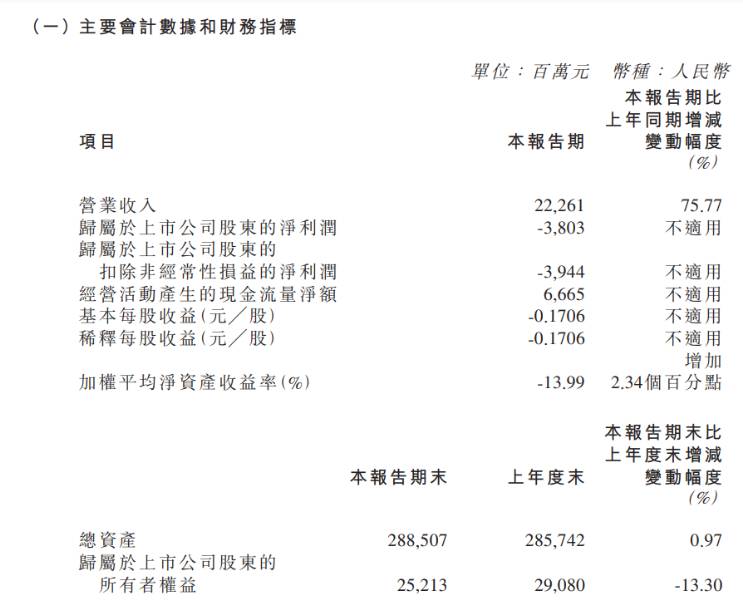

On the evening of April 28, China Southern Airlines and China Eastern Airlines announced their first quarter 2023 results, respectively。Public data show that China Southern achieved revenue of 340 in the first quarter of this year..5.5 billion yuan (RMB, the same below), up 58.61%, net profit attributable to the parent is -18.9.8 billion, with diluted earnings per share of -0.1 yuan。China Eastern achieved revenue of 222 in the first quarter of this year..6.1 billion yuan, up 75% year-on-year.77%, net profit attributable to the parent -38.$0.3 billion, with diluted earnings per share of -0 per share..17 yuan。

China Southern Airlines Q1 Main Financial Data

China Eastern Q1 Main Financial Data

For the first quarter results of the two companies, UBS immediately released a research report saying that China Southern Airlines 34.1 billion yuan in the first quarter of this year, up 59% year-on-year, equivalent to 90% of the 2019 level.。Net loss of 1.9 billion yuan, basically in line with market expectations。UBS raises its 2023-25 annual revenue forecast by 3% to 6%, given better-than-expected recovery in domestic business。However, due to higher-than-expected unit costs per saleable seat kilometer (ASK), the bank raised its cost forecast for China Southern, with adjusted earnings per share forecasts for the period reduced by 1%, 2% and 3%, respectively.。Meanwhile, UBS will target China Southern's H-share price from 5.HK $9 down slightly to 5.HK $8, Maintain Neutral Rating。

For China Eastern Airlines, UBS believes the company's first-quarter revenue rose 76% year-over-year to $22.3 billion, equivalent to 74% of the 2019 level.。Net loss narrowed to $3.8 billion during the period, slightly weaker than market expectations。And a loss of 9.3 billion yuan in the previous quarter and a loss of 7.8 billion yuan in the same period last year.。UBS believes that, given the stronger-than-expected performance of China Eastern's mainland passenger traffic and earnings, it also raised its revenue forecast for 2023-25, but will adjust its earnings per share forecast from zero..09 yuan, 0.$25 and 0.Rmb39, down to 0.06 yuan, 0.21 yuan and 0.33 yuan RMB。In addition, UBS has also reduced its target price for China Eastern's H shares from 4.HK $1 to 3.HK $8, maintain "buy" rating, while expecting the recovery of Japanese routes to be the next positive catalyst for China Eastern Airlines。

May Day ticket "volume and price rise," the follow-up holiday travel demand will be strong on the airline passenger transport support.

According to Ctrip's FlightAi market insight platform data show that this year's "May Day" period, ticket search heat than in 2019 rose 162%。The average domestic one-way tax-inclusive economy class ticket price was 1211 yuan, an increase of 39% over 2019; the average one-way "two-class ticket" price was 2443 yuan, an increase of nearly 80% over the same period in 2019.。Although the first quarter of the two airlines have recorded a net profit loss, but the second quarter of the May Day "hot," as well as the Dragon Boat Festival and summer vacation and other holidays, in the context of a strong recovery in domestic consumption, tourism demand or get further release, which will form a support for the airline's passenger revenue。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.