Hawkinsight Hong Kong Market Closing Roundup (1.15) | Red Sea Crisis Escalates Shipping Stocks Stronger Again

On January 15, the three major indexes of Hong Kong stocks opened for a dive, picked up before midday and remained volatile in the afternoon.。Hang Seng Index closes down 0 at close.17%, reported 16216.33 points。

On January 15, the three major indexes of Hong Kong stocks opened for a dive, picked up before midday and remained volatile in the afternoon.。Hang Seng Index closes down 0 at close.17%, reported 16216.33 points; Hang Seng SOE Index closes down 0.65%, at 5446.52 points; Hang Seng Tech Index closes down 1.92%, reported 3404

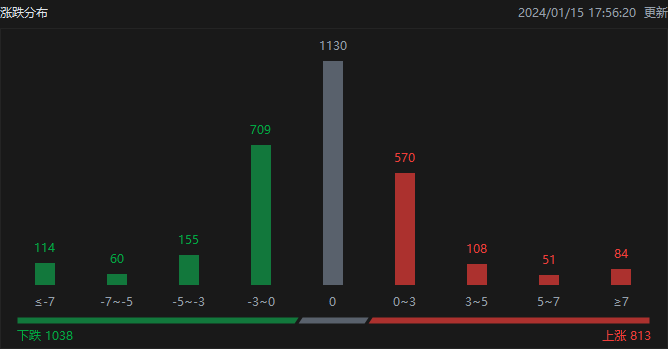

In terms of the distribution of ups and downs, as of the close of the day, Hong Kong stocks rose 813, fell 1038, closing flat 1130

On the day of the Hong Kong stock market, North Water traded a net buy of 42.HK $300 million, of which the Hong Kong Stock Connect (Shanghai) traded a net purchase of 24.HK $3.5 billion, Hong Kong Stock Connect (Shenzhen) net sales of 17.HK $9.5 billion。

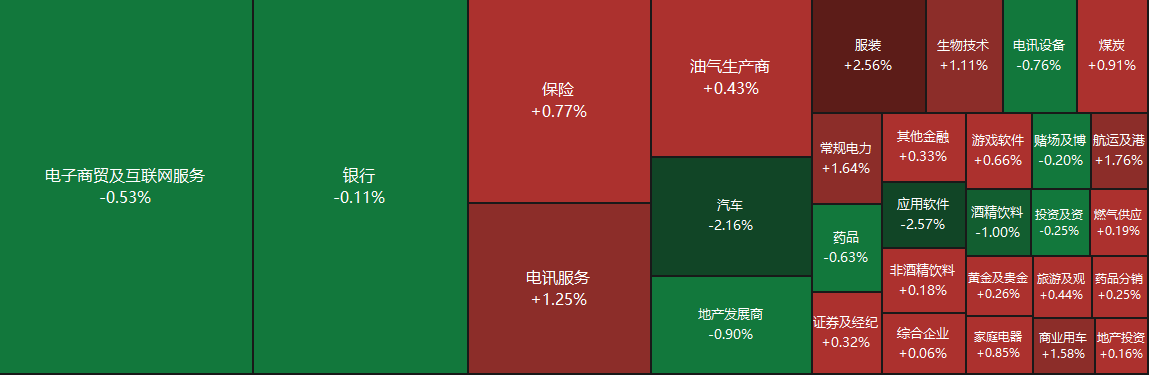

Sectors and Fundamentals

From the disk, the company's stocks fell, Baidu fell more than 11%, fast hands fell more than 3%, Jingdong, beery beery fell about 2%, Alibaba, millet fell nearly 1%

Fundamentally, the Red Sea crisis escalates again。On January 12, Yemen's Houthis issued a statement saying that U.S. and British forces had launched 73 attacks on Yemen.。Container index (European line) futures opened higher today, the main 2404 contract was up more than 14% at the beginning of the session, a new high since January 8。South China Futures noted that Friday's sharp rise in futures prices was more like a fermentation of the impact of the Yemeni Houthi attack on U.S. ships and the German strike。And last Friday was also the last working day before shipping companies raised freight rates on Asia-Europe routes in mid-January.。In the short term, the current conflict between the United States and the United States and the Houthi armed forces has escalated the Red Sea crisis again, including Maersk, including the liner giants have announced an increase in the number of ships bypassing the Cape of Good Hope, and impose a corresponding surcharge, both from the emotional and realistic side will give freight support, so it is expected that the price still has some upside space。However, it is not appropriate to overestimate the price of the consolidation period.。

January 15, Apple China official website online activity forecast, will be on January 18-21 to open the "Spring Festival limited time discount"。Apple introduced, with eligible payment methods to buy specified products, up to 800 yuan can be saved。Among them, the price reduction products involve mobile phones, computers, tablets, watches, headphones and other products。Analysts at investment bank Jefferies (Jefferies) said in a note that Apple was hit hard in the Chinese market, with iPhone sales falling sharply in the first week of 2024, down 30% from a year earlier.。According to the analyst, this is mainly due to fierce competition from local Chinese competitors, especially Huawei's strong counterattack.。Jefferies analysts predict Apple will continue to face more pressure from domestic competitors in 2024。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on January 9, Alibaba reduced its holdings of 3.1 million shares of Fast Dog Taxi at a price of 0 per share..HK $6,410, total reduction of approximately 198.HK $710,000。The latest number of shares held after the reduction is about 4260..870,000 shares, with the shareholding ratio changed to 6.79%。

On January 9, Xiaomo increased its holdings of Haier Zhijia 92.24.66 million shares, price per share 21.HK $7730, total increase of approximately 2008.HK $490,000。The latest number of holdings after the increase is about 2..8.6 billion shares, shareholding changed to 10.01%。

New Stock News

According to the Hong Kong Stock Exchange on January 12, hand back to Technology Co., Ltd. (hereinafter referred to as "hand back to Technology") to the main board of the Hong Kong Stock Exchange, CICC, Huatai International for its joint sponsors.。

According to the prospectus, Hand Back Technology is an online life insurance intermediary service provider in China, committed to providing customized insurance service solutions to insurance customers through a digital life insurance trading and service platform centered on insurance customers.。During the Track Record Period, the Company had approximately 100

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.