The most complete basic knowledge of novice investment in Hong Kong stocks in 2024

This article will bring you the most complete Hong Kong stock investment lazy package, including an introduction to the types of Hong Kong stocks, trading hours, ups and downs mechanism, transaction costs, how to trade Hong Kong stocks, how to study Hong Kong stocks, etc.。

As one of the most important financial markets in Asia and the world, the Hong Kong stock market has always been loved by investors and famous companies.。Hong Kong's stock market is ranked 6th in the world in terms of market capitalization and 2nd in Asia after Tokyo, Japan。As of February, there were as many as 2,257 companies listed in Hong Kong, including many Chinese companies such as Tencent, Alibaba, and Industrial and Commercial Bank of China.。

Many investors who are not in Hong Kong lack understanding of Hong Kong stocks, and the author will explain in detail in this article about Hong Kong stocks, such as the types of Hong Kong stocks, trading hours, and transaction costs.

▍ Common investment products of the Hong Kong Stock Exchange

-

blue chip stocks

Blue chips are companies with high value, large market capitalization, mature business and long-term stable performance.。Hang Seng Index components are also known as blue chips。

Examples of blue chips (not all):

- Tencent Holdings (00700)

- Alibaba SW (09988)

- HSBC Holdings (00005)

- ICBC (01398)

- Sun Hung Kai Properties (00016)

-

red chips

A red-chip company is a company whose headquarters and its main business are in mainland China, but whose company is incorporated outside the mainland and listed on the Hong Kong Stock Exchange.。

| blue chip stocks | red chips | |

| Origin | The West | Hong Kong |

| color meaning | Blue, representing the highest value chips | Red, representing China |

| 定义 | Companies with large market capitalization, high prices and mature businesses | Companies with business in China but registered and listed in Hong Kong |

Examples of red chips (not all):

- China Mobile (00941)

- China Offshore Oil (00883)

- Bank of China Hong Kong (02388)

- CITIC Shares (00267)

- China Resources Land (01109)

-

H Shares

H-shares refer to companies incorporated in mainland China and approved by the CSRC for listing in Hong Kong.。The shares of these companies are listed in Hong Kong, subscribed and traded in Hong Kong dollars or other currencies.。H-shares are also known as equity shares because most of these companies are state-owned enterprises under a central government department or committee.。In addition, some H-share companies have been listed in mainland China and traded in RMB, known as A-shares.。

H-share examples (not all included):

- Tencent Holdings (00700)

- Alibaba SW (09988)

- China Mobile (00941)

- Construction Bank (00939)

- China Offshore Oil (00883)

-

ETF

ETF (Exchange Traded Fund), Chinese called Index Equity Fund, is a fund that can track the movement of major indices, stocks and other commodities.。An ETF is like a basket, containing a series of stocks。A Hong Kong stock ETF is an ETF based on the Hong Kong stock market index.。

-

REIT

REIT is a real estate investment trust that provides investors with continuous rental dividend income by focusing on real estate investments that provide rental income, such as shopping malls, office buildings, hotels and serviced apartments in Hong Kong.。

Examples of REITs in Hong Kong (not all):

- Leading Property Fund (00823)

- Guanjun Industrial Trust (02778)

- Rich Industrial Trust (00778)

- Yuexiu Property Trust (00405)

- Huixian Industrial Trust (00405)

-

IPO (new shares)

Initial Public Offering (IPO) is the first time the company has issued and sold shares to the public to raise funds and listed on the stock market.。Investors need to become shareholders of the company by subscribing to the IPO.。In Hong Kong, IPOs are also known as new shares.。

In Hong Kong, "playing new shares" is very popular.。Playing new shares means participating in the purchase of new shares, and if you win the bid, you will sell the arbitrage directly after the new shares are listed.。

Investors can check the performance of semi-new shares at aastocks。The semi-new stock index is the performance of newly listed new shares (IPOs).。

In 2022, a total of 89 new shares will be listed in the Hong Kong market.。It can be seen that the performance of semi-new shares in Hong Kong stocks over the past two years has been very good, with the highest increase so far, Guanze Medical (02427) as high as 550%, while the highest performance on the first day of listing is Morisone International (02155), up to 258.8%。

In 2023, Hong Kong stocks continued to heat up, with 10 new listings in January alone。According to the report, 132 companies have applied to the HKEx for listing.。Investors can keep an eye out for information on aastocks tracking new shares。

-

Ward wheel (single)

Warrants (Warrants) is a derivative instrument, buying a Warrant is equivalent to buying a right, investors can buy or sell a specified asset within a specified period of time (maturity), at a specified price (exercise price), this asset can be stocks, commodities, foreign exchange and so on.。

There are two types of nest wheels, bullish and bearish, i.e., Call and Put。For example, an investor who is bullish on Company A's stock will rise next can buy Company A's Call round, because theoretically when Company A's stock price rises, Company A's round will also rise, and the rise will be higher.。Conversely, if Company A is bearish, then the price of the Put round will also rise and investors can profit from it。

| Call Turbine | Put Turbine | |

| specific asset price increases | Turbine prices rise | Turbo prices down |

| Decline in specific asset prices | Turbo prices down | Turbo Prices Up |

The advantage of trading a nest wheel is that you can participate in fluctuations in the price of a particular asset at a lower price, plus the fact that the nest wheel is a leveraged instrument with greater price volatility。But volatility is also bad, and when the price of a particular asset is in the opposite direction to buying, the price of its nest wheel is also volatile.。In addition, when the intrinsic value of the nest wheel equals zero at maturity, the nest wheel price will also equal zero。

-

CBBC

CBBC is an investment derivative product introduced by the Hong Kong Stock Exchange in 2006 and is a leveraged investment vehicle.。CBBCs are linked to a specific asset, which can be an index or a stock.。

- If you are optimistic that asset prices will rise, you can make a profit by trading bull certificates.

- If the asset is bearish, profit by trading bear warrants。

Its concept is similar to that of a single (Hong Kong stock term for nest wheel, Warrant).。The difference between the nest wheel and the CBBC is that the CBBC has a mandatory withdrawal mechanism。The mandatory withdrawal mechanism means that when the trading price of the CBBC reaches the exercise price (Exercise Price) before it expires, it is settled immediately and the transaction is stopped.。The nest wheel, on the other hand, can be traded on or before the maturity date, whether or not it reaches the exercise price.。

-

Hong Kong Stock Futures

A futures contract is a derivative instrument in which a buyer and seller commit to buy or sell a specified number of underlying products of the contract at a pre-agreed price at a specified date in the future, which may be stocks or indices.。Index futures are the most concerned by Hong Kong investors.。Index futures are settled directly in cash.。Investors are at risk of increasing margin when the price of the underlying asset fluctuates significantly。When the margin falls to the lowest level of maintenance margin, the investor must replenish the margin (term: cover position) or the broker will close the position (term: cut position)。

Investors generally buy and sell futures in a directional manner, also known as unilateral speculation, i.e. bullish or bearish.。Since futures are a leveraged investment, investors need to consider their financial affordability, carefully measure risk, and properly control leverage to reduce the huge losses caused by investment mistakes.。

▍ Hong Kong Stock Index

-

Hang Seng Index

The Hang Seng Index (HSI) is one of the most famous indices in the world and is used as a reference to the overall stock market movements in Hong Kong.。The index includes companies with the largest market capitalization and the most active transactions and listed on the Main Board of the Hong Kong Stock Exchange.。The constituents are adjusted for market capitalization and then weighted by market capitalization to calculate the index。Initially, the Hang Seng Index was made up of 52 Hong Kong stocks, but starting last year, the HKEx planned to increase the number of stocks to 100, and there are currently 82 stocks in the Hang Seng Index.。Point

The chart above shows the trend of the Hang Seng Index over the past 5 years, down 36 so far in 2018.75%, indicating that the overall trend of the Hong Kong stock market can be said to be very weak.。

-

SOE Index

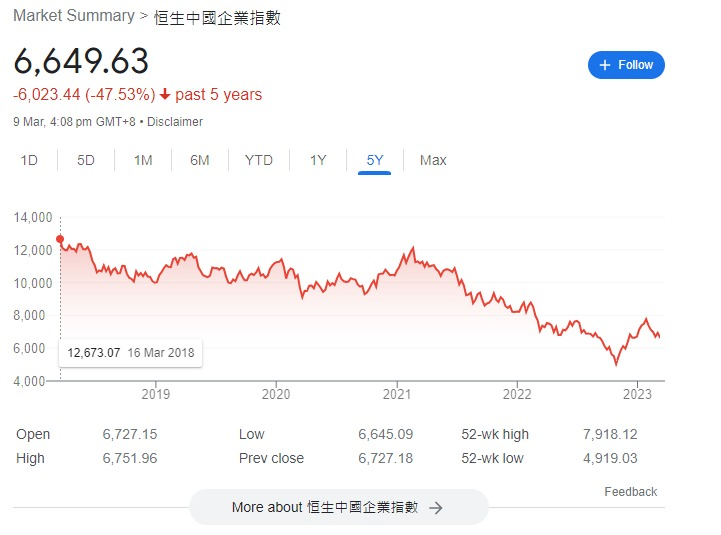

The Hang Seng China Enterprises Index (HSCEI) is a weighted index of 50 H-shares that tracks the performance of H-share companies.。

The chart above shows the trend of the SOE index over the past five years, down 47 so far in 2018.53%, mainly due to the stronger trend of the renminbi over the Hong Kong dollar, resulting in mainland Chinese investors preferring to invest in Chinese companies listed in mainland China (A-shares) rather than converting Hong Kong dollars to invest in Chinese companies listed in Hong Kong.。

-

red chip index

The Hang Seng Hong Kong Chinese Enterprises Index (commonly known as the Red Chip Index, HSCCI) is a weighted index of 25 red chips that tracks the performance of red chip companies.。

The chart above shows the trend of the red-chip index over the past five years.。Comparing the Hang Seng and SOE indices, the red-chip index is relatively strong, down only 11% so far in 2018。

▍ The basic structure of the Hong Kong stock market

-

Hong Kong Stock Market: Main Board and ChiNext

The Hong Kong Stock Exchange is mainly divided into the Main Board and the Growth Enterprise Market.。

- Companies listed on the Main Board are companies with more stable and mature financial and performance records and are larger。Main board companies include multinational groups, banks, real estate developers, Internet companies and healthcare providers.。

- The Growth Enterprise Market (GEM) is a new stock market launched by the HKEx in 1999, primarily to allow smaller, potential companies to list on the HKEx at a lower threshold.。At first, the trading volume of the GEM was sluggish, but after the reform, the trading volume of the Hong Kong stock GEM has become higher and higher recently, and the companies listed on the GEM are also called quality.。

motherboard and gem of distinction

| Motherboard | GEM | |

| FINANCIAL SITUATION | Operating cash flow must exceed HK $100 million in the three years prior to listing | Operating cash flow in the two years prior to listing must exceed HK $30 million |

| Profitable | Cumulative earnings of more than HK $80 million in the three years prior to listing | No requirement |

| Market Value | The company's market value exceeds HK $500 million | The market value of the company exceeds 1.HK $500 million |

| Number of shareholders | The company must have at least 300 shareholders | The company must have at least 100 shareholders |

| Changes in the Company's management | The company's management has not changed in the last three years. | The company's management has not changed in the last two years. |

| Financial Report Submission | Semi-annual financial reporting | Quarterly financial reporting |

-

Hong Kong Stock Trading Hours

Hong Kong stock trading hours are as follows:

| Hong Kong Stock Trading Hours | All Day City | Half-Day City |

| Bid before opening | 9.00a.m. - 9.30a.m. | 9.00a.m. - 9.30a.m. |

| Morning Market | 9.30a.m. - 12.00p.m. | 9.30a.m. - 12.00p.m. |

| Market closed at noon | 12.00p.m. - 1.00p.m. | Not applicable |

| noon market | 1.00p.m. - 4.00p.m. | Not applicable |

| Closing Bid | 4.00p.m.- 4.08p.m.To 4.10p.m.Between | 12.00p.m.-12.08p.m.to 12.10p.m.Between |

During the opening and closing bids, investors are free to enter the bid and offer prices within a reference price range, their orders interact with each other, and the price with the highest volume will become the opening and closing prices and execute orders at that price。

Half-day trading on holidays such as Christmas, New Year and the eve of the Lunar New Year, and no afternoon trading on that day。

In addition, extreme weather will also affect trading in the Hong Kong stock market. If the Hong Kong Observatory issues Typhoon Signal No. 8 (or above) and Black Rainstorm Warning, please pay attention to the news issued by the HKEx market system to see if the typhoon signal / rainstorm warning will affect trading.。

-

Hong Kong Stock Trading Unit

In U.S. stocks, the minimum trading unit is one unit, for example, Apple's stock price is $155 a share, so the transaction cost is $155.。

And in Hong Kong stocks, the lower unit of the lower unit is also a first-hand。But the difference is that the number of shares per lot in Hong Kong stocks is determined by each company.。For example, Tencent's primary unit is 100 shares and the transaction cost is HKD331..6 x 100 shares = HKD 33160。ICBC's primary unit is 500 shares and the transaction cost is HKD4..06 x 500 shares = HKD 2030。

We may have learned on the trading platform that each unit of each stock。Here is a moomoo mobile app demonstration, after searching for stocks, you can see the number of shares per lot on the quote page。

In addition, when there is less than one stock, the holdings are called "broken stocks."。Broken stocks cannot be traded through the HKEx's cross-market system, but many online brokerages today offer broken stock trading services, such as moomoo (Singapore), Futu Bull (Hong Kong), Weiniu, Longbridge, Tiger Securities, etc.。

It should be noted that the circulation of broken stocks is very small, so usually the transaction price of buying broken stocks will be a few price levels higher than the price of the whole lot, and the transaction price of selling broken stocks will be a few price levels lower than the price of the whole lot.。

Broken stocks can only be traded during the continuous trading hours of Hong Kong stocks (i.e. 9: 30am ~ 12: 00pm, 13: 00pm ~ 16: 00pm), and there is no morning market or closing auction period.。

-

Hong Kong stocks rise and fall mechanism

There is no mechanism for Hong Kong stocks to rise or fall, and everything is freely determined by the market.。So, Hong Kong stocks could collapse 90% a day, or they could rise dozens of times a day.。

In 2019, Accor Holdings (HKEX: 3313) saw its share price fall 98% in a single day after being abandoned for inclusion in the MSCI China Index, almost spitting back in a single day its gain of up to 3800% in the year.。

In the absence of a rise and fall mechanism, it is clear that the risk is greater, so investing in Hong Kong stocks should avoid buying inferior stocks in order to avoid the hands of stocks in one day.。

-

Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect

The Shanghai-Hong Kong Stock Connect and the Shenzhen-Hong Kong Stock Connect are mechanisms for interconnecting the stock markets of Mainland China and Hong Kong, allowing investors from both markets to invest directly in each other's markets.。

The Shanghai-Hong Kong Stock Connect was launched in November 2014 to allow Hong Kong and other overseas investors to trade qualified shares listed on the Shanghai Stock Exchange (SSE) through Hong Kong securities dealers.。At the same time, mainland Chinese investors can also trade eligible stocks listed on the HKEx through mainland brokerages.。Through the Shanghai Stock Connect, individual investors can invest in components of the SSE 180 Index, components of the SSE 380 Index, and stocks listed in both Hong Kong and Shanghai (H-shares and A-shares).。Institutional investors can invest in GEM stocks.。

In August 2016, the Shenzhen-Hong Kong Stock Connect mechanism was launched to allow Hong Kong and other overseas investors to trade qualified shares listed on the Shenzhen Stock Exchange (SZSE) through Hong Kong securities dealers.。Through the Shenzhen Stock Connect, individual investors can invest in components of the SZSE Index, components of the SZSE SME Innovation Index, and stocks listed in both Hong Kong and Shenzhen (H-shares and A-shares).。Institutional investors can invest in GEM stocks.。

Hong Kong and overseas investors trade Chinese mainland stocks through the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect in RMB, with 100 shares per lot.。

As long as there are brokerages on the market that offer Hong Kong stock trading, there are Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect trading services that allow investors to invest directly in the stocks of their superiors on the SSE and Shenzhen Stock Exchange.。

▍ Hong Kong stocks vs ADR

Companies like Alibaba, Tencent, Baidu, Jingdong and others are listed in U.S. and Hong Kong stocks, so what's the difference between the two??

American Depositary Receipt (ADR) is an investment vehicle issued in the form of notes by a non-U.S. company listed in the United States.。In order to increase access to financing, companies from Hong Kong and other countries can be listed in the United States in the form of ADRs.。

How ADRs work: U.S. investment banks buy shares of overseas listed companies and then issue ADRs on the U.S. stock market that represent the shares in U.S. dollars, allowing investors in the U.S. to participate in overseas companies in the U.S. stock market.。

Buying ADRs is not the same as buying shares, because ADRs are pre-trust securities, so investors do not have voting rights in the company, but can also receive dividends。

And buying a company listed in Hong Kong is tantamount to buying shares of its company as a shareholder with voting rights.。

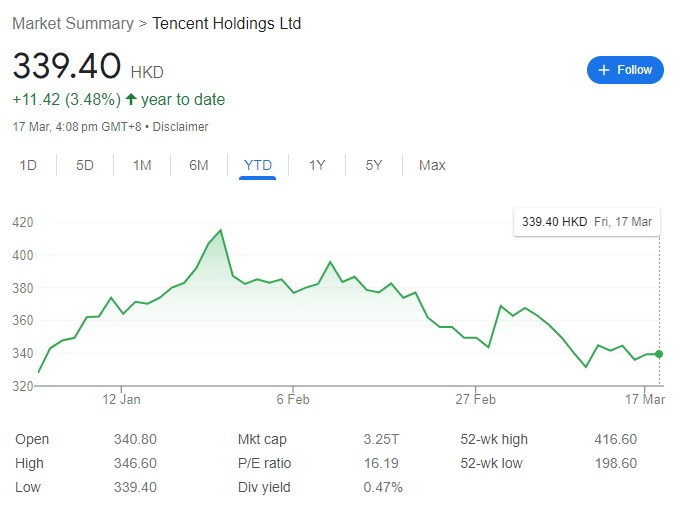

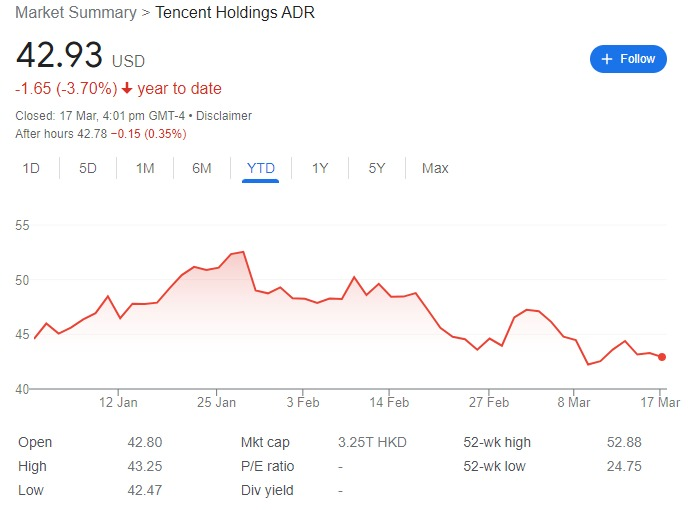

tencent hong kong stocks

Tencent ADR:

The share price movements of ADRs and Hong Kong stocks are very close, so investing in ADRs and Hong Kong stocks is no different。

Should I invest in ADR or Hong Kong stocks??Investing in ADRs is subject to exchange rate risk, and when exchange rates fluctuate significantly, the cost of investment and share price performance will follow suit。So, if you're investing primarily in stocks in Hong Kong dollars, there's no need to convert dollars to trade ADRs。And if you invest primarily in stocks in dollars, it's easier to invest in ADRs。

In addition, the threshold and admission fees for trading ADRs are relatively low, as the lowest trading unit for U.S. stocks is one share, while the lowest unit for Hong Kong stocks is one lot, and the admission fees for trading Hong Kong stocks are therefore higher.。

However, it should be noted that the U.S. has been cracking down on Chinese companies listed on ADRs in the U.S. in the past two years, tightening its control, resulting in many ADRs at risk of delisting from the U.S. stock market, and share prices have fallen a lot as a result.。

▍ Want to invest in Hong Kong stocks, where to start studying Hong Kong stocks?

Investing requires regular access to the latest market information, such as stock price movements, performance reports, company announcements, financial news, etc.。The following are some websites suitable for obtaining information on Hong Kong stocks.。

-

AA Stocks

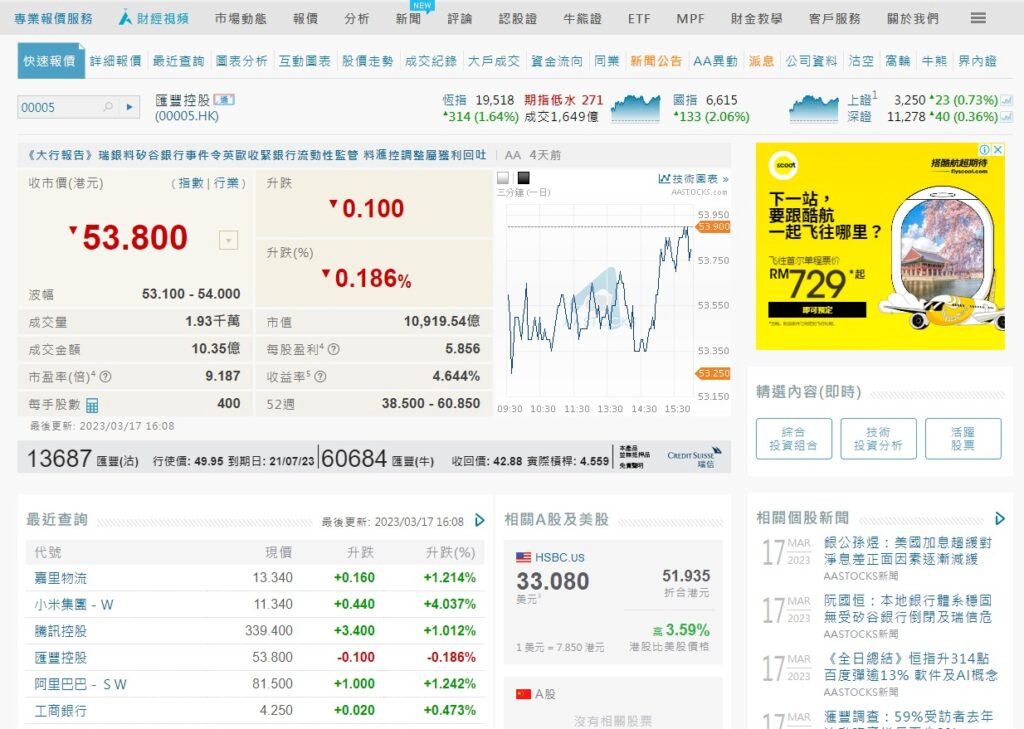

AA Stocks is a must-use website for Hong Kong stock investors。AA Stocks provides the most up-to-date news updates, market dynamics, stock quotes, fundamental and technical analysis of the Hong Kong, China and US stock markets, and more。

-

Yahoo Finance

Yahoo Finance official website

Yahoo Finance provides multiple functions, including company profiles, real-time news, listed company research reports, charts, stock screening, personal portfolio management and more.。

-

Futu Niu Niu

Futu Niu Niu is a one-stop investment platform, in addition to providing a trading platform, Futu Niu Niu also provides Hong Kong stocks, U.S. stocks, new stocks, Chinese stocks and other market information.。It is recommended to use the Futu Bull Bull app to find more advanced data such as charts, quotes, research reports, financial reports, etc., as well as to communicate with other investors in its community.。

-

HKEx Disclosure Ease

HKEx Discloses Official Website

Any information about the listed company, including financial statements, circulars, and other documents, will be uploaded to the Disclosure Ease.。

Annual Report:

Interim Report:

Note that unlike other markets, Hong Kong stocks do not require listed companies to issue quarterly reports.。Investors usually refer to the interim reports (i.e., semi-annual / quarterly) and annual reports of Hong Kong stocks.。

Other documents:

▍ Hong Kong stock transaction costs

| 项目 | Collector | 费用 |

| Transaction Levy | SFC | 0.00% |

| Transaction Fee | HKEx | 0.01% |

| Stamp duty | Government | 0.13% |

| Financial Return Board Transaction Levy | SFC Hong Kong | 0.00% |

| Trading system usage fees | HKEx | 0.5 yuan |

| Trading Commission | Brokers | Depending on the broker |

▍ How to buy and sell Hong Kong stocks?Where to trade?

The first step in investing in Hong Kong stocks is to open a brokerage account.。As with investing in U.S. stocks, the average investor can open an account through an overseas brokerage firm (online brokerage firm), while Malaysians can also open an account through a Malaysian online brokerage firm and a local Malaysian investment bank in the form of a re-commission.。

-

Overseas Brokers (Internet Brokers)

There are currently two common types of overseas brokerages in the market: traditional overseas brokerages and emerging online brokerages.。

Traditional overseas brokerages include TD Ameritrade, Interactive Brokers, Saxo Market and POEMS.。Emerging online brokerages include Singapore's Futu Securities moomoo trading platform, Longbridge Securities (Longbridge) and Tiger Brokers (Tiger Brokers).。

The advantages of using overseas brokerages are low transaction costs and a very simple and easy-to-use interface.。Some brokerages also offer virtual accounts that allow users to familiarize themselves with the operation before starting to invest.。

However, there are also risks associated with the use of overseas brokerages, such as safety and regulatory issues, and fees for deposits and withdrawals may be high.。

-

Network Brokers in Malaysia

FSMONE and Rakuten Trade launched Hong Kong stock trading services in 2021 and 2022 respectively, making it easier for Malaysian investors to invest in the Hong Kong stock market.。Both brokerages are regulated by Malaysia's Securities Commission.。

Compared to the local investment bank's entrustment method, the advantage of local network brokers is that Hong Kong stock trading commissions are lower.。

| Rakuten Trade | FSMOne | |

| Commission (trading in Hong Kong dollars) | 0.1% or minimum HKD35 | 0.08% or minimum HKD50 |

| Commission (trading in RMA) | 0.1% (minimum RM7, maximum RM100) | Not applicable |

Rakuten Trade also supports the trading of Hong Kong stocks in Malaysian dollars.。

-

Malaysia's local investment bank re-commissioned

Most local investment banks in Malaysia, such as CGS CIMB, Kenanga, RHB Bank, Hong Leong Investment Bank and Maybank Investment Bank, provide Sub-Brokerage services to allow local investors to trade Hong Kong stocks.。

The advantage of re-commissioned brokerage firms is a high degree of security and convenience, investors do not need to convert funds into U.S. dollars, while the deposit and withdrawal can also be made using local banks, very convenient.。

However, the disadvantage of re-commissioning brokers is the higher commission fees。For example, CGS CIMB trades U.S. stocks at a commission rate of 0.2% with a minimum commission of HK $80。For small investors, a $25 commission fee increases investment costs and is not very cost-effective。

▍ Summary

Although investing in the Hong Kong stock market is relatively complicated, as long as you have more contact, research and practice, I believe you will soon be able to grasp the investment in Hong Kong stocks.。

The advantage of investing in Hong Kong stocks is that it gives investors the opportunity to invest more in mature and robust companies, as Hong Kong is one of the world's largest financial markets, with many well-known and mature Chinese and Hong Kong companies listed on the HKEx and very high liquidity.。

But in terms of the Hang Seng Index, the Hong Kong stock market has been very weak in the last five years.。Referring to the chart below, the Hang Seng Index has fallen 35% in the last 5 years.。It means that if you bought a Hang Seng Index ETF five years ago, you're still losing 35% today.。In contrast, the U.S. S & P 500 index has risen 52% in the past five years.。

Weak Hong Kong stocks are good or bad for investors.?Bad for technical investors。But for fundamentals and value investors, it's good because it means that Hong Kong stocks are much cheaper to value.。As long as you do your homework and choose the right company, you have a better chance of making money.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.