What is SIPC? How does it protect investors' rights?

SIPC cover can make your investment safer and this article will give you an overview of the SIPC cover that you must know before choosing a stockbroker.

As financial technology flourishes and knowledge about stock investment spreads, the barrier to entry for investing gradually decreases, and public interest in various financial products increases. However, in this era of high inflation, investors need to be vigilant about investment risks, especially those related to financial investment fraud.

According to data from the Federal Trade Commission of the United States, financial investment-related fraud cases increased by 70% year-on-year in 2021, exposing the risks that investors face in the investment process.

To reduce the risk of investment brokerage firms, it is recommended that investors confirm whether the brokerage firm is a member protected by the Securities Investor Protection Corporation (SIPC) and the Financial Industry Regulatory Authority (FINRA) when choosing a US stock trading brokerage firm.

Role and Importance of SIPC

Established in 1970, SIPC is a non-profit membership organization set up under the Securities Investor Protection Act (SIPA). Its primary mission is to protect investors' assets in the event of brokerage firm bankruptcy.

When a brokerage firm faces bankruptcy or liquidation, SIPC intervenes to provide protection for affected investors, up to a maximum of $500,000 in coverage, including up to $250,000 in cash protection.

Coverage and Funding Sources of SIPC

The coverage of SIPC applies to customers of member companies, i.e., investors using brokerage services. Under certain conditions, investors' cash and securities losses will be compensated, with a single protection limit of $500,000, including a cash limit of $250,000.

The funds of SIPC mainly come from its members, who must pay a fee of 5% of gross profits to establish an investor protection fund. These funds are used to invest in US government bonds and cover SIPC's operating expenses.

Scope of SIPC Protection

The coverage of SIPC includes cash and securities but does not include currencies, commodities, or futures contracts. Investors' investment losses may also not be covered by SIPC, depending on the specific circumstances. Therefore, investors should carefully choose investment products and trading platforms and understand the scope of SIPC coverage.

SIPC Claims Process

In the event of brokerage firm bankruptcy or liquidation, investors can file claims through SIPC. SIPC will appoint independent trustees to handle bankruptcy cases, asset liquidation, and compensation work. Investors can file claims through trustees or directly through the payment procedure, following the regulations of SIPC.

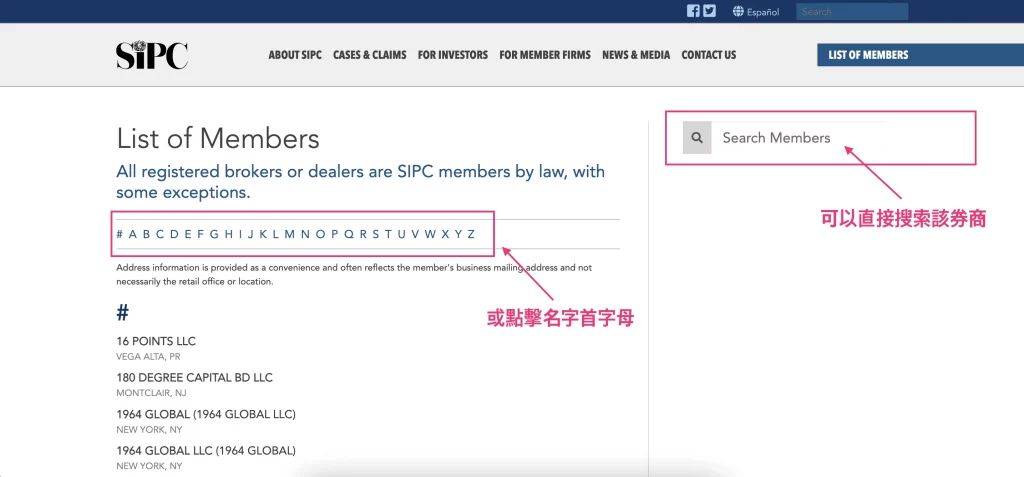

SIPC Member Brokerages

Choosing a SIPC member brokerage is key to ensuring investment security. Some common SIPC member brokerages in the market include Interactive Brokers (ticker symbol: IBKR), TD Ameritrade (ticker symbol: AMTD), Tiger Brokers (ticker symbol: TIGR), among others. Investors should carefully research whether a brokerage is a SIPC member and understand its service quality and reputation when selecting a brokerage.

Case Study: Lehman Brothers Bankruptcy

The Lehman Brothers bankruptcy case is a typical example of SIPC protection. During the 2008 financial crisis, Lehman Brothers faced bankruptcy, affecting 110,000 investors. After SIPC intervention, affected investors were provided with over $9.2 billion in protection, helping them weather the storm and preserve their assets through compensation.

FAQ

Understanding relevant issues about SIPC protection when investing can help investors evaluate risks more comprehensively and make wise investment decisions.

- Do investors need to register for SIPC protection? No, they do not. SIPC protection is based on the Securities Investor Protection Act (SIPA), enacted by federal law. Each customer of a brokerage firm in liquidation status can receive protection.

- Is SIPC protection limited to US citizens? No, it is not. Regardless of investors' nationality or place of residence, as long as they have accounts opened with SIPC member companies, they can enjoy SIPC protection.

- Can foreign non-SIPC member brokers also receive SIPC protection? If a foreign brokerage firm opens accounts for non-US clients in a SIPC member company and that member company is ordered to liquidate, each client of the foreign firm may be eligible for indirect SIPC protection.

- Are non-SIPC member brokers necessarily non-compliant? Some non-SIPC member brokers may operate legally in their home countries but may not meet SIPC membership requirements or choose not to become SIPC members. Investors should carefully consider when choosing brokers to ensure they select those that meet regulatory standards.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.