What is the Rule of 72?

The Rule of 72 operates on the concept of compound interest, enabling a swift calculation of the time needed for an initial investment to double at a certain interest rate. It can also be utilized to estimate the annualized rate of return required within a specific timeframe to achieve the goal of doubling the principal.

Definition of the Rule of 72

The Rule of 72, also known as the "compound interest rule of 72," operates on the principle of compound interest, allowing for a quick estimation of the time required for an investment to double at a certain interest rate. It can also be applied to approximate the annualized rate of return needed over a specific period to achieve asset doubling.

Origin of the Rule of 72

The roots of the Rule of 72 trace back to 1494, introduced by the renowned Italian mathematician Luca Pacioli in his work "Summa de arithmetica, geometria, proportioni et proportionalità." Pacioli is also revered as the father of modern accounting.

Calculation Formula of the Rule of 72

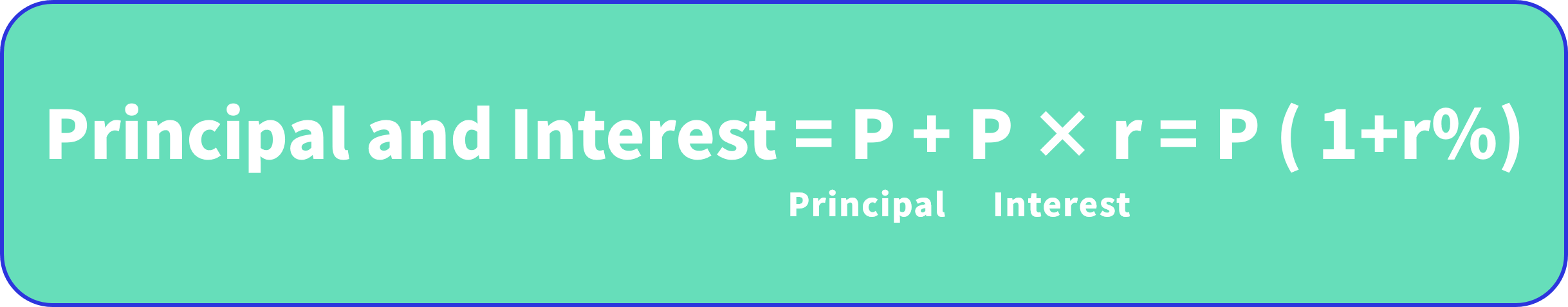

Assuming a principal amount of P yuan and investing it in a product with an annual interest rate of r%, the time required for the principal to double after N years can be computed. The calculation proceeds as follows:

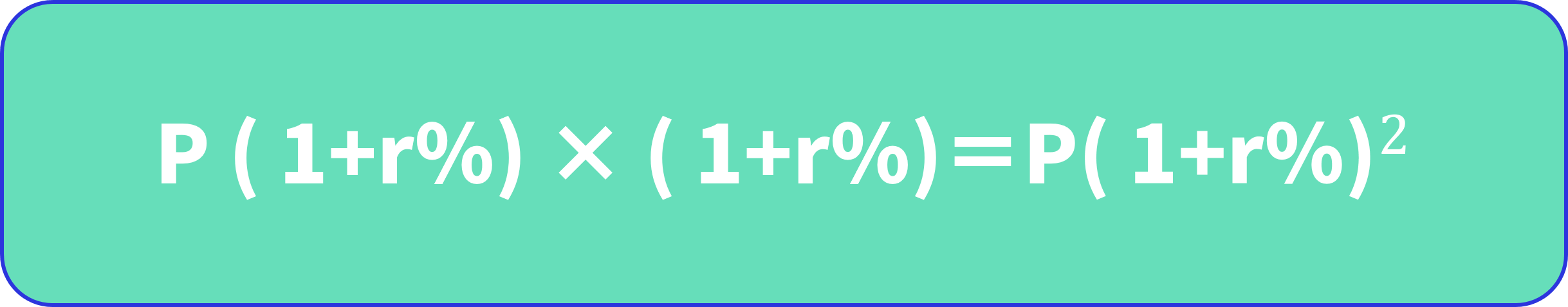

From the second year onwards, the principal becomes the sum of the previous year's principal and interest (P(1+r%)), and the interest is recalculated. The formula for calculation is:

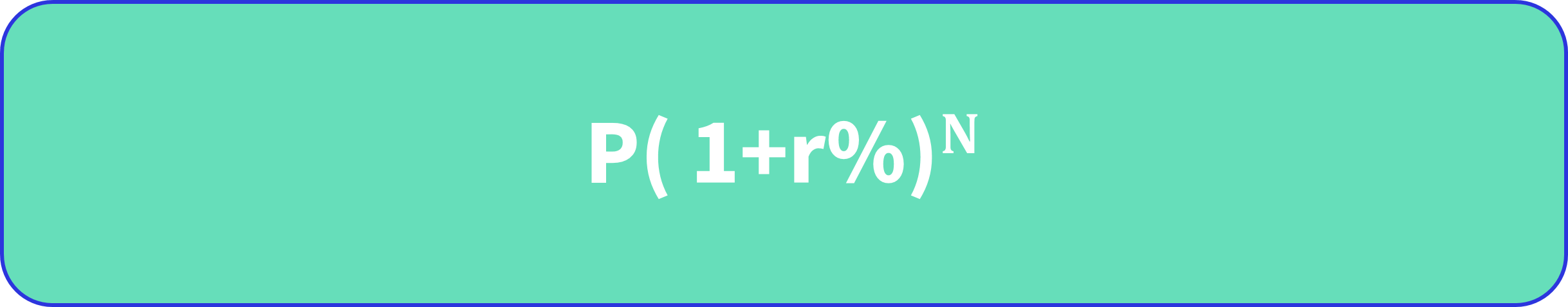

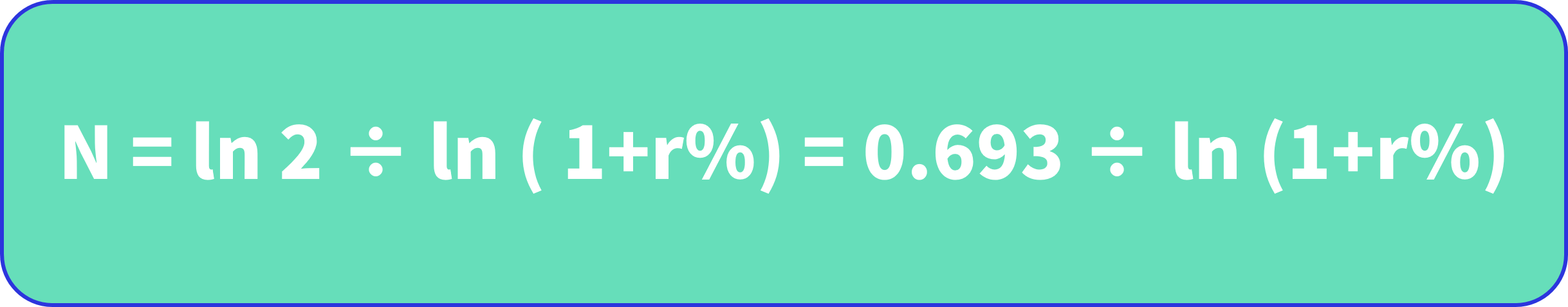

Hence, the formula to determine how much the principal accumulates after compounding for N years becomes:

Having grasped this formula, one can calculate the time required for capital doubling.

So why is the Rule of 72 used instead of 69.3, even though the calculated result is 69.3?

Because the number 72 has more factors, making it more likely to yield an integer result during calculations, thus facilitating quick computation. However, there may be some margin of error in the results, especially as the annual interest rate being calculated increases.

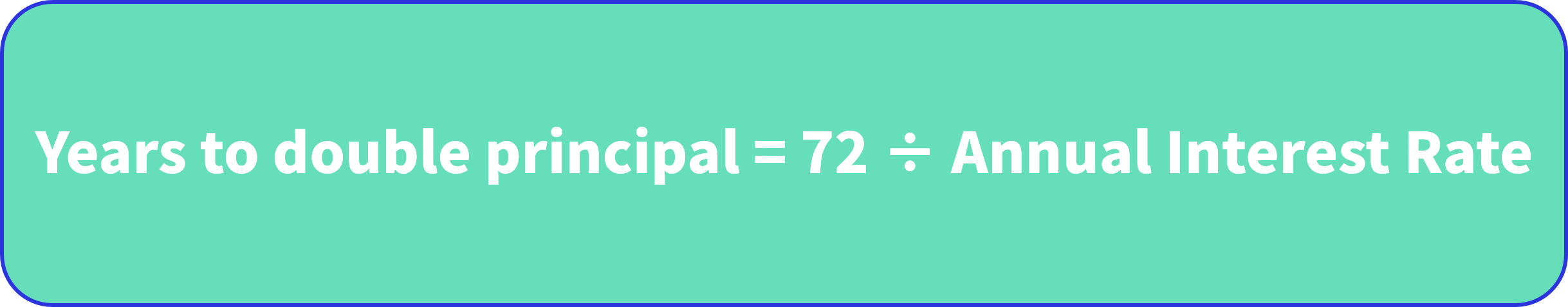

The formula for the Rule of 72 calculation is:

Utilization of the Rule of 72

Armed with the understanding of the Rule of 72's computation, investors can employ it to estimate investment returns or forecast the time required for wealth doubling.

For instance, if you possess 500,000 yuan of investment funds and encounter an opportunity with an annualized return rate of 8%, you can calculate the time needed to double your investment to 1,000,000 yuan:

Investment years for doubling assets = 72 ÷ Annualized return rate = 72 ÷ 8 = 9 (years)

According to the calculation derived from the Rule of 72, an investment of 500,000 yuan with an annualized return rate of 8% would take approximately 9 years to double. Although there may be slight discrepancies between the calculated and actual results, the disparity is minimal.

Suppose you aim to achieve asset doubling within 8 years. In that case, you need to select an investment product with an annualized return rate:

Annualized return rate for doubling assets = 72 ÷ Investment years = 72 ÷ 8 = 9%

Based on the Rule of 72, you would require an investment product with a 9% annualized return rate to realize asset doubling within 8 years.

Considerations

While the Rule of 72 serves as a convenient tool for estimation, several factors warrant consideration. Firstly, the stability of the investment product's annual interest rate is crucial for ensuring the accuracy of the calculation. Secondly, higher annualized return rates often entail higher risks, necessitating careful evaluation of the risk-return trade-off by investors.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.