How to Assess Corporate Financial Leverage by Debt-to-Equity Ratio?

This paper explains the concept of debt-to-equity ratio, what the value represents, and the considerations when evaluating the debt-to-equity ratio.。

Typically, the debt-to-equity ratio reflects the extent to which a firm uses financial leverage。This article will introduce you to the concept of the debt-to-equity ratio, the calculation formula, the meaning of its high and low, and the considerations for evaluation.。

What is the debt-to-equity ratio?

Debt To Equity Ratio (Debt To Equity Ratio, D / E), also known as the debt-to-equity ratio or debt-to-equity ratio, is a measure of a company's financial leverage, showing the level of borrowing debt, and is therefore also considered the extent to which financial leverage is used.。

The debt-to-equity ratio reflects the relationship between debt and equity in the composition of an enterprise's assets, whether its source of funding is mainly debt financing or equity financing.。The higher the debt-to-equity ratio, the higher the debt-to-equity ratio, which represents the use of higher borrowing by the firm in its operations, rather than the firm's own capital。As a result, creditors may be at risk of uncollectible payments。

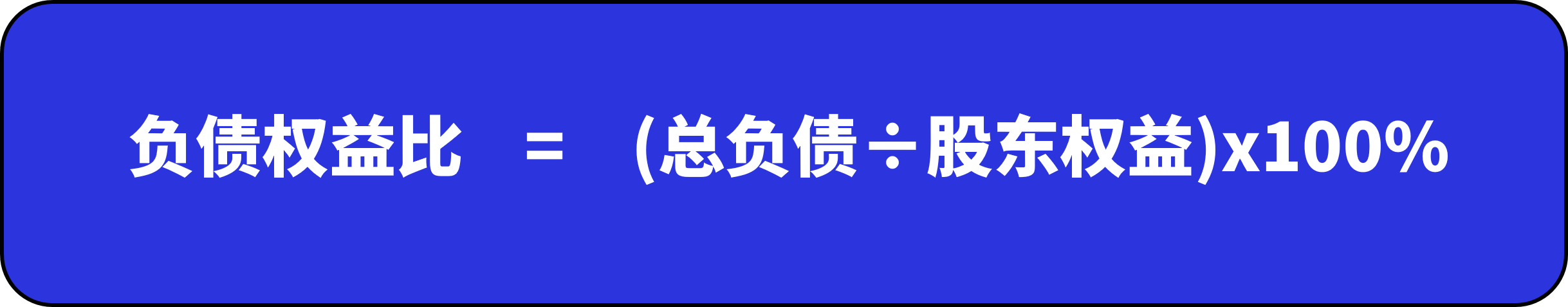

debt-to-equity ratio formula

The debt-to-equity ratio is calculated by dividing "total liabilities" by "shareholders' equity," reflecting the ratio of the company's debt to shareholders' equity, which we can find in the balance sheet using the following formula.

- Liabilities: debts incurred by an enterprise as a result of past transactions or other events, which must be repaid in the future.。

- Shareholders' equity: refers to the own capital owned by an enterprise, also known as net assets, which mainly includes equity, capital surplus and retained surplus.。

If an enterprise borrows more, its total liabilities are higher than shareholders' equity, which means that the enterprise has a lower degree of protection for creditors and a higher proportion of financial leverage; conversely, if shareholders' equity is higher than total liabilities, it means that the enterprise has a higher degree of protection for creditors.。

The meaning of the debt-to-equity ratio.

In general, excessive borrowing by a company can cause investors and creditors to worry about the company's ability to repay its debts, as if it is unable to repay its debts, it could face bankruptcy in severe cases.。

But if the company itself does not have much capital, it may not be able to effectively create more profit opportunities for the company, so moderate debt is not entirely a bad thing。

high debt to equity ratio

From the formula, when the debt-to-equity ratio is 1, it represents that the total liabilities of the enterprise are higher than the shareholders' equity.。

However, due to the high debt-to-equity ratio, on behalf of the enterprise to use higher financial leverage, the enterprise to repay the interest cost will also increase, business risk will also be relatively increased, for creditors will also be less secure.。

Low debt-to-equity ratio

When the debt-to-equity ratio is less than 1, the total liabilities of the enterprise are lower than the shareholders' equity, which means that the enterprise uses less leverage.。In the face of bad business climate, it can reduce the pressure of debt repayment, the business risk will be less.。

However, if the enterprise does not give full play to the role of financial leverage, for future development may make profitability can not be effectively improved, the ability to make money for shareholders will be reduced.。

What to pay attention to when evaluating the debt-to-equity ratio?

In assessing the debt-to-equity ratio, shares of the same industry group are generally compared to each other and assessed on the basis of long-term trends.。Because the asset structure of companies varies by industry class, some industries have higher debt-to-equity ratios such as finance, leasing and manufacturing, which typically use higher leverage。

SUMMARY

The debt-to-equity ratio is an indicator used to assess a company's financial leverage, and while companies that use high financial leverage appear to have higher investment risk, they may not be able to grow effectively if they do not make good use of financial leverage.。

Therefore, a company with reasonable liabilities, for the operating side has the opportunity to create a greater return on investment, the company has a positive benefit.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.