What is Relative Strength Index (RSI)?

The Relative Strength Index (RSI) is a tool that helps investors assess whether an asset is priced below or above its real value, based on its recent price changes. It can help investors make decisions about whether to buy or sell assets.

The Relative Strength Index (RSI) is a tool based on recent price changes of an asset, designed to help investors predict potential future price trends.

Definition of RSI

Investors can effectively predict stock price fluctuations using the RSI. Created by analyst James Welles Wilder, Jr. in 1978, RSI measures the speed and magnitude of recent price changes. This indicator assists traders in determining whether a stock is overvalued (trading above its actual value) or undervalued (trading below its actual value). Undervalued stocks may face price increases, while overvalued stocks may experience declines. Although RSI is a useful tool, it is not perfect and is best used in conjunction with other indicators.

Example Analysis:Suppose a shoe store sells a new style of shoes for $50. As the style becomes increasingly popular, the store raises the price by $5 each day. Two weeks later, the price reaches $120. If the actual value of the shoes is only $50 (for example, based on pricing from other stores), you might consider the price in this retail store to be overvalued. In this case, you might hesitate to make a purchase, predicting that the store may lower the price in the future. Even without complex charts for reference, your thought process is similar to how traders use the RSI: tracking recent price changes to predict future trends and make investment decisions.

Calculation of RSI

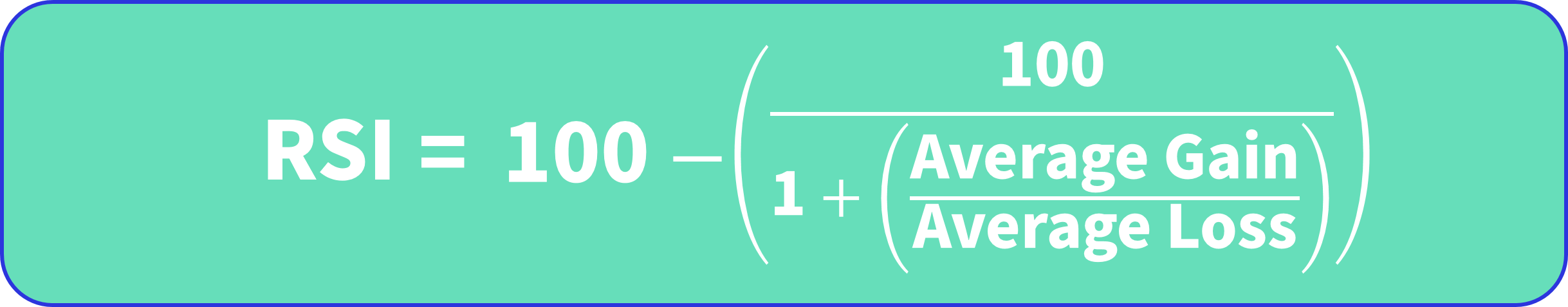

The calculation of the Relative Strength Index is relatively complex, usually based on the average price gains and losses over a 14-day period. The basic formula is:

Calculating RSI manually can be cumbersome due to the two-week data requirement, so online RSI calculators can simplify this process.

Significance of RSI

The RSI predicts future trends by analyzing an asset's historical performance. The RSI values range from 0 to 100, with common rules indicating that an RSI value above 70 suggests the asset is overvalued and may decline, while an RSI below 30 indicates the asset may be undervalued and could rise. An RSI value of 50 is generally viewed as neutral, meaning the asset is neither overvalued nor undervalued.

It’s important to note that 30 and 70 are general indicators. If an asset’s RSI frequently exceeds 70 (indicating prolonged overvaluation), a reference value of 80 can be considered. Certain assets may remain overvalued or undervalued for extended periods without price corrections.

Interpreting the RSI Chart

The RSI is typically presented in chart form, often displayed alongside the price chart of the stock. Comparing the RSI chart with price trends provides investors with richer information than using the RSI alone. The vertical axis of the RSI chart displays the range of RSI values, typically from 0 to 100, while the horizontal axis shows the relevant time period (generally 14 days).

Is RSI a Reliable Indicator?

The Relative Strength Index (RSI) holds some reference value in the stock market, but predicting price movements solely based on RSI is not always reliable, as stock price fluctuations are influenced by various factors. RSI mainly relies on recent price history, but historical data does not guarantee future predictions. Its effectiveness is enhanced only when the RSI values align with the long-term trend of the asset’s price. However, pinpointing the exact timing of potential price reversals can be challenging. Additionally, assets may remain overvalued or undervalued for long periods without corresponding price changes.

Combining RSI with other technical indicators can improve prediction accuracy. For example, the Moving Average Convergence Divergence (MACD) uses different exponential moving averages (EMA) to assess the relationship between recent prices, helping identify trend changes and momentum. This combination provides a more comprehensive reflection of market dynamics.

Definitions of Overbought and Oversold

-

Oversold: An oversold asset is trading below its expected price based on other value indicators, typically indicating a potential price increase. An RSI value of 30 or below is usually considered oversold. However, definitions of oversold may vary among analysts.

-

Overbought: An overbought asset indicates its price is too high compared to other value indicators or historical prices. An RSI value of 70 or above typically suggests overvaluation, signaling a potential price correction. As with oversold conditions, different analysts may interpret this concept differently, and prices may not immediately decline.

Common RSI Patterns

-

Divergence: Divergence refers to the opposite movements between an asset's price and technical indicators like RSI. When investors spot divergence, it usually indicates that the price trend may soon slow down or change direction. Positive divergence can signal a price increase, while negative divergence may suggest a price decrease. However, divergence does not always coincide with price reversals.

-

Swing Rejections: When the RSI moves from an oversold or overbought area toward neutrality, the market trend may experience rejection, especially in a generally rising stock market. In this scenario, the RSI may retreat again and break through previous highs. Investors with keen observation skills can capitalize on these impending swing rejections for potential profit.

The Relative Strength Index offers guidance in analyzing asset price fluctuations, but investors should conduct comprehensive analyses in conjunction with other technical indicators to enhance decision-making accuracy and effectiveness.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.