A-Share Investment in China: Risk and Market Analysis

This article will introduce the current situation and investment risks of the Chinese market, and explain whether foreigners can invest in stocks within China, and then introduce the more recommended investment methods.

In recent years, global markets have become increasingly interconnected, making it possible to invest not only in mature markets but also in emerging ones. As one of the engines driving global economic growth, the Chinese market has gradually attracted the attention of investors.

The Chinese market is both attractive and mysterious, leaving many investors eager to understand it but unsure of where to begin.

Current Situation of A-Share Market

In recent years, China's economy has experienced rapid growth, with many rural areas transforming into urban centers. As urbanization accelerates, the demand for infrastructure construction increases, and educational levels improve. The improvement in infrastructure and education will contribute to building a more prosperous society and raising per capita wealth and living standards.

During the process of social progress, many enterprises have emerged, creating enormous wealth for shareholders. Among them, some enterprises such as Alibaba, Jingdong and Tencent have even become global leaders.

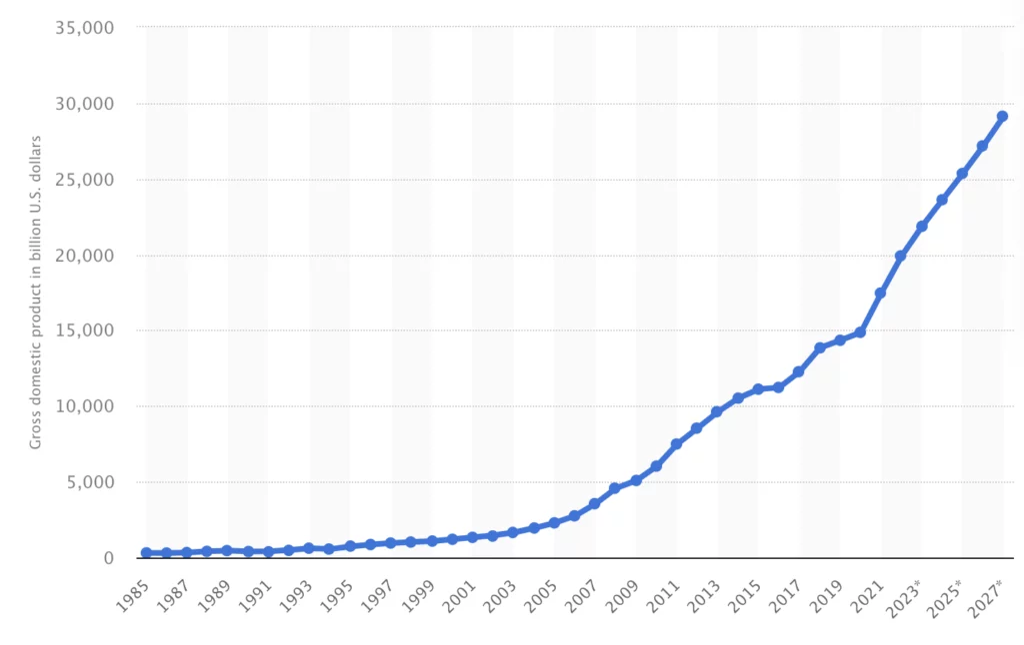

In terms of GDP, China's economy has been continuously growing since the 1970s, with an average GDP growth rate of 10% since 1978.

Risks of Investing in A-Share

Despite the global visibility of some of China's largest companies, the overall market is less mature than the U.S. stock market, which deters many investors. The risks of investing in the Chinese stock market are mainly in the following areas:

- Political risk: As one of the communist countries, although the stock market follows free market principles, the specificities of the country's political system cannot be ignored. Government policies have a greater impact on business operations and investors need to consider the impact of political factors on stock market performance.

- Insider Trading: Unlike the United States, insider trading is prevalent in China. Although policies prohibit major shareholders from trading within a month before the release of financial reports, research has shown that the level of insider trading is still much higher than in other countries.

- Difficulty in Obtaining Information: Compared to other mature markets, foreign investors find it challenging to obtain information about the Chinese market. Making investment decisions based on limited information carries higher risks because investors are investing in a relatively "ignorant" state.

How to Invest in A-Share?

Although investing in stocks within China is challenging for foreign investors, there are several mainstream methods to participate in the Chinese market:

- Investing in ADRs (American Depositary Receipts): ADRs are a form of foreign companies entering the US stock market, with each ADR representing a share or a small portion of a foreign company. Some large Chinese enterprises enter the US stock market through ADRs. Foreign investors can invest in these Chinese stocks through brokers that offer ADR trading, with transactions conducted in US dollars, thus avoiding concerns about the renminbi exchange rate.

- Purchasing ETFs (Exchange-Traded Funds): ETFs are another mainstream method, and investing in ETFs can diversify risks since ETFs essentially invest in the entire Chinese market, making them less susceptible to the influence of individual enterprises. There are approximately 50 Chinese ETFs in the US stock market, which investors can purchase through brokers. Common Chinese ETFs include MCHI and FXI.

- Investing in A-shares through specific brokers: Some brokers provide mechanisms for investing in the Chinese market, such as investing in ADRs and ETFs.

Conclusion

In conclusion, as one of the fastest-growing economies globally, the Chinese market has attracted investors' attention. However, investing in the Chinese market requires a thorough understanding of its uniqueness and proper risk assessment.

Although direct investment in stocks within China faces many restrictions, foreign investors can still participate in the Chinese market through ADRs and ETFs, seizing the opportunities it offers.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.