What is a Market Cycle? How to Navigate Through Market Cycles?

Unlock the secrets of the market cycle and learn how to navigate through its different stages with a strategic mindset.Maximize your returns with our expert tips.

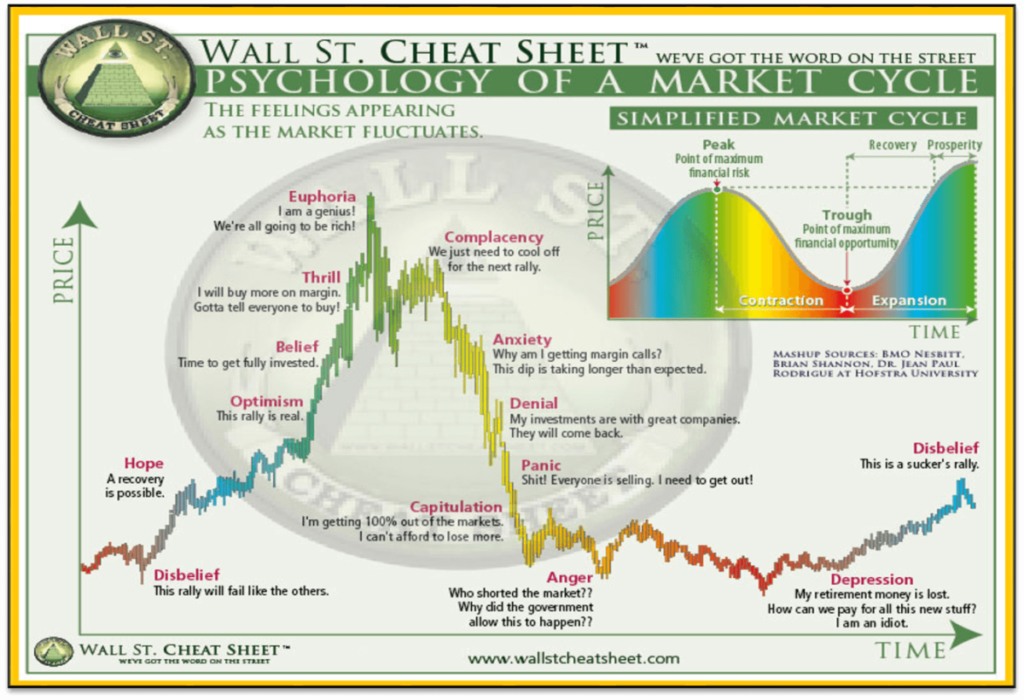

The market is a constantly changing entity, and understanding the psychology of market cycles is crucial for investors and traders. By identifying the psychological factors that influence market behavior, investors can better predict market movements and make more informed decisions.

In this article, we will delve into the psychology of market cycles and explore the different stages of the market and how they are affected by psychological factors.

Stages of Market Cycles

Here is the Wall Street Cheat Sheet illustrating the psychology of market cycles:

1.Boom Stage – Optimism and Confidence

The boom stage of the market is characterized by rapid growth and increased investor optimism. During this phase, investors are more likely to take on greater risk and engage in speculative behavior, believing that the market will continue to rise. However, this optimism can lead to asset overvaluation and a subsequent market crash.

2.Bubble Stage – Excitement and Euphoria

The bubble stage of the market is marked by irrational exuberance and overvaluation. Investors are driven by the fear of missing out and are willing to pay high prices for assets not supported by fundamentals. This stage is often followed by a market crash as investors realize that asset prices are unsustainable.

3.Crash Stage – Anxiety, Denial, and Panic

The crash stage of the market is characterized by rapid decline and increased investor panic. Investors are more likely to sell their assets at a loss, believing that the market will continue to fall. This panic can exacerbate the decline, as more investors sell their assets, creating a self-fulfilling prophecy.

4.Bear Market Stage

The bear market stage is characterized by a prolonged period of decline and investor pessimism. During this phase, investors are more likely to adopt a wait-and-see approach, believing that the market will continue to fall. However, this stage can also present opportunities for savvy investors, as assets may be undervalued and offer attractive buying opportunities.

5.Recovery Stage

The recovery stage of the market is marked by gradual growth and increased investor optimism. Investors are more likely to take on risk and engage in speculative behavior, believing that the market will continue to rise. However, it is important to note that the recovery stage can be fragile, and a market crash can occur if conditions change.

6.Bull Market Stage

The bull market stage is characterized by a prolonged period of growth and investor optimism. Investors are more likely to adopt a buy-and-hold strategy, believing that the market will continue to rise. However, it is important to note that the bull market stage can be followed by a bear market as conditions change and investor sentiment shifts.

7.Overvaluation Stage

The overvaluation stage of the market is marked by irrational exuberance and asset overvaluation. Investors are driven by the fear of missing out and are willing to pay exorbitant prices for assets not supported by fundamentals. This stage is often followed by a market crash as investors realize that asset prices are unsustainable.

8.Correction Stage

The correction stage of the market is characterized by a period of decline and increased investor caution. Investors are more likely to adopt a wait-and-see approach, believing that the market will continue to fall. However, this stage can also present opportunities for savvy investors, as assets may be undervalued and offer attractive buying opportunities.

The Key Role of Emotions in Market Cycles

Emotions play a crucial role in market cycles. Fear and greed are two major emotions that influence market behavior. Fear can lead to panic selling and a market crash, while greed can lead to overinvestment and a bubble.

Strategies for Navigating Market Cycles

To succeed in the ever-changing market cycles, investors can use the following strategies:

- Long-Term Perspective: Focus on fundamentals and avoid being swayed by short-term market fluctuations.

- Diversification: Spread investments across different assets to reduce risk.

- Risk Management: Set clear stop-loss points to avoid significant losses due to market volatility.

- Continuous Learning: Keep learning about market dynamics to improve understanding and forecasting abilities.

Conclusion

The psychology of market cycles is a dynamic and complex field, and understanding the underlying psychological factors is essential for investors.

By adopting a long-term perspective, diversifying investments, managing risk, and continuously learning, investors can better navigate the challenges of market cycles and achieve their financial goals.

Each stage of the market cycle offers different investment opportunities and risks, and understanding the psychological characteristics of these stages can help investors make more informed decisions.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.