What about Zurich Securities? Is it safe and reliable? Comprehensive analysis of HK and US stock brokerage account opening and fees | HK and US Stocks Investment Guide

Want to know if Zircon Securities is safe and worth choosing? This article comprehensively evaluates its compliance, trading fees for Hong Kong and US stocks, account opening process, and account opening benefits in April 2025, helping you select the most suitable brokerage for HK and US stock investments.

When choosing a brokerage firm for Hong Kong and US stocks, investors are most concerned about the following questions: Is it legitimate? Is it safe? Is it convenient to open an account? Are the trading fees transparent and reasonable? As one of the rapidly developing brokerage firms in recent years, Zircon Securities has been attracting more and more attention from investors in Hong Kong and US stocks, thanks to its diversified products and technological advantages. So, what exactly is Zircon Securities like? Is it trustworthy? This article will comprehensively analyze it from multiple dimensions, including license qualifications, safety and compliance, trading fees, service advantages, and the latest account - opening benefits.

I. Introduction to Zircon Securities' Background: Licensed, Compliant, and Technology - Driven

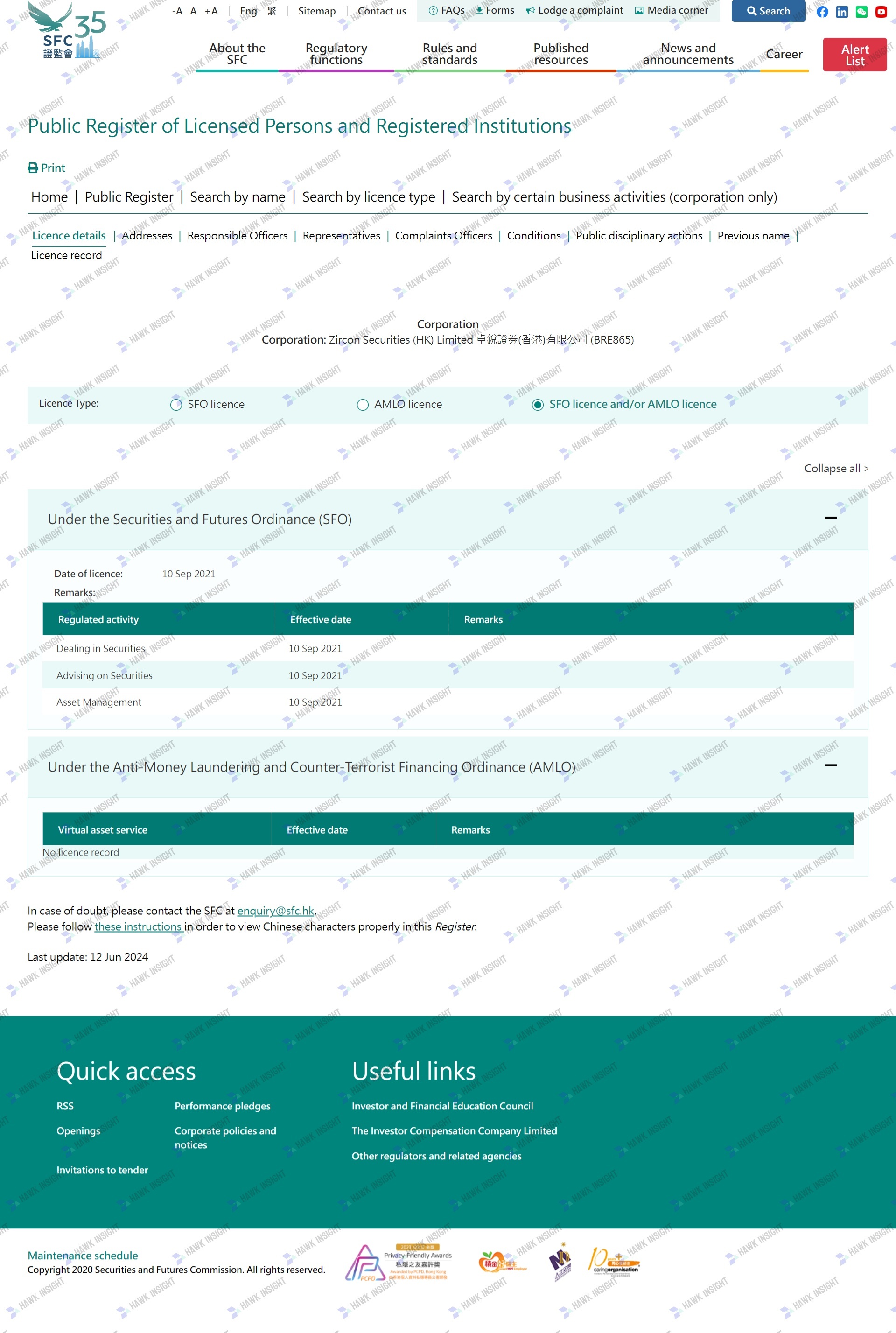

Established in 2019, Zircon Securities is a fintech brokerage brand under the Zircon Group in Singapore. It is committed to providing professional, diversified, and efficient financial services to overseas Chinese around the world. Currently, Zircon Securities is registered as a licensed corporation with the Hong Kong Securities and Futures Commission (SFC) (Central Number: BRE865) and holds Class 1, 2, 4, 5, and 9 licenses. Its business covers multiple fields such as securities trading, futures contracts, investment consulting, and asset management.

It is worth mentioning that Zircon Securities has upgraded its Class 1 license and obtained the qualification to provide virtual asset trading services for professional investors. In addition, it is also a member of the Hong Kong Investor Compensation Fund, and users' assets are protected by law. These compliance backgrounds and qualifications have become the key labels for Zircon Securities to be "legitimate and safe".

II. Is Zircon Securities Safe? Starting from Supervision, Qualifications, and User Protection

- Regulatory Compliance: Zircon Securities is strictly regulated by the Hong Kong Securities and Futures Commission. It needs to regularly report its business operations, compliance reports, and financial status to the regulatory authorities, indicating a high level of compliance.

- Fund Segregation Mechanism: Customers' funds are independently separated from the company's own funds. The trading operations are transparent, ensuring that investors' assets are not misappropriated.

- Compensation Protection System: Zircon Securities participates in the Hong Kong Investor Compensation Fund. If investors suffer losses due to the brokerage's non - compliance, they can apply for compensation of up to HK$500,000.

- Data Encryption and System Stability: The platform adopts bank - level SSL encryption and a multi - protection system, supporting high - concurrency trading and anomaly monitoring to ensure trading security.

III. Highlights of Zircon Securities' Advantages: Diversified Products + Intelligent System + Low Fees

1. Rich Product Portfolio, Supporting Trading in Major Global Markets

Zircon Securities supports trading in a variety of products, including Hong Kong stocks, US stocks, A - shares (Shanghai - Hong Kong Stock Connect), US stock options, money market funds, monthly - paid stocks, ETFs, turbo warrants and bull - bear certificates, and virtual assets, providing investors with comprehensive asset allocation opportunities. In particular, its money market fund products can achieve an annualized return of up to 5%, making them suitable for customers seeking stable returns.

2. Empowered by Intelligent Tools for More Efficient Trading

The platform offers intelligent trading functions, including grid trading, conditional orders, automatic profit - taking and stop - loss, intelligent market monitoring, and trading strategy backtesting. These are suitable for day traders, quantitative traders, and strategy - based investors. In addition, it also opens up API interfaces to facilitate programmatic trading access, meeting the needs of users at different levels.

3. Transparent and Affordable Fees, Suitable for High - Frequency Traders

Zircon Securities' trading fees are highly competitive in the industry. The online commission for Hong Kong stocks is only 0.03% of the transaction amount, with a minimum of HK$3. For US stocks, it is only $0.0049 per share, with a minimum of $0.99. The commission for US stock options is only $0.3 per contract. The platform's fee rates are also publicly transparent, with no hidden costs, making it very suitable for investors who trade frequently.

4. Simple and Flexible Account Opening, Supporting Online Account Opening for Mainland Chinese Residents

It supports the online account - opening process for users in the Chinese mainland and other regions, with simple operations and high review efficiency. Mainland Chinese investors, whether they are in the country or abroad, can complete the account - opening process by providing their ID cards, passes, and corresponding supporting documents. There is no need to travel to Hong Kong in person, nor is there a need for cumbersome paper - based procedures, greatly lowering the account - opening threshold.

[Related readings] Zircon Securities opens accounts, deposits and deposits?

IV. Zircon Securities' Account - Opening Benefits in April 2025: A Limited - Time Offer Worth HK$2,388

Zircon Securities has joined hands with Hawk Insight to launch the "Spring Bonanza" event. Newly - registered users or those who have already opened an account but have not made a deposit can enjoy multiple benefits worth up to HK$2,388 by opening an account through the exclusive registration link and completing the deposit. At the same time, entering the invitation code 100106 in the "My - Enter Invitation Code" section within the APP can also successfully activate the corresponding rights and interests.

Instructions for Claiming Benefits: All benefits can only be claimed after opening an account through the exclusive registration link of Hawk Insight. The registration link is as follows:

Exclusive account - opening link for Zircon Securities, Invitation Code 100106

- Account - Opening Reward: 12 new - share margin subscription vouchers

- IPO Benefits: Interest - free margin + 0 cash subscription fee + HK$10 cash voucher if you are allocated new shares

- First - Deposit Reward:

| Deposit Amount | Stock Cash Vouchers |

| HK$10,000 | HK$400 (50×8 pieces) |

| HK$50,000 | HK$600 (50×12 pieces) |

| HK$500,000 | HK$800 (50×16 pieces) |

| HK$1,000,000 | HK$1,200 (50×24 pieces) |

- Account - Transfer Reward: Get an iPad Air if you transfer over HK$5 million, and an iPhone 16 Pro Max if you transfer over HK$10 million

- Event Time: April 1, 2025 - April 30, 2025

V. Summary of Zircon Securities' Fee - Standard Tables

Fee Standards for Hong Kong Stocks

Zircon Securities offers an attractive fee structure for Hong Kong stock trading, suitable for both long - term holders and day traders:

| Transaction - related charges calculated based on transaction amount | ||

| Charge Type | Fee Rate (Based on Transaction Amount) | Minimum and Maximum Charges |

| Transaction Levy (SFC) | 0.000027 | Minimum HK$0.01 |

| Exchange Fee (HKEX) | 0.0000565 | Minimum HK$0.01 |

| Clearing Fee (HKCC) | 0.003% (0.002% collected on behalf of HKCC) | Minimum HK$3 / Maximum HK$200 |

| Stamp Duty (Hong Kong Government) | 0.1% (less than HK$1 is counted as HK$1) | Minimum HK$1 |

| Transaction Levy for Accounting and Financial Reporting Council (AFRC) | 0.0000015 | Minimum HK$0.01 |

| Commission (Online) | 0.0003 | Minimum HK$3 |

| Commission (Offline) | 0.001 | Minimum HK$50 |

| Dark Pool | 0.1% of transaction amount (buy and sell are calculated separately from regular transactions) | Minimum HK$55 |

| Platform Fee | Fixed HK$12 per order (new charge effective from March 19, only applicable to new customers, existing customers are not affected) | N/A |

| Stock Depository and Settlement Fees | ||

| Charge Type | Fee | Minimum and Maximum Charges |

| Stock Transfer Out via Settlement Instruction (SI) | HK$10 per lot per stock, less than 1 lot counted as 1 lot | Minimum HK$500 |

| Stock Transfer In via Settlement Instruction (SI) | Exempted | Exempted |

| Investor Central Clearing System Settlement Instruction (ISI) | Exempted | Exempted |

| Express Physical Stock Transfer Fee | HK$200 per stock | N/A |

| Deposit of Physical Stocks | HK$5 per transfer stamp duty receipt | N/A |

| Withdrawal of Physical Stocks | HK$10 per lot per stock, less than 1 lot counted as 1 lot | Minimum HK$1,000 |

| Mandatory Buy - in Fee (Collected by HKEX) | 1.0% of the stock value calculated based on the previous settlement day's closing price | Minimum HK$280 per stock |

| Agent Services and Corporate Actions Fees | ||

| Charge Type | Fee | Minimum and Maximum Charges |

| Transfer Fee | HK$1.5 per lot, less than 1 lot counted as 1 lot | - |

| Collection of Cash Dividends | 0.5% * total cash dividends | Minimum HK$30 |

| Collection of Bonus Shares | HK$1 per lot | Minimum HK$30 |

| Collection of Rights Issues | HK$1 per lot | Minimum HK$30 |

| Handling of Rights Issues, Warrants, CBBCs, Range Accruals on Behalf | 1) HK$1 per lot 2) Corporate action fee: HK$0.8 per lot collected by HKCC | 1) Minimum HK$30 2) N/A |

| Application for Additional Rights Issues | HK$1 per additional new lot after successful application | Minimum HK$30 |

| Submission of Shares under Take - over Offer / Share Privatization / Share Redemption | 1) 0.2% of the amount received 2) Corporate action fee: HK$0.8 per lot collected by HKCC | 1) Minimum HK$30 2) N/A |

| Proxy Transfer (Physical) | 1) Handling fee: HK$200 per stock 2) Registration and transfer fee: HK$2.5 per share certificate | N/A |

| Share Consolidation and Split | Exempted | Exempted |

| Attendance at Shareholder Meetings and Voting | HK$50 per vote or per attendee per occasion | N/A |

| Dividend Tax | 10% * total dividends and bonus shares (deducted at the time of distribution, bonus shares are taxed based on face value) | N/A |

Fee Standards for US Stocks

In US stock trading, Zircon Securities provides a fixed and low - cost trading model:

| Transaction - related charges | ||

| Charge Type | Fee | Minimum and Maximum Charges |

| SEC Fee (on sell) | 0.00278% of transaction amount | Minimum US$0.01 |

| Clearing Fee (US Clearing Agency) | US$0.003 per share | Minimum US$0.4 |

| FINRA Trading Activity Fee (on sell) | US$0.000166 per share | Minimum US$0.01 / Maximum US$8.30 |

| FINRA CAT (Consolidated Audit Trail) Fee | US$0.000035 per share | Minimum US$0.01 |

| Commission (Online) | US$0.0049 per share | Minimum US$0.99 |

| Commission (Offline) | Offline service not available | N/A |

| Platform Fee | US$0.0049 per share (new charge effective from March 19, only applicable to new customers, existing customers are not affected) | Minimum US$0.99 |

| Agent Services and Corporate Actions Fees | ||

| Charge Type | Fee | Minimum and Maximum Charges |

| Dividend Collection | 0.5% of dividends | Minimum US$5 |

| Bonus Share Collection | US$1 per lot | Minimum US$5 |

| DTC Settlement Instruction | Deposit of securities: Free; Transfer of securities to other brokers: US$150 per stock | - |

| ADR Custody Fee | US$0.01 - US$0.05 per share | - |

| Corporate Action Fee | US$5 per stock per occasion | - |

| Dividend Tax Collection (IRS) | Generally 30% * dividends | - |

Fee Standards for US Stock Options

For investors in US stock options, Zircon Securities also offers a competitive fee structure:

| Charge Type | Fee | Minimum and Maximum Charges |

| SEC Fee (on sell) | 0.00278% of transaction amount | Minimum US$0.01 |

| Trading Activity Fee (on sell) | US$0.00279 per contract | Minimum US$0.01 |

| Options Regulatory Fee | US$0.02675 per contract | N/A |

| Options Clearing Fee | US$0.02 * number of contracts | Maximum US$55 |

| FINRA CAT (Consolidated Audit Trail) Fee | US$0.0035 per contract | Minimum US$0.01 |

| Commission (Online) | US$0.3 per contract | Minimum US$1 |

| Commission (Offline) | Offline service not available | N/A |

| Platform Fee | US$0.5 per contract | Minimum US$0.8 |

Fee Standards for A - Shares (Shanghai - Hong Kong Stock Connect)

For users who need to allocate A - shares, Zircon Securities supports Shanghai - Hong Kong Stock Connect trading:

| Transaction - related charges calculated based on transaction amount | ||

| Charge Type | Fee (Based on Transaction Amount) | Minimum and Maximum Charges |

| Handling Fee (SSE / SZSE) | 0.00341% of transaction amount (0.004% for ETF transaction amount) | Minimum CNY 0.01 |

| Securities Regulatory Fee (CSRC) | 0.002% of transaction amount (ETF exempted) | Minimum CNY 0.01 |

| Transfer Fee (China Securities Depository and Clearing Corporation Limited and Hong Kong Securities Clearing Company Limited) | 0.003% of transaction amount (0.001% of bilateral transaction amount paid according to Shanghai - Hong Kong Stock Connect rules of China Securities Depository and Clearing Corporation Limited; and 0.002% of bilateral transaction amount paid according to general rules of Central Clearing and Settlement System as a charge for Hong Kong Securities Clearing Company Limited's Shanghai stock settlement services) (ETF exempted) | Minimum CNY 0.01 |

| Transaction Stamp Duty (State Taxation Administration, levied in equivalent Hong Kong dollars) (on sell) | 0.05% of transaction amount (ETF exempted) | Minimum CNY 0.01 |

| Portfolio Fee* (Collected by Hong Kong Securities Clearing Company Limited) | 0.008% of stock holding value / 365 days (calculated daily and collected monthly) | Minimum CNY 0.01 |

| Commission (Online) | 0.03% of transaction amount | Minimum CNY 3 |

| Commission (Offline) | 0.1% of transaction amount | Minimum CNY 50 |

| Platform Fee | Fixed CNY 12 per order (new charge effective from March 19, only applicable to new customers, existing customers are not affected) | N/A |

| Stock Depository and Settlement Fees | ||

| Charge Type | Fee | Minimum and Maximum Charges |

| Stock Transfer Out via Settlement Instruction (SI) | CNY 288 per stock | N/A |

| Stock Transfer In via Settlement Instruction (SI) | Exempted | Exempted |

| Investor Central Clearing System Settlement Instruction (ISI) | Service not available | Service not available |

| Physical Stocks | Service not available | Service not available |

| Mandatory Buy - in Fee | 1.0% of the stock value calculated based on the previous settlement day's closing price, in CNY | Minimum CNY 280 per stock |

| Agent Services and Corporate Actions Fees | ||

| Charge Type | Fee | Minimum and Maximum Charges |

| Collection of Cash Dividends | 0.5% * total cash dividends | Minimum CNY 30 |

| Collection of Bonus Shares Fee | CNY 1 per lot | Minimum CNY 30 |

| Handling of Rights Issues (Warrants / Rights Subscription) on Behalf | 1. CNY 1 per new lot after exercise / conversion of each stock 2. CNY 1 per lot | Minimum CNY 30; N/A |

| Submission of Shares under Take - over Offer / Share Privatization / Share Redemption | 1. 0.2% of the amount received 2. CNY 1 per lot of received stocks | Minimum CNY 30; N/A |

| Stock Deposit Fee (via Central Clearing) | Exempted | Exempted |

| Stock Withdrawal Fee (via Central Clearing) | CNY 288 per stock | N/A |

VI. Frequently Asked Questions (FAQ)

Here are some common questions and answers for investors when choosing Zircon Securities, which can help you quickly understand the platform's services and advantages:

Q1: What types of investors is Zircon Securities suitable for?

It is suitable for investors who have trading needs for Hong Kong stocks, US stocks, US stock options, and virtual assets, especially medium - to high - frequency users and those who focus on low fees.

Q2: Does it support account opening with a Mainland Chinese ID card?

Yes, it does. Mainland Chinese users (both in - country and overseas) can complete the account - opening process online. The required documents include an ID card, bank statements, or customs clearance certificates.

Q3: Does it support deposit in RMB?

Currently, it supports multi - currency telegraphic transfers for deposits. You can deposit by exchanging RMB through your bank account.

Q4: Are there any hidden fees?

All trading fees on the platform are clearly marked. There are no additional fees other than those listed in the table, ensuring high transparency.

Q5: Does the customer service support Chinese?

Yes, it does. It provides multi - language online customer service and telephone support, with a prompt response. The APP also has a built - in help center.

VII. Conclusion: Is Zircon Securities Worth Choosing?

With its strong compliance qualifications, rich trading products, affordable fee structure, and continuous user benefits, Zircon Securities has become one of the preferred platforms for many investors in Hong Kong and US stocks. For users who hope to seize overseas market opportunities in 2025, the current April benefits are unprecedented. Opening an account through the exclusive channel of Hawk Insight can also earn you exclusive rewards.

Open an account now: Click to enter the exclusive account - opening channel, or enter the invitation code 100106 in the APP to unlock all benefits.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.