What is an income statement??Three Major Projects and Key Indicators

The company's financial statements are complemented by three parts: the income statement, the balance sheet, and the cash flow statement.。

What is an income statement??

The income statement, also known as the income statement, records a company's operating income and overhead expenses over a period of time (one year, one quarter, or a specified period of time), as well as the operating income (profit or loss) resulting from the subtraction of the two.。

Operating income (Revenues / Sales / Turnover)

Operating income refers to the income earned by a company from the sale of business products or services.。The higher a company's operating income, the better it is, which means that the larger the company's business, the better the business.。

Ideally, the company's operating income is increasing steadily every year, which means that the company is growing steadily.。So, it's best to focus on a company's revenue growth rate, which means comparing the company's operating income over time。

When interpreting, it is recommended to read the notes section of the financial report to understand the company's core products or services, business model, countries and regions in which the business segments are located, etc.。

Cost of Goods Sold (COGS / Cost of Revenue)

Operating costs are the direct costs in the production of a company's products or services, including: the cost of purchasing raw materials, the cost of machine parts, labor costs, and miscellaneous costs;。

Gross Profit

Operating margin can be seen in the strength of the company's profitability.。Ideally, the company must continuously increase its operating income while striving to reduce operating costs and increase profit margins。

Comparing a company's operating margin to its operating income as a percentage allows you to determine the nature of the company。

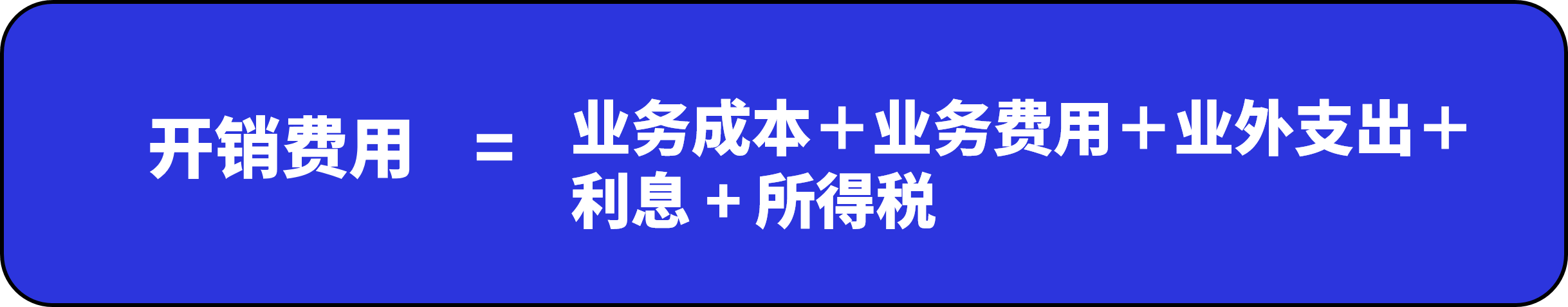

Operating Expenses

Operating expenses are actually expenses other than operating costs, or indirect costs。In general, you can think of it as the cost of selling a product or service, such as General and Administrative Expenses, Selling and Distribution Expenses, Research and Development Expenses, and so on.。

Operating Income / Loss

Operating profit and loss is usually the data that investment bank analysts value, because it has not been adjusted for non-operating items such as interest, so it can show the true strength of the company's business performance.。

Out-of-business profit and loss (Other Income / Loss)

If a company has income and expenses outside of its business, they are placed in this item。If carefully listed, out-of-business income may include proceeds from the sale of assets, interest income, exchange rate gains, dividend income, capital income, etc.。Conversely, expenses include loss on asset disposals, interest expense, exchange rate losses, etc.。

Income before Income Taxes

This amount has not been included in the company's next tax expense.。

Income Taxes

Any company with a policy in place must pay a variety of taxes in accordance with local regulations, but the most important thing governments levy is sales and income taxes.。

Net Income / Loss after tax

After-tax profit and loss represents the company's final profit or loss.。If the company pays a dividend, the same amount is used.。

Tips for observing items in the income statement

After understanding the significance of each item in the financial report, we can think about the changes and nature of the business by observing changes in the financial report data over time.。When reading the financial report, you can pay attention to several aspects:

- Operating income: Does operating income grow steadily?The company's revenue is a continuous stable income, or to undertake the project ups and downs.?Sudden increase in operating income, is there any one-time gain on asset divestment?

- Cost operating efficiency: Does the company's revenue follow a significant increase in costs??

- Cost structure: What are the main costs of the company?Whether the money is spent on the knife edge?There is no unknown reason for the continuous increase in administrative costs.?

- Increase or decrease in operating earnings: Is the profitability of the company's core business growing??If there is a decline this year, what is the main reason?Is this temporary or permanent??Will it affect your investment decision??

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.