Getting better, Quick Q4 adjusted net loss narrows sharply 98.7%! Domestic business turnaround

After trading on March 29, the fast hand released its 2022 annual results announcement.。The company reported fourth-quarter revenue of 282..900 million yuan, up 15.8%。

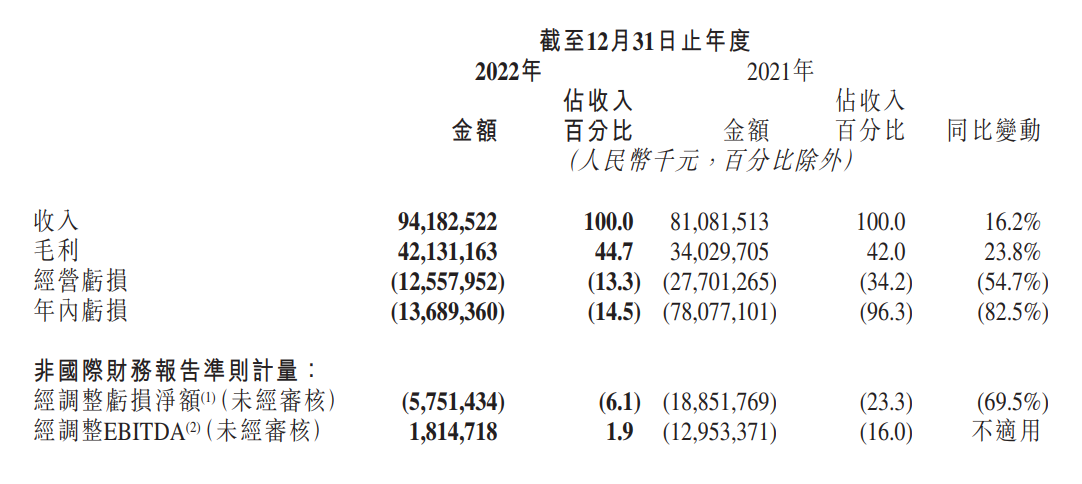

After trading on March 29, the fast hand released its 2022 annual results announcement.。The company reported fourth-quarter revenue of 282..900 million yuan (RMB, the same below), up 15.8%; net loss of $1.5 billion。Adjusted net loss of $45.3 million, a significant year-on-year narrowing of 98.7%。Kuaishou's full-year revenue in 2022 reached 94.2 billion yuan, up 16.2%; full-year net loss of $13.7 billion; full-year adjusted net loss of $57.500 million yuan。

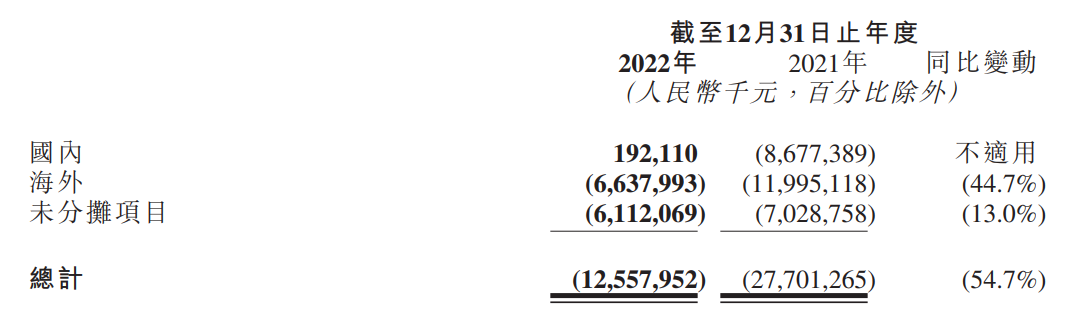

It is worth noting that although Fast Hand is still at a net loss in 2022, its domestic business has begun to turn a profit at the management level.。Financial results show that in 2022, the company's domestic business to achieve operating profit 1..9.2 billion, with adjusted EBITDA turning positive at 1.8.100 million。For the same period in 2021, the operating loss on domestic operations was 86.800 million yuan。And the full-year loss status is also decreasing quarter by quarter, with losses of 63 in the first three quarters, respectively.5.4 billion yuan, 31.7.6 billion yuan, 27.1.3 billion yuan, narrowed to 15 in the fourth quarter..$4.7 billion。It can be seen that the fast hand has been getting better, trying to get rid of the "loss king" name。

Consolidate the Source Fast Track Online Marketing Service Revenue Increases by 14% in 2022.9% live broadcast revenue reached 10 billion in the fourth quarter

By business, online marketing business。Revenue from online marketing services increased by 1.4 billion yuan from 42.7 billion yuan in 2021..9% to RMB 49 billion by 2022。Online marketing is the most important source of revenue for Kuaishou, contributing 53% of Kuaishou's revenue in 2022..4%, directly occupy half of its profits。In this regard, Kuaishou said that the better performance of the business is mainly due to the growth of platform traffic, diversified product portfolio and refined operations based on industry attributes, driving the number of advertisers and advertisers to increase.。

In the live broadcast business, this revenue increased by 14% from RMB31 billion in 2021..2% to RMB 35.4 billion by 2022。In the fourth quarter of 2022, revenue from live broadcast business even recorded RMB 10 billion, up 13% year-on-year..7%, a record high。Kuaishou said that this is mainly due to the continuous enrichment of the platform's content supply, the continuous development of cooperation strategies with the guild, and the continuous iteration of the live streaming ecology and algorithms.。

Among other services, this revenue increased by 31% year-on-year from RMB7.4 billion in 2021..4% to RMB 9.8 billion by 2022。Kuaishou pointed out that the sharp increase in revenue was mainly due to an increase in the total volume of commodity transactions in its e-commerce business.。The increase in the number of active merchants and active buyers in 2022, as well as the increase in the repeat purchase rate, contributed to it.。Especially in the fourth quarter, due to the impact of the holiday promotion and other factors, the average monthly number of fast-selling merchants grew by more than 50% year-on-year, and the average monthly store efficiency of head merchants achieved double-digit year-on-year growth.。

Overseas, in 2022 and 2021, Kuaishou's overseas division recorded operating losses of RMB6.6 billion and RMB12 billion, respectively, an improvement of 44.7%。Kuaishou said the lower operating loss for the segment was primarily due to rapid growth in overseas revenue and the company's continued efforts to improve the efficiency of marketing expenses under its ROI-driven global strategy.。In addition, by the end of 2022, the average daily usage time of each active user in the overseas market has increased to more than 65 minutes.。

Earnings Call: 2024 Achieves Quarterly DAU Over 400 Million Multimodal Content Understanding and Generation Technology Maturing

After the performance, Quick Hand founder and CEO Cheng Yixiao, CFO attended the earnings call to respond to concerns。

Jin Bing said that throughout 2022, the company continued to improve the efficiency of customer acquisition in all major growth channels, refined the algorithmic model of user growth and maintenance, and improved the ROI retained by users through high-quality content supply and iterative traffic distribution strategies, so that the company in 2022 in the premise of growth and maintenance costs fell sharply year-on-year, DAU still achieved 15 year-on-year..Strong growth of 4%。

He also said that with the increasing penetration of short videos for the Internet population, the company also feels that the difficulty of future user growth will gradually increase, which will correspondingly bring about a gradual flattening of the marginal improvement curve of unit customer acquisition costs, but the company will still achieve high-quality user growth targets based on the premise of ROI constraints, with strict control of user growth and maintenance investment.。The company expects to achieve steady growth in users in 2023, and in the medium term, the company is also confident of achieving its quarterly DAU target of over 400 million in the second half of 2024.。

According to the data, the average daily active user and average monthly active user of the Kuaishou app in the fourth quarter of 2022 hit 3.66.2 billion and 6.400 million record highs, up 13.3% and 10.7%。In the fourth quarter of 2022, the average daily usage time per daily active user of the Fast Hand app increased by 12% year-over-year..6% to 133.9 minutes。

In addition, for the recent hot artificial intelligence technology problems, fast hand has also been clear about its own layout。

Cheng Yixiao said, relying on the company's artificial intelligence team, Kuaishou has many years of technology and application accumulation in generative artificial intelligence, especially in large-scale language models (LLM), multi-modal pre-training large models, intelligent creative tools, etc., has a deep technical precipitation.。In terms of LLM, the company launched a series of special projects at the end of last year, covering areas such as LLM model training, automatic copywriting, dialogue system development, and cross-modal generation.。In addition to text, the company also has an active layout in various modal content generation such as voice, image, video, 3D graphics, etc.。Overall, Kuaishou's multimodal content understanding and generation technology is maturing。

Investment bank: fast hand performance exceeded expectations in the fourth quarter of last year to maintain the company's "buy" rating

After the earnings announcement, Jefferies said that the fourth quarter results of the fast hand exceeded expectations, the fundamentals and profitability are expected to continue to improve in 2023, maintain the company's "buy" rating, and the company's target price slightly raised by nearly 3% to HK $105。

Goldman Sachs, for its part, issued a research report saying that Kuaishou's fourth-quarter revenue and profit beat the bank and market expectations。In addition, the company's share growth in advertising and live streaming and continued improvement in profitability this year, overlaid with its optimistic guidance, have provided upside to current market expectations, but Kuaishou remains one of the three Chinese Internet companies that have underperformed the market since the beginning of the year.。As a result, the bank raised its target price from HK $89 to HK $91 and maintained its "buy" rating.。

At today's open, Hong Kong stocks open fast 5.16%, 9% higher in the day。As of press time, fast hands up 6.04%, reported at 59.HK $65。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.