Dogecoin (DOGE) Market Cap Surpasses Porsche, but Momentum Could Be Fading

DOGE price surges to $0.48, overtaking Porsche’s market cap. Learn why technical indicators signal a potential trend reversal for DOGE.

- Dogecoin (DOGE) hit $0.48, surpassing Porsche in market cap at $58B, but momentum shows signs of weakening.

- Ichimoku Cloud and DMI indicators reveal consolidation, with DOGE trading near key support levels amid market indecision.

- If DOGE breaks $0.48 resistance, it could rise to $0.50-$0.60; failure to hold $0.36 support may lead to a sharp decline.

Dogecoin (DOGE) Price recently surged to $0.48, its highest level since 2021, while surpassing Porsche in market capitalization at $58 billion.

However, indicators like the EMA lines suggest the current uptrend may lose momentum, with a potential reversal on the horizon.

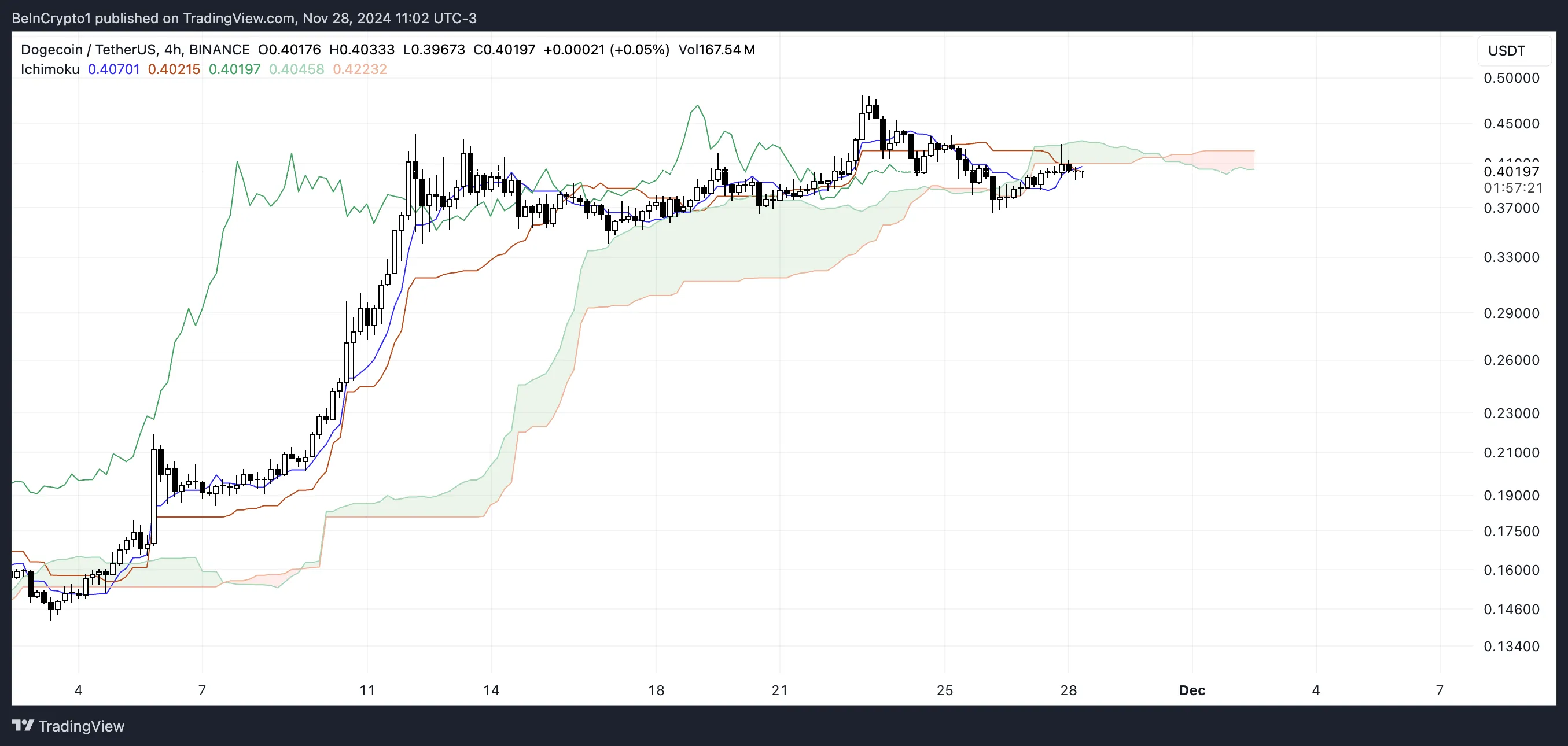

DOGE Ichimoku Cloud Shows a Potential Shift In Sentiment

The Ichimoku Cloud chart for Dogecoin shows a consolidation phase. The price currently trades near the Kijun-Sen (orange line) and Tenkan-Sen (blue line).

DOGE price is hovering around the edge of the cloud (Senkou Span A and B), indicating uncertainty in momentum. While the price has yet to fall decisively below the cloud, its proximity signals that the bullish momentum is weakening, and the cloud may now act as a key support zone.

The green cloud structure suggests mid-term support is intact for now, but the lack of strong upward movement above the Tenkan-Sen and Kijun-Sen lines reflects hesitation in the market.

If DOGE price fails to reclaim higher levels and slips below the cloud, it could signal the start of a bearish trend. On the other hand, a clear move above the Kijun-Sen with increasing volume could reignite bullish momentum and push the price higher.

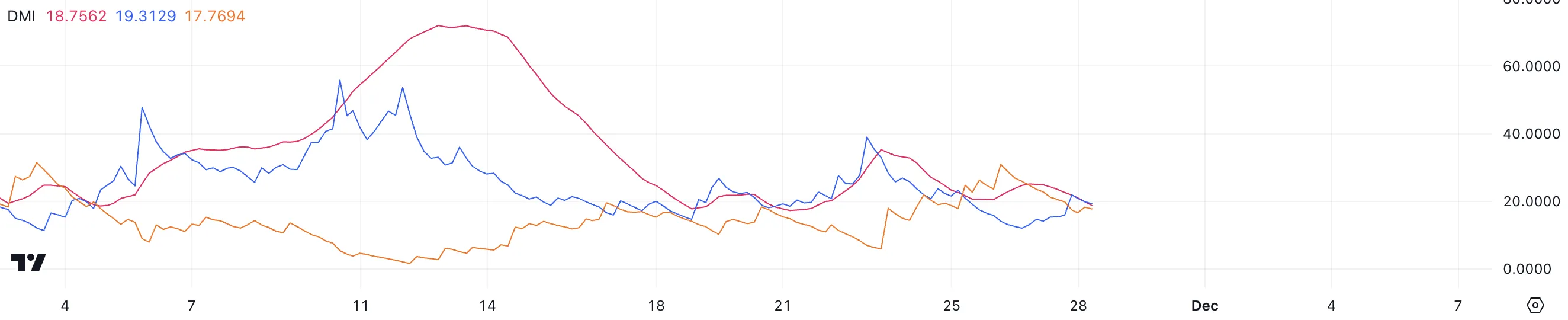

Dogecoin Current Trend Isn’t Strong Anymore

The DOGE DMI chart shows that its ADX has dropped to 18.7 from 25 in just one day, signaling a weakening trend. The ADX, or Average Directional Index, measures the strength of a trend, regardless of direction, on a scale from 0 to 100.

Values above 25 indicate a significant trend, while values below 20 suggest a weak or no trend. This drop in ADX suggests that DOGE recent momentum is losing steam, and the market could be entering a consolidation phase.

With the positive directional indicator (D+) at 19.3 and the negative directional indicator (D-) at 17.7, the marginal dominance of D+ over D- reflects a slight bullish bias. However, the narrow gap between the two indicators highlights an indecisive market, with neither buyers nor sellers strongly in control.

For Dogecoin to establish a clear trend, either D+ needs to rise significantly to confirm renewed bullish momentum, or D- must increase to indicate growing bearish pressure. Until then, price movements are likely to remain range-bound.

DOGE Price Prediction: Can It Reach $0.50 Soon?

DOGE price recently reached its highest level since 2021, peaking at $0.48 on November 23. It now boasts a market capitalization of $58 billion, surpassing the iconic automaker Porsche’s $56 billion.

If DOGE price can regain its bullish momentum, it could retest the $0.48 resistance level and potentially rise to $0.50 or even $0.60, moving closer to its all-time high.

However, DOGE’s EMA lines indicate that the current trend may reverse into a downtrend, as the formation of a death cross could occur soon. If Dogecoin price breaks below the critical $0.36 support level, it could decline further to $0.14, marking its lowest level since early November.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.