VanEck Argues That a Strategic Bitcoin Reserve Could Slash US Debt 36% by 2050

Asset manager VanEck has argued that a Strategic Bitcoin Reserve as a solution to reduce the United States' national debt by 36% by 2050.

- VanEck has projected that the United States could reduce its national debt by 36% by 2050 by establishing a Strategic Bitcoin Reserve.

- This aligns with Senator Cynthia Lummis's advocacy for the US to accumulate 1 million Bitcoin to ensure long-term financial stability.

- Despite the optimistic forecast, the initiative has faced skepticism from figures like venture capitalist Nic Carter and investor Peter Schiff.

VanEck, a leading asset management firm, has recently projected that the United States could significantly cut its national debt by as much as 36% by 2050 through adopting a Strategic Bitcoin Reserve.

This initiative aligns with Senator Cynthia Lummis’s Bitcoin Act, which advocates for the US to amass 1 million bitcoins within the next five years. The lawmaker argues that such a reserve could place future generations on a more stable financial footing, free from debts they did not accrue or benefit from.

How a Bitcoin Reserve Could Transform US Debt Management by 2050

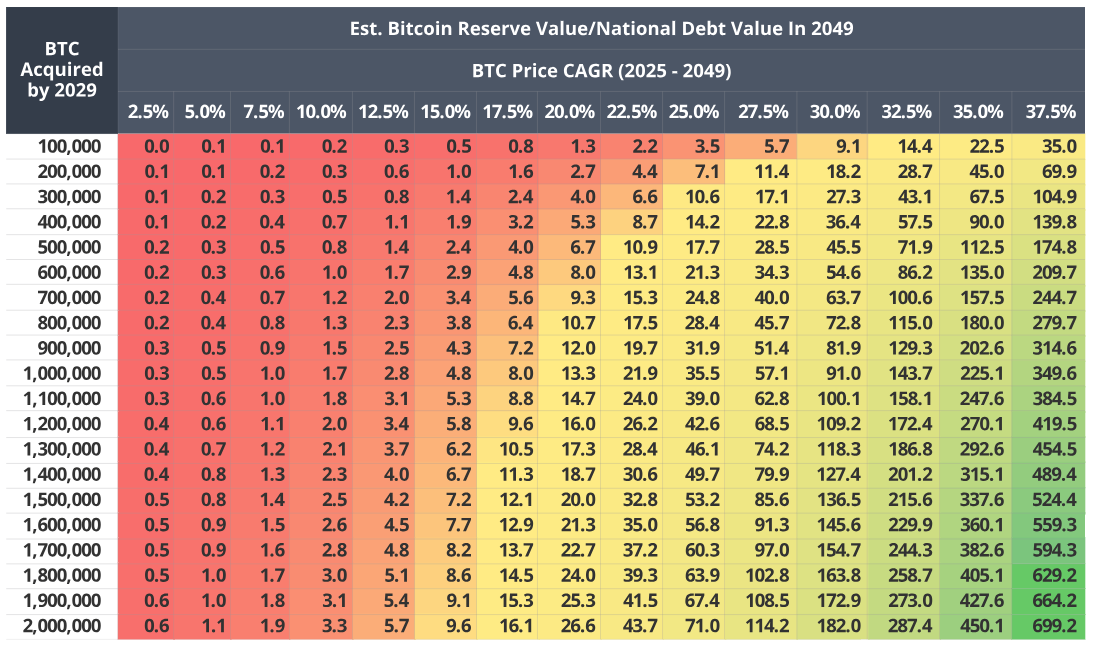

VanEck’s analysis supports this strategy, predicting that such an investment could cut national liabilities by an estimated $42 trillion by 2049. This projection assumes a consistent debt growth rate of 5% and an annual bitcoin appreciation rate of 25%.

In this scenario, Bitcoin’s value would skyrocket to over $42 million, making it a substantial player in the global financial arena by 2049.

“Assuming today’s $900 trillion of total global financial assets compound at 7.0% from 2025 – 2049, Bitcoin would represent 18% of global financial assets in this scenario,” the firm added.

Mathew Sigel, VanEck’s head of research, emphasized Bitcoin’s potential role in reshaping the global financial landscape. He suggested that Bitcoin might become the leading settlement currency in global trade – presenting an alternative to the US dollar – especially for countries seeking to sidestep US sanctions.

“It’s very possible bitcoin will be widely used as a settlement currency for global trade by countries who wanted to avoid the parabolic increase in USD sanctions that have been imposed,” Sigel wrote.

To kickstart this ambitious project, VanEck recommends several preliminary measures, including stopping the sale of Bitcoin from US asset forfeiture reserves.

Furthermore, they suggest that adjustments could be made under President Donald Trump’s incoming administration, such as revaluing gold certificates to their current market prices and using the Exchange Stabilization Fund to make initial Bitcoin purchases.

Indeed, these steps could help establish the reserve quickly without waiting for extensive legislative approval.

However, the proposal has met with some skepticism. Venture Capitalist Nic Carter has questioned whether a Bitcoin reserve would genuinely bolster the US dollar. Meanwhile, Peter Schiff proposes an alternative of the creation of a new digital currency called the USAcoin.

“The US could save a lot of money by creating USAcoin. Just like Bitcoin, the supply can be capped at 21 million, but with an upgraded blockchain to make USAcoin actually viable for use in payments,” Schiff suggested.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.