Hyperliquid Gains 37%, Faces Headwinds Amid Correction Fears

HYPE price surges 37%, with RSI and BBTrend showing bullish momentum. Key levels at $28.95 and $15 define the outlook.

- Hyperliquid price jumps 37% in a week, with RSI at 55.8 showing neutral-to-bullish momentum.

- BBTrend remains positive at 28.4, signaling upward momentum, though the pace of the rally has slowed from its peak.

- HYPE could test $28.95 if the trend holds but risks a 42% correction to $15 if support fails.

Hyperliquid (HYPE) price has surged 37% in the last seven days, following one of the largest airdrops of the year. Momentum indicators like RSI and BBTrend suggest the uptrend remains intact, with room for further gains, though the pace has slowed compared to its peak.

If the bullish momentum continues, HYPE could test a new all-time high near $28.95 and potentially rise to $30 or $35. However, a weakening trend could expose the price to a correction, with strong support at $15 representing a potential 42% downside.

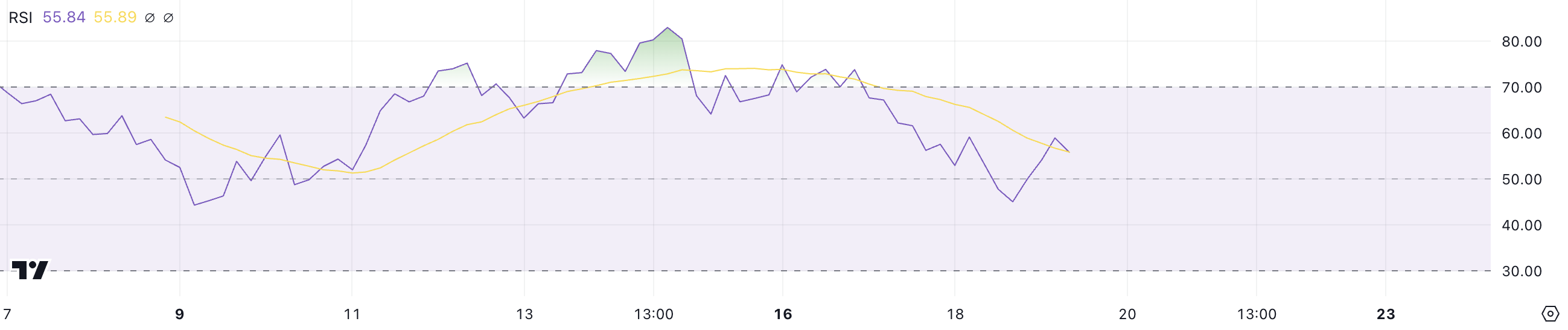

HYPE RSI Is Currently Far from Overbought

HYPE’s RSI is currently at 55.8, up from 46 yesterday, indicating a notable recovery in momentum. This increase suggests that buying pressure is returning after a recent cooldown for the perpetuals DEX. Between December 13 and December 15, when HYPE reached a new all-time high, the RSI stayed above 70, reflecting overbought conditions.

The current reading, while below the overbought threshold, shows a shift toward a more bullish sentiment, which could support further price stabilization or gains in the short term.

The RSI (Relative Strength Index) measures the magnitude and velocity of price movements to evaluate whether an asset is overbought or oversold. Readings above 70 typically signal overbought conditions and potential pullbacks, while readings below 30 suggest oversold conditions, often preceding rebounds.

With HYPE RSI at 55.8, it indicates neutral-to-bullish momentum, suggesting room for further upward movement as it remains comfortably below overbought levels. If the buying momentum continues, HYPE could test new resistance levels, but if the RSI stalls, it might face short-term consolidation.

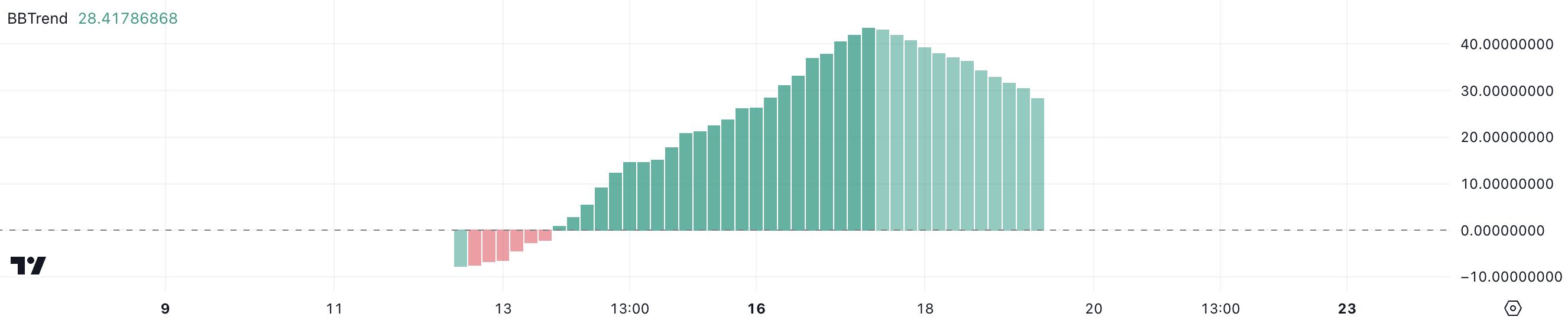

Hyperliquid BBTrend Is Still Positive

HYPE’s BBTrend is currently at 28.4, remaining positive since the end of December 13, days after its airdrop, signaling continued bullish momentum. However, it has declined from its peak of 43 on December 17, which marked a period of heightened strength when HYPE reached a new all-time high, just like other altcoins.

This decrease suggests that while the uptrend remains intact, the pace of upward movement has slowed compared to earlier in the rally.

BBTrend, derived from Bollinger Bands, measures the strength and direction of a price trend. A positive BBTrend reflects bullish momentum, while a negative value indicates bearish pressure.

With HYPE’s BBTrend still very positive at 28.4, the asset is likely to sustain its upward trajectory, although at a more moderate pace than during its peak. This steady momentum could support further gains, but the cooling trend implies that HYPE may rise less aggressively in the short term.

HYPE Price Prediction: A New All-Time High Soon?

If the current uptrend continues, HYPE could soon challenge a new all-time high near $28.95, making it one of the best-performing new altcoins.

A successful breakout above this level could push the price further, with targets at $30 and potentially $35, representing a potential 34% upside.

However, if the uptrend weakens and a downtrend forms, HYPE price may face significant downside risk. The closest strong support lies around $15, which, if tested, would mean a potential 42% correction from current levels.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.