Ethereum (ETH) Loses Steam as Fed Rate Cut Fails to Fuel $4,500 Breakout

Ethereum slips 4.5% post-Fed rate cut as bearish signals dominate. Learn why ETH risks hitting $3,501 unless buying volume recovers.

- Ethereum dropped to $3,624 after the Fed’s 25 bps rate cut fell short of market expectations, sparking bearish momentum.

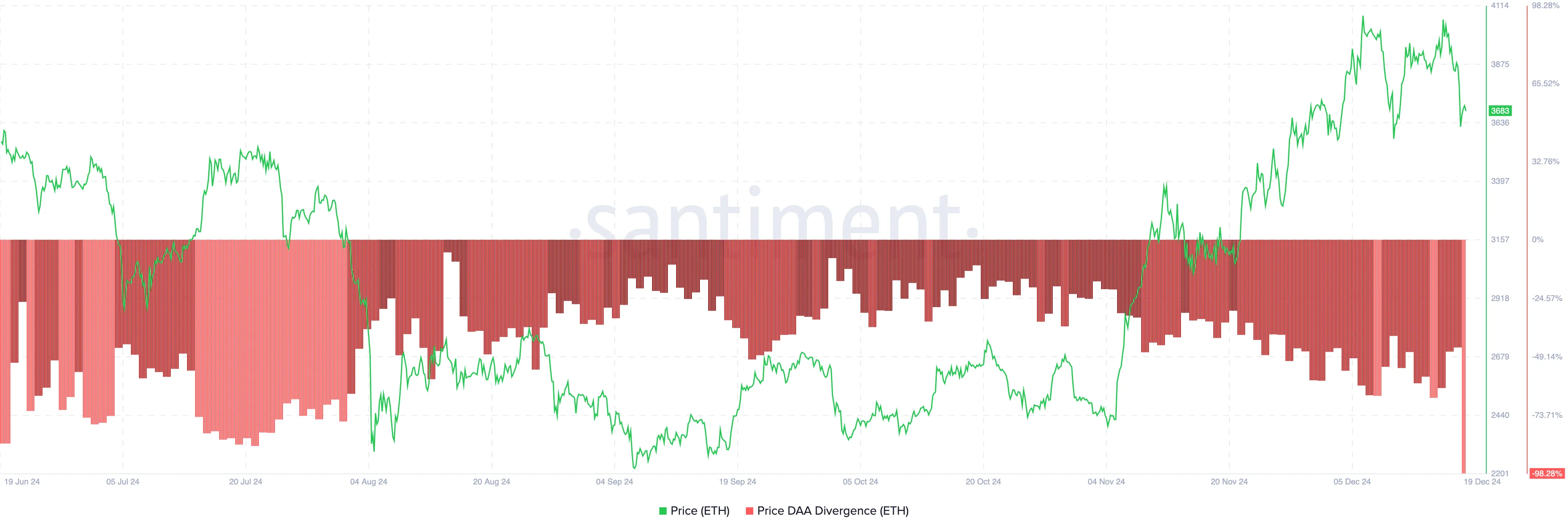

- With price DAA divergence at -98.28%, lower user engagement suggests potential further declines in Ethereum’s price.

- A bearish head-and-shoulders pattern could push ETH price to $3,501, but increased volume may invalidate this bias.

Before Federal Reserve Chair Jerome Powell announced a 25 basis point (bps) interest rate cut, Ethereum (ETH) holders were optimistic that the event would fuel a rally toward $4,500. However, the rate cut did not yield the anticipated bullish outcome, with ETH experiencing a 4.50% decline shortly afterward.

This drop has diminished hopes for a notable breakout, raising questions about what could be next for Ethereum.

Ethereum Changes It Reaction Compared to Last Rate Cut

Some months back, the Fed cut interest rates by 50 bps. This development drove a notable rally in crypto prices, including Ethereum. At that time, the sentiment leaned toward expectations of a similar rate cut before the year ended. However, this did not materialize.

Following yesterday’s decision, ETH’s price dropped from $3,890 to $3,624. While the cryptocurrency has recovered slightly, several on-chain indicators reveal that the attempted rebound could be a fakeout.

One of the indicators suggesting such is the price-Daily Active Addresses (DAA) divergence. The price DAA divergence checks if the user participation is growing alongside the price. When it is positive, it means engagement with the cryptocurrency has increased and is bullish for thhe price.

On the flip side, a negative rating indicates fewer interactions, which is bearish. According to Santiment, Ethereum’s price DAA divergence has declined to -98.28%, indicating lower user participation. Should this trend continue, ETH’s price could face a steeper price decrease.

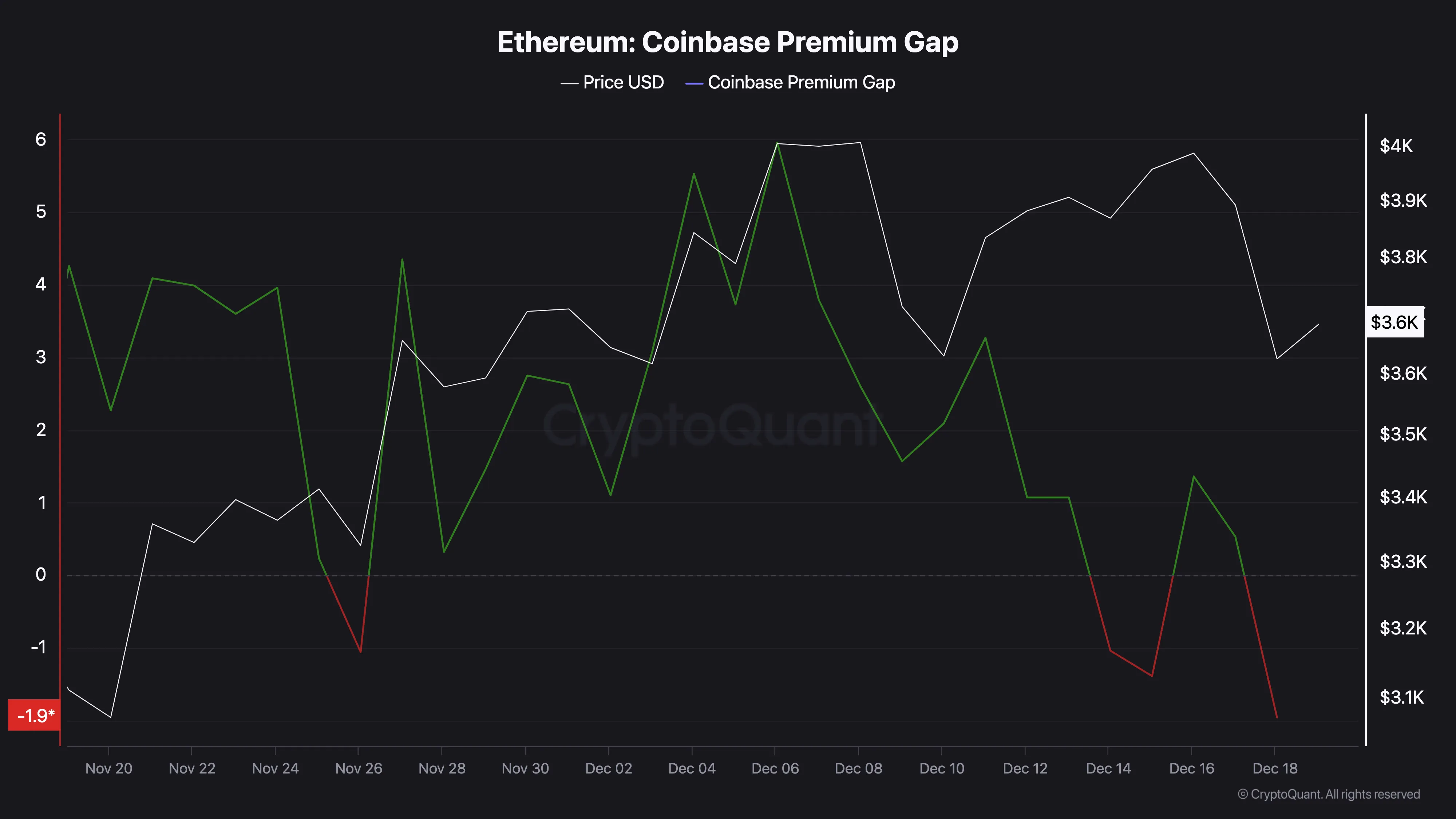

In addition to the metric above, the Coinbase Premium Gap is another indicator that supports a further ETH decline. This metric measures the price difference between the Coinbase ETH/USD pair and the same pair on Binance.

When there is a high premiumprice on Coinbase relative to Binance, it signals notable buying activity among US-based investors. This buying pressure may come from heightened demand within the region and favors a price uptick.

Conversely, when the price on Coinbase lags behind Binance, it might suggest a relative cooling of demand in the US market or stronger selling pressure from institutional or retail investors.

The chart above shows that the premium gap has fallen to -1.96, indicating significant selling pressure for ETH following the Fed rate cut.

ETH Price Prediction: Not Yet the Season for $4,500

Beyond ETH Fed rate cut reaction, it experienced a decline due to the formation of a head-and-shoulders pattern on the 4-hour chart. A head-and-shoulders pattern is a classic technical analysis chart formation that signals a potential trend reversal from bullish to bearish.

The pattern features a price rise (left shoulder), followed by a peak (head), and then a decline (right shoulder). When the price breaks below the neckline after forming the right shoulder, it signals a bearish trend reversal.

However, the pattern’s reliability depends on the trading volume. As seen below, the volume around ETH has decreased, and the price has broken below the neckline.

Should this remain the same, then the ETH price might drop to $3,501. However, if volume increases alongside buying pressure, this prediction might not come to pass. Instead, Ethereum’s price might rise to 4,109 and eventually toward $4,500.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.