Kraken Explores More Token Listings Amid Trump-Driven Crypto Optimism

Kraken has announced plans to list 19 new tokens, including popular meme coins, and integrate three additional blockchains.

- Crypto exchange Kraken has expanded its token listing roadmap to include 19 tokens, including popular Trump-linked meme coins.

- The move comes amid optimism that the incoming Trump administration’s pro-crypto stance will create a more favorable regulatory environment.

- Despite ongoing SEC legal challenges, Kraken and other exchanges are capitalizing on market momentum to expand their offerings.

Kraken, one of the leading cryptocurrency exchanges, has announced plans to list 19 new tokens, including a range of popular meme coins, and to integrate three additional blockchains.

This development has sparked optimism across the crypto industry, with many anticipating a more favorable environment for token listings under the incoming Trump administration.

Kraken Plans to List 19 Tokens and Integrate 3 Blockchains

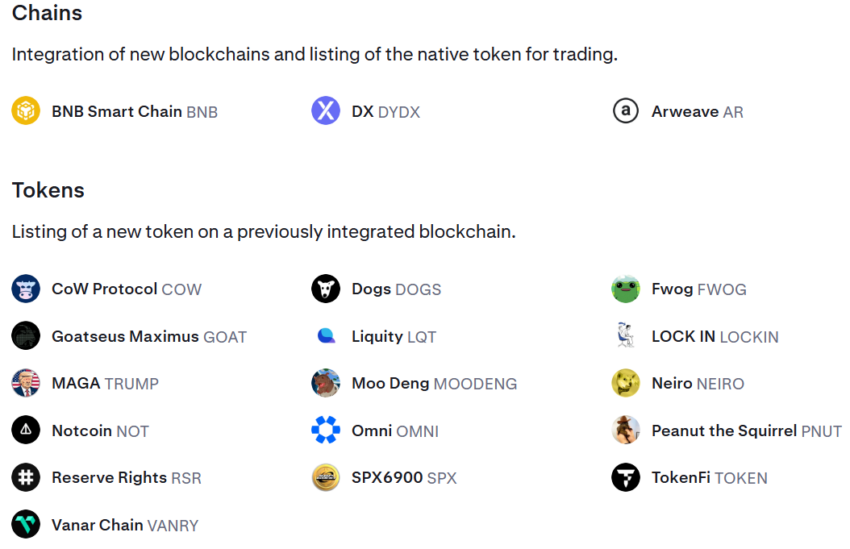

According to its recently published tradeable asset roadmap, Kraken will add the Binance Smart Chain, dYdX, and Arweave blockchains to its platform. Each integration will include support for the native tokens of these networks.

“Kraken lists BNB,” Binance founder Changpeng Zhao stated.

In addition to these three, Kraken plans to list 16 other tokens, primarily meme coins. Some of the notable additions include FWOG, TRUMP, NEIRO, DOGS, GOAT, PNUT, MOODENG, and COW, alongside eight others. These tokens belong to blockchains already integrated into Kraken’s ecosystem.

However, the exchange clarified that listing plans are not guaranteed. Funding and trading for these tokens will only begin after an official announcement through Kraken Pro’s account on X. The company warned that Depositing tokens prematurely could result in losses.

Kraken’s planned token expansion comes at a time when the exchange is navigating legal challenges. The US Securities and Exchange Commission (SEC) has accused Kraken of operating an unregistered securities exchange and offering staking services in violation of federal laws. The exchange has been actively defending itself against these allegations.

Despite regulatory hurdles, crypto industry stakeholders are optimistic that the incoming administration will ease restrictions on token listings. Many believe President-elect Trump’s pro-crypto stance could pave the way for a more supportive regulatory environment. Expectations include a clear regulatory framework, the potential establishment of a Bitcoin reserve, and a departure from the SEC’s regulation-by-enforcement approach.

Already, major US exchanges are capitalizing on the growing market optimism to expand their token listings. Coinbase recently listed PEPE and FLOKI, leveraging the ongoing meme coin trend.

Similarly, Robinhood expanded its offerings by adding tokens that the SEC previously described as securities — XRP, Cardano, and Solana. These moves reflect a broader effort by exchanges to capture market momentum and cater to diverse investor interests.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.