RENDER Price Surges 48% In One Month, But Whale Activity and Trends Raise Doubts

RENDER price surges 48%, leading AI coins by market cap, but declining whale interest and weakening trends pose challenges ahead.

- RENDER Leads AI Coins: With a $4.1B market cap, RENDER outpaces TAO, FET, and WLD, reflecting strong AI sector demand.

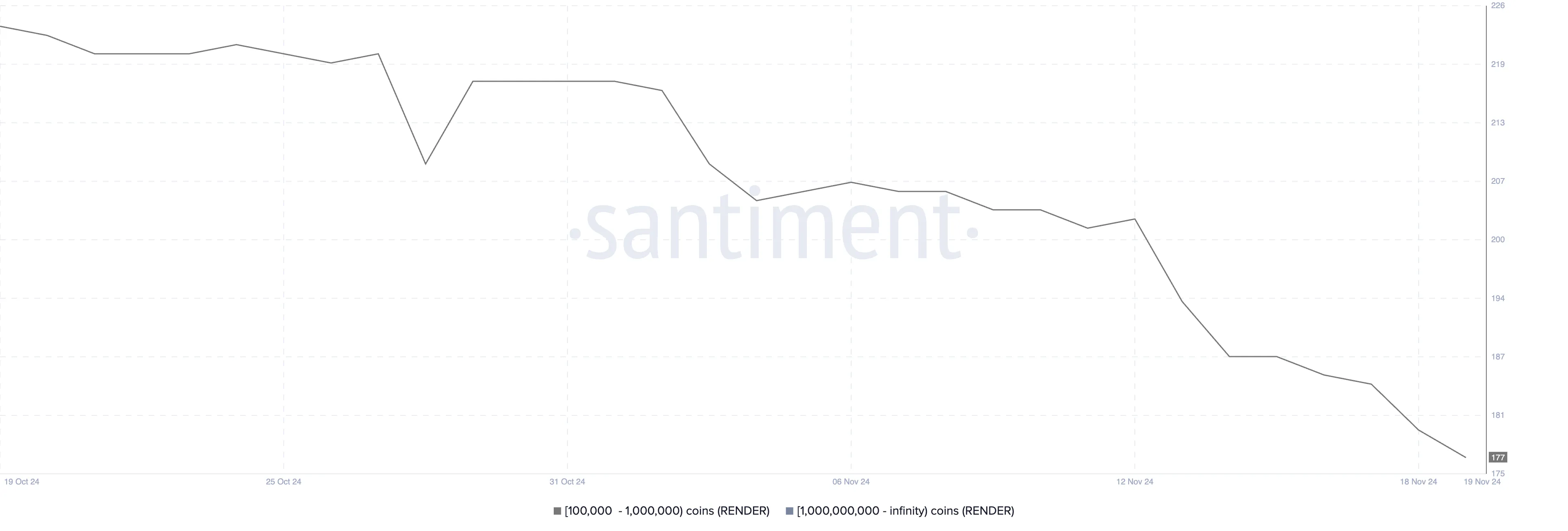

- Whale Interest Declines: Large holders drop from 218 to 177 in November, signaling waning confidence despite the rally.

- Weakened Momentum: BBTrend stays positive but far from mid-November highs, hinting at a fragile uptrend and potential pullbacks.

RENDER price has surged 48% in the last month, solidifying its position as the largest artificial intelligence coin by market cap at $4.1 billion. It now leads over its closest competitors, TAO, FET, and WLD, reflecting growing interest in the AI-focused asset.

However, despite this impressive rally, declining whale activity and weakening trend indicators suggest potential challenges ahead. Whether RENDER can sustain its upward momentum or face a reversal depends on how market confidence evolves in the coming days.

Whales Are Not Accumulating RENDER

RENDER is struggling to attract whale interest, as the number of holders with balances between 100,000 and 1,000,000 coins has dropped sharply since the beginning of November.

This figure started at 218 on November 1 and has fallen to 177, marking a significant decline in large holders despite recent market activity.

This trend is notable because whales often play a crucial role in driving and sustaining price momentum. Even with RENDER price surging 48% in the past month, the continued decline in whale numbers suggests a lack of confidence among major investors.

This could indicate that the recent rally may face challenges in maintaining its upward trajectory without strong support from large holders.

RENDER BBTrend Is Still Positive

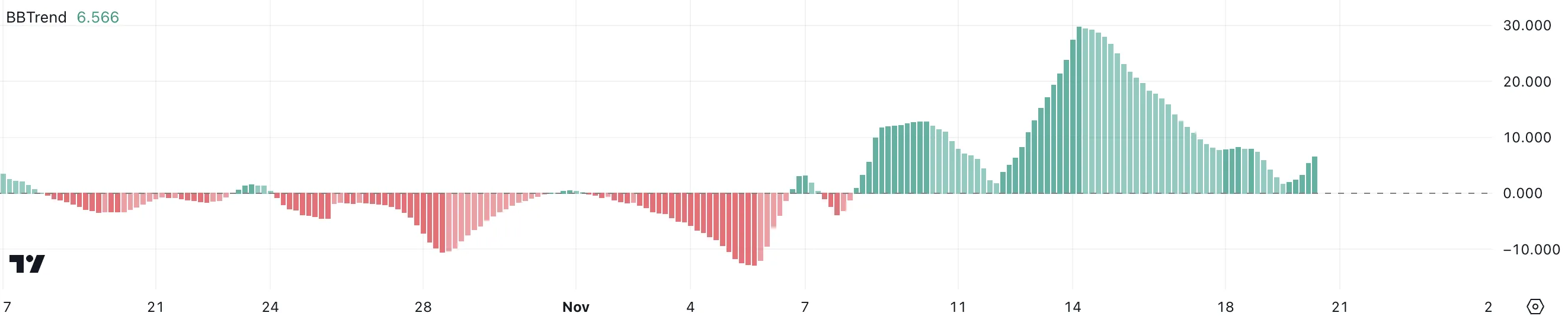

BBTrend for RENDER is currently around 6.4, recovering from a recent low of 1.7 on November 19.

While it reached a three-month high of 29.7 on November 14, the indicator has since dropped significantly, reflecting a loss of momentum after its peak.

BBTrend measures the strength and direction of a trend by analyzing Bollinger Bands, with positive values indicating an uptrend and negative values signaling a downtrend.

Although BBTrend for RENDER has been positive since November 8 and is now showing signs of recovery, it remains far below the mid-November highs. This suggests that while the uptrend is not over, its current strength is relatively weak, indicating potential hesitation in sustaining further price increases.

RENDER Price Prediction: Back To The $5 Soon?

RENDER’s EMA lines currently indicate a bullish setup, with short-term lines above long-term ones and the price trading above all of them.

If the uptrend gains momentum again, RENDER price could test the resistance at $8.29, with the potential to rise further to $9.47, marking its highest price since May and establishing RENDER as the biggest artificial intelligence coin in the market.

On the downside, metrics like BBTrend and whale activity point to weakening confidence. If the trend reverses, RENDER may test supports at $6.3 and $5.8, and if those fail to hold, the price could drop as low as $5.0.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.