Stocks Surge as February Inflation Comes in Lower Than Expected Despite Tariff War

The latest CPI data for February has been released, revealing a softer-than-expected inflation print despite escalating trade tensions. Investors welcomed the report, boosting stocks as they gained co

The latest CPI data for February has been released, revealing a softer-than-expected inflation print despite escalating trade tensions. Investors welcomed the report, boosting stocks as they gained confidence in the inflation trajectory amid new tariff risks.

Key Figures:

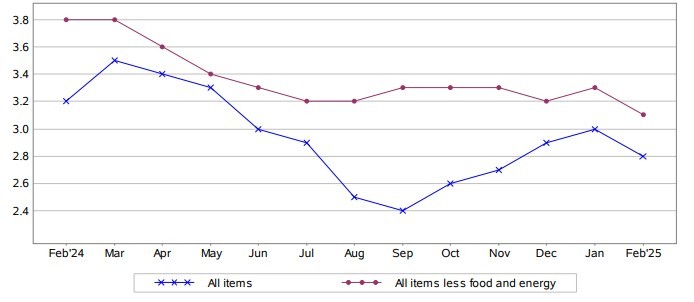

Headline CPI: 2.8% y/y, 0.2% m/m, compared to the expected 2.9% y/y

Core CPI (excluding food and energy): 3.1% y/y, 0.2% m/m, compared to the expected 3.2% y/y

Although inflation remains elevated, the slight undershoot of expectations has been perceived as a positive sign by the markets, suggesting that price pressures may be stabilizing.

Following the release of the CPI report, S&P 500 futures and Nasdaq 100 futures saw an immediate rally of more than 1%. The lower-than-expected core CPI figure alleviated some concerns about persistent inflation, even as the broader economic environment faces uncertainty due to the latest U.S. trade policies.

The CPI data comes in the wake of President Donald Trump's 10% additional tariff on China, which took effect in February, with further tariff hikes expected in March. While these tariffs contribute to higher import costs, February's inflation data suggests that other factors—such as lower energy prices—are helping to offset some of the impact.

Breakdown of Key CPI Components:

Shelter Costs: Up 0.3%, contributing to nearly half of the monthly CPI increase.

Airline Fares: Down 4.0%.

Gasoline: Declined 1.0%, though the overall energy index still rose 0.2% due to increases in electricity and natural gas.

Food Prices: Up 0.2%, led by a 0.4% rise in food away from home, while grocery prices remained unchanged.

Core CPI Components: Categories such as medical care, used cars and trucks, household furnishings, recreation, apparel, and personal care all saw price increases, while new vehicles and airline fares declined.

With inflation still above the Federal Reserve's 2% target, traders are now pricing in no rate cut at next week's meeting. The odds of three 25 bps rate cuts by year-end stand at 32%, reflecting ongoing uncertainty around monetary policy.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.