USD/JPY Breaches 150 Yen as Dollar Index Rebounds USD/JPY Breaches 150 Yen as Dollar Index Rebounds

Key momentsThe USD/JPY pair surged past 150 yen on Monday, reaching 150.25.The Dollar Index regained its footing above $104.In March, Japans private sector shrank, with the composite PMI falling to 48

Key moments

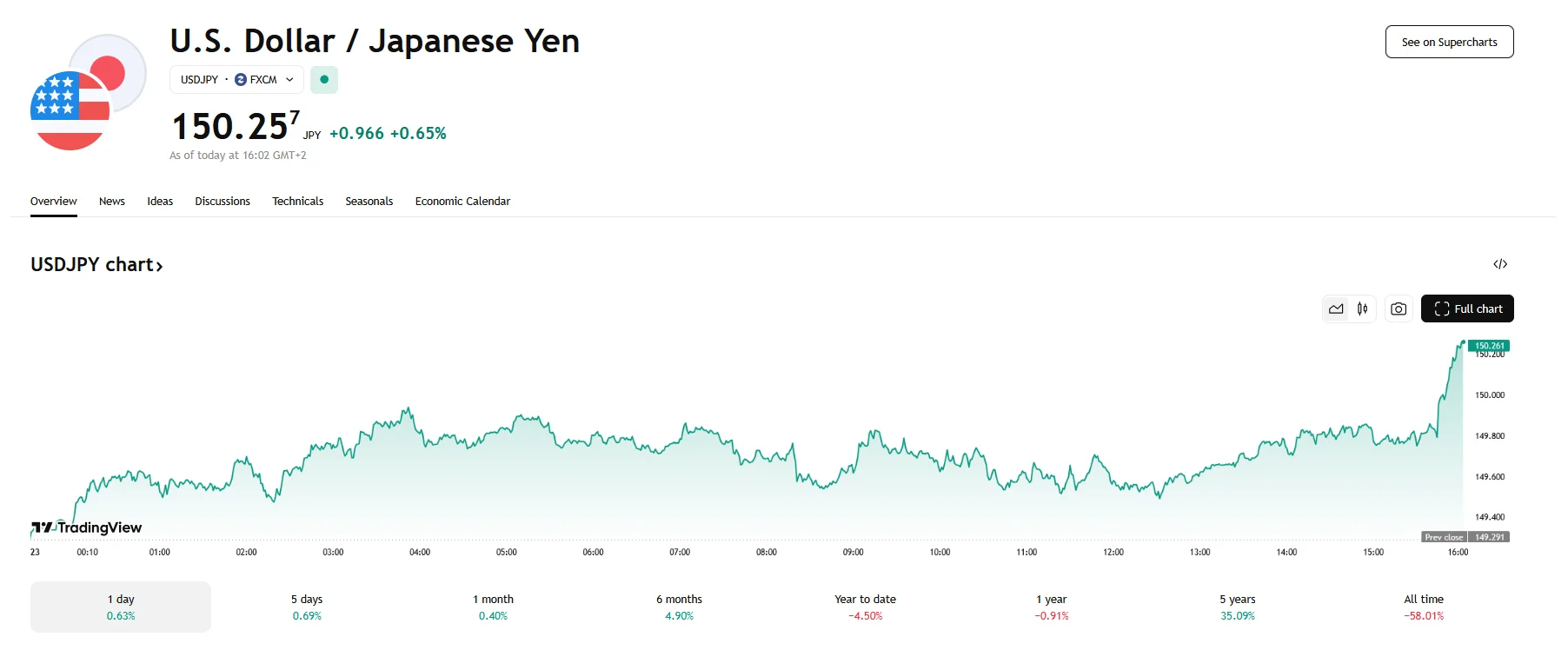

- The USD/JPY pair surged past 150 yen on Monday, reaching 150.25.

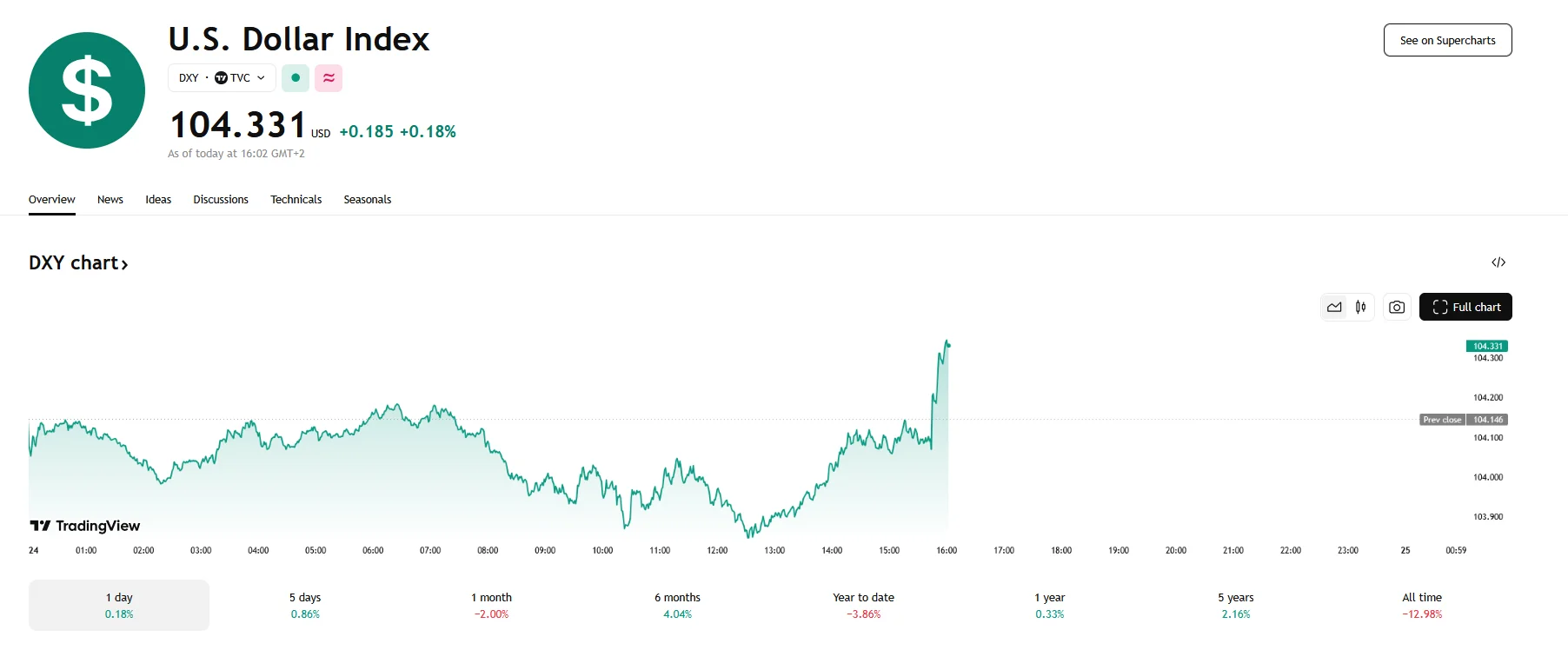

- The Dollar Index regained its footing above $104.

- In March, Japan’s private sector shrank, with the composite PMI falling to 48.5.

Dollar Recovery Propels USD/JPY Above 150 Yen Mark

The USD/JPY currency pair has breached the significant 150 yen mark, reaching 150.25, the result of a 0.65% increase. This surge coincides with a notable recovery in the U.S. Dollar Index, which, after today’s initial decline, rose 0.18% to $104.331.

The past week saw the yen and the USD/JPY pair experience considerable fluctuations, ranging from a low of around 148 yen to figures hovering around 149, which marked multiple unsuccessful attempts at breaching the 150 mark. This volatility occurred despite the Bank of Japan’s decision to keep its interest rates at 0.5%.

The U.S. Dollar Index, reflecting the dollar’s strength against a basket of six major currencies, has also experienced swings in value. Early Monday saw the index fall below the 104 threshold, but after a steady rebound, it is trading above $104.300 at the time of writing. This strength is attributed to a range of factors, including the Fed’s signals that it is not in a hurry to reduce interest rates, thereby maintaining the dollar’s attractiveness to investors. Reports relating to the Trump Administration’s tariff policies, specifically how they might be less broad than feared, have further aided positive market sentiments.

In contrast, the Japanese yen continues to face downward pressure. Analysts point to the yen’s underperformance against other major currencies. The Bank of Japan’s anticipated policy adjustments are crucial in determining the yen’s future trajectory, and current market expectations suggest that the BoJ is unlikely to implement substantial tightening measures, which could limit the yen’s potential for appreciation.

Economic indicators from Japan reveal a concerning trend. March witnessed a decline in private sector activity, with the composite PMI falling to 48.5, signaling a renewed contraction. The services PMI also fell, hitting 49.5, the lowest in three months. Manufacturing did not fare well either, as the PMI plummeted to the lowest it has been in years (48.5). According to Finance Minister Katsunobu Kato, Japan’s struggle with deflation is ongoing, and inflated prices are mainly the result of a weakening yen and rising commodity costs.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.