UK Inflation Drops to 2.8%, GBP/USD Down 0.25% UK Inflation Drops to 2.8%, GBP/USD Down 0.25%

Key momentsThe GBP/USD exchange rate fell to 1.2910 on Wednesday.Official statistics revealed the UKs annual Consumer Price Index for February was lower than analyst forecasts at 2.8%.The milder-than-

Key moments

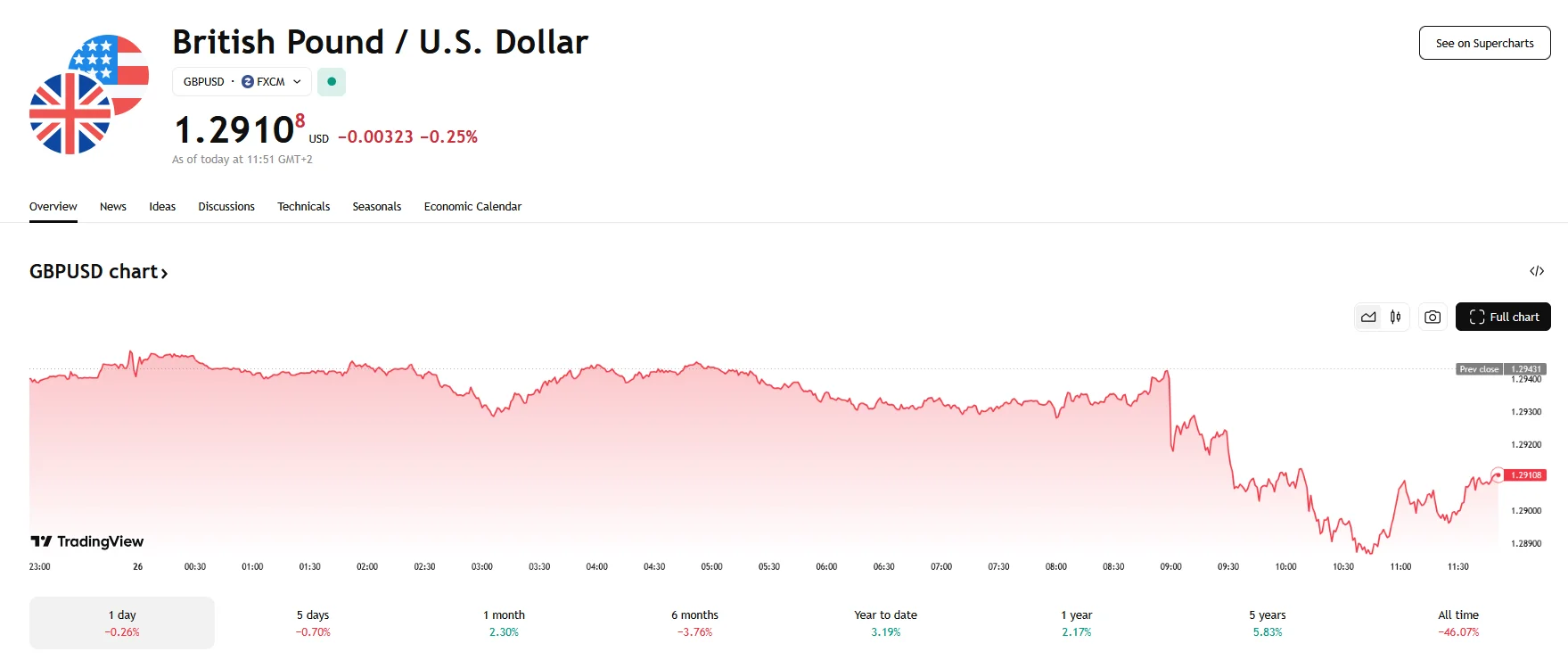

- The GBP/USD exchange rate fell to 1.2910 on Wednesday.

- Official statistics revealed the UK’s annual Consumer Price Index for February was lower than analyst forecasts at 2.8%.

- The milder-than-expected inflation could result in future interest rate cuts.

Market Reacts to UK Inflation Figures, Sterling Under Pressure

Wednesday saw the GBP/USD pair decline by 0.25% to reach 1.2910. This movement reflects a notable shift in market sentiment, particularly after the sterling briefly dipped below the $1.29 threshold earlier in the trading session. The primary catalyst for this decline was the release of unexpectedly low inflation figures from the United Kingdom, which have prompted reassessments of the Bank of England’s (BoE) monetary policy outlook.

Data released by the Office for National Statistics revealed that the annual Consumer Price Index (CPI) for February came in at 2.8%, lower than the anticipated 3%. As lower inflation rates typically provide central banks with greater flexibility in easing monetary policy, market participants are speculating that the BoE could implement potential interest cuts. The core CPI also fell short of predictions, rising 3.5% versus the expected 3.6%, which further reinforced the notion of moderating inflationary pressures within the UK economy.

The market’s reaction to the inflation data has been swift and decisive, with the pound weakening against its major counterparts. Traders are now pricing in a higher probability of multiple interest rate cuts by the BoE in the coming months, reflecting a growing consensus that the central bank will adopt a more dovish stance. The shift in market expectations is further amplified by the technical analysis of the GBP/USD pair, which indicates a potential for further downside movement if the 1.2880 support level is breached.

Despite the recent decline, it is important to note that the pound has demonstrated relative strength against the dollar over the past three months, experiencing a significant appreciation. This upward trend has been supported by both favorable inflation data and broad dollar weakness. However, the latest inflation figures have introduced a degree of uncertainty, prompting traders to reassess their positions and adjust their expectations.

The upcoming release of the UK’s Office for Budget Responsibility (OBR) forecasts and Chancellor Rachel Reeves’ Spring budget presentation are expected to provide further insights into the UK’s economic outlook. Additionally, the release of February Durable Goods Orders data from the United States and speeches by Federal Reserve policymakers will also influence the GBP/USD pair’s trajectory. These events will offer crucial information regarding both the UK and US economies, providing clues for future monetary policy decisions.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.