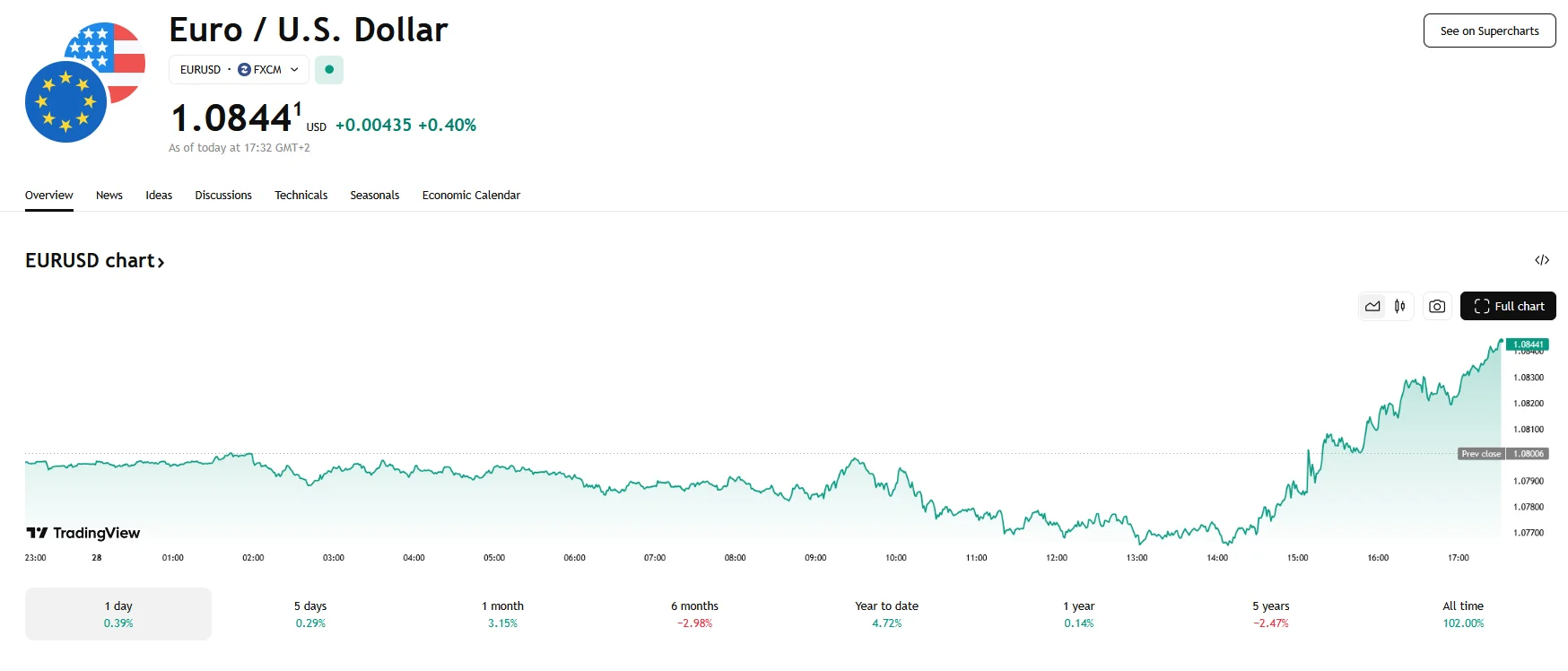

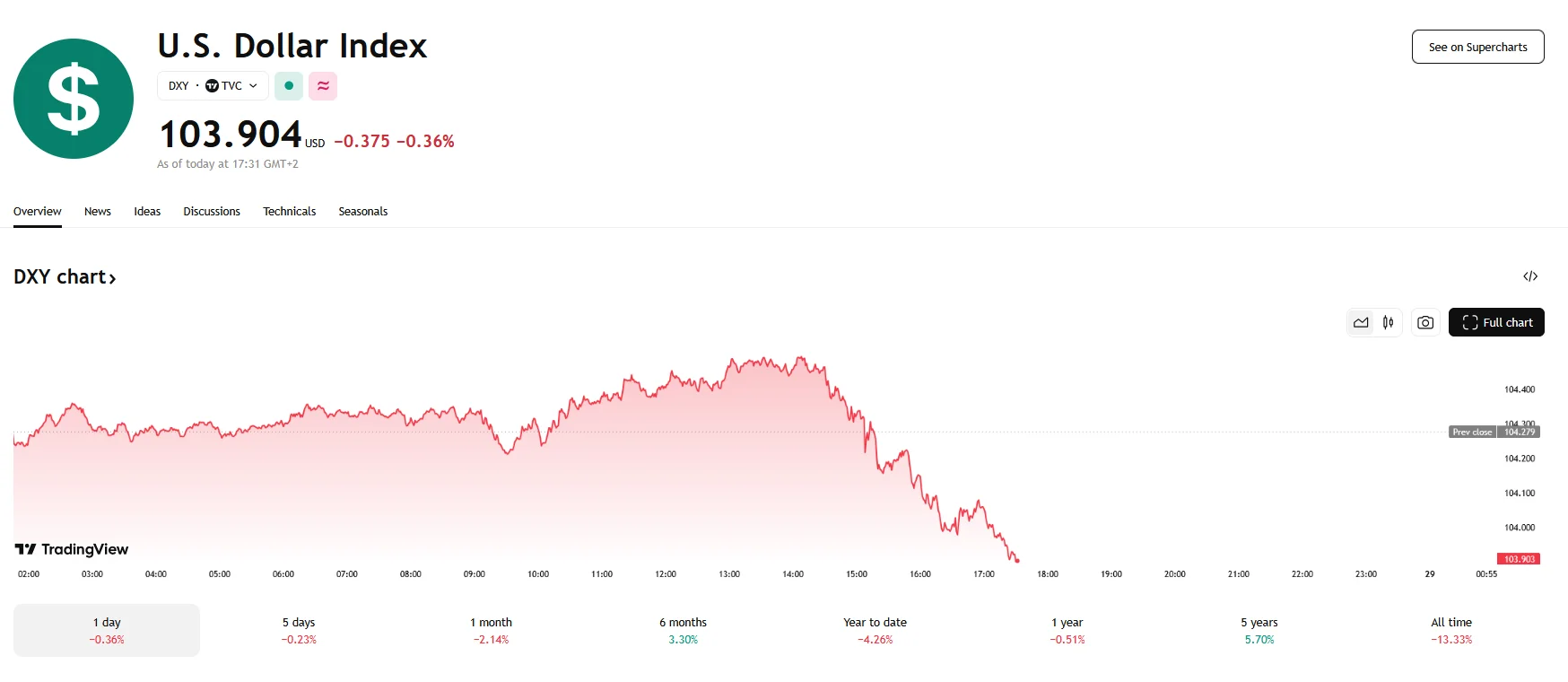

US Core Inflation Reaches 2.8%, Dollar Index Sinks as EUR/USD Climbs Above 1.0840 US Core Inflation Reaches 2.8%, Dollar Index Sinks as EUR/USD Climbs Above 1.0840

Key momentsThe EUR/USD pair managed to breach the 1.0840 threshold on Friday.A weakening U.S. dollar saw the Dollar Index experienced a 0.36% decline.Februarys U.S. core inflation, as indicated by the

Key moments

- The EUR/USD pair managed to breach the 1.0840 threshold on Friday.

- A weakening U.S. dollar saw the Dollar Index experienced a 0.36% decline.

- February’s U.S. core inflation, as indicated by the PCE price index, climbed to 2.8%.

The EUR/USD pair experienced a significant recovery on Friday, pushing above the 1.0840. This upward movement, showing a 0.40% increase to 1.0844, coincided with a weakening U.S. dollar, as the Dollar Index slipped 0.36% to just above 103.900.

The dollar’s decline was largely attributed to a combination of rising U.S. inflation figures and escalating trade tensions, particularly concerning potential tariffs imposed by the Trump administration.

U.S. core inflation, as measured by the Personal Consumption Expenditures (PCE) price index, reached 2.8% in February, exceeding market expectations. This higher-than-anticipated inflation reading, coupled with a 0.4% increase in consumer spending, raised concerns about the Federal Reserve’s path to achieving its 2% inflation target. The data, seen as a key metric by the Fed, prompted immediate market reactions, with stock market futures and Treasury yields briefly declining. The heightened inflation figures added to investor anxieties, particularly in the context of potential tariffs, which could further exacerbate price pressures.

Simultaneously, the U.S. dollar faced downward pressure as traders grappled with the implications of President Trump’s proposed tariffs. The announcement of a 25% tariff on imported cars and light trucks, along with threats of further levies on Eurozone and Canadian goods, created uncertainty in the currency sphere. Negative market sentiments were compounded by the European Commission’s (EC) indication that it was preparing concessions for the U.S. to mitigate the impact of these tariffs. The EC’s proactive stance, aimed at preventing a full-blown trade war, provided a boost to the euro, as it signaled a potential de-escalation of trade tensions.

A broader market downturn on Wall Street further influenced the greenback. Major U.S. indices experienced significant losses, with the Nasdaq Composite index falling over 2.13%, while Dow and S&P 500 sank over 1%. This widespread market sell-off reflected concerns about the economic implications of rising inflation and trade disputes.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.