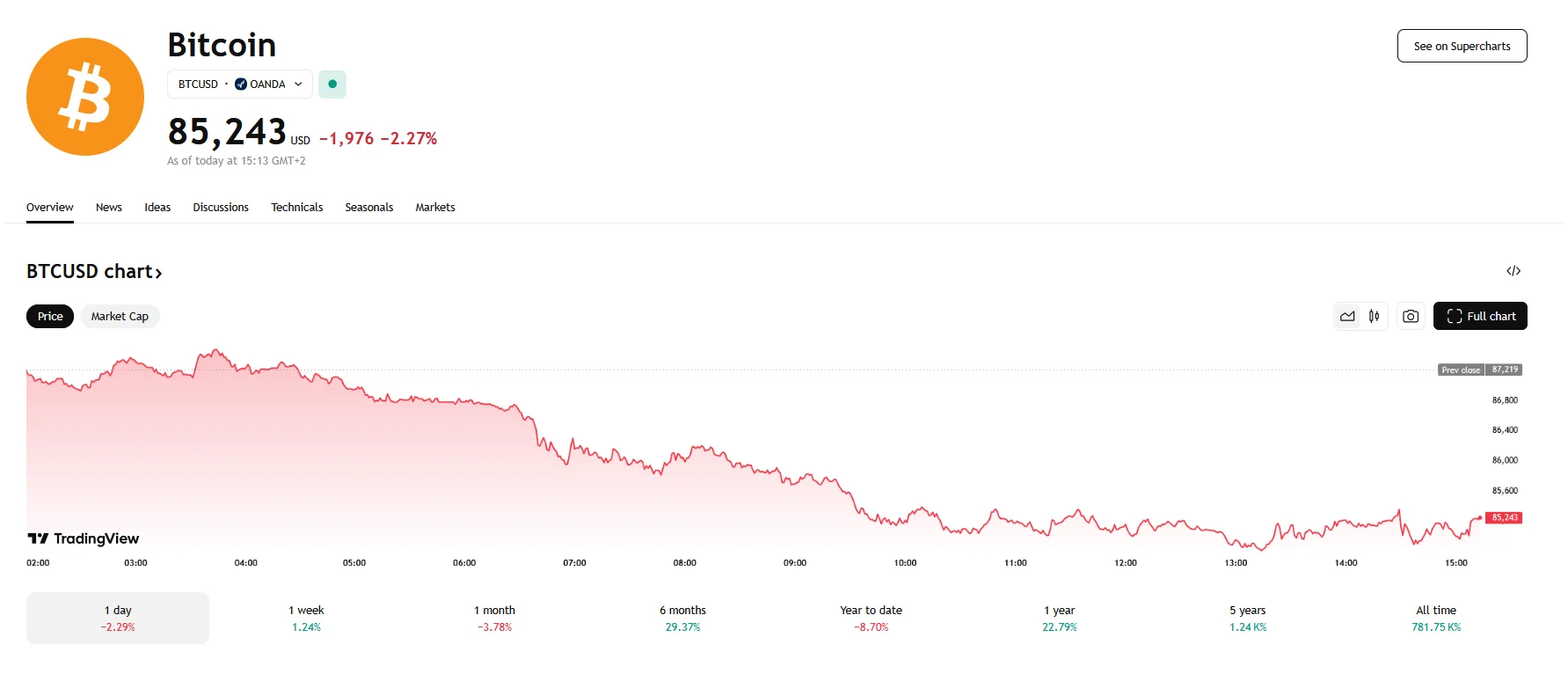

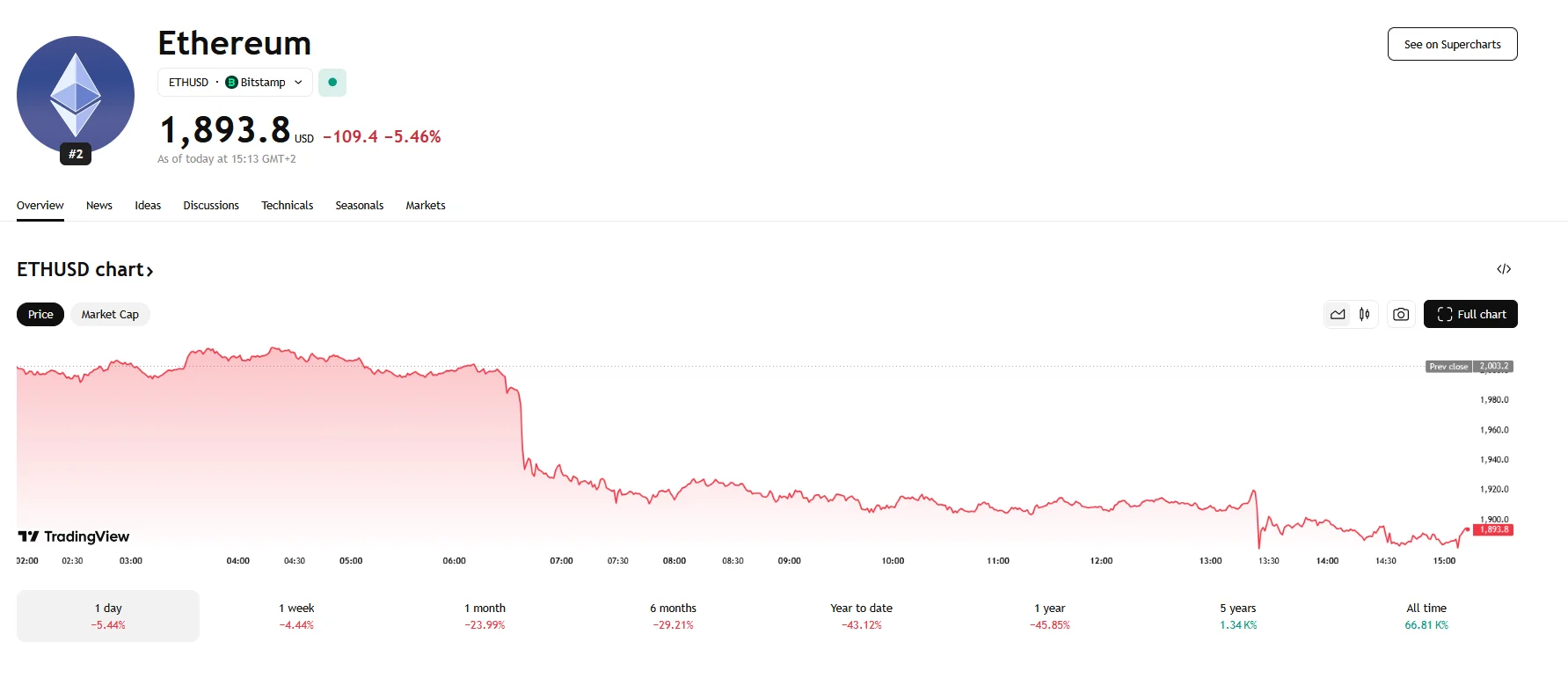

Bitcoin Falls 2.27% to $85,243, Ethereum Slumps Below $1,900 Bitcoin Falls 2.27% to $85,243, Ethereum Slumps Below $1,900

Key momentsBitcoins value retreated by 2.27% on Friday.Ethereum’s price plummeted by 5.46%, reaching $1,893.8.Tariffs planned by the Trump Administration sparked trade war fears within the crypto sphe

Key moments

- Bitcoin’s value retreated by 2.27% on Friday.

- Ethereum’s price plummeted by 5.46%, reaching $1,893.8.

- Tariffs planned by the Trump Administration sparked trade war fears within the crypto sphere and traditional markets.

The cryptocurrency market experienced a notable downturn on Friday, with Bitcoin (BTC) and Ethereum (ETH) both registering significant losses. Bitcoin’s value decreased by 2.27%, reaching $85,243, while Ethereum witnessed a steeper decline of 5.46%, dropping to $1,893.8. This market movement reflects broader anxieties stemming from global economic uncertainties and escalating trade tensions.

A primary catalyst for investor apprehension in the crypto space is President Trump’s decision to impose tariffs of 25% on imported automobiles. This move has raised concerns about a potential trade war, particularly following Canada’s announcement of retaliatory tariffs against U.S. goods. The subsequent market turbulence has had a negative impact on major U.S. indices, and it has disproportionately affected risk-bearing assets, including cryptocurrencies. Moreover, analysts have identified a close relationship between Bitcoin’s price activity and U.S. stock market performance, with a 0.88 weekly correlation recorded on March 28th.

Further declines might be on the horizon, according to analysts. Bitcoin has struggled to maintain its position above the $86,000 mark, with analysts predicting a possible pullback towards the $84,300 level. The inability to reclaim the $90,000 threshold has raised concerns about a deeper correction, potentially pushing Bitcoin below $80,000.

Ethereum’s decline mirrors the broader cryptocurrency market’s bearish trend. The fall below the $1,900 price point represents a significant drop, driven by a combination of macroeconomic factors and internal market dynamics. Additionally, a wave of long liquidations has exacerbated Ethereum’s price decline. Thursday and Friday saw over $97 million worth of Ethereum positions being liquidated. Analysts expect Ethereum’s bearish momentum to persist, with potential targets as low as $1,200.

Despite these short-term challenges, increased network activity and a decrease in Ethereum’s exchange supply may create conditions favorable for a rebound. However, the immediate market sentiment remains cautious, with investors closely monitoring global economic developments and technical indicators.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.