easyMarkets Forward Trading Guide

Only a few brokers offer forward trading in their services, and easyMarkets is one of them。Learn how it works in this article。

Only a few brokers offer forward trading in their services, and easyMarkets is one of them。Learn how it works in this article。

Derivatives are financial contracts arranged between two parties whose value comes from other financial entities, such as the underlying asset, a group of assets, or a fund.。Some of the most common assets used in derivatives are stocks, currencies, commodities, bonds, interest rates and market indices.。Traders often use derivatives to enter specific markets, hedge risk, or maximize returns。

There are many types of derivatives to choose from, one of which is called a forward transaction or forward contract。This type of contractual agreement is considered a premium transaction and is therefore usually reserved for institutional clients, banks, brokers and companies。However, this does not mean that retail traders cannot use it at all。

What is Forward Trading?

A forward transaction is a contractual agreement between a buyer and a seller to trade the underlying asset at a certain price at a specified date in the future.。Naturally, the buyer will hold a long position and the seller will hold a short position。The set price is called the forward price and is calculated using the spot price and the risk-free rate。The former refers to the current price of the asset and the latter is the assumed rate of return on the transaction under the zero-risk assumption.。

Forward contracts are traded over the counter (OTC) and are therefore not standardized or regulated by the exchange, so forward trading is flexible。Traders can tailor the transaction to their needs, such as the maturity date and the amount of assets involved in the transaction。Note, however, that the lack of regulation may also present additional risks。

In addition, the idea of forward trading is that the parties involved in the contract can manage volatility by locking in the price of the underlying asset on a specified date。Traders can use this opportunity to close or hedge their positions, minimizing the risk of unpredictable future exchange rate movements。When the payment rate and date are agreed, the trader has locked in the payment amount。

How it works?

To create a forward transaction, the buyer and seller must agree on the specifications of the contract, including the number of assets, the price per unit, and the effective date of the contract。On the agreed date, the buyer must pay the agreed price to the seller and receive a predetermined amount of the asset in return。If the current market price is lower than the contract price, the seller will make a profit, but if the current market price is higher than the contract price, the buyer will make a profit.。

Here's an example: Suppose the current price of wheat is $10 a bushel, but farmers are concerned that wheat prices will fall sharply in the coming months。To hedge their risk, the farmer signed a contract with a grocery store agreeing to buy 1 million bushels of wheat for $10 over three months.。

On the day of the settlement, the following may occur:

The price is exactly the same as the price determined in the contract: the settlement is carried out at the agreed price, so there is no profit or loss for either party。

Price below negotiated price: Assuming the price drops to $8 per bushel, the settlement still needs to be at the agreed price。The buyer must pay $10 for the goods, while the seller profits from the hedge。

The price rises above the agreed price: the contract is settled at a negotiated price and the buyer makes a profit.。

Why Choose Forward Trading?

In trading, forward transactions are used to hedge。It is an effective tool to protect your trading from unpredictable market changes and potential future losses, especially in markets where prices are often extremely volatile and highly volatile.。For example, traders can use forward trading to predict large price fluctuations in currency exchange rates when making large cross-border purchases。

Forward trading is simple, fast and highly customizable。You can sign a specific contract that exactly meets your expectations, and if everything goes according to plan, you can easily make a lot of profit。The maturity period of such contracts is up to 30 days, which can undoubtedly reduce the pressure on you to try to analyze market movements and protect your live trading。

In addition to this, forward trading can also be used for speculative purposes only.。This option may not be as popular as a futures contract, but it still serves the same purpose and is very effective for hedging volatility。If you think the future spot price of the asset will rise, open a long forward position。If the future spot price is indeed higher than the agreed contract price, you will make a profit; conversely, if you establish a forward short position, you should expect the price to be lower than the current price。

Forward Trading and Futures Contracts

Forward and futures contracts are derivatives, but not exactly the same。The first and most obvious difference is the way they are regulated, with forwards traded over the counter and futures contracts traded on an exchange.。As a result, forward trading is unregulated and customized, while futures contracts are regulated and standardized by the central government.。

Another major difference lies in the level of risk and assurance。Futures contracts are managed by clearing houses, which are basically intermediaries that guarantee the settlement of contracts.。Clearing all responsibilities to ensure that contracts are properly settled。Some futures contracts even require margin or margin as collateral to predict risk, while forward trading does not, so the risk is considered higher。One way to predict this may be to establish a premium in forward transactions to minimize the possibility of error。

Forward trading at easyMarkets

easyMarkets is one of the few brokers that offers forward trading to retail clients.。Since 2001, the broker has been known for offering a variety of innovative products to its clients, including exclusive risk management tools, derivatives trading, frozen interest rates and more.。You can also find other features besides trading, such as market analysis tools and trading courses。

EasyMarkets has been writing its own story in the financial markets since 2001.。Simplicity, honesty and transparency are the three values of easyMarkets。The company tries to make the trading process as simple as possible.。

In 2016, they changed their name from easy-forex to easyMarkets。Over the years, easyMarkets has expanded its range of CFDs products to cover global indices, options, metals, foreign exchange, commodities and cryptocurrencies, and the company has been licensed by CySEC and ASIC.。

Another privilege when trading at easyMarkets is its own platform。The easyMarkets Ease platform is simple and versatile. According to trader reviews, it is friendly to new customers and provides many features for experienced traders。Customers can also get free guaranteed stops, no slippage, fixed spreads, and no capital or withdrawal fees from easyMarkets.。

The platform has three unique features。First, dealCancellation enables traders to "undo" their trades。easyMarkets is the only broker that offers to close trades before the trading time reaches 60 minutes for a small fee。

In addition, traders can enjoy the internal viewer。The tool helps traders gain a deeper understanding of market sentiment by showing them the percentage of buy and sell executed in the platform。The third unique feature is the freeze rate, which traders can use to suspend the exchange rate and place their trades at the "frozen" rate。

easyMarkets also offers financial calendars, market news, trading charts and trading signals as a perk of the platform, offering the technology on a mobile interface via iOS and Android devices, allowing traders to enter the market anytime, anywhere。

MetaTrader 4 is also provided by easyMarkets。Traders will get negative balance protection and fixed spreads when using this popular trading platform。In addition to this, the broker offers ordinary options。

As a result of these innovations, easyMarkets has become an award-winning broker, winning the 2019 Forex Broker Award from Dubai Forex Expo, the 2018 Most Innovative Broker Award from World Financial Markets Awards, the 2018 Best Asia Pacific Broker Award from ADVFN International Finance Awards, the 2017 Most Transparent Broker Award from ADVFN International Finance Awards, the 2017 Best Forex Service Provider Award from FXWord China, and more.。

In addition, easyMarkets offers three account types, such as VIP accounts, Premium accounts, and Standard accounts。All accessible via web / app and MT4 platform。Maximum leverage is 1: 200 when using the easyMarkets Web / App platform and 1: 400 when using MT4。

Fixed spreads in forex trading from 1.Start at 0: 00。Traders can become easyMarkets VIP customers and enjoy some benefits, such as trading by phone, obtaining the most stringent fixed spreads, personal analysts, and real-time market updates via SMS。

Traders pay no additional fees, whether commissions, account fees or withdrawals。The account currency has 18 options, including euro, Canadian dollar, Czech koruna, Japanese yen, New Zealand dollar, US dollar, Singapore dollar, etc.。The company offers a variety of deposit and withdrawal methods, some of which are credit / debit cards, bank transfers and e-wallets such as Neteller, Skrill and Fasapay。

Traders can contact one of the company's local offices or its headquarters in the Marshall Islands directly if they have any questions or need help.。In addition, traders can chat with their customer service via email, Facebook, WhatsApp, Viber and live chat.。

Based on the above comments, easyMarkets offers an easy-to-use platform and some unique tools that traders can access anytime, anywhere。In addition, traders do not have to pay additional trading commissions and deposit and withdrawal fees.。Traders registered with easyMarkets can enjoy the EUR / USD pair as low as 0 in the MT4 platform.Spread of 9。

When it comes to forward trading, easyMarkets helps you protect your trades and hedge your positions against future price changes.。All you need to do is create an easyMarkets trading account and follow these steps:

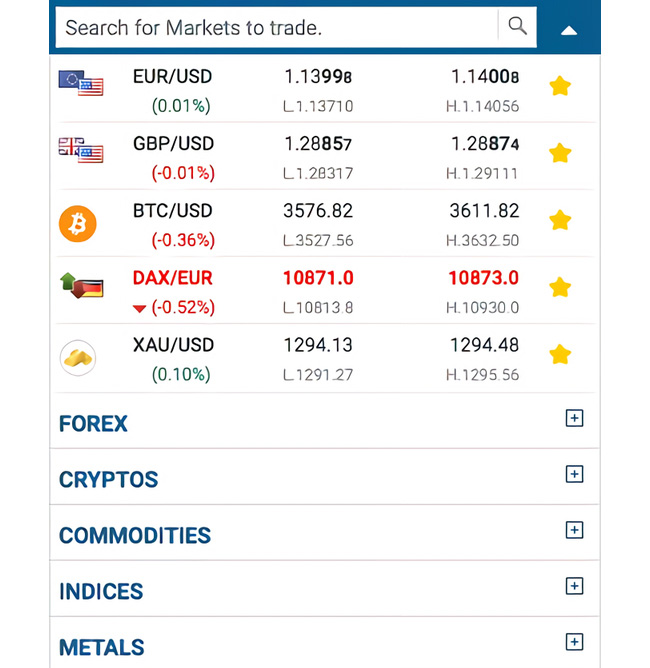

1.Visit the broker website and log into your account。In the trade order of the easyMarkets platform, select "Forward"。

2.Select your market from the available list。Note that not all assets can be provided through forward transactions。If you make a decision through market browsing, you can easily see what can be traded as forwards。

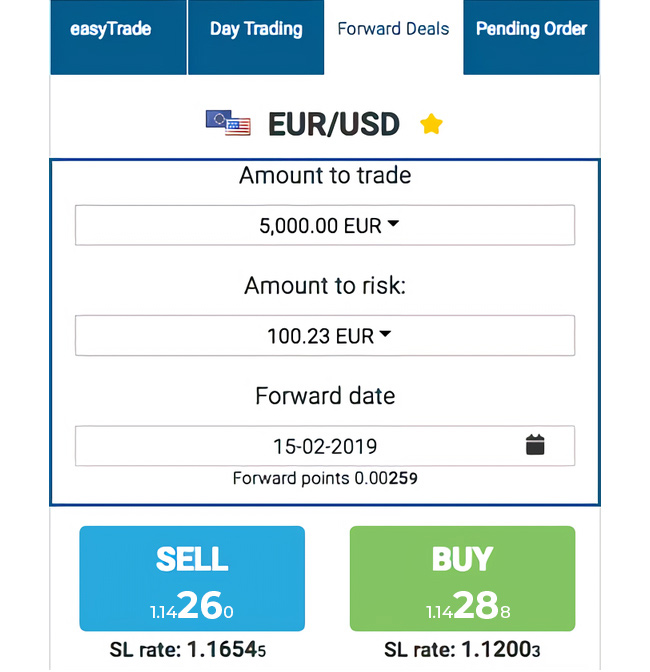

3.Indicate in the contract the amount of the transaction and the risk you are willing to take.。Then, set the due date of the settlement。

4.Click the Sell or Buy button to create an agreement。

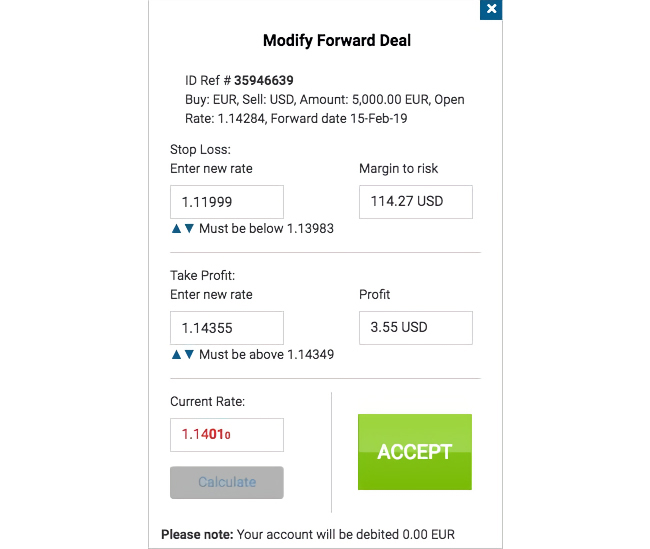

5.Stop loss is set automatically, but you can choose to modify the stop loss and take profit level from the forward trading section below the trading area, or you can click "My Open Trades" on the menu; you can also modify your risk amount and the easyMarkets account will be credited or debited accordingly, click "Accept"。

Conclusion

Derivatives such as forward contracts can be an effective tool for maximizing your returns, protecting your position from future price declines, and diversifying your portfolio with assets such as commodities.。Whether you're a buyer or a seller, the goal is to hedge price uncertainty and lock in the future price of the underlying asset。

If you are interested in forward trading, easyMarkets is your best choice, you can find everything you need for forward trading through a low-cost and intuitive platform。

However, it is worth mentioning that forward trading is highly speculative, as it is impossible to predict future price changes with absolute accuracy.。Therefore, it is more recommended for large or experienced traders with in-depth knowledge of derivatives trading and a good risk management system.。

easyMarkets Founded in 2001, the only way to trade was through a physical trading room, which has been committed to helping all traders enter the market, fundamentally transforming the online trading industry in many ways with the basic concept and business model of "simplicity, sincerity and transparency."。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.