FTX Co-Founder Gary Wang Receives No Jail Time After Testimony Against SBF

The ex-FTX co-founder avoids prison for cooperation in $11 billion fraud case, sparking debate over justice and crypto regulation.

- Gary Wang receives no jail time for aiding prosecutors in the FTX case, despite creating the code enabling Alameda's $11 billion fraud.

- Critics argue Wang's leniency could incentivize criminals to cooperate as a strategy to avoid severe punishment.

- The FTX co-founder will be on supervised release for the next three years.

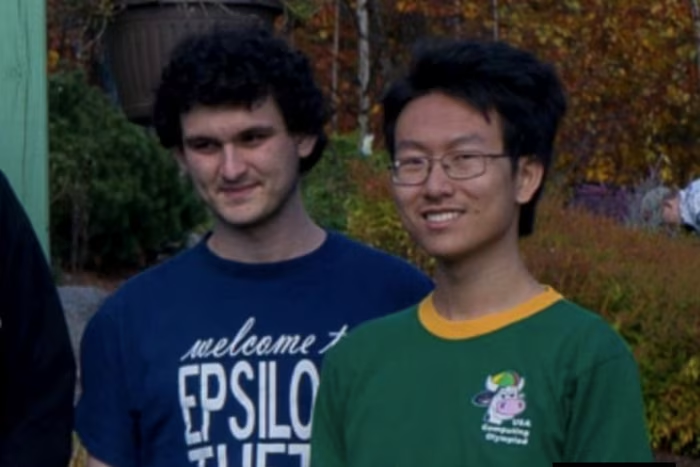

The court sentenced the FTX co-founder and long-time friend of Sam Bankman-Fried to no jail time and three years of supervised release.

Authorities credit Wang’s help with their fast extradition of the ex-CEO from the Bahamas in December 2022.

Cooperation With Prosecutors Exempts Wang From Prison

On November 20, Gary Wang was sentenced for his involvement in the 2022 collapse of crypto exchange FTX. Wang became the second testifying party to avoid prison time, joining ex-FTX engineering chief Nishad Singh, who received his sentence in October.

“You did the right thing for yourself, and the right thing for the country. If this wasn’t the biggest financial fraud in US history, it was certainly among the biggest 2 or 3. It is the judgment of this court that you be committed to time served three years of supervised release,” Judge Lewis A. Kaplan said during the trial.

The former FTX CEO Sam Bankman-Fried is serving a 25-year prison sentence for embezzling over $11 billion in customer and investor funds. The court found him guilty of seven counts of fraud, money laundering, and conspiracy. He has since filed an appeal.

Authorities charged Alameda’s ex-CEO, Caroline Ellison, in September. They ordered her to forfeit the money and sentenced her to two years in prison. Last year, Wang testified in the case, detailing how FTX’s sister firm, Alameda Research, illegally drew funds using an unlimited line of credit.

According to Wang’s testimony, Alameda had special access to an ‘allow negative balance’ feature due to changes made to the FTX codebase. This meant that their withdrawals could come from assets borrowed from the exchange.

The FTX co-founder created the software that operated the company’s widely used crypto trading platform. Wang wrote the code that created a backdoor on FTX, allowing Alameda unlimited access to its customer funds. On his road back from the scandal, he later used his technical skills to assist authorities in the future.

“Gary has worked with the government to design and build a new software tool to detect potential financial fraud in public markets,” Wang’s lawyers wrote in a letter.

However, not everyone appreciated Wang’s attempt to rebuild his reputation after the incident. Some argued his cooperation should not act as a “get out of jail free” card. Wang’s help in exposing the fraud was significant but still drew criticism.

Critics believe his leniency sets a troubling precedent for future cases. Dennis Kelleher, CEO of Better Markets, published a memo addressing Wang’s legal defense.

“While Wang appears to have cooperated extensively and continues to cooperate in meaningful and important ways, no criminal should be handed a ‘get-out-of-jail-free’ card. That would create perverse incentives causing future criminals to continue their criminal activities hoping they won’t get caught but also planning, if they do get caught, to race to the prosecutor’s office to be the first one in the door so that he or she can get the lightest sentence, if any at all,” the executive argued.

As the FTX collapse fades, the legal and ethical consequences of its players’ actions remain a topic of debate. It will be remembered as one of the largest financial frauds in US history.

At the same time, the broader crypto industry struggles to recover its reputation and implement stronger protections against similar abuses.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.