OPEC + surprise production cut! Oil prices rebound, but inflation fears widen again

Saudi Arabia said it would cut production by 500,000 barrels a day from May until the end of 2023, state media reported.。

On Sunday night, the crude oil market suddenly broke big news。

Saudi state media reported that Saudi Arabia will cut production by 500,000 barrels per day from May until the end of 2023.。Saudi Ministry of Energy officials stressed that the production cut is aimed at supporting the stability of the oil market, while the voluntary production cut is based on the production cut agreement reached at the 33rd OPEC and non-OPEC ministerial meeting on October 5, 2022.。

Similar to Saudi Arabia, Russian Deputy Prime Minister Novak also said that Russia will voluntarily reduce production by 500,000 barrels per day from May until the end of 2023.。Novak added that the global oil market is currently experiencing a period of high volatility and unpredictability due to the ongoing banking crisis in the United States and Europe, uncertainty in the global economy, and unpredictable and short-sighted energy policy decisions.。At the same time, stability and transparency in global oil markets are key to ensuring long-term energy security.。

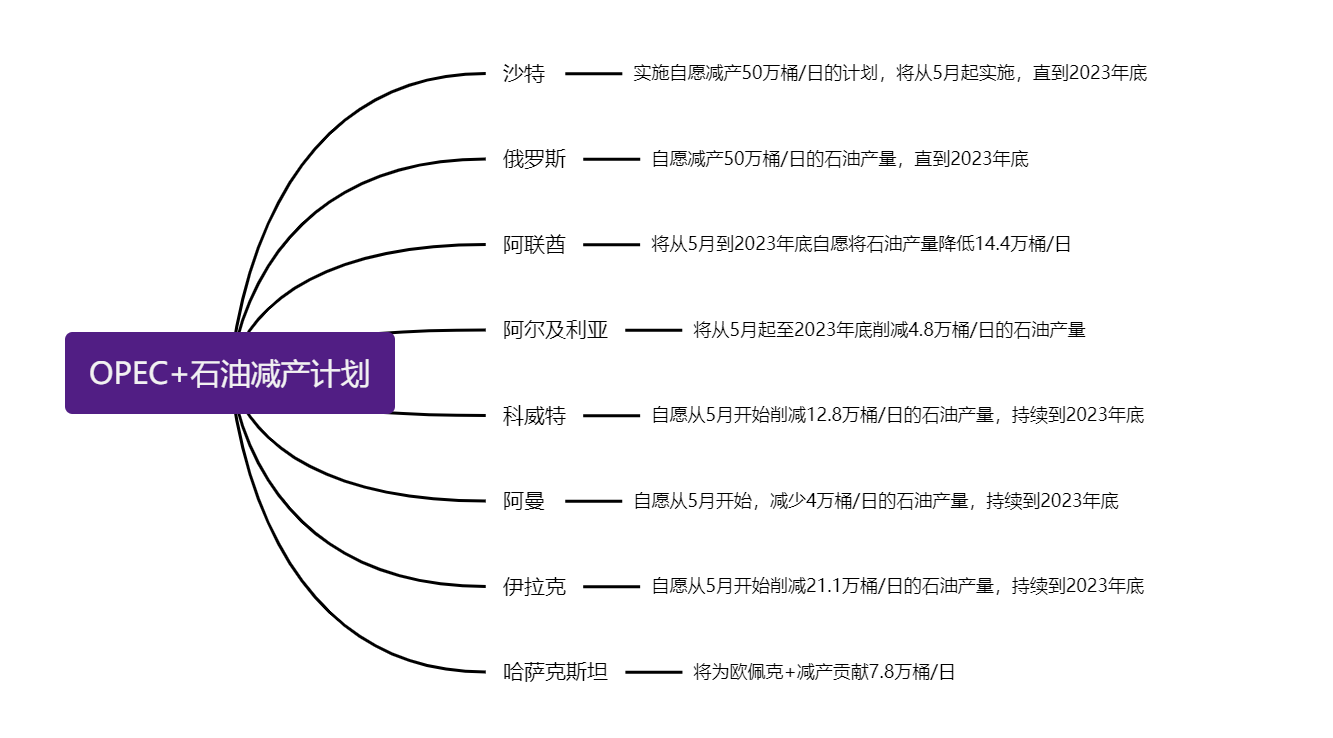

In addition, several OPEC and non-OPEC participating countries have announced decisions to implement voluntary oil production cuts.。According to incomplete statistics, member countries have announced cumulative production cuts of more than 1.6 million barrels, accounting for about 1 of global oil production..5%。

Fourteen traders and analysts polled by the media last week all expected no change in OPEC + policy.。Saudi Energy Minister Prince Abdulaziz bin Salman also said last month that the current OPEC + production target "will remain unchanged for the rest of the year."。Just when the market expected little change in crude oil production in major oil-producing countries, the sudden production cut was a surprise to the market.。

In fact, voluntary production cuts by major oil-producing countries are conducive to bottoming out oil prices。Oil prices hit last month by banking crisis。Reduced sales at this time will help improve April crude oil supply and demand balance expectations, compaction rebound basis。

Boosted by this news, WTI crude oil jumped more than 7% higher at the start of trading on April 3, Beijing time, and Brent crude oil also stood at $85 a barrel after the start of trading.。You know, according to data released by the U.S. Energy Information Administration (EIA) on Friday, U.S. crude oil production rose to 12.46 million bpd in January, the highest level since March 2020, and it makes sense that the news will drag down oil prices this week.。

Sharp-smelling Goldman Sachs raised its crude oil forecast as soon as it heard the news。Goldman Sachs said it raised its end-2023 Brent crude price forecast to $95 from $90 and its end-2024 Brent crude price forecast to $100 from $97.。

Also raising the price of crude oil is the small motorcycle.。The bank still expects Brent crude to average $89 a barrel in the second quarter of 2023, rising to $94 a barrel in the fourth quarter and reaching $96 a barrel by the end of the year, Komo said.。

The market also gave a pessimistic view on the OPEC + member's production cuts。As the Fed has already raised its balance sheet in response to the banking crisis, if oil prices rise sharply due to production cuts by major oil-producing countries, or make inflation sticky, dragging down its early rate hike preparations, may lead to the formation of recession expectations。

"A cut in crude oil production could lead to a slowdown in global economic growth and a renewed rise in inflation, and could force central banks around the world to take stronger action."。Ziad Daoud, chief emerging markets economist at Bloomberg Economics, said:。

Second, the U.S. Department of Energy announced not long ago that it may begin to replenish the Strategic Petroleum Reserve later this year.。This production cut will undoubtedly make it more difficult for the U.S. to make up for it.。The White House said the OPEC + decision to cut oil production by more than 1 million barrels a day was unwise under current market conditions.。

According to Guotai Junan, OPEC + 's voluntary production cuts far exceed market expectations。Oil prices fell in mid-March on recession fears, while OPEC + voluntary production cuts showed a willingness on the part of oil producers to match falling demand to solidify the bottom of long-term prices。In addition, the agency believes that while crude oil will remain affected by macro sentiment for the rest of 2023, supply-side tightening will help lift the price pivot.。On the other hand, it is still necessary to observe the actual resolution changes of the JMMC meeting.。

There are also institutions that believe that the impact of production cuts on oil prices may be much greater than the impact on inflation, so it should not be interpreted as a turning point in central bank interest rates, nor is it a clear recessionary signal of slowing demand after bank failures.。The key is that a recovery in oil prices has been widely expected。As a result, the ripple effect of the event on inflation and interest rates is expected to be limited.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.