Four reasons to drag down the dollar?Let's see what professional investors say.

Recently, a foreign media survey of professional investors only showed that the dollar is likely to continue to fall from the nearly 20-year high reached last year, because these investors believe that the market underestimates the power of the Fed's upcoming easing cycle。

A recent foreign media survey of professional investors only shows that the dollar is likely to reach nearly 20Annual highs continue to fall as these investors believe the market underestimates the power of the Fed's upcoming easing cycle。

87%Respondents expect terminal rates below 3% Banking crisis may prompt the Fed to increase easing.

In 2022, the dollar index recorded a nearly 20-year high, rising 8.19%, closed at 103.2。The last time the dollar index closed above the $100 mark during the year, it dates back to 2016。

According to the survey, about 87 percent of the 311 professional investors believe the Fed will cut the terminal rate to 3 percent or less.。In addition, about 40 percent of those surveyed said the easing cycle would begin this year.。It is worth noting that market pricing has set the Fed's implied policy rate for the past two years at 3.05% or so, it is clear that respondents are expecting a more extensive easing cycle。

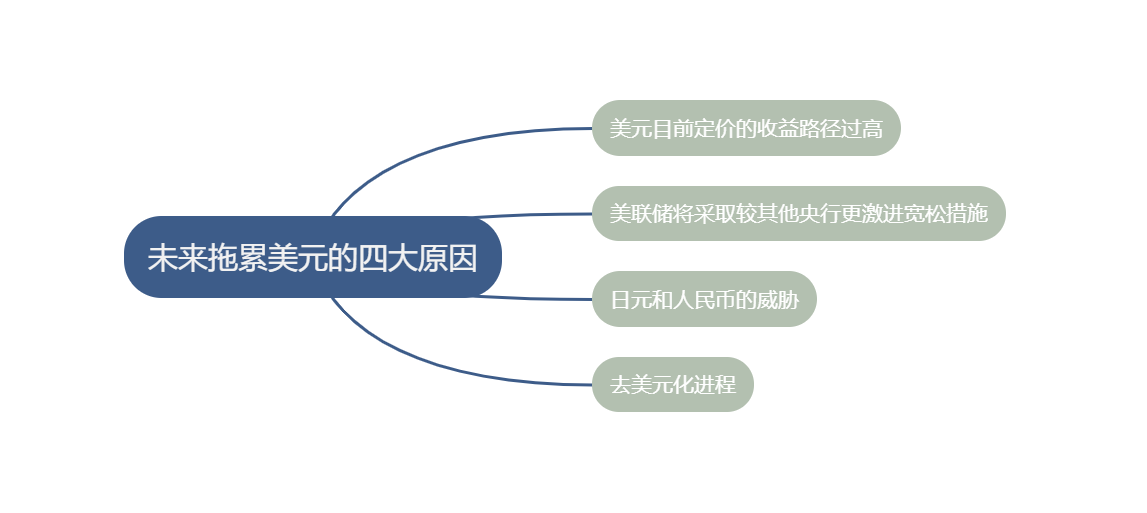

As a result, these investors are mostly bearish on the dollar, with only 17% wavering。In their view, "the current pricing of the dollar's earnings path is too high" and "the banking crisis will force the Fed to take a more aggressive easing path than other central banks" are the top two reasons.。

The survey commented that while it doesn't sound plausible that the Fed and other central banks have had discrepancies in monetary policy, this has happened before.。During the dot-com bubble of the early 2000s and the year before the collapse of Lehman Brothers, the monetary policies of the Federal Reserve and some of the world's central banks were arguably far apart.。Before the collapse of Lehman Brothers, for example, the Federal Reserve cut its benchmark interest rate by 325 basis points between August 2007 and April 2008, while the European Central Bank raised its benchmark interest rate by 25 basis points in July 2008, so the dollar was actually very weak before the Lehman crisis.。

The dollar will suffer from the yen yuan competition "de-dollarization" is the biggest concern of investors.

Surveys show that the dollar's weakness may not be solely for its own sake, but that the rise of the yen or yuan will also hit the dollar。

In terms of the yen, Kazuo Ueda, the Bank of Japan governor who just took office this month, is wavering on ending the YCC, and Japan's ultra-quantitative easing continues to weigh on the yen。However, if Ueda and Naoki can exit the YCC mechanism in due course with minimal pressure on the yield market, the yen is expected to continue to appreciate.。On this issue, there are already signs that any subtle policy changes by the Bank of Japan will have a disproportionate impact on the yen.。

In terms of the yuan, Citi's China Economic Surprise Index is close to its highest level since 2006, but the value of the yuan relative to the trade-weighted basket of currencies is up only 1% from the beginning of the year, suggesting that there is room for the yuan to continue to rise.。As China's economy recovers, the yuan will gain more recognition。

Finally, a growing number of respondents also said that the risk to the dollar from the "de-dollarization" process was gradually increasing, saying that the dollar's share of global reserves could fall to less than half within a decade.。

It's worth noting that these professional investors have said almost nothing about the U.S. debt ceiling。However, this does not deny that the current political environment is extremely intense and the risks remain high.。The U.S. debt crisis of 2011 gave us a good template for this。At the time, U.S. bond yields plunged and the dollar rebounded strongly during this period as the dollar's safe-haven properties were amplified here。

As of press time, the dollar index edged up 0 in the day..15% at 101.89。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.