The U.S. job market is so hot that even Fitch's downgrade of the country's credit rating can't stop it.

Despite many efforts, inflationary pressures, like the sword of Damocles, still hang over the U.S. economy, suffocating。

Local time on August 2, known as the "small non farm" said the United States ADP employment data released, the market is expected to raise interest rates again。

Doubts about inflation are lingering

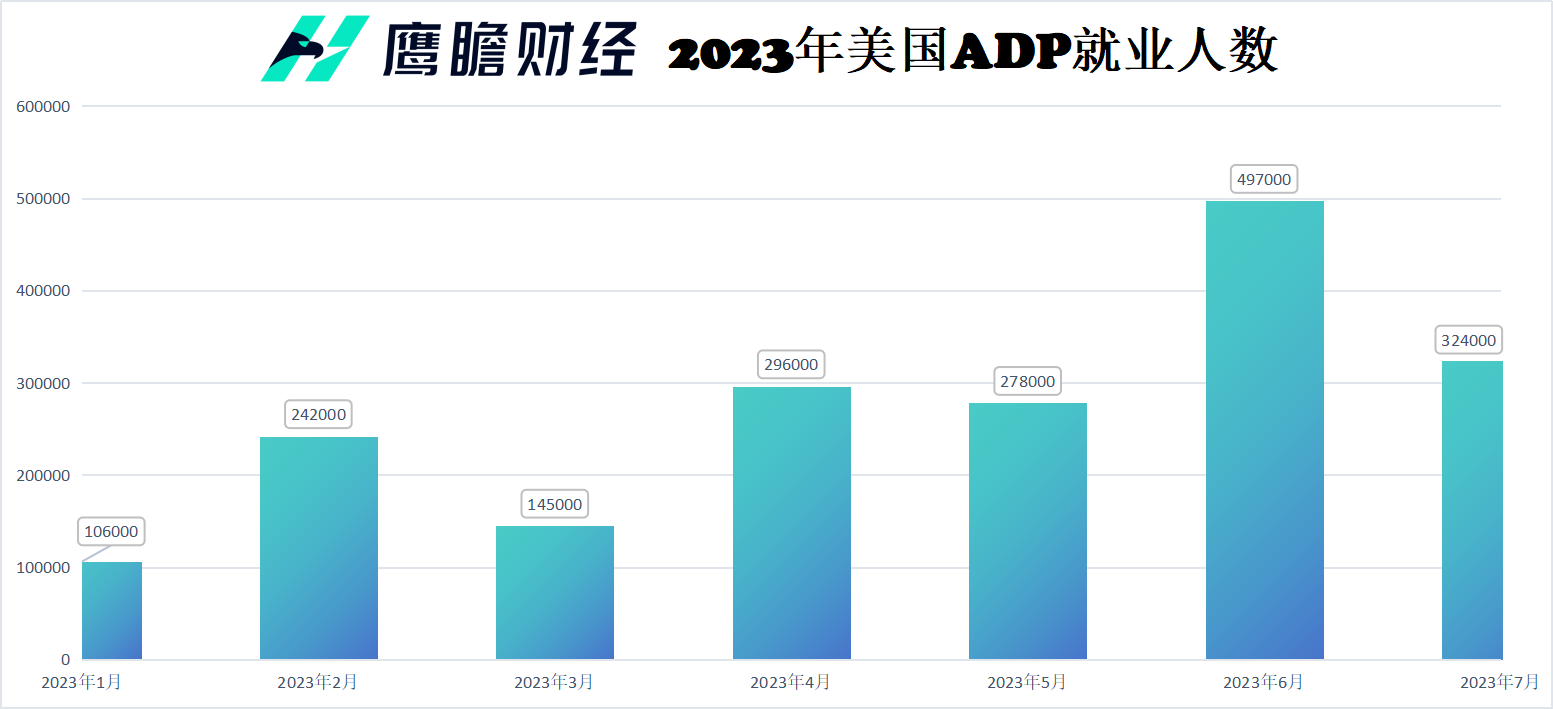

Data show that in July, the U.S. private sector created far more jobs than expected, and the labor market remains strong: according to economists surveyed by Dow Jones, the U.S. ADP data is expected to be 17 for the month..50,000 people。However, according to the data released, the number of new jobs created by ADP in the United States in July was 32.40,000, almost double the expected value, making the market jaw-dropping。

You know, just last week, the Fed just made a decision to raise its benchmark interest rate by 25 basis points in July, and finally "relaxed" on the September rate hike, saying that "from the next meeting, there are 2 jobs and inflation reports, the Fed may raise interest rates, or may keep interest rates unchanged."。

In the eyes of many people, this passage is regarded as the best proof that the Fed hinted at the end of the rate hike cycle, even if not the end of the rate hike cycle, the Fed should at least "skip" the September rate hike action。

But the fiery ADP jobs report has undoubtedly poured cold water on the market because it represents: the U.S. job market remains strong and inflation doubts remain lingering despite the Fed's increased efforts to slow the economy and reduce inflation。

Ironically, a day earlier, according to the Labor Department's June Job Openings and Labor Turnover Survey (JOLTS) report, the U.S. labor market was already showing signs of weakening in June: job openings hit a two-year low, and the number of voluntary resignations fell by nearly 300,000.。At the time, many believed it was a sign that the U.S. labor market was gradually "going down."。

Unexpectedly, only in January, the U.S. ADP data exploded again and the labor market continued to heat up.。Despite many efforts, inflationary pressures, like the sword of Damocles, still hang over the U.S. economy, suffocating。

Slightly relieved July salary growth of only 6.2%

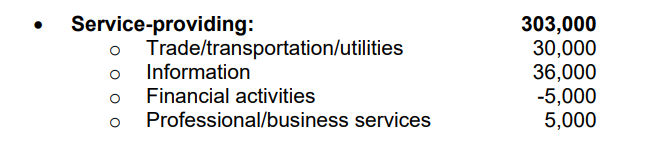

Specifically, the service sector contributed the most in July's employment data, creating 30.30,000 jobs。Among them, hotels, restaurants, bars and their affiliates increased by about 200,000; information services increased by 3.60,000 jobs; 30,000 new jobs were created in trade, transport and utilities; and other service categories, including dry cleaning and housekeeping, contributed 2..40,000 jobs。

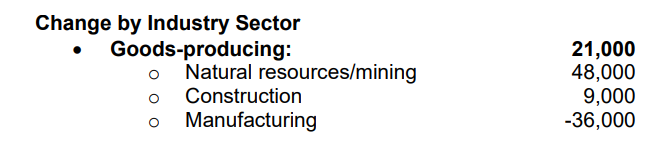

In contrast, the commodity industry's contribution was slightly weaker, increasing by only 2.10,000 jobs。Among them, natural resources and mining increased by 4.80,000, manufacturing down 3.60,000, plus 0 in the construction industry.90,000 jobs。

In terms of business size, small businesses with less than 50 employees have increased their hiring by 23.70,000, contributing more than two-thirds of last month's increase in private employment; medium-sized businesses with 50-500 employees added 13 new jobs in July.80,000 people; large companies with more than 500 employees were cut by 6.70,000 jobs。

Slightly comforting, according to the report, U.S. private sector salaries rose just 6.2%。Although this figure is much higher than the long-term growth rate, it is the lowest increase since November 2021, representing a slight easing of inflationary pressures.。

Commenting on the data, ADP chief economist Nela Richardson said the economy performed better than expected, a healthy labor market continued to support household spending, and "wage growth continued to slow, but there was no mass unemployment."。"

Financial market research firm FWDBONDS chief economist Rupkey (Christopher Rupkey) said that this is a sign of the U.S. economy "soft landing" of the latest economic data, that is, Fed officials called the slowdown in inflation, but will not cause mass unemployment.。

He also confidently predicted that the Fed could skip another rate hike at its September meeting as long as future reports show inflation remains low.。

Market interest rate hike expected to heat up

The market is particularly concerned about the release of this ADP data, even overshadowing Fitch's downgrade of the U.S. sovereign rating。

On Tuesday, international rating agency Fitch announced that it would downgrade its long-term foreign currency issuer default rating (IDR) from "AAA" to "AA +" in anticipation of continued deterioration in U.S. fiscal conditions over the next three years.。

On the first day after the downgrade, the U.S. stock market's response was fairly normal: all three major indexes fell.。Among them, the Dow fell 348.16 points, down 0.98% at 35,282.52 points; Nasdaq down 310.47 points, down 2.17%, at 13,973.45 points; S & P 500 down 63.36 points, down 1.38%, at 4513.37 points。

However, the dollar index rose instead of falling, driving gold lower - the U.S. index rose strongly 0.4%, gold prices fell 0.4%, the range is basically quite。U.S. Treasury yields also rose, with the 10-year U.S. Treasury yield rising to 4.077%, the highest level since November。

It stands to reason that Fitch's downgrade of the U.S. sovereign rating suggests a debt crisis is coming, which could lead the Fed to a rate cut cycle。However, the reaction of gold prices and Treasury yields on the day represented a rise in expectations of a rate hike - suggesting that the market was more afraid of the freshly released ADP report during the session than the Fitch downgrade of the U.S.。

Michele Schneider, director of trading education and research at MarketGauge, said the price action in the market was a liquidity event as frightened investors turned to cash.。

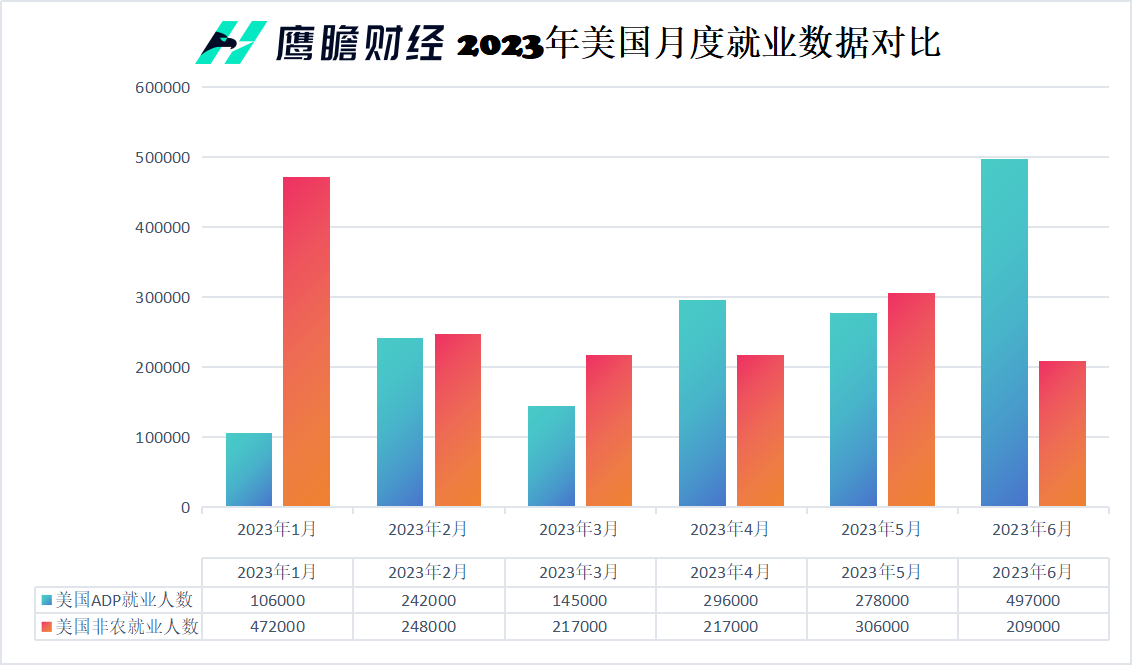

In fact, in the near term, the gap between ADP data and non-farm payrolls data is widening, causing some investors to doubt the accuracy of the data.。Take June's employment data, for example, the ADP data was released at 45.50,000, 20 of the non-farm data released.More than twice as many as 90,000 people。According to statistics, in the first six months of this year, the ADP report showed an average of 25 new additions per month..60,000 jobs, compared to an average of 27 for non-farm data.80,000, slightly higher than the former。

Heading into the first week of August amid mixed data, the market has turned its attention to the nonfarm payrolls report due out this Friday。As the most authoritative data depicting the U.S. employment situation, if this non-farm report again exceeds expectations, the market may really need to reassess the Fed's monetary policy in September。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.