U.S. debt suffered a historical level sell-off Fed doves began to calm the market.

To ease market anxiety, Bostic said: "I think our policy rate has reached a sufficiently restrictive position to push inflation back to 2 percent.。"

As the Fed continues to keep policy rates high and signals that it will raise rates again this year。U.S. Treasuries have suffered a recent wave of historical-level selling - 10-year U.S. bond yields have soared by more than 40 basis points in just two weeks since the Federal Reserve's September interest rate decision, causing a series of ripple effects。

In this context, the U.S. real estate and banking sectors have already sent a letter to the Federal Reserve on October 9, saying that in the context of soaring housing costs and a "historic shortage" of homes for sale, if the Fed continues to raise interest rates, its impact on the real estate industry may accelerate the U.S. hard landing.。

In the letter, the two industries hope that the Fed will not "consider further rate hikes" and will not actively sell its holdings of mortgage securities.。In the absence of larger economic turmoil, the speed and magnitude of these rate increases, and the resulting industry disruptions, are painful and unprecedented, they say。

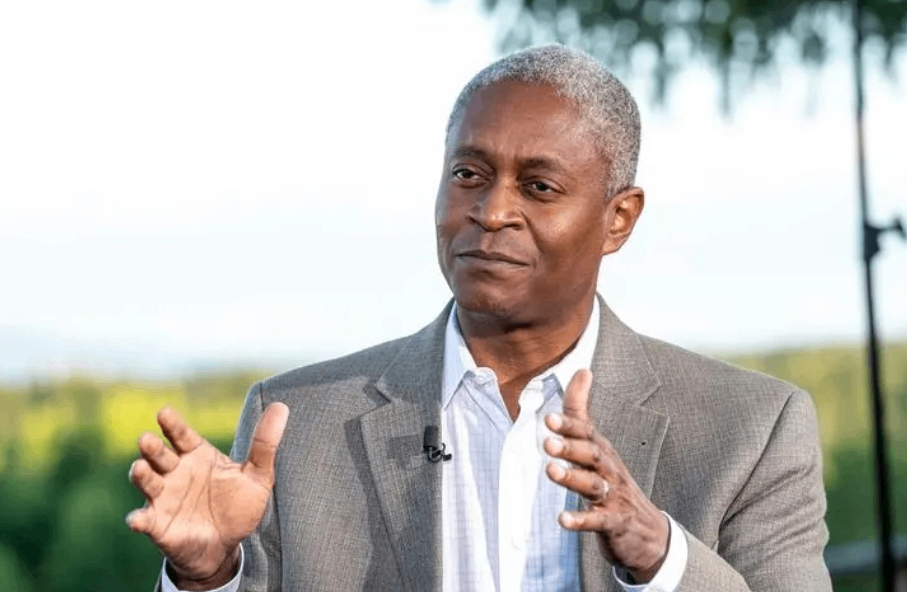

Bostic: Fed doesn't need to raise rates further

In an effort to ease market jitters, Fed officials have begun to reassure markets。On October 10, Atlanta Fed President Raphael Bostic (Raphael Bostic) publicly dove during the annual meeting of the American Bankers Association, saying that the current level of interest rates is enough to be "restrictive," the Fed does not need to raise interest rates further.。

Bostic said: "I think our policy rate has reached a sufficiently restrictive position to push inflation back to 2%.。He continued: "Now that the economy has begun to decelerate, there are still many effects to be seen, and there are still many commercial loans to be refinanced in the next few years that will face much higher interest rates."。With supply and demand now starting to balance, I actually don't think we need to continue raising interest rates next。"

Bostic is seen by many as a solid dove in the Fed camp, but he has been quite hawkish in his recent statements。At the end of August this year, Bostic had publicly stated to the media that he did not approve of the Fed's policy easing in the short term.。Heading into October, he added that the Fed "still has some way to go to get inflation back to target."。In his latest forecast, the Fed's rate cut will come at the end of next year by just 25 basis points。

Another dove yesterday was San Francisco Fed President Daly (Mary Daly), a Fed official who is also seen by the public as biased in favor of the easing side of the line。At an event at Chicago's City Hall on Tuesday, Daly said, "5% is not going to be the new neutral rate.。There is no evidence that this will be the new neutral rate - this is still the policy rate trying to fight high inflation。"

The remarks are in response to a recent domestic view that the U.S. will maintain higher neutral interest rates for a long time to fight stubborn inflation.。As of now, the Fed has moved the target range for the federal funds rate from 0 in March 2022.25-0.5% range increased to 5 in July 2023.25-5.5% range, the highest level in 22 years。

Daley also said that the neutral rate may now be higher than its pre-epidemic level, but that rates will not remain at their current high indefinitely。She also noted that financial conditions have tightened recently and that the Fed may not need to do as much more。

Kashkari: Fed may keep raising rates if economy is more resilient

Neither Bostic nor Daley will have a vote this year, but in 2024, they will have a vote at the Fed's interest rate decision meeting.。Many people believe that 2024 will be a key year for the Fed's monetary policy shift, because in their eyes, the Fed will open a window of interest rate cuts next year, ending this protracted and huge rate hike.。

For the interest rate cut, Fed Chairman Jerome Powell (Jerome Powell) has always been secretive - in his speech, in addition to being able to feel the Fed's head of the firm determination to control inflation, it is difficult to read more information from its body。Powell's most recent public appearance was at a business event in Pennsylvania on October 2.。At the time, Powell was invited to give an opening speech for the celebrity-studded event, and it was no surprise that Powell made no comment on current monetary policy or the economic outlook throughout the process。

Like Powell, hawks within the Fed have been relatively cautious on issues related to monetary policy。A few days ago, known as the Fed's new "Eagle King" Mingzhou Fed Chairman Kashkari (Neel Kashkari) has publicly stated to the media, said: if the U.S. economy is more resilient, the Fed may need to continue to raise interest rates。

In Kashkari's eyes, the recent rise in 10-year U.S. bond yields "confusing," he believes that the U.S. debt in the short term suffered a historical level of sell-off is mainly due to the rise in U.S. bond issuance, and did not mention the Fed's aggressive interest rate action。But he also said the rise in U.S. bond yields meant "the Fed has less to do."。

Kashkari also said he was not yet convinced that soaring long-term U.S. bond yields would reduce the need for further rate hikes, saying it depended on the factors driving up recent borrowing costs。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.