July "Terror Data" Better Than Expected Fed Officials Emergency Falcon

US consumer spending performed well in July, leading to better-than-expected "horror data"。But for this "good news," the market is not happy。

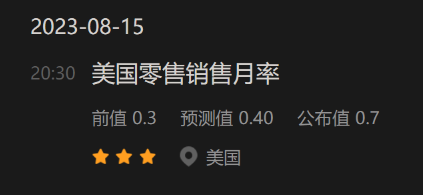

On August 15, local time, the U.S. Census Bureau (US Census Bureau) released July U.S. retail sales data, which the market is highly concerned about as retail sales account for about a third of all U.S. consumer spending.。US retail sales data is also known as "horror data."。

Retail sales data is better than expected, but the market is not happy.

According to the data released this time, U.S. retail sales in July increased by 0.7%, reaching $696.4 billion, exceeding the previous value of 0.3% (revised to 0.2%), which also exceeded market expectations of 0.4%, the largest increase in six months, a strong performance。

According to the report, due to the gradual slowdown in inflation, superimposed on Amazon's "PrimeDay" online shopping boom and other factors, the US consumer spending in July performed well, resulting in better-than-expected "terrorist data."。

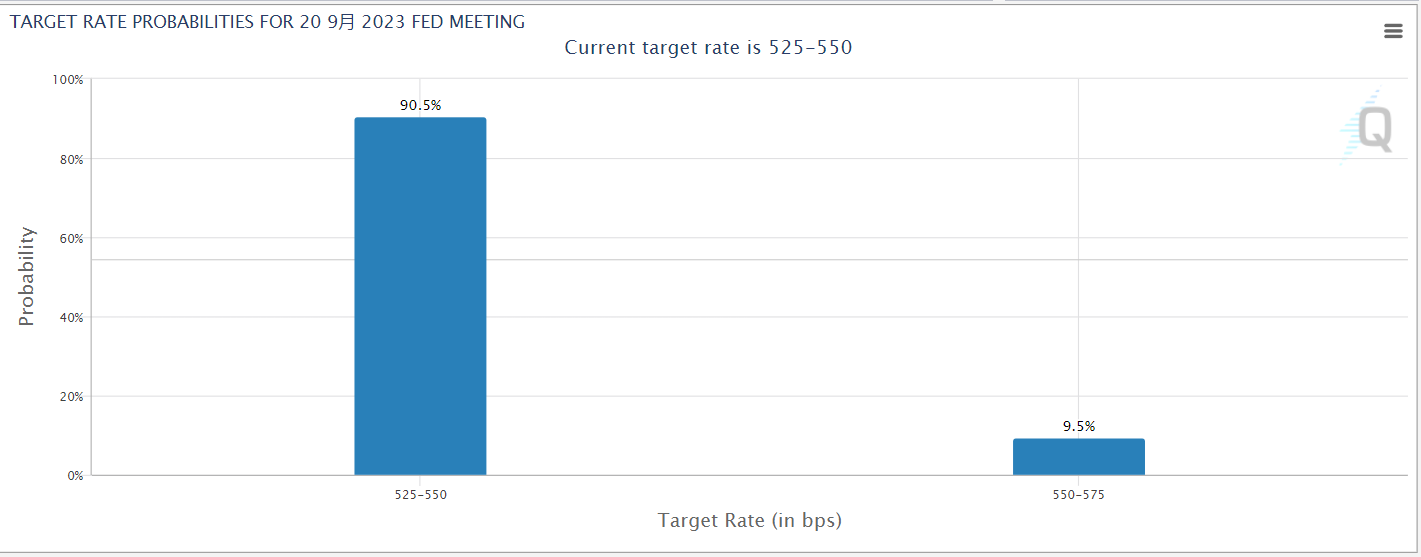

But for this "good news," the market is not happy。At the policy level, strong consumption data from Americans may prompt the Fed to continue to maintain its current high interest rates, and it may even continue to raise interest rates in September。Jennifer Lee, senior economist at BMO Capital Markets, said in an interview with MarketWatch that the US consumer should never be underestimated.。The situation in July confirms this, and the situation the Fed is in has become a bit complicated。

Sure enough, interest rate hike expectations are heating up again after the data。Gold fell to the $1,900 / oz mark; U.S. bond yields surged, with U.S. 2-year Treasury yields rising to 5%, near year highs, and U.S. 10-year Treasury yields rising to 4.270%, the highest level since October 24 last year; the dollar index pulled up 20 points in the short term to 103.27。

According to another data released by the United States yesterday, the price of imported goods in the United States also rose slightly more than expected in July, driven by higher fuel prices, which may stimulate a rise in inflation.。In addition to fuel import prices in July 3.In addition to 6%, refined oil prices also rose significantly by 3.5%。In addition, the import prices of capital goods, food, feed, beverages and automobiles have all risen to varying degrees.。

On the bright side, however, the report further confirms the likelihood that the United States may avoid a recession.。According to media analysis, since March last year, the Fed has raised interest rates by 525 basis points.。While borrowing costs have reached 22-year highs, consumption, which accounts for about two-thirds of the economy, still seems to be holding up。

U.S. online retailer sales jump again in July Kashkari hawks

Looking at several important data points: U.S. retail sales increased by 0% month-on-month in July..7%, expected 0.4%, previous value 0.2%; retail sales excluding automobiles increased 1.0%, expected 0.4%, previous value 0.2%; retail sales excluding automotive and natural gas increased 1.0%, expected 0.4%, previous value 0.3%; retail sales in the control group used to calculate GDP (excluding automobiles, gasoline, construction materials and food services) increased 1.0%, expected 0.5%, previous value 0.6%。

According to media statistics, from May to July this year, total retail sales in the United States increased by 2.3%。Breakdown, non-store retail sales increased by 10% over the same period last year..3%, while food service and bar sales were up 11.9%。This is undoubtedly good news for the U.S. economy: historically, when U.S. consumers have stable jobs and sufficient confidence in the economy, restaurant sales rise and vice versa.。

The brightest performer in this report was undoubtedly online retailer sales in July, which jumped 1.9%, a significant increase for the second consecutive month, mainly boosted by the Amazon Prime Day shopping festival in mid-July。According to Amazon, the shopping festival event has a promising record, with Amazon setting the strongest single-day sales record ever on its first day。

In terms of declining sub-items, demand for U.S. furniture and appliances and electronics remains sluggish。Furniture sales fell 1 month on month in July..8%, electronics and appliance stores fell 1.3%。Sales of new cars and auto parts fell by 0 in July..3%, but year-on-year, sales of new cars and auto parts increased by 7.6%。

After the data was released, Neel Kashkari, a hawkish representative within the Fed and President of the Federal Reserve Bank of Minneapolis, said that now that U.S. inflation is falling, the Fed has made some good progress, but inflation is still too high.。Kashkari surprised by economy's resilience amid Fed's aggressive rate hike。He says it's a bit of a double-edged sword because the question in his mind is whether the Fed has done enough or needs to do more。

In addition, a senior analyst at a North American analyst firm also said that "another impressive retail sales report shows that the economy is not weakening, which will force the Fed to retain the possibility of further rate hikes."。

As of press time, according to CME Fed Watch, the market is betting that the bank will maintain another pause in rate hikes at its September policy meeting with a high probability of 90.5%, which may be at odds with the Fed's expected monetary policy path。On Thursday, the Fed will release the minutes of its July policy meeting, in which markets may be able to explore more relevant information。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.