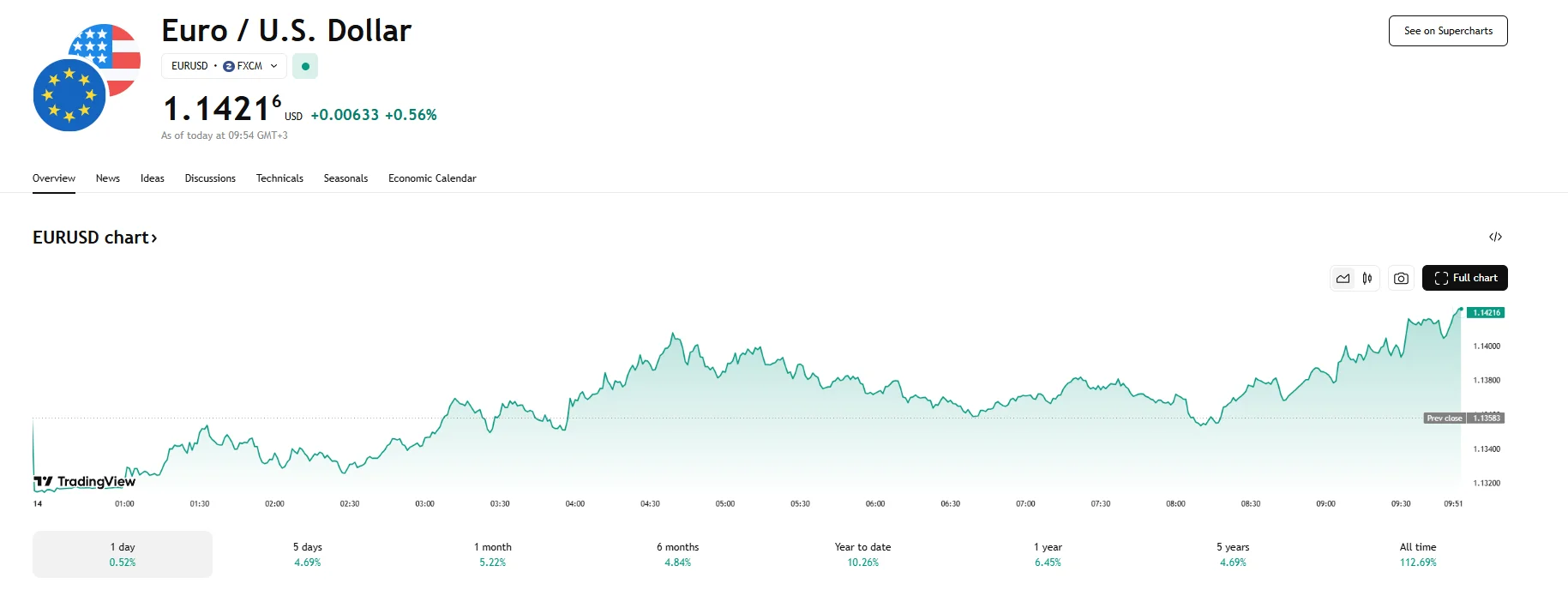

EUR/USD Gains 0.56% to 1.1421 EUR/USD Gains 0.56% to 1.1421

Key momentsThe EUR/USD surged on Monday, climbing 0.56% to 1.1421.In contrast, the US Dollar Index declined to just above 99.220.Potential fed rate cuts, as well as the ongoing trade war between the U

Key moments

- The EUR/USD surged on Monday, climbing 0.56% to 1.1421.

- In contrast, the US Dollar Index declined to just above 99.220.

- Potential fed rate cuts, as well as the ongoing trade war between the US and China, have weighed heavily on the dollar.

EUR/USD Rockets Over 0.50% Amidst Weakening Greenback

After a decline that pushed the EUR/USD dip below the 1.1320 threshold, the pair experienced a notable resurgence on Monday. This renewed momentum saw the exchange rate between the euro and the US dollar successfully climb past 1,1400. Should this positive momentum persist, the pair could reach the 1.1500 resistance zone and potentially achieve further gains.

Meanwhile, the US dollar is exhibiting weakness across the board, as indicated by the US Dollar Index (DXY), which fell to 99.223 and continues to fluctuate around a three-year low. Several interconnected factors appear to be fueling bearish sentiments towards the greenback.

A significant contributor to the euro’s strengthening and the dollar’s depreciation is the escalating trade friction between the United States and China. Recent actions by both nations to increase tariffs have ignited fears of a prolonged global trade war. This apprehension has cast a shadow over the prospects of the US economy, leading investors to become more cautious about the dollar.

Volatility can also be attributed to the Trump administration’s recent approach towards tariffs on technology products in particular. Last week, the White House announced smartphones and other electronics would be exempt from the reciprocal tariffs against China. However, subsequent clarifications revealed these very same imports might still be subject to separate levies within the coming months and that they are still targeted by the 20% “Fentanyl Tariffs.” US President Donald Trump also intends to launch a national security investigation into the semiconductor industry and the broader electronics supply chain.

Adding to the dollar’s woes is the growing anticipation among investors that the US Federal Reserve will adopt a more accommodative monetary policy stance. There is increasing speculation that the central bank might implement multiple interest rate cuts throughout 2025. This expectation of lower interest rates in the future makes dollar-denominated assets less attractive to international investors, further contributing to the currency’s downward pressure.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.