"Break arm to survive" has achieved remarkable results MetaQ1 a number of financial data are more than expected!

After Microsoft and Google, the two "big guys," handed over satisfactory results, social media Facebook and Instagram's parent company Meta Platforms followed suit and brought a little surprise to the market.。

After Microsoft and Google, the two "big guys," handed over satisfactory results, social media Facebook and Instagram's parent company Meta Platforms followed suit and brought a little surprise to the market.。

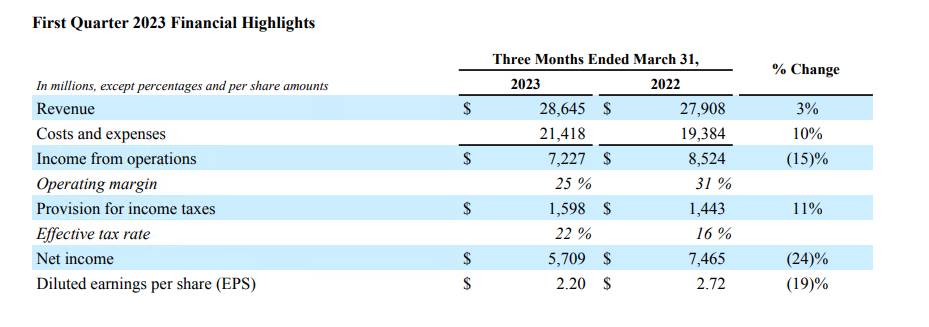

After the U.S. stock market on Wednesday, April 27, Meta reported its results for the year ended March 31, 2023.。MetaQ1 operating income rose 3% to 286.$4.5 billion, higher than the company's previous guidance range of $26 billion to $28.5 billion, while also exceeding analysts' expectations of 276.$700 million; capex rises to 70.$900 million, compared to 55.$500 million; net profit was $5.7 billion, down 24% YoY; diluted EPS was 2.$20, down 19% YoY, but still above analyst expectations of 2.01 USD。

Judging from the overall financial data, Meta, which suffered from the weakness of its core business last year, seems to be "regaining its life."。

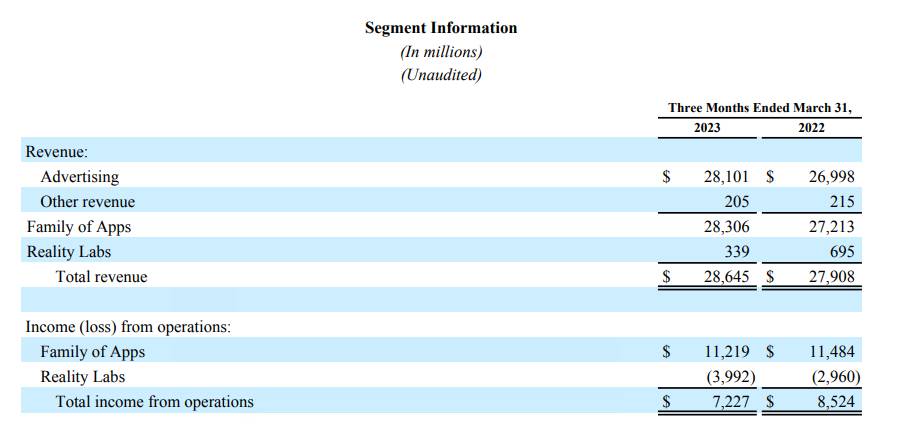

By business, Meta's largest business application family business (Family of Apps)。The business, which includes Facebook, Instagram, Messenger, WhatsApp and other services, saw first-quarter revenue rise 4% year-over-year to 283.$06 billion; operating profit fell 2.3% to 112.$1.9 billion。

Then there is Meta's "meta-universe" related "reality lab" business (Reality Labs)。The business, which includes AR and VR-related hardware, software and other content, saw first-quarter revenue decline 51% year-over-year to 3.$3.9 billion; operating losses widened further by nearly 35% year-on-year to $3.9 billion..$9.2 billion。

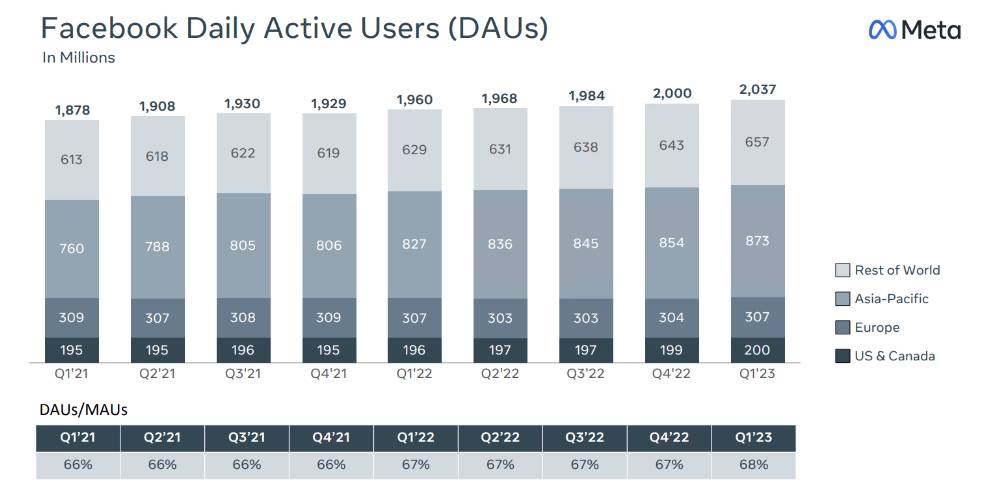

However, it is worth noting that in the fourth quarter of last year, the number of daily active users (DAU) of Facebook, the social media platform in the application family business, reached a record high of 2 billion for the first time.。And earnings data show that Facebook's DAU in the first quarter of this year was 20.3.7 billion, still continuing to break record highs。

How the impact of the meta-million layoffs on the company?

In an overwhelmed macroeconomic environment, Meta pioneered massive layoffs in Silicon Valley to "survive with a broken arm."。

Last November, Meta announced that more than 1.For the first time in the history of a 10,000-person company, layoffs were made.。The company still said it would continue to cut 10,000 jobs this year, and it began cashing in in the middle of this month.。On April 19, the company laid off about 4,000 employees, who were concentrated in technical positions.。

In this financial report, Meta said that as of the end of the first quarter, the company's total number of employees 7..71.14 million, down 1% YoY。All layoffs announced in November are no longer reflected in the number of people reported as of the end of March this year, and the impact of this year's layoffs has been reflected in the report at the end of March.。

But the cost of such massive layoffs is undoubtedly an important concern for investors.。In disclosing its first-quarter results, Meta said it included $3 billion to $5 billion in restructuring costs related to facility integration costs, severance payments and other personnel costs in its cost guidance for the full year。

Meta CEO Mark Zuckerberg also said in a quarterly earnings call last year that the company's main theme this year will remain "cost cutting and efficiency," and said it will "proactively cut projects that are not performing or may no longer be critical" and strive to improve decision-making efficiency.。

In addition, Zuckerberg also said on this quarter's earnings conference call that Meta has been in a "hiring stasis" for more than half a year.。Meta will resume hiring as layoffs are gradually completed in April and May。With the gradual opening of the recruitment channel, we expect the annual growth rate of employees in 2024 to exceed 1% -2%。However, the company's long-term focus has not changed and remains cost-effective。

However, the conclusion that can be drawn from this year's quarterly data is that despite the unsatisfactory performance of the core business, cutting costs through layoffs does play a role。

AI and metaverse "two-pronged approach"?

Since the release of ChatGPT by Microsoft-backed OpenAI, a number of tech giants have struggled to catch up, intending to get a piece of the AI industry。

Meta is no exception, and in February this year, Meta launched LLaMA, a large language model for the research community, but unlike generative chatbots such as ChatGPT, Meta's language model is a research tool that can be made available to researchers and entity workers in government, community and academia under non-commercial licenses.。

In response to analyst questions on the post-earnings call, Meta CEO Zuckerberg also said that Meta will release more products and services related to generative AI in the coming months。

"Overall, I think there's a huge opportunity in generative AI," Zuckerberg said.。"

Zuckerberg also said: "From a visual point of view, generative AI can also help advertisers to create more creative opportunities, if AI can be introduced into the business conversation, tens of millions of small businesses can use AI instead of human, help them answer user questions, more enterprises can also afford to save a lot of labor costs."。In my opinion, this is also one of the application prospects of generative AI.。"

In the end, Zuckerberg said that he will grasp both AI and the meta-universe。But as you can see from this conference call, the CEO seems to be more focused on AI research and development at the moment, and the talk of the meta-universe is sloppy.。

After the earnings announcement, Meta shares surged 11% after the U.S. market and are now at $230.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.