Trading Commission Based on Forex Broker Type

Each broker has a different set of rules regarding commission fees。This article will discuss how to measure forex broker commissions and see if their conditions are reasonable enough for a trader。

Each broker has a different set of rules regarding commission fees。This article will discuss how to measure forex broker commissions and see if their conditions are reasonable enough for a trader。

The currency market is a vast and highly dynamic market that is different from other markets, and it can provide you with many opportunities to become a successful trader。First, you need to find a forex broker to facilitate your trading。The role of the broker is to connect the trader with the currency market and provide the tools needed to trade online and execute orders。

But using the broker's facilities cannot be completely free, as they also need funds to survive further.。Therefore, in exchange for services, the trader must pay a commission for each trade, depending on the terms and conditions of each broker。

Essentially, there are 3 sources of income for brokers。

- Spread: Determined by the difference between the selling price and the buying price, so the spread of each currency pair is obviously different and can provide a fixed or variable spread。

Trading with clients: only for DD brokers or market maker brokers, who create their own markets for clients and can trade in reverse with clients under certain conditions。Thus, the client's loss is the broker's direct profit。

Commission: Brokers will charge a certain amount of commission for each trade, in this article we will pay more attention to this topic。

Each broker has a unique set of profitability rules and requirements, and some can leverage their clients more than others。Brokers will set their rules by leveraging the three sources of income described above。For example, some brokers can enjoy free commissions but higher spreads and vice versa。

However, the different regulations of each broker can sometimes be confusing。In fact, each option has pros and cons。Which one makes the most money??Here we will discuss how to measure the fairness of forex broker commissions to see if their conditions are reasonable enough for traders。

Forex Trading Commission

Forex broker commissions are essentially transaction fees that traders must pay, sometimes per lot。As a trader, this is part of your daily expenses。The money is part of the broker's income, as well as payments to its trading partners, i.e. liquidity or technology providers.。After all, brokers are not charities willing to work for free, and their clients are the main or even the only source of income.。

To optimize services, brokers should collaborate and cooperate with multiple forms of institutions。The first is banks, which are technically in a higher position than brokers because they can provide liquidity to the market, and these multinational banks are linked to the interbank networks that form foreign exchange pair prices.。As an opportunity to obtain bank quotes, liquidity providers should charge commissions。Therefore, the funds obtained from the trader are partly used to pay commissions to the bank。

Not only for banks, but also for brokers to pay technology providers if they decide to work with them。Technology provider companies need to promote online forex trading and provide the latest technology to provide a better experience for traders, so many brokers include this service fee in the commission。

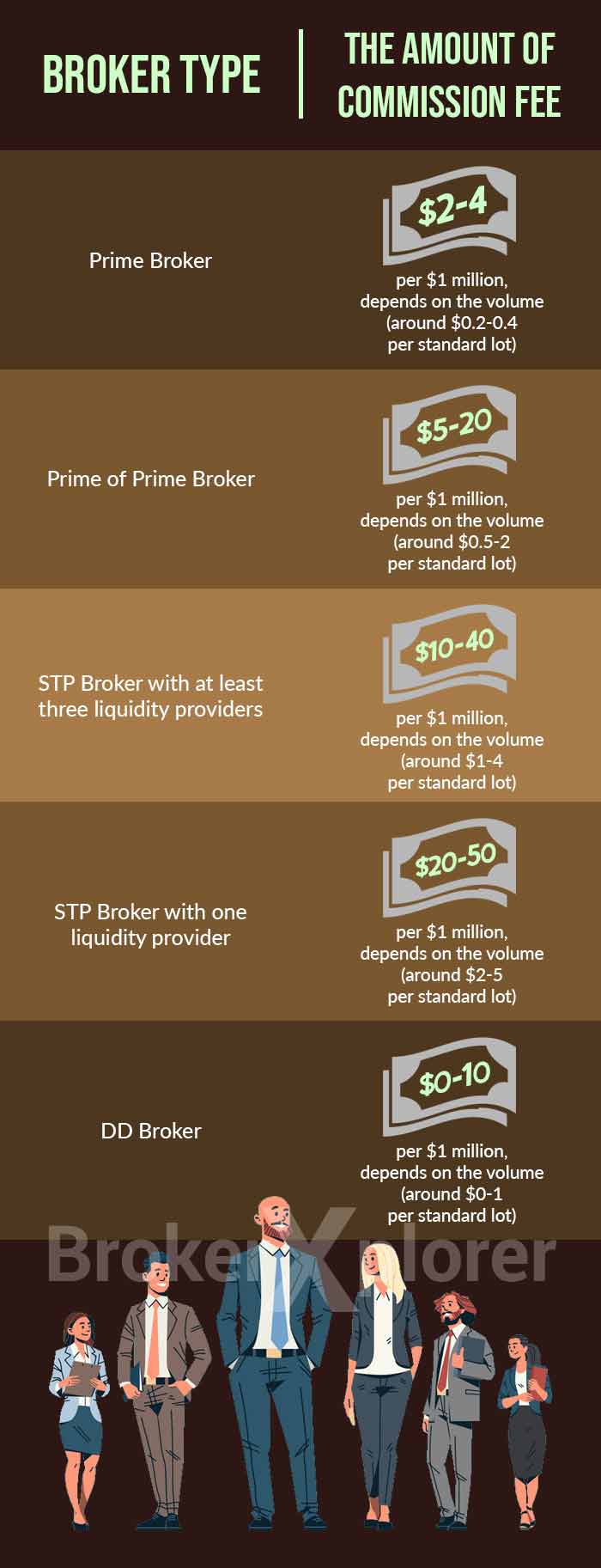

Reasonable commission range based on broker type

One of the most challenging parts of finding the right broker is to calculate the total cost of the transaction and ensure that the commission fee is still affordable, but not too cheap to prevent being deceived。The team at Boston Technologies, one of the leading online trading technology providers, has listed some reasonable forex trading commission ranges based on broker type:

To better understand the classification of Forex brokers in the chart, please read the following instructions:

- Bulk broker: often used by professional and experienced traders such as Goldman Sachs and Morgan Stanley, but also for institutional traders such as hedge funds。

PoP (Prime of Prime) brokers: mainly by working directly with liquidity providers to provide services to retail traders。Many people advertise themselves as an ECN or STP or DMA broker。To name a few, IG Markets, Pepperstone, Dukascopy, Varengold, IC Markets, and Saxo Bank are classified as PoPs。

STP (Straight-Through Processing) Brokers: Basically the same as PoP brokers, it can be a bit confusing for novice traders to distinguish between the two without knowing more about the business aspects, especially since many STP brokers also like to call themselves ECN or STP mode brokers。

DD (Dealing Desk) broker: Operates by creating markets and acts as a liquidity provider, so it is not just a liaison between traders and the market, but also trades in its own market。

Trading fees for bulk brokers tend to be low due to high daily trading volume and high deposit requirements。In addition, the smaller the broker's deposit requirements and trading volume, the higher the commission.。However, it does not apply to DD brokers because DD brokers do not have to pass orders to liquidity providers, so according to Boston Technologies, no commission fees should be incurred。

For some types of brokers (such as DD and STP brokers), commissions can be eliminated, which seems very profitable for traders。But keep in mind that the broker should receive income from the trader in order to continue to operate in some way。Therefore, in these cases, they do not charge a commission, but transfer the commission to the spread (mark-up)。Some brokers offer fixed spreads, others offer variable spreads, or they can charge commissions based on a percentage of the initial spread。

Different brokers, different quality

In addition to fees that may need to be added to total transaction costs, each broker has a different level of service, and not all brokers can explore the market equally。The foreign exchange market is an over-the-counter market, which means that banks should work with other banks and price aggregators to create comprehensive conditions based on the capital size and creditworthiness of each institution, indicating that the effectiveness of brokers depends on their relationship with these institutions and how much value they trade between them。

In this case, you may want to find a broker that can provide you with high liquidity and reasonable spreads。A slippage occurs when there is a gap between the expected price and the execution price, which is a situation you want to avoid。If brokers have important and strong relationships with liquidity providers and aggregators, their prices will not differ too far and are more likely to execute accurately。Even as spreads continue to widen, they are able to offer more competitive spreads than other undercapitalized brokers。

Regarding the broker's commission fees, the certain amount you should pay actually depends on the broker's offer。Suppose the broker charges you a slightly higher commission than other brokers, about $2-3 per 100,000 units traded。In exchange, you get access to complex platforms and analytical tools that are seen as completely new in the Forex trading industry。

Conclusion

Nowadays, the competition between brokers is becoming more and more intense。Many brokers try to attract clients by keeping commissions and spreads as low as possible, and this trend is definitely beneficial for traders。However, the total cost of the transaction is not the only aspect you need to consider。That being said, the goal should not be to find the cheapest broker, but to find the right one。Even though you may think you're getting the best deal at the lowest price, you may not realize that you're sacrificing other benefits as well。

In fact, the price you have to pay is equal to the service you will receive, and sometimes paying more means getting more。Make sure you check the specifications of all brokers (not just commission fees) and compare them with those of other brokers。This way, you can really see which broker is best for you and can help you achieve your trading goals。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.