How is EC Markets? Is it Reliable?

EC Markets is a UK-based forex trading broker that offers traders a wide range of trading products, including CFDs, commodities, stock index futures, and global securities.

Introduction to EC Markets

EC Markets is a brokerage firm headquartered in London, UK, established in 2012 and strictly regulated by the UK’s Financial Conduct Authority (FCA). It offers investors access to over a hundred trading instruments with transparent pricing, allowing traders to engage in various financial instruments, including forex, precious metals, CFDs on indices, oil, and stocks. The trading platform supports mobile, tablet, and desktop devices, providing users with the ability to conduct real-time and secure transactions.

Security of EC Markets

EC Markets Group Ltd is authorized and regulated by the UK Financial Conduct Authority (FCA), under registration number FRN: 571881. This ensures the firm operates securely and reliably, offering trading opportunities to both beginners and experienced traders across global markets. Additionally, EC Markets Limited is authorized and regulated by the Seychelles Financial Services Authority (FSA License No.: SD009) and the Mauritius Financial Services Commission (FSC License No.: GB2100130).

The company ensures the safety of client funds by adhering to top-tier FCA regulations, which include segregating client funds from the company’s accounts and avoiding the use of these funds in daily operations. Furthermore, EC Markets provides negative balance protection, safeguarding traders' accounts from deficits during market volatility or unforeseen events.

Key Features of EC Markets Services

EC Markets offers clients simple, fast, and reliable trading solutions, featuring:

- Market Competitiveness: Provides globally competitive trading quotes.

- Order Execution Speed: Average order completion time is less than 2ms, ensuring efficient trade execution.

- Low-Cost Trading: Offers commission-free trading accounts, reducing transaction costs.

- Diverse Trading Products: Access to over a hundred trading instruments, including forex, precious metals, oil, and indices.

EC Markets Account Types

EC Markets provides three different types of trading accounts to cater to the needs of various traders. New traders also have the option to open a demo account for free, allowing them to practice trading and test different strategies.

-

STD Account: Spreads start from 1.0 pips, with leverage up to 500:1 for forex and precious metals, and 200:1 for oil. The minimum order size is 0.01 lots, with no maximum position limit. Margin call and stop-out levels are set at 100% and 50%, respectively.

-

ECN Account: Designed for professional traders seeking ultra-low spreads, starting from 0 pips. It offers the same leverage conditions as the STD account, with identical minimum order size, maximum position limit, margin call, and stop-out levels.

-

PRO Account: Offers the lowest trading spreads, starting from 0 pips. Leverage, minimum order size, and maximum position limit are the same as those in the ECN account, with the same margin call and stop-out levels.

A comparison of the three account types is illustrated in the table below:

| Account Type | STD Account | ECN Account | PRO Account |

|---|---|---|---|

| Features | Classic trading account suitable for all traders | Premium trading conditions for professional traders | Lowest trading spreads |

| Spreads | From 1.0 pips | From 0 pips | From 0 pips |

| Leverage | Forex 500:1, Precious Metals 500:1, Oil 200:1 | Forex 500:1, Precious Metals 500:1, Oil 200:1 | Forex 500:1, Precious Metals 500:1, Oil 200:1 |

| Minimum Order | 0.01 lot | 0.01 lot | 0.01 lot |

| Maximum Position | Unlimited | Unlimited | Unlimited |

| Margin Call | 100% | 100% | 100% |

| Stop-Out Level | 50% | 50% | 50% |

EC Markets Account Opening Process

The account opening process with EC Markets is straightforward. Click "Open an Account with EC Markets Now" and use the exclusive referral code 【V7MAA】 to receive a welcome package!

Here is the basic process:

- Visit the Website: Start by visiting the official EC Markets website.

- Locate the Account Opening Option: Usually, there’s an “Open an Account” or “Register” option on the homepage.

- Fill Out the Registration Form: Click the account opening button and fill in personal details such as name, address, email, phone number, etc.

- Submit Required Documents: Identity verification typically requires submitting proof of identity (e.g., passport or ID card) and proof of address (e.g., recent utility bill or bank statement).

- Wait for Account Verification: After submitting all necessary information and documents, your account will enter the verification process, which may take a few business days.

- Activate Your Account: Once verified and approved, you will receive instructions on how to activate your account.

- Deposit Funds: After account activation, make your first deposit according to EC Markets’ instructions to start trading.

EC Markets Deposit and Withdrawal

Deposit Methods

- Log In: First, visit the EC Markets website and log into your account.

- Select Deposit Option: After logging in, click on “Funds Management” or “My Account” and select the “Deposit” option.

- Choose Payment Method: EC Markets supports various payment methods, including bank transfer, e-wallets (like Skrill, Neteller), and credit/debit cards.

- Fill in Deposit Details: Provide the necessary deposit information, such as amount and currency.

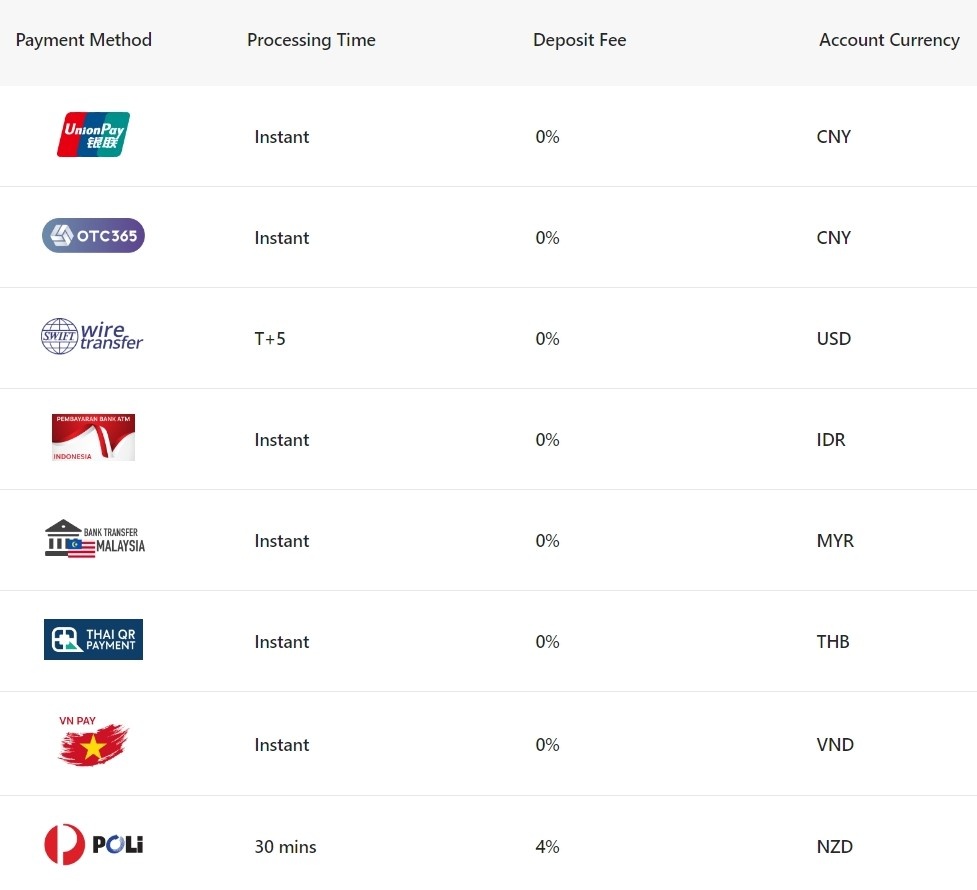

- Confirm and Complete the Deposit: After reviewing all the details, confirm the deposit request. Most deposits are processed instantly, but the exact time may vary depending on the payment method.There are several common deposit methods:

Withdrawal Methods

- Access the Account Backend: First, visit the EC Markets website and log into your account.

- Select Withdrawal Option: In the account management interface, find and click on the “Withdraw” function.

- Choose Withdrawal Method: Select a withdrawal method. Typically, EC Markets requires using the same method as the deposit.

- Fill in Withdrawal Information: Enter the withdrawal amount and other necessary details.

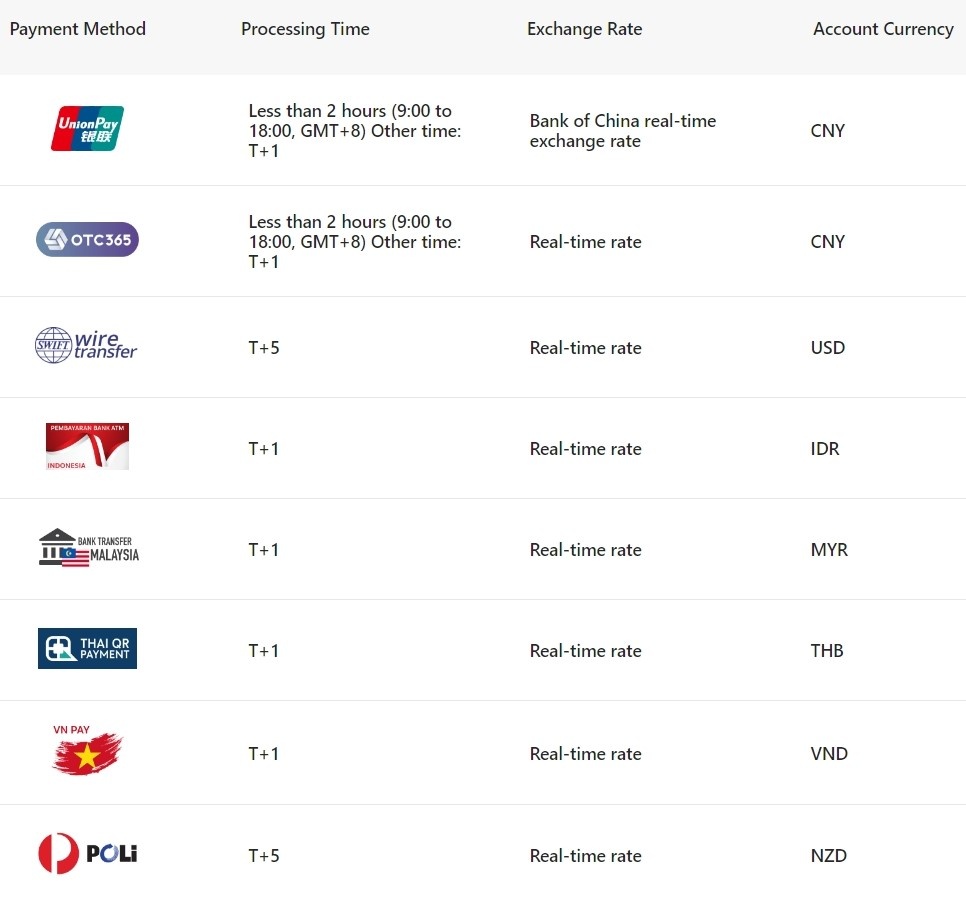

- Submit Withdrawal Request: Confirm the details and submit the withdrawal request. The request will be processed within 24 hours, but the exact processing time depends on the bank or payment provider.There are several common withdrawal methods:

Notes

- For security and compliance reasons, withdrawals may need to be returned to the same payment method.

- Withdrawal processing times may vary depending on the payment provider.

- Before making deposits or withdrawals, please ensure that your account has completed the necessary identity verification process to avoid any delays.

EC Markets Trading Platform

EC Markets offers traders the MetaTrader 4 (MT4) trading platform, featuring various functions, including technical indicators, trading analysis tools, an intuitive interface, multiple execution options, and various order types. It’s suitable for implementing various strategies, including swing trading. MT4 can be accessed via web, Android, Windows, macOS, or web-based platforms, making it suitable for both novice traders and those with complex strategies.

Desktop

- Automated trading

- Supports backtesting

- Timeframe charts

- Over 50 built-in technical analysis tools

- Multi-language support

- Customizable profit/loss control functions

- Real-time account status

Android

- Account information display

- Real-time trading

- Modify trading orders at any time

- Interactive chart function

- View trading history

- Customizable app themes

- Free download from Google Play

iOS

- Convenient navigation features

- Real-time account status

- Real-time trading

- Modify trading orders at any time

- Interactive chart function

- View trading history

- Free download from Apple Store

EC Markets Trading Products

- Forex: Over 50 major and minor currency pairs are offered, including Major, Minor, and Exotic pairs.

- Oil: Trade CFDs on major global commodities like oil, seeking profit opportunities in global market fluctuations. Typically, rising oil prices increase travel and transportation costs, adding inflationary pressure, which can often hinder economic growth.

- Precious Metals: At EC Markets, the minimum trading cost for gold is just $6/lot. London Gold, one of the most popular precious metals trading products among investors, is traded under the symbol XAU.

- CFD Indices: Trade global indices at EC Markets, including Dow Jones, Nikkei 225, Hang Seng, and the US Dollar Index.

- Cryptocurrency: Trade cryptocurrencies with competitive spreads and leverage without owning them. Since the FCA bans retail traders from using cryptocurrencies, crypto CFDs are only offered through international entities.

Frequently Asked Questions

- Is EC Markets a member of the Financial Compensation Scheme?

Yes, EC Markets is a member of the Financial Services Compensation Scheme (FSCS), designed to protect eligible claims (mainly from individual investors) and provide compensation if the company goes bankrupt. If EC Markets goes bankrupt or fails to return traders’ funds, traders may be entitled to compensation from the FSCS, depending on the business type and circumstances.

- What is client funds protection?

Protecting client funds is a crucial part of EC Markets' financial security commitment. EC Markets strictly adheres to FCA client funds rules, segregating all client funds from its own funds under FCA rules.

EC Markets holds traders’ funds in segregated client accounts at Barclays Bank, a top-tier bank. A trust deed review is conducted with all banks holding client funds, ensuring that in the event of liquidation, traders' funds are handled separately from the company’s liabilities.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.