Best forex broker offering mobile app

Today, brokers with mobile applications are becoming more popular because they are simple and flexible to use.。Which brokers offer the best mobile apps?

Today, brokers with mobile applications are becoming more popular because they are simple and flexible to use.。Which brokers offer the best mobile apps?

The term mobile trading refers to the use of wireless technology in trading, and many mobile trading apps allow traders to access trading platforms via their smartphones.。

Mobile trading applications in this article refer to applications developed by brokers themselves.。Some broker mobile apps only allow traders to access the trading platform, but others allow full control of their accounts.。

So which broker with a mobile app is best for trading anytime, anywhere?

- eToro: Can be used for documentary trading。

OctaFX: various ways to deposit and withdraw money in the mobile app。

Exness: provides trading, analysis and other utilities。

AvaTrade: allows traders to observe the market and process deposits。

XM: Manage accounts anytime, anywhere。

FBS: Open Positions and Manage Accounts。

FP Markets: Simple technical analysis at the fingertips of traders。

EasyMarkets: Free demo account available

Vantage FX: Provides technical indicators and analysis。

Xtrade: equipped with advanced technical analysis tools。

Read on to see what traders can get from the above brokers。

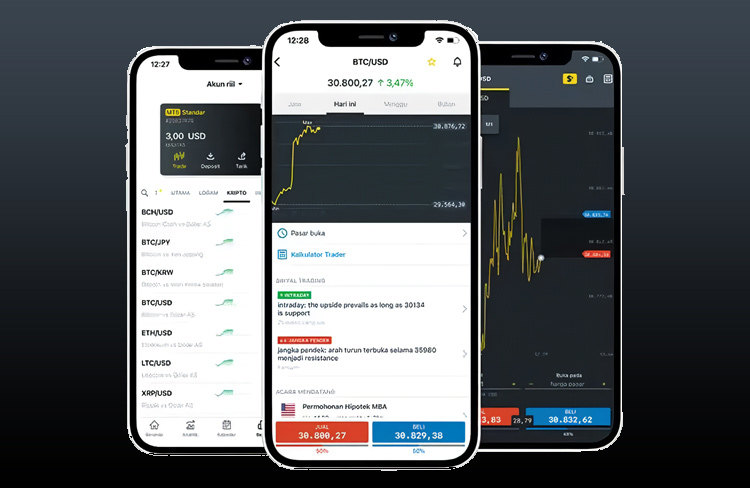

1. Exness

Exness is a broker founded by a group of professionals, founded in 2008。Since then, they have grown to 145,400 customers worldwide.。Exness is widely known by CFD traders and currently offers different types of instruments, including metals, commodities, foreign exchange, etc.。

Exness is also one of the best brokers with a mobile app to support mobile trading for all types of traders。Their app offers utilities such as trading, analytics, deposits and withdrawals。Exness claims easy registration, fast deposit and 24 / 7 support to help their mobile traders。They also ensure that customers receive the latest fundamental news from the built-in economic calendar。

The choice of broker is adjusted according to the needs of each trader. If you only need the basic platform and trading functions with the best attributes, then Exness may be your best choice。

Exness with its 0 only.Advantages such as the low spread from 1 o'clock make up for the lack of changes in its functions, which is very suitable for traders using scalping strategies (Scalper)。Spreads for major currency pairs in some account types can also be as low as 0.0 point, depending on market conditions。

Not only that, traders can also enjoy other advantages such as automatic withdrawals。Exness will process most customer withdrawals immediately without manual inspection; however, depending on the payment provider or method selected, withdrawals may be restricted。

Exness is one of the STP / ECN brokers in Europe, and the safety of traders' funds is also guaranteed。Exness became the official partner of Real Madrid football team for 3 years from July 2017, which also proves that the company has a high degree of stability.。

Exness supports deposits and withdrawals 24 hours a day, 7 days a week。However, it should be noted that the Company does not assume any responsibility if there is a problem with the deposit or withdrawal due to the payment system.。

Traders don't need to worry about transaction fees when making deposits and withdrawals.。Exness does not charge traders any transaction fees, and the chosen payment provider may incur some fees。Exness offers traders a variety of payment methods, including wire transfers, bank cards, Neteller, Skrill and more。

Financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the world's top four accounting firms。

In addition, Exness is one of the most transparent brokers in the online trading industry, and traders can find all the information about the company on the website, such as trading volume, number of active customers, customer deposits, company funds, etc.。

Exness offers different platforms, including MetaTrader 4, MetaTrader 5, web and mobile platforms, which makes it easier for traders to trade on Exness because the Exness platform can be accessed anytime, anywhere。

Over the years, Exness has developed into a broker that attracts traders, who comply with financial regulations such as FCA and CySEC, further strengthening their trust.。

One measure of customer confidence is the volume of transactions。As of December 2018, the monthly trading volume of its clients reached $348.4 billion, with more than 50,342 active traders worldwide.。

With the programs offered by Exness, traders also have the opportunity to earn extra income by becoming their partner。By introducing the Broker (IB) program, partners can earn up to 33% spread commission from each new customer who registers。

Additional income from Exness Partners。Traders who register through the member link can earn up to 25% spread commission per trade.。

Customers can also use their free VPS hosting service when trading at Exness。VPS (Virtual Private Server) provides traders with greater reliability and stability because they can maintain their trading and expert advisors without interruption in the event of unexpected technical problems (such as Internet or power outages)。

In summary, Exness is a trader's favorite broker due to its low spreads and flexible account type, ideal for traders with limited funds but need more opportunities to maximize profits。The broker is also known for its maximum support for new and old partners.。

2. FBS

FBS is an international brokerage firm founded in 2009 with more than 17,000,000 traders and experience worldwide.。The broker not only offers trading products, but also provides its customers with educational materials, standard accounts, micro accounts and cent accounts and other account types。

There is no doubt that FBS has become one of the best brokers to have a mobile application, their application not only allows traders to open positions, but also manage accounts, and provide complete statistics。The app also gives traders the ability to customize leverage, VPS security, bonuses, and more。

Since 2009, FBS Holding Inc.(FBS) achievements in the field of foreign exchange transactions have been recognized by various international institutions.。As of 2019, the number of FBS clients reached 14 million, winning the most transparent Forex broker in 2018, the best investor education in 2017, the best customer service broker in Asia in 2016, the IB Forex program and many other titles.。

FBS is regulated by Belize IFSC and Cyprus CySEC。The broker is trusted by millions of traders and 370,000 partners from all countries.。According to the data, FBS has about 7,000 new trader and partner accounts every day.。And, 80% of customers will stay in FBS for a long time。

Trading products offered by FBS include Forex, CFD, Precious Metals and Equities。For Forex trading, CySEC-regulated FBS provides leverage of up to 1: 30 for cent accounts and standard accounts。Customers who want to try higher leverage can also register an account with FBS Belize。

In all types of accounts, the spread is from 1 point。Volume orders in standard accounts can be 0.01 to 500 lots, it is recommended that experienced traders use the account。

And on the cent account, bulk orders can be executed up to $500 breakups or the equivalent of 5 standard lots.。Cent accounts involve varying degrees of risk。FBS recommends cent accounts to beginners。All account types support the following trading instruments: 28 currency pairs and 2 metals。

Before entering the real Forex market, traders can practice using the FBS demo account, which is divided into two types, namely standard account and cent account。

Using the MetaTrader 4 and MetaTrader 5 platforms, FBS provides services on Windows and Mac, as well as Android and iOS mobile devices, providing traders with a trading experience at their fingertips, allowing traders to trade anytime, anywhere。

The MetaTrader platform also has a variety of key features, including the creation, purchase and use of Expert Advisors (EA) and scripts, one-click trading and embedded news, technical analysis tools, documentary other traders, hedging positions and VPS service support。

Another advantage of FBS is that customers who meet specific requirements receive a 100% deposit bonus and the deposit and withdrawal process is fast and convenient.。According to the customer, in addition to holidays, usually no more than 3-4 hours。

In order to increase the security of client funds, FBS also offers segregated accounts where 70 per cent of funds can be deposited with the client's bank; in addition, the margin is between 10 and 100 per cent.。If the trader loses funds in the course of trading but is insured, FBS will refund the trader's funds。

Traders have the opportunity to develop a side business when trading with FBS, i.e. as an economically recommended (IB) or affiliate。The commission provided by the FBS partner system is already at level 3, and traders can only earn additional income if they introduce new customers to FBS according to certain procedures。

Traders will also gain trading education experience at FBS。They have prepared a comprehensive foreign exchange course divided into 4 levels: beginner, beginner, intermediate and advanced。Traders can take courses that transform them from novice to professional, all materials are well structured。In addition, FBS offers a variety of forex analysis, webinars, forex news and daily market analysis that can be easily accessed on its website。

Traders can visit the official FBS website, which is available in multiple languages, including English, Dutch, Italian, French, Portuguese, Indonesian, Spanish, etc., and also provides live chat support 24 hours a day, 7 days a week。

In summary, FBS is a well-known broker among global retail traders。Due to flexible trading conditions, customers are able to use a variety of instruments for trading, low deposits, etc.。

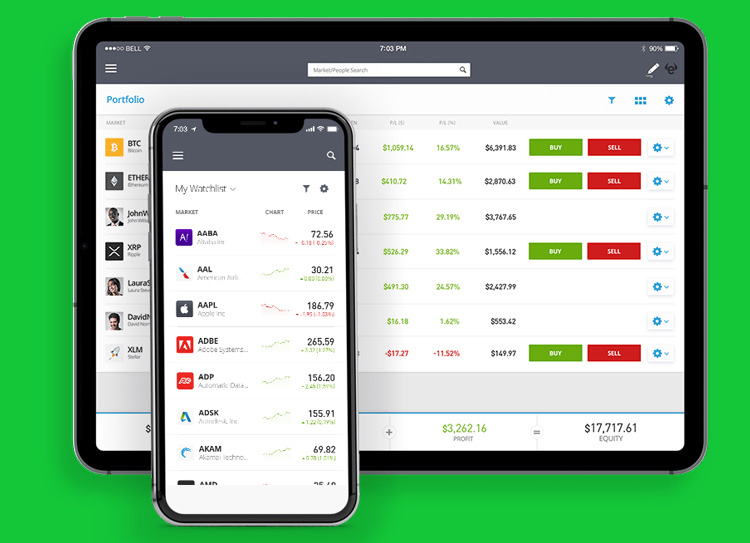

3. eToro

eToro is a multi-asset broker founded in 2007 and now serves clients around the world.。The broker offers its traders 0% commission and free insurance。For those who love social trading, eToro is the best broker, with the largest community of traders and investors in more than 140 countries, numbering over 20 million.。

eToro is also one of the best brokers with a mobile app on Google Play, and their mobile app includes features such as trading, documentary trading, and access to different tools such as Forex, Stocks, Commodities, and Cryptocurrencies, ensuring that clients can check their portfolios at any time.。

Founded in early 2007, eToro's mission is to make transactions available to anyone, anywhere, and to reduce reliance on traditional financial institutions.。The company has headquarters in the UK, Cyprus, USA and Australia。

eToro (Europe) Limited is a financial services company authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number # 109 / 10.。Meanwhile, eToro (UK) Limited is regulated and regulated by the Financial Conduct Authority (FCA) under license number FRN 583263.。

As foreToro AUS Capital Pty Ltd, whose legal status is recognised by the Australian Securities and Investments Commission (ASIC), provides financial services under Australian Financial Services Licence 491139。

As a belonging4-digit broker, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative CopyPortfoliosTM, a fully managed thematic portfolio。

自Since 2007, eToro has been at the forefront of the fintech revolution.。The latest is CopyPortfolio, which was launched in 2017 and is powered by machine learning Al。In addition to developing CopyPortfolio, the company also integrated Microsoft's machine learning technology into Momentum DD.。

NewThe CopyPortfolio investment strategy uses artificial intelligence to find the most stable traders who are most likely to earn double-digit returns and bundles traders into a fully managed portfolio.。eToro has hundreds of financial assets available for trading, including stocks, commodities, crypto assets, currencies, indices and ETFs。Each asset class has its own characteristics and can be traded using multiple investment strategies。

Certain positions on eToro involve ownership of underlying assets, such as non-leveraged positions in equities and crypto assets。Using contracts for difference (CFD) will make various options possible, such as leveraged trading, short (sell) positions, fractional ownership, etc.。For example, a trader can invest in gold at a minimum amount of $100, even if the price of a single unit of gold is $1,000.。eToro's most popular CFD commodities include gold, oil, gas, silver and platinum。

Currency can only be used asCFD Trading on eToro。In addition, CFD allows for short selling (short) positions and leveraged trading, even for assets that do not offer this option in traditional trading.。Some popular currency pairs include EUR / USD, GBP / USD, AUD / USD, USD / JPY, and USD / CAD。

In addition, exchange-traded funds (ETF) is a financial instrument consisting of several assets, used as a tradable fund。After opening an eToro account, traders can invest at least $250 in an ETF that sells for $500.。Some popular ETFs on eToro include SPY, VXXB, TLT and HMMJ。

However,eToro also provides additional functionality through the use of CFD trading。All leveraged ETF positions in the UK are regulated by the FCA。Meanwhile, all CFD positions executed by eToro Australia are regulated by ASIC.。

The company also has other advantages。of all tradable financial assets,eToro does not charge any deposit or transaction fees other than spreads。

eToro charges $25 for withdrawals, with a minimum withdrawal amount of $50。holdings of cryptocurrencies, stocks andETF non-leveraged long positions are not executed as CFD and no fees are charged。eToro charges overnight or weekend fees for CFD positions, such as leveraged positions and short (sell) orders。

Update of fees always applies to open positions。Fees are subject to change at any time and may change on a daily basis based on market conditions without prior notice。

As a beginner, traders can useeToro's Copy Trading Features。Unlike the features of other brokers, traders can copy the strategies of professional traders for free without splitting into profits。因此 ,100% of the profit goes entirely to the trader。For example, when Trader A, copied by Trader B, generates 10% profit this month, Trader B also earns 10% profit。

The company is the world's leading social trading network.。因为eToro operates in complete transparency, and each trader has valuable information in their eToro profile, so it is helpful for other traders who are interested in copying their trades when creating their best portfolio。

Another unique feature of eToro is personalized social news subscriptions。Just like on any social media, traders can post their own updates in a subscription, comment on other people's posts, and gradually create a subscription that suits a trader's trading and investing interests.。在在On the eToro social trading platform, traders will also be notified when there are new posts and other important updates from traders。

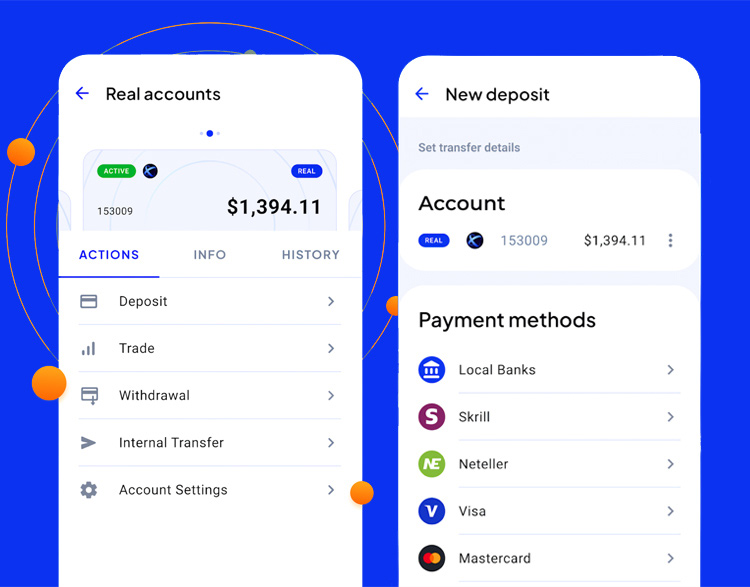

4. OctaFX

Another broker with a good mobile app is OctaFX, an STP broker based in Saint Vincent and the Grenadines。As a well-known broker, OctaFX's most popular features include low spreads, 50% deposit bonuses, no commissions, and more.。

OctaFX realized that more and more traders were moving to mobile trading, so they created a mobile app。The app allows traders to trade and manage their accounts through one app, as well as invest through virtual accounts and deposit and withdraw funds using multiple payment methods。For those who want to try documentary trading, OctaFX has also launched a special app specifically for documentary traders, allowing traders to select documentary objects and track their investments.。

OctaFX is one of the most famous brokers in the world and has won many awards for its very comfortable trading atmosphere and close-to-client service。OctaFX was founded in 2011 and is headquartered in Nicosia Strovolou 47, Kyros Tower。

OctaFX has received authoritative awards including "Best ECN / STP 2019" and "Best Broker in Asia 2019" from FX Daily Info; the Best Broker in Asia 2018 from Global Banking and Finance Review Magazine; and the Best Forex Broker and Best Trading Conditions 2018 from European CEO Magazine.。

For traders in most countries, OctaFX is licensed by Octa Markets Incorporated and registered in Saint Vincent and the Grenadines.。The broker also offers various facilities, such as live chat in Indonesian and WhatsApp support services, and deposits and withdrawals can be made through various local banks.。OctaFX does not charge a commission for every deposit and withdrawal made by a trader。

OctaFX offers different types of accounts that use market execution (STP / ECN) and 0.Floating spread of 2 points。All accounts of the OctaFX broker allow the use of various forex strategies, including scalping, hedging and trading with an EA。

There is also a fixed exchange rate discount when opening a Micro MT4 account.。All deposits made in IDR will be calculated at the exchange rate of US $1 = Rs 10,000 and will be credited to the trader's account balance。In addition, Muslim traders who want to avoid overnight interest can also use a no overnight interest account。

OctaFX trading is also suitable for novice traders。Because OctaFX offers low spreads, from 0.0 points to start floating, the required initial deposit is also very low, only $25。Account currencies are USD and EUR。

OctaFX gives 50% bonus every time a trader makes a deposit。and OctaFX's opening opportunities increase, deposit bonuses can be withdrawn on terms and conditions。

If traders are still confused about calculating profits, the OctaFX platform provides a trading calculator for each account type, where traders simply enter the currency pair being traded, the amount of leverage, the number of lots, and the type of currency used in the account。

With the Autochartist function, the opportunity to make a profit is also increasing。Traders are quickly notified when a trade shows a profit signal。Trend prediction accuracy reached 83%。

Traders do not need to worry about the security of the broker's funds, OctaFX uses segregated accounts and protects personal data and online financial transactions through SSL technology, which is adjusted according to international accounting standards and regulations.。

Another advantage offered by OctaFX is the Trade & Win program。Opening an account with OctaFX will give you the opportunity to collect lots, which can be accumulated into a variety of attractive prizes. Traders only need to open a real account on MetaTrader4 or MetaTrader5 through OctaFX to redeem the prizes for this promotion. Prizes include T-shirts, Android smart watches, smartphones and laptops。

OctaFX often has bonuses and other promotions, the broker runs weekly trading competitions on demo accounts and offers real bonuses that can be used for trading。One of the prize contests is the OctaFX Champion-MT4 Demo Contest, with four winners per period and a total prize of $1,000.。

5. AvaTrade

AvaTrade was founded in 2006 and its experience cannot be underestimated。The brokerage firm offers various trading tools such as cryptocurrencies, commodities and, of course, forex。In addition to offering a desktop trading platform, they also offer a mobile app。

The broker won the 2020 Global Forex Best Forex Mobile Trading Platform / App Award, and their mobile app has enough features for you to enjoy, for example, traders can use the mobile app to trade, observe the market and process deposits。

Avatrade is one of the most comprehensive brokers, supporting almost all trading styles。Avatrade not only allows hedging, scalping and expert advisors (EA), but also completes its services through one cancellation of another order (OCO) and automated trading in many variants of automated trading systems.。

Founded in 2006, AvaTrade's primary mission is to allow people to trade with confidence.。If traders are still confused about the best broker to support traders trading, AvaTrade may be the trader's choice, as it has been evaluated and recognized for some of the industry's most outstanding financial and technical achievements for its clients.。

In 2019, the Dublin-based broker acquired Daytrading."Best Forex Broker 2019" by com。In addition, the company has been honored as "Best Forex Broker," "Best Bitcoin CFD Trading Provider of the Year" and "Best Alliance Program in Europe."。

In addition, for more liquid traders, AvaTrade offers a number of platforms that allow traders to trade using laptops and mobile phones。The availability of the free Autochartist tool in the platform is the best support for both novice and experienced traders, as it makes it easier for them to find trading opportunities without having to look at the chart all day。

Autochartist free signals available in gold accounts, platinum accounts and AVA Select。By opening an account with AvaTrade, traders do not have to pay for the full Autochartist service。Autochartist itself is a market scanning tool that can detect trading signals from various technical perspectives.。

Traders can access AvaTrade on multiple platforms such as AvaTradeGO, MetaTrader 4, MetaTrader 5, Automated Trading, Mac Trading, Web Trading, Mobile Trading and AvaOptions。

On the regulatory side, AvaTrade has a large number of credible licenses that guarantee security even with deposits as high as $10,000.。AvaTrade uses a separate account system, subject to the Central Bank of Ireland (No..C53877), ASIC Australia (No.406684), Japan JFSA (No.1662) and South Africa (FSP 45984) regulatory。

In the event of extreme market volatility, will traders suddenly lose more than their deposits??AvaTrade explicitly answers no because traders have negative balance protection。

AvaTrade has a minimum deposit of $100 and offers different leverage depending on the trading instrument; whether it is Forex (30: 1 start), Indices (20: 1 start), Commodities (5: 1 start), ETFs (5: 1 start) or Cryptocurrencies (2: 1 start)。

AvaTrade is committed to maintaining a set of customer-related values。As a result, the company offers the best trading experience with multilingual customer service and the most advanced and user-friendly trading platform.。

New traders can also learn Forex trading in the "Education" tab of the official AvaTrade website。Traders will find tons of articles, video tutorials and more tools to help them every step of the way。This is an important requirement as the forex market can be a bit unbearable and even scary at times, so traders need to make sure they are fully prepared before they start trading in a live account。

AvaTrade offers a variety of account types, as well as Islamic trading accounts specifically for Muslim traders.。The Islamic account type is similar to the regular account type with one key difference; it does not charge any special fees or interest (no overnight interest), which is in line with the financial principles of Islamic law。

Traders can choose AvaTrade as an ideal option if they are confident in forex trading。The minimum deposit and the various platforms offered are suitable for beginners trying Forex trading for the first time。

6. XM

XM has more than 5,000,000 customers since its inception in 2009 who care about their customers by providing 24 / 5 real-time support in over 30 languages。XM offers different products such as CFDs, stocks, indices, commodities and forex。Currently, the brokerage firm is also focused on its mobile traders.。

As a broker with a mobile app, XM offers different types of mobile trading capabilities。The app allows traders to instantly access their accounts directly from their smartphones and can also manage accounts anytime, anywhere, including deposits and withdrawals。The XM mobile app has a very simple user interface and is easier to use。

XM was founded in 2009 as a company called Trading Point of Financial Instruments Ltd..A member of an online brokerage firm。To serve customers worldwide, the company has split into XM Australia and XM Global, as well as XM Cyprus。Each member has a different head office and license, XM Australia is registered under the Australian Securities and Investments Commission (reference number: 443670), XM Worldwide is registered under the International Financial Services Commission (60 / 354 / TS / 19), and XM Cyprus is registered under the Cyprus Securities and Exchange Commission (reference number: 120 / 10).。

XM is one of the more experienced brokers in today's online forex trading world。Since its inception, the broker has undergone many changes, including the addition of an ultra-low account and webinar function, which supports 19 different languages with 35 local instructors in each language。

In terms of trading instruments,XM is known for its diversity of asset providers, ranging from Forex, commodities, CFDs for equity indices, precious metals, energy, to equities。XM prides itself on being the ideal broker to execute trades, providing a statistic that 99.35% of orders executed in less than a second。Trading at XM also offers a strict no-re-quote policy, no virtual trader plug-ins, no rejection of orders, real-time market execution, and the option for traders to place orders online or over the phone.。

在在Spreads across all major currency pairs can be as low as 0 in an Ultra-Low account.6 points, while the spread of other accounts usually starts at 1 point。XM chose to limit their leverage to a scale of 1: 888, rather than offering a maximum leverage of 1: 500 or 1: 1000 (whole numbers), a unique number now widely recognized as a trademark of XM.。

In order to protect the client's funds in the case of extreme volatility,XM provides negative balance protection for each type of account。Deposits for micro and standard accounts start at $5, while Ultra-Low accounts require a minimum deposit of $50。Traders who open an account at XM can get conditions similar to a penny account environment in a micro-account, where each lot has a contract size of only 1,000 units.。If you use the smallest number of lots on the MetaTrader platform, which is 0.01 lots, then the trader can trade only 10 units per trade。

For deposits,XM applies zero-fee deposits in most of its available payment methods。Traders can choose to deposit and withdraw money by wire transfer, credit card, and the most popular electronic payment options such as Skrill, Neteller, and FasaPay.。

XM also provides Islamic accounts for Muslim traders who comply with Sharia law that prohibits the use of interest-bearing overnight swaps for each currency pair.。In order to provide their customers with the best trading experience, XM has opened access to MT4 and MT5 platforms, each with more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android and Android tablets).。

In general, there is no doubt,XM has gone global, with its deep commitment to providing trading services worldwide available in more than 15 languages.。In addition to simplifying the trader's experience through mainstream trading platforms and high-quality trade execution, XM is open to all types of traders, from small capital traders to preparing large deposits.

for their global approach,XM has ensured that traders from various countries can easily access their services.。This has resulted in different domain names for traders in specific jurisdictions。

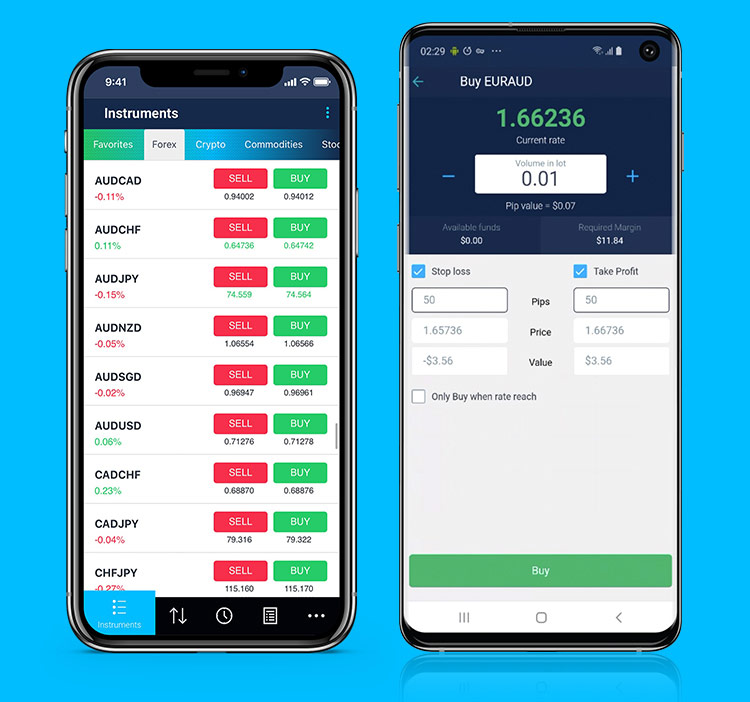

7. FP Markets

The brokerage firm provides clients with the convenience of trading CFDs across multiple instruments such as forex, stocks, indices, etc. It is a good choice for traders who like small spreads.。The broker is regulated by the Australian Securities and Investments Commission (ASIC) and has won over 40 awards in the field of executive technology.。

Is FP Markets a broker with a mobile app??Of course, their app allows instant access to the market and gives traders the tools they need for technical analysis at their fingertips.。The easy-to-use interface also makes the app suitable for all kinds of traders。

Maintaining an overnight position will not result in overnight / rollover fees reducing your income, so you don't have to worry about。FP Markets offers the most competitive swap rates in the industry by introducing swap points in the form of real-time swap rate listings on the MT4 and MT5 platforms。For example:

ACWI: long position is -5.00, the short position is -2.50。

ADAUSD: long position at -20.00, with a short position of -20.00。

AGG: long position is -5.00, the short position is -2.50。

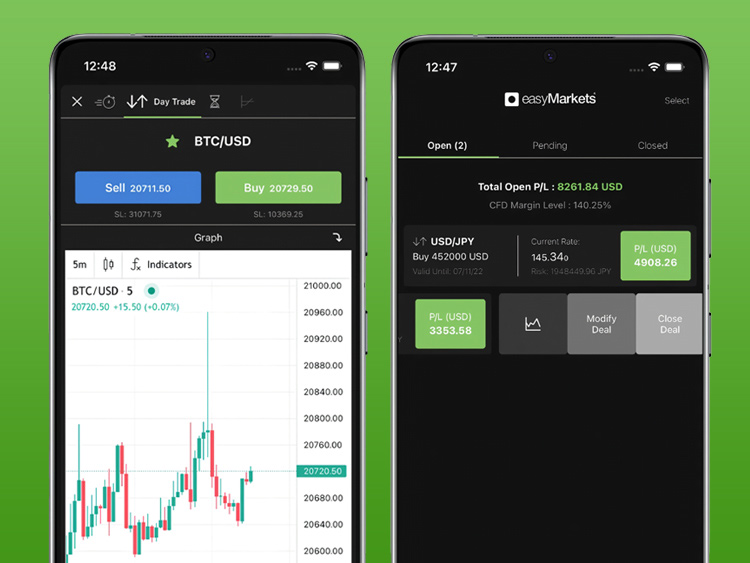

8. easyMarkets

easyMarkets offers its traders a simple, transparent and easily accessible trading experience。Founded in 2001, the broker has expanded its range of CFD products to include global indices, energy, metals and more.。

As one of the best brokers with a mobile app, easyMarkets gives mobile traders access to over 200 tools in their hands。The app features a free demo account for new traders to practice and learn without risking any money。easyMarkets also offers top trading tools and updates traders "information with simple account monitoring。

EasyMarkets has been writing its own story in the financial markets since 2001.。Simplicity, honesty and transparency are the three values of easyMarkets。The company tries to make the trading process as simple as possible.。

In 2016, they changed their name from easy-forex to easyMarkets。Over the years, easyMarkets has expanded its range of CFDs products to cover global indices, options, metals, foreign exchange, commodities and cryptocurrencies, and the company has been licensed by CySEC and ASIC.。

Another privilege when trading at easyMarkets is its own platform。The easyMarkets Ease platform is simple and versatile. According to trader reviews, it is friendly to new customers and provides many features for experienced traders。Customers can also get free guaranteed stops, no slippage, fixed spreads, and no capital or withdrawal fees from easyMarkets.。

The platform has three unique features。First, dealCancellation enables traders to "undo" their trades。easyMarkets is the only broker that offers to close trades before the trading time reaches 60 minutes for a small fee。

In addition, traders can enjoy the internal viewer。The tool helps traders gain a deeper understanding of market sentiment by showing them the percentage of buy and sell executed in the platform。The third unique feature is the freeze rate, which traders can use to suspend the exchange rate and place their trades at the "frozen" rate。

easyMarkets also offers financial calendars, market news, trading charts and trading signals as a perk of the platform, offering the technology on a mobile interface via iOS and Android devices, allowing traders to enter the market anytime, anywhere。

MetaTrader 4 is also provided by easyMarkets。Traders will get negative balance protection and fixed spreads when using this popular trading platform。In addition to this, the broker offers ordinary options。

As a result of these innovations, easyMarkets has become an award-winning broker, winning the 2019 Forex Broker Award from Dubai Forex Expo, the 2018 Most Innovative Broker Award from World Financial Markets Awards, the 2018 Best Asia Pacific Broker Award from ADVFN International Finance Awards, the 2017 Most Transparent Broker Award from ADVFN International Finance Awards, the 2017 Best Forex Service Provider Award from FXWord China, and more.。

In addition, easyMarkets offers three account types, such as VIP accounts, Premium accounts, and Standard accounts。All accessible via web / app and MT4 platform。Maximum leverage is 1: 200 when using the easyMarkets Web / App platform and 1: 400 when using MT4。

Fixed spreads in forex trading from 1.Start at 0: 00。Traders can become easyMarkets VIP customers and enjoy some benefits, such as trading by phone, obtaining the most stringent fixed spreads, personal analysts, and real-time market updates via SMS。

Traders pay no additional fees, whether commissions, account fees or withdrawals。The account currency has 18 options, including euro, Canadian dollar, Czech koruna, Japanese yen, New Zealand dollar, US dollar, Singapore dollar, etc.。The company offers a variety of deposit and withdrawal methods, some of which are credit / debit cards, bank transfers and e-wallets such as Neteller, Skrill and Fasapay。

Traders can contact one of the company's local offices or its headquarters in the Marshall Islands directly if they have any questions or need help.。In addition, traders can chat with their customer service via email, Facebook, WhatsApp, Viber and live chat.。

Based on the above comments, easyMarkets offers an easy-to-use platform and some unique tools that traders can access anytime, anywhere。In addition, traders do not have to pay additional trading commissions and deposit and withdrawal fees.。Traders registered with easyMarkets can enjoy the EUR / USD pair as low as 0 in the MT4 platform.Spread of 9。

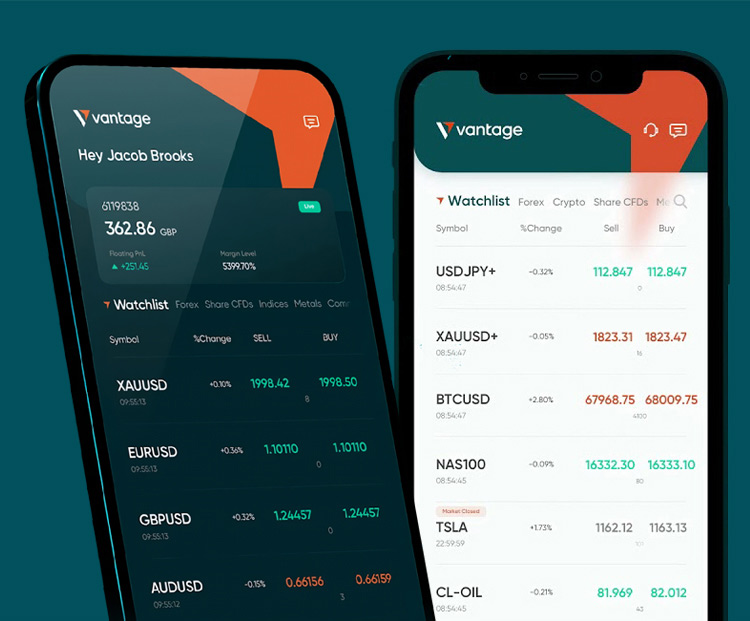

9. Vantage FX

Another broker with a mobile app worth considering is Vantage FX。Founded in 2009 by financial professionals, the broker has over 50,000 active clients worldwide with over 300 CFD tools, including forex and commodities, ideal for CFD traders.。

Customers can also trade CFDs via the Vantage FX mobile app。Technical traders will love using this app as the broker allows multiple types of technical indicators to be used in the mobile app and also provides market analysis to help traders develop the best strategy and understand the current price situation。In addition, Vantage FX offers 24 / 7 multilingual customer support。

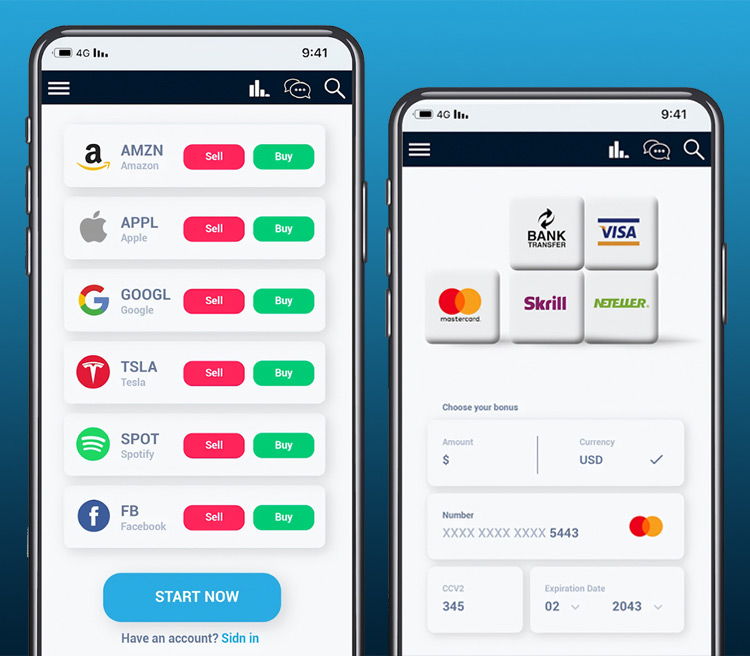

10. Xtrade

Xtrade has been around for 10 years and has clients in more than 25 countries, offering CFD trading, equities, forex, commodities and other instruments.。Xtrade promises 24-hour support to ensure its customers are well served。

As one of the best brokers with a mobile app, Xtrade ensures its user experience is simple, fast and intuitive。Trading with this broker means that there are no commissions and the payment is also safe, and traders can customize alerts and notifications according to their needs。Xtrade offers advanced technical analysis tools to maximize the trader's experience。

XTrade Europe Ltd.Operated as an online CFD broker since 2010, affiliated with XTrade Group and through Offersfx.eu offers forex and contract for difference trading。The broker was formerly known as xtrade.eu, regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 108 / 10。

It is therefore subject to the regulatory requirements of the Markets in Financial Instruments Directive (MiFID II).。For non-European traders who open an account with XTrade, they will be approved by Xtrade International Ltd..Management, Xtrade International Ltd.is a Belize-based entity licensed by the Belize International Financial Services Commission。

As OffersFX, XTrade Europe Ltd.Emphasize that it provides customers with a rich choice of trading assets。From Forex to Cryptocurrencies, OffersFX manages to offer all of these services。The broker also offers interesting alternatives such as stocks, ETFs and bonds, providing opportunities for traders and investors from different markets.。

Its unique advantages include strong financial resources, fast and efficient withdrawal process, cutting-edge platform technology and global customer support.。

Following the launch of XTrade International, XTrade Europe no longer offers trading with the popular MetaTrader platform。The broker has its proprietary platform that enables traders to enter the market through Web-Trader with rich features and trading tools to ensure an optimized trading experience.。The platform can be used not only on the desktop, but also on mobile apps and tablets。

Trading conditions are not thoroughly explained as brokers do not offer selectable account types。Forex trading in XTrade offers a fixed spread of 2-5 pips without commission。

Information on maximum leverage and minimum deposits without clear details。However, XTrade Europe Ltd.It is explicitly mentioned that overnight trading positions are subject to a premium fee。

There is no charge for deposits and withdrawals and traders can choose from bank transfer, credit card, PayPal, Skrill and Neteller as payment methods。

However, it is important to acknowledge that if a trader ignores their trading account in OffersFX for 3 months, there will be an inactivity fee of up to $50 per month.。Additionally, hibernation maintenance fees of up to $100 per month for accounts inactive for one year or more。

For all the assets offered to traders, OffersFX does not equip them with deep educational materials。Each trading instrument has a specific explanation, but the broker has no further content to educate traders about online trading in individual markets。

All in all, XTrade Europe Ltd.is a CySEC-regulated broker offering multiple trading tools。It is a unique company that offers traders a fixed spread as the only trading commission and does not meet the popular preference of the MetaTrader platform.。

However, XTrade Europe Ltd.Not very good at transparency and information sharing, and fairly high fees are charged for inactive accounts, but at least no deposit and withdrawal commissions are required。

Advantages of Mobile Trading

Mobile trading has many benefits, so this method is becoming more and more popular nowadays。For example, brokers with mobile apps often provide traders with real-time market data as well as real-time relevant news, and traders can review their portfolios at any time and get a simple understanding of their asset performance.。

Most brokers with mobile apps also offer them as trading platforms, which allow traders to access their positions and place market orders without having to open a computer.。In fact, some advanced apps offer analytical tools and trading signals on mobile apps。All in all, mobile apps offer busy traders the opportunity to enter the market quickly and easily。

Limitations of Mobile Trading

Mobile trading also has its drawbacks。For example, some applications restrict access to certain instruments and analytical tools, and options will be limited if traders trade through mobile applications。Another disadvantage is the small screen, which may be uncomfortable for traders who usually use a computer or laptop。

Connectivity issues can also be a problem for mobile trading, especially when traders often visit remote locations that are not connected。In addition, a slow smartphone can cause trouble during the transaction, not to mention that it controls all orders。

Conclusion

Mobile transactions are becoming more popular as the world goes digital。Most brokers realize that their traders want a flexible trading experience to support their busy lives。More and more traders are looking for brokers with mobile apps for more flexible trading activities。Although mobile applications bring many benefits to traders, there are also some limitations。Therefore, some traders should maintain access to desktop trading platforms while using mobile apps for fast trading。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.