The importance of market execution and related brokers

There are different types of execution in the foreign exchange market, and market execution is often considered a better。This is why?Which brokers offer this execution?

There are different types of execution in the foreign exchange market, and market execution is often considered a better。This is why?Which brokers offer this execution?

To enter the currency market, you need to register with a forex broker。The main function of a broker is to connect traders and the market, as well as to facilitate trading and execute orders。

Many brokers offer various types of trading accounts and other features, such as leverage, spreads and minimum deposits, which every trader must consider before choosing a broker and checking its legitimacy and trustworthiness。

But apart from these aspects, have you ever heard of market execution?In fact, this feature is usually not explicitly displayed on the broker's website, but only after you get to know them carefully。

There are some brokers that provide market execution transparently, here is a list:

- IC Markets

- Exness

- XM

- OctaFX

- Admiral Markets

- Alpari

- FxPro

- FXTM

- ThinkMarkets

Therefore, in this article, we will discuss the types of execution of these Forex brokers and why market execution may be a better choice for you。

Brokers offering market execution

The following brokers claim to provide market execution for some of their accounts:

1. IC Markets

IC Markets is one of the top ECN brokers regulated by ASIC and has a good reputation among traders。Like XM, the broker uses the market execution type for all types of accounts。

Although the broker does not provide details about this feature, you can view it directly on the trading platform of the IC Market。Interestingly, brokers claim that they can execute orders faster than other brokers because they use NY4 and LD5 servers.。

IC Markets is a private company in International Capital Markets Pty Ltd..) an online forex brokerage company operated under。Traders under Australian jurisdiction offer trading services at IC Markets-AU, which is based in Australia and licensed by the Australian Securities and Investments Commission (ASIC).。

On the other hand, non-Australian traders who open accounts with the broker are under the Seychelles-basedIC Markets SEY registered and regulated by the Seychelles Financial Services Authority (SFSA)。This dual operation is the result of the Australian Securities and Investments Commission's relatively new rules, which prohibit its regulated brokers from providing trading services outside Australia.。

IC Markets is classified as an ECN broker offering clients MetaTrader 4, MetaTrader 5 and cTrader as platform trading options。The broker also follows market trends with cryptocurrencies as one of its products, enriching its already wide selection of trading assets, including currencies, indices, metals, energy, software, stocks and bonds.。

with other affectedThe minimum deposit for IC Markets is at a moderate level compared to ASIC-regulated brokers, as each customer has a deposit of $200。Market analysis materials are also regularly prepared for trading insights on the official website of IC Markets, proving their ability to provide traders with important content created specifically for the market experts they work for.。

For payment methods,IC Markets allows financing and withdrawals via wire transfers, credit cards, PayPal, Skrill, Neteller, FasaPay, UnionPay, and BitPay's Bitcoin。The more interesting aspect of the broker is its multiple base currencies, including the US dollar, Australian dollar, euro, British pound, Singapore dollar, New Zealand dollar, Japanese yen, Swiss franc, Hong Kong dollar and Canadian dollar。

因为IC Markets' trading technology is equipped with highly centralized servers and extremely low latency (especially on cTrader), and the broker is well known for its ability to host traders with special needs for high-frequency trading and order brushing。

Anyway,IC Markets is the right destination for active traders looking for well-regulated brokers。IC Markets is also flexible in terms of base currency and payment methods, which demonstrates their commitment to welcoming traders from outside their home countries.。By the end of 2019, IC Markets was offering websites in 18 international languages, including English, Korean, Indonesian, French, Spanish, Italian, Malay, German and Chinese.。

2. Exness

Exness is a well-known broker offering various types of trading accounts, partly executed using the market。Interestingly, there is an account that can use both instant execution and market execution。

The choice of broker is adjusted according to the needs of each trader. If you only need the basic platform and trading functions with the best attributes, then Exness may be your best choice。

Exness with its 0 only.Advantages such as the low spread from 1 o'clock make up for the lack of changes in its functions, which is very suitable for traders using scalping strategies (Scalper)。Spreads for major currency pairs in some account types can also be as low as 0.0 point, depending on market conditions。

Not only that, traders can also enjoy other advantages such as automatic withdrawals。Exness will process most customer withdrawals immediately without manual inspection; however, depending on the payment provider or method selected, withdrawals may be restricted。

Exness is one of the STP / ECN brokers in Europe, and the safety of traders' funds is also guaranteed。Exness became the official partner of Real Madrid football team for 3 years from July 2017, which also proves that the company has a high degree of stability.。

Exness supports deposits and withdrawals 24 hours a day, 7 days a week。However, it should be noted that the Company does not assume any responsibility if there is a problem with the deposit or withdrawal due to the payment system.。

Traders don't need to worry about transaction fees when making deposits and withdrawals.。Exness does not charge traders any transaction fees, and the chosen payment provider may incur some fees。Exness offers traders a variety of payment methods, including wire transfers, bank cards, Neteller, Skrill and more。

Financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the world's top four accounting firms。

In addition, Exness is one of the most transparent brokers in the online trading industry, and traders can find all the information about the company on the website, such as trading volume, number of active customers, customer deposits, company funds, etc.。

Exness offers different platforms, including MetaTrader 4, MetaTrader 5, web and mobile platforms。This makes it easier for traders to trade on Exness because they can also access the Exness platform anytime, anywhere.。

Over the years, Exness has developed into a broker that attracts traders, who comply with financial regulations such as FCA and CySEC, further strengthening their trust.。

One measure of customer confidence is the volume of transactions。As of December 2018, the monthly trading volume of its clients reached $348.4 billion, with more than 50,342 active traders worldwide.。

With the programs offered by Exness, traders also have the opportunity to earn extra income by becoming their partner。By introducing the Broker (IB) program, partners can earn up to 33% spread commission from each new customer who registers。

Additional income from Exness Partners。Traders who register through the member link can earn up to 25% spread commission per trade.。

Customers can also use their free VPS hosting service when trading at Exness。VPS (Virtual Private Server) provides traders with greater reliability and stability because they can maintain their trading and expert advisors without interruption in the event of unexpected technical problems (such as Internet or power outages)。

In summary, Exness is a trader's favorite broker due to its low spreads and flexible account type, ideal for traders with limited funds but need more opportunities to maximize profits。The broker is also known for its maximum support for new and old partners.。

3. XM

XM provides details about the type of execution of its orders and even puts it on a specific page explaining the broker's use of market execution。Some of the advantages offered include no need to re-quote, fast performance, and allowing orders even on weekends and holidays。

Since the broker does not mention whether the execution type is only applicable to certain account types, it can be considered that market execution is applicable to all types of accounts。

XM was founded in 2009 as a company called Trading Point of Financial Instruments Ltd..A member of an online brokerage firm。To serve customers worldwide, the company has split into XM Australia and XM Global, as well as XM Cyprus。Each member has a different head office and license, XM Australia is registered under the Australian Securities and Investments Commission (reference number: 443670), XM Worldwide is registered under the International Financial Services Commission (60 / 354 / TS / 19), and XM Cyprus is registered under the Cyprus Securities and Exchange Commission (reference number: 120 / 10).。

XM is one of the more experienced brokers in today's online forex trading world。Since its inception, the broker has undergone many changes, including the addition of an ultra-low account and webinar function, which supports 19 different languages with 35 local instructors in each language。

In terms of trading instruments,XM is known for its diversity of asset providers, ranging from Forex, commodities, CFDs for equity indices, precious metals, energy, to equities。XM prides itself on being the ideal broker to execute trades, providing a statistic that 99.35% of orders executed in less than a second。Trading at XM also offers a strict no-re-quote policy, no virtual trader plug-ins, no rejection of orders, real-time market execution, and the option for traders to place orders online or over the phone.。

在在Spreads across all major currency pairs can be as low as 0 in an Ultra-Low account.6 points, while the spread of other accounts usually starts at 1 point。XM chose to limit their leverage to a scale of 1: 888, rather than offering a maximum leverage of 1: 500 or 1: 1000 (whole numbers), a unique number now widely recognized as a trademark of XM.。

In order to protect the client's funds in the case of extreme volatility,XM provides negative balance protection for each type of account。Deposits for micro and standard accounts start at $5, while Ultra-Low accounts require a minimum deposit of $50。Traders who open an account at XM can get conditions similar to a penny account environment in a micro-account, where each lot has a contract size of only 1,000 units.。If you use the smallest number of lots on the MetaTrader platform, which is 0.01 lots, then the trader can trade only 10 units per trade。

For deposits,XM applies zero-fee deposits in most of its available payment methods。Traders can choose to deposit and withdraw money by wire transfer, credit card, and the most popular electronic payment options such as Skrill, Neteller, and FasaPay.。

XM also provides Islamic accounts for Muslim traders who comply with Sharia law that prohibits the use of interest-bearing overnight swaps for each currency pair.。In order to provide their customers with the best trading experience, XM has opened access to MT4 and MT5 platforms, each with more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android and Android tablets).。

In general, there is no doubt,XM has gone global, with its deep commitment to providing trading services worldwide available in more than 15 languages.。In addition to simplifying the trader's experience through mainstream trading platforms and high-quality trade execution, XM is open to all types of traders, from small capital traders to preparing large deposits.

for their global approach,XM has ensured that traders from various countries can easily access their services.。This has resulted in different domain names for traders in specific jurisdictions。

4. OctaFX

According to the official website of OctaFX, all account types are executed in the market, and the processing time is less than 0.1 second。Like XM and IC Markets, the broker offers three types of accounts: micro accounts, professional accounts and ECN accounts.。

Minimum deposit of $100 for micro and ECN accounts and $500 for professional accounts。This amount may sound expensive, but the remaining transaction costs are relatively low compared to other brokers。

OctaFX does not charge any additional commissions other than the floating spread for zero accounts。

OctaFX is one of the most famous brokers in the world and has won many awards for its very comfortable trading atmosphere and close-to-client service。OctaFX was founded in 2011 and is headquartered in Nicosia Strovolou 47, Kyros Tower。

OctaFX has received authoritative awards including "Best ECN / STP 2019" and "Best Broker in Asia 2019" from FX Daily Info; the Best Broker in Asia 2018 from Global Banking and Finance Review Magazine; and the Best Forex Broker and Best Trading Conditions 2018 from European CEO Magazine.。

For traders in most countries, OctaFX is licensed by Octa Markets Incorporated and registered in Saint Vincent and the Grenadines.。The broker also offers various facilities, such as live chat in Indonesian and WhatsApp support services, and deposits and withdrawals can be made through various local banks.。OctaFX does not charge a commission for every deposit and withdrawal made by a trader。

OctaFX offers different types of accounts that use market execution (STP / ECN) and 0.Floating spread of 2 points。All accounts of the OctaFX broker allow the use of various forex strategies, including scalping, hedging and trading with an EA。

There is also a fixed exchange rate discount when opening a Micro MT4 account.。All deposits made in IDR will be calculated at the exchange rate of US $1 = Rs 10,000 and will be credited to the trader's account balance。In addition, Muslim traders who want to avoid overnight interest can also use a no overnight interest account。

OctaFX trading is also suitable for novice traders。Because OctaFX offers low spreads, from 0.0 points to start floating, the required initial deposit is also very low, only $25。Account currencies are USD and EUR。

OctaFX gives 50% bonus every time a trader makes a deposit。and OctaFX's opening opportunities increase, deposit bonuses can be withdrawn on terms and conditions。

If traders are still confused about calculating profits, the OctaFX platform provides a trading calculator for each account type, where traders simply enter the currency pair being traded, the amount of leverage, the number of lots, and the type of currency used in the account。

With the Autochartist function, the opportunity to make a profit is also increasing。Traders are quickly notified when a trade shows a profit signal。Trend prediction accuracy reached 83%。

Traders do not need to worry about the security of the broker's funds, OctaFX uses segregated accounts and protects personal data and online financial transactions through SSL technology, which is adjusted according to international accounting standards and regulations.。

Another advantage offered by OctaFX is the Trade & Win program。Opening an account with OctaFX will give you the opportunity to collect lots, which can be accumulated into a variety of attractive prizes. Traders only need to open a real account on MetaTrader4 or MetaTrader5 through OctaFX to redeem the prizes for this promotion. Prizes include T-shirts, Android smart watches, smartphones and laptops。

OctaFX often has bonuses and other promotions, the broker runs weekly trading competitions on demo accounts and offers real bonuses that can be used for trading。

One of the prize contests is the OctaFX Champion-MT4 Demo Contest, with four winners per period and a total prize of $1,000.。

5. Admiral Markets

Admiral Markets is a broker offering market execution for all accounts with a minimum deposit of $200。Some of the other features offered by this FCA-regulated broker include additional MetaTrader Extreme Edition, one-click trading, volatility protection settings, and market depth for secondary pricing。

6. Alpari

Alpari offers a wider range of account types compared to the previously mentioned brokers, but only ECN accounts use market execution。Despite the limitations, Alpari's market execution is fairly reliable, supported by years of experience, proving its competitive advantage.。

Alpari International, one of the largest Forex brands, strives to ensure that traders make the best trading and investment decisions。Alpari was founded on December 24, 1998, by a small group of people who wanted to start a financial business in one of the most economically unstable years in Russian history.。

In 20 years of experience in the Forex industry, approximately 2 million traders have chosen Alpari as a broker to trade with.。Alpari is headquartered at 5th Floor, 355 NEX Tower, Rue du Savoir, Cybercity, Ebene 72201, Mauritius。The company is regulated in Saint Vincent and the Grenadines (license number 20389 IBC 2012), Belize IFSC (license number IFSC / 60 / 301 / TS / 18)。

The broker uses MetaTrader 4 and MetaTrader 5, both of which offer great flexibility, charting tools and an easy-to-use interface。To boost trading volumes, the company also offers the Alpari International Direct platform, which offers enhanced features for senior investors.。

The company offers a range of real trading accounts to choose from.。Each offers different opportunities and allows traders to trade in different ways。All their accounts use USD, EUR, GBP and NGN as base currency options。However, NGN accounts are only available to customers in Nigeria。

Each account has a different spread, with standard accounts offering spreads from 1.2, the spread of micro-accounts from 1.7, ECN accounts and professional accounts spread from 0.4。Traders can open an account in Alpari and choose to trade currencies (forex major currencies, forex minor currencies, forex exotic currencies and forex rubles), spot metals, spot commodities, stock trading, spot indices and cryptocurrencies。

Traders can know the minimum spreads, pips, swaps and trading time periods for each instrument before starting trading.。If traders are still not sure where to start, they can find the answer in the guide available on the official Alpari website。

Their trading guides are designed to break down terms and answer traders "most common questions。Traders will soon be able to trade faster and with more confidence。

Alpari also offers PAMM (Percentage Allocation Management Module), which allows traders to select the account manager they want.。This gives traders the opportunity to make more profit without advanced knowledge of forex trading, managers often have extensive market experience with tried and tested strategic trading decisions。

The program also offers experienced traders the opportunity to become forex master traders。As forex master traders, they can use their trading experience to earn more from profitable trades, have access to Alpari's premium projects and all the tools needed to train a large number of investors。Investors will then help forex master traders earn more with commissions of up to 40%。

Their website also offers a variety of forex trading strategies。In order to increase the chances of profit, it is important to know as much as possible about the market and the trading strategies behind it。Alpari believes that strategies provide traders with a roadmap for trading, reducing the panic decisions that can occur on the spur of the moment。In other words, trading at Alpari allows traders to understand any type of forex trading strategy。

For educational purposes, the company offers trading webinars, a variant of technology that allows users to host seminars, talk shows and discussions online without having to meet face-to-face.。

Alpari creates a very convenient money and withdrawal experience for every trader。Traders can transfer money by any means, such as electronic payments (e.g., FasaPay, local transfers, TC Payment, etc.), credit cards (Visa, Mastercard, and Maestro), e-wallets (Neteller, Skrill, VLOAD, TC Pay wallets, WebMoney, Perfectmoney, Bitcoin), and bank transfers。An inactivity fee of €5 / USD / GBP will be charged if there has been no trading activity in the trader's account for at least 6 months。

All background transfers are processed during standard business hours, Monday to Friday 03: 00 - 19: 00 GMT + 2 (GMT + 3 during daylight saving time)。If traders are still confused, they can contact Alpari's team by any means, such as live chat, telegram or email。

7. FxPro

FxPro is an FCA regulated broker with market execution approach。Uniquely, the broker does not categorize its accounts based on lot size, spread or execution type, but rather focuses more on trading platforms。

You can get all the advantages of market execution in all types of accounts of this broker, especially the MT4 account allows you to use both market execution and instant execution。

Since its inception in 2006, FxPro has successfully expanded to serve retail and institutional clients in more than 170 countries and is headquartered in London, UK.。

FxPro UK Limited has been licensed and regulated by the FCA since 2010。Meanwhile, other subsidiaries, such as FxPro Financial Services Limited, have been authorized and regulated by CySEC since 2007 and by FSCA since 2015.。So traders no longer have to worry about their money。As a staunch supporter of transparency, it sets the highest security standards for client funds, as companies choose to keep their money in major international banks, completely segregated from corporate funds.。

They always strive to provide transparent and ethical practices in the global trading industry。In 2018, 74.65% of market orders are executed at the requested price, 12.8% of customer orders are executed with positive slippage。In addition, only 1 of all instant orders.4% received a re-offer, of which 0.72% received a better price at the time of execution。

FxPro's total number of transactions increases year by year。In 2018, trading volume reached 53.6 million。Based on the trust of customers, FxPro won the UK's Most Trusted Forex Brand Award 2017 from Global Brand Magazine。In addition, they became the first broker to sponsor an F1 team in 2008 and FxPro has won around 60 UK and international awards.。

They are committed to creating a dynamic environment that provides traders with all the tools they need to gain a trading experience.。Open an account with FxPro to access more than 250 CFDs across 6 asset types, including FX, equities, spot indices, futures, spot metals and spot energy。They want to provide clients with top-of-the-line liquidity and advanced trade execution without the need for trading desk intervention.。Average execution time less than 11.06 milliseconds, up to 7,000 orders per second。These advantages allow traders to benefit from tight spreads and competitive prices。

In addition, FxPro is recognized as an innovative broker。The company allows customers to enjoy a wide range of trading platforms such as MetaTrader 4, MetaTrader 5, cTrader and FxPro Edge。Web-based versions and mobile applications are also available so that traders can access financial markets anytime, anywhere。

Traders can choose the platform according to their needs。Traders for MT4 provide instant execution and easy-to-use trading platform。In this account, leverage is as high as 1: 500, with spreads from 1.From 6: 00, no commission。

Traders should opt for an FxPro MT5 account if they want to gain experience with more modern technologies。In this account, the spread from 1.5 start, leverage up to 1: 500, no commission。

Another type of account is FxPro cTrader。Compared to other account types, it is suitable for traders who prioritize execution speed and have the strictest spread limits。FxPro cTrader is a powerful trading platform that provides the best bid and ask prices, orders can be completed in just a few milliseconds。The platform also provides market depth and trade analysis tools, in which the spread is only from 0.From 3 o'clock。However, traders must pay a commission of $45 per $1 million of forex and metals trades (opening and closing positions).。

The main difference between MetaTrader 4, MetaTrader 5 and cTrader is the range of CFD products available。The MT4 platform provides traders with the opportunity to open positions in all 6 asset classes, while MT5 does not support stocks and cTrader does not support stocks and futures。

In addition to the above 3 types of platforms, you can also access FxPro Edge when trading in FxPro。The platform provides customers with a new way to trade the market in the form of spread betting。

Every broker has advantages and disadvantages, and FxPro is no exception。In addition to the advantages explained earlier, FxPro also has a high minimum deposit amount。In addition, FxPro does not offer many types of payment and withdrawal methods。Some types of methods even require the trader to pay a fee。However, it is still important to note that customers can trade forex, stocks, indices, metals and energy in Fxpro with a limited risk account at no additional cost。

Regardless of the pros and cons, FxPro can be one of the best brokers with advanced technology of choice for traders who are ready to trade with funds starting at $500。

8. FXTM

At first glance, FXTM is very similar to Alpari in that both only use market execution for their ECN accounts, so this broker is more suitable for experienced traders in terms of providing market execution。

If people open an account with this broker, they can choose from a variety of trading instruments。After all, FXTM is known for its commitment to providing retail traders with the best trading services ever.。

Originally launched in 2011, FXTM's unique vision is to offer unparalleled superior trading conditions.。Opening an account with FXTM also gives you access to advanced education and advanced trading tools in the Forex industry。

FXTM is now registered with the UK Financial Conduct Authority with registration number 600475, the company is also regulated by the Cyprus Securities and Exchange Commission with CIF licence number 185 / 12 and licensed by the South African Financial Conduct Authority (FSCA) with FSP number 46614.。

FXTM has 1 million registered accounts and more traders join every day。The company continues to strive to improve its performance and has won many awards such as the World Finance Award for Best Trading Experience 2019, the International Finance Award for Best Online Forex Trading Company in Nigeria 2018, the Hexun 2018 Reputable Investor Education Forex Broker Award, Fxeye.Com 2018 China Foreign Exchange Brand Award, etc.。

As a responsible broker, FXTM determines leverage (expressed as a ratio of trade size relative to the trader's purchasing power) based on the trader's trading knowledge and experience level, and evaluates it through an appropriateness assessment. It also supports leveraged trades up to 1: 1000。

As for spreads, FXTM offers 0.The low spread from 1 o'clock, so traders can withdraw profits at the beginning of the trade。With headquarters in several countries, the company uses No Trading Desk (NDD) technology and works with reliable liquidity providers to deliver the best bid and ask prices.。

For beginners, there is an automated trading tool called algorithmic trading。Traders can develop their own trading strategies or adopt the strategies of other traders when trading at FXTM。In addition, the strategy is also applied to automated trading systems, such as smart trading systems, so that traders don't have to worry about losing opportunities without observing the market and still make profits。

Three types of ECN accounts using MT4 and MT5 trading platforms。There are also mobile and tablet app trading platforms。In addition to offering multiple account variants, FXTM also makes every effort to ensure that customers receive the excellent support they deserve, so that their trading experience is optimal and user-friendly。

FXTM also offers a variety of products, in addition to more than 50 foreign currencies, gold, silver, commodity futures (oil) CFDs, ETF CFDs and indices.。

The broker also provides education on basic concepts of the forex industry。Traders can read all the concepts offered in the form of e-books, video tutorials, articles, webinars and forex seminars。The FXTM website is available in 17 languages for traders to understand Forex。

Traders can also choose from a variety of payment methods, including credit cards (Visa, Mastercard, Maestro) and e-wallets (Neteller, Skrill, Western Union)。For withdrawal of funds, traders do not have to pay a fee of 2 hours to 2 days。Traders can ask further questions via live chat and contact the administrator via email, FXTM has a question and answer page on Forex trading。

9. ThinkMarkets

ThinkMarkets is one of the Australian brokers after IC Markets and if you look at the official website of ThinkMarkets you will not find a specific page explaining the type of execution used by the broker。They only call themselves using the institutional model connected to the Equinix server service.。

As for the trading account, you can choose between a standard account and a ThinkZero account。The difference between the two is very obvious, because in the standard version, the minimum point difference is from 0.Start at 4: 00; and in ThinkZero accounts, spreads can be as low as 0: 00。

In addition, the operating balance in the standard account is 0, while the ThinkZero account has a limit of $500。

As a multi-asset online brokerage, ThinkMarkets offers a wide range of trading assets from Forex to Precious Metals, Commodities, Indices, Stocks and Cryptocurrencies。The Australian-based broker was founded in 2010 and has since opened more headquarters in London and regional offices in Asia Pacific, the Middle East, North Africa, Europe and South America.。

Along with its historical operations, ThinkMarkets has received numerous awards and recognition in various aspects.。They recently won the Best Value Broker Award in Asia at the 2020 Global Forex Awards。

Standard account average forex spread for traders who open an account with ThinkMarkets from 1.From 2, while ThinkZero offers 0.Best trading experience at 1 point spread。However, traders may want to take into account that ThinkZero charges 3 per side for every 1,000,000 trades..$5 commission。

As a global online brokerage firm, ThinkMarkets operates under the supervision of multiple financial regulators, for example, ThinkMarkets Australia is managed by TF Global Markets (Aust) Limited and licensed by the Australian Financial Services Authority and the Australian Securities and Investments Commission (ASIC), ABN: 69158361561。ThinkMarkets UK is registered with the Financial Conduct Authority (FCA) under the name TF Global Markets (UK) Limited (No.09042646)。

ThinkMarkets is always committed to improving its trading environment through a variety of advanced products.。Auto trading enthusiasts can use free VPS hosting, while enthusiastic traders who want to experience outside the MetaQuote platform can try ThinkMarkets' proprietary platform ThinkTrader。

The trading platform offers 3 different interfaces designed for web desktop, tablet and mobile display。In addition, custom tools such as more than 80 drawing tools and more than 125 technical analysis indicators can even be accessed via mobile screens, which will undoubtedly provide a new mobile trading experience.。

In terms of market updates, the ThinkMarkets deal will be accompanied by news from FX Wire Pro, which is known for its strict policy of adhering to objective news reporting and providing critical, credible information in real time.。Information areas covered by FX Wire Pro include economic commentary, technical-level reports, currencies and commodities, central bank bulletins, energy and metals, and event-driven bulletins。

For payment methods, ThinkMarkets provides gateways through bank transfers, credit cards (Visa and MasterCard), Skrill, Neteller, POLi online banking, BPay, and Bitcoin wallets。

All in all, for a company that has been in business since 2010, ThinkMarkets has been quite successful in terms of legal status and trading technology innovation.。As an additional guarantee of safety for traders, the broker highlighted its commitment to a $1 million insurance protection plan, which is achieved through ThinkMarkets and Lloyd's of London insurance policies, in the unlikely event of bankruptcy Provide up to $1 million in protection for customers' funds。

10. FXOpen

As we all know, FXOpen is a pioneer in facilitating the trading of Bitcoin CFDs by Forex brokers, providing market execution in all types of accounts except micro accounts.。

The spread applies only to cryptocurrency and STP accounts, while commissions are in ECN accounts (1.$5 standard hand) and cryptocurrency accounts (0 per half turn.5%) in charge。If you want to start small, you can choose between cryptocurrency and STP, as an ECN account requires a deposit of at least $500.。

It should be noted that there is a monthly maintenance fee of $10. If the account is inactive, the broker can deactivate it and charge a fee of $50 before the trader reactivates。

FXOpen has been operating as an online trading provider for retail customers since 2005.。The company was founded by a group of traders with a mission to provide services in the interests of traders.。FXOpen claims to be one of the first companies to offer ECN trading via MetaTrader 4 (MT4)。With unique proprietary price aggregation technology, customers can benefit from the industry's most competitive spreads (from 0 points) and low trading commissions。

In 2006, FXOpen also became the first broker to offer micro and swap-free accounts.。Since then, they have gone on to become pioneers in a number of high-tech services, including the first crypto account that can offer trading facilities for 24 cryptocurrency pairs such as Bitcoin, Litecoin and Ethereum.。

In addition, the company also provides one-click trading and secondary MT4 plug-ins, allowing traders to trade with just a click of the mouse。Traders don't need to worry about trading security at FXOpen。They are registered with Nevis, FCA UK and ASIC Australia。

Provide STP, Micro, ECN and other trading accounts, as well as free unlimited demo accounts。Minimum deposit per account depends on account type; $1 for micro accounts, $10 for STP and cryptocurrency accounts, and $100 for ECN accounts。FXOpen also offers leverage up to 1: 3 (for cryptocurrency accounts) and up to 1: 500 (for micro, STP and ECN accounts)。

In addition, traders can enhance their trading capabilities with Myfxbook and Zulutrade automated trading systems.。Both services allow anyone to copy the trades of an experienced trader。Thus, a trader can replicate the results of a professional trader's strategy。

The FXOpen PAMM service allows transactions to be copied from the main account to one or more follower accounts and automatically distributes profits and losses。A professional trader operates personal funds through a PAMM account, his trading strategy is copied into the funds of his followers。The owner of the follower account can view and analyze the performance of the PAMM account with the help of advanced analytics。FXOpen has 3 PAMM accounts, STP, ECN and Crypto PAMM。

On ECN accounts, traders will receive direct quotes from leading liquidity providers, including Dresdner Bank, SG Paris, Standard Chartered, Barclays Capital, Bank of America, CRNX, JPMorgan Chase, Morgan Stanley, Deutsche Bank, Royal Bank of Scotland, Citibank and UBS Group。

After seeing the various advantages offered by FXOpen, traders can easily register an account by simply filling out the form in the registration menu of the FXOpen website。Traders will be required to verify documents in advance if they want to deposit or withdraw funds。According to the trader's experience and information, since the establishment of FXOpen, customers have not had any major complaints about payments (deposits or withdrawals)。

After registering with FXOpen, traders also have the opportunity to receive other benefits, such as the FXOpen cash return program within the first 90 days after new customer registration。Cash back minimum $5, maximum $1,000。

In addition, ECN, STP and crypto account holders can also use free VPS。Traders who can maintain a net worth of $5,000 at the end of the month or reach a monthly trading volume of $10,000,000 can use FXOpen VPS for 1 month free of charge。The advantages of VPS on FXOpen are excellent accessibility, flexibility and speed。

Trading on FXOpen becomes easier because traders can increase their insight into trading by participating in competitions。FXOpen Broker via ForexCup.com website offers weekly and monthly trading competitions on demo accounts, traders can participate in free competitions to hone their skills。If you want a bigger challenge, there are trading competitions on real accounts。

The company also offers a forex partnership program to traders, forex brokers and website owners who post information on fiat and cryptocurrency trading.。There are 3 types of partner levels, including using referral (affiliate) links, Forex rebates, and personal partner conditions to attract new customers to FXOpen's Forex IB (Forex Agent)。

All in all, FXOpen is a comprehensive forex brokerage firm for traders who want to try a variety of trading tools, the trading environment for ECN accounts, low minimum deposits, the best cryptocurrency trading conditions, and interesting trading features such as PAMM and mock competitions.。

There is no limit to the types of trading strategies, and brokers welcome all popular trading strategies, whether it is scalping, hedging or using expert advisors。In addition, traders can use up to 1: 3 leverage。

Overall, traders have access to more than 40 cryptocurrency markets where they can test their specific trading strategies to make a decent profit.。It also provides an opportunity for traders to diversify their portfolios by trading 24 / 7 at home or on the move through the FXOpen app.。

Order Execution Type

In a broader sense, trade execution refers to the processing of a trader's orders in the market.。In this case, the broker should pass orders to the market in accordance with its role as an intermediary between traders and liquidity providers in the market.。In the process, various things can happen。Did you know that sometimes the execution price of an order may be different from the trader's expected price?It is also possible to suspect a broker of cheating or a malfunctioning trading platform。

But this is not always the case, because in the nature of foreign exchange trading, the price can change faster than the execution speed。

In addition to this, there are two ways of order execution, namely, market execution and instant execution。

Market Execution

Market execution is a type of execution that is completely dependent on the available market price, so the trader simply places an order and specifies the volume。If the updated market price differs from the price at the time of placing the order, the broker will automatically execute the order at the best price closest to the request。

That is, the order will certainly be executed, but the price is flexible and depends on market conditions。The situation where the completion price is different from the asking price (which may be higher or lower than the due price) is called slippage, and this may happen if you use this type of execution。

Advantages

- Brokers use market prices to be more honest and transparent。

Faster performance without any re-quotes。

It is possible to get a positive slip point。

The order will surely be carried out。

Primarily used by non-trading desk brokers。

Low spread or even zero。

Disadvantages

- Usually a trading commission is charged。

Unable to control slippage, negative slippage is possible。

In some brokers, stop loss and take profit can only be added after the order is executed and the price is known.。

Instant Execution

In contrast to market execution where orders are executed based on market prices, instant execution will execute orders at the price the trader expects。Therefore, in this type, the trader must place an order and specify the quantity and price。

If there is no expected price in the market, the broker cannot change the execution price。Instead, they can reject the order and send a re-quote to the trader, who can accept or reject。

To avoid re-quotes, some trading platforms offer a maximum deviation feature that sets the maximum difference between the target price and the re-quote so that traders can adjust the tolerance limit to the level they want。

Keep in mind that although this feature will not eliminate re-quotes, it can help you control your execution within an acceptable price range。

Advantages

- No slippage。

Maximum deviation can be used to avoid re-quoting。

When there is no asking price in the market, you can better control it, or you can choose to accept or reject the re-offer。

Stop loss and take profit can be set before opening an order.。

No additional commission。

Spreads are usually fixed。

Disadvantages

- The order is not always executed, it can be rejected or rejected, especially if the price exceeds the maximum deviation。

Re-quotes can be obtained from brokers so that orders can be placed, not suitable for scalpers and news traders who need to execute orders immediately。

Most market makers or trading desk brokers use。

Higher spread。

Execution is not as fast as market execution。

How to identify the execution type of a broker

Now that we know the importance of the broker execution type, how do we identify it among brokers?First of all, you can study the official website of the broker。Although brokers rarely explicitly display information about order execution, you can mine this information and a good broker will provide information about its services transparently and in great detail。

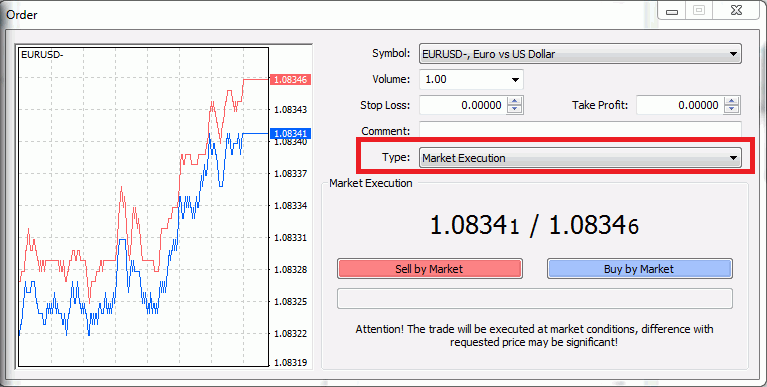

The second thing is to look at the MT4 order window。However, this method requires more processing time because you must first register an account and install the trading platform。

In the MT4 order window, you can view the execution type as follows:

Keep in mind that this information is not always accurate, as only brokers can determine which type they use。Therefore, as a trader, you can also tell empirically whether a broker is acting on the execution they claim。

You can also discuss with other traders to determine which broker is right for the word。To avoid the risk of encountering a non-honest broker, you can read the comments of other traders before choosing a broker or starting trading with a broker。

Conclusion

According to the above explanation, the market execution type seems to be more advantageous and reputable because it uses real market prices。Market price benchmarks make the broker's market execution more transparent, while in the immediate execution type, the broker can easily manipulate the price。

But even so, it's unwise to think that all instant-executed brokers are prone to cheating。Sometimes there is not enough quantity in the market to meet the required price, so the order cannot be processed, which will increase the number of re-quotes by the broker and affect the quality of execution。

The fact is that there are many instant execution brokers who want to grow their business over the long term and serve their clients as thoughtfully as possible, especially those who have been licensed by a reliable regulator.。

So, instant execution brokers still exist and are very popular in the forex trading industry, despite the widespread belief that market execution brokers are more favorable。When choosing the best type, you need to consider the advantages and disadvantages of these two types。

Hybrid brokers typically offer two execution models in two different account types。For example, on cent and standard accounts, brokers use instant execution; on ECN accounts, market execution。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.