Coinbase Celebrates Regulatory Win as SEC Closes Review of Financial Filings

SEC completes its review of Coinbase's financial disclosures, offering regulatory clarity amid market challenges and a 29.2% stock decline.

- SEC has completed its review of Coinbase’s financial disclosures, confirming no amendments or restatements are needed.

- Coinbase’s CLO announced the conclusion of the SEC review, affirming confidence in its financial practices.

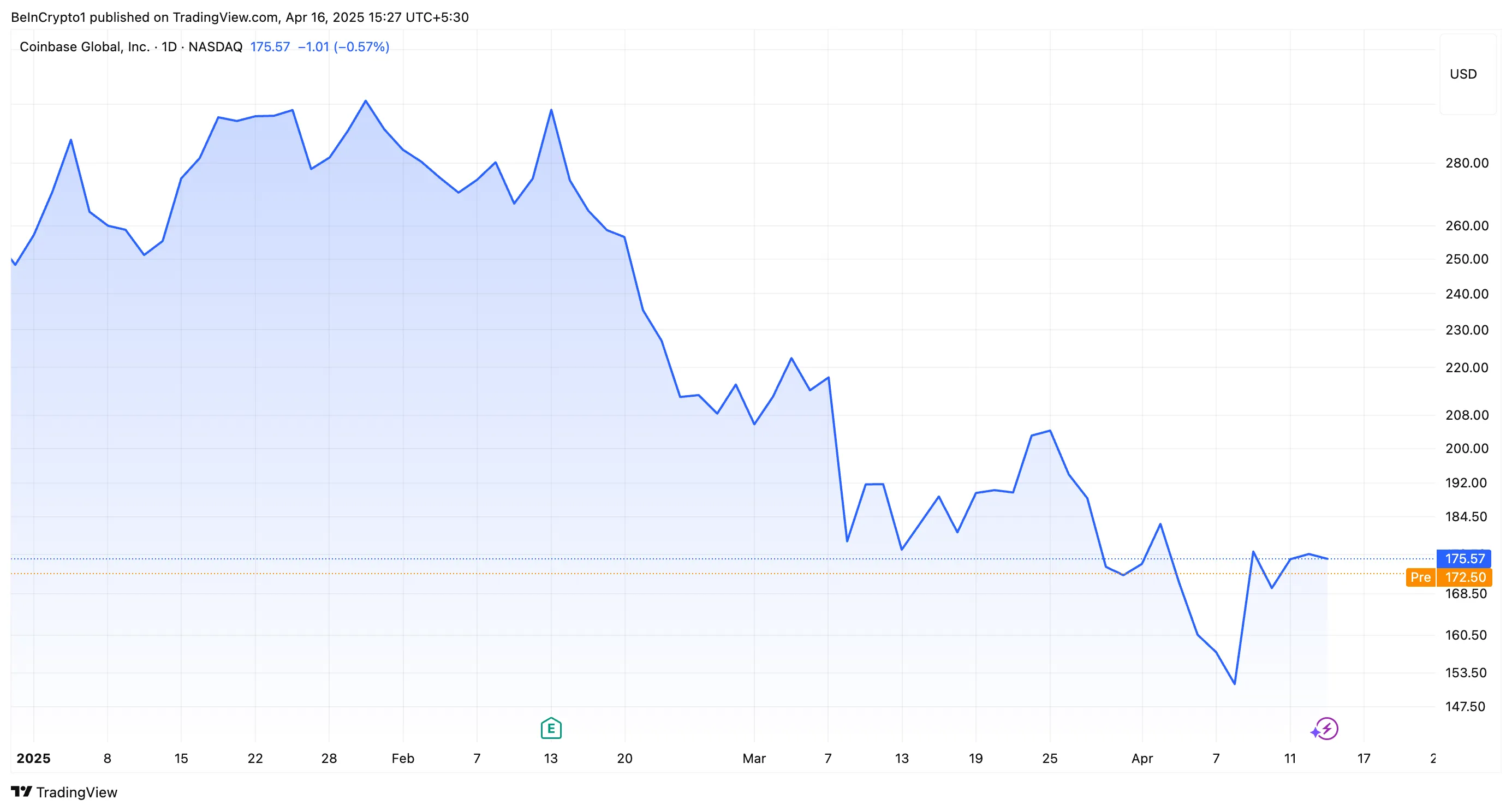

- Despite regulatory wins, Coinbase's stock (COIN) has fallen 29.2% in 2025, facing broader market challenges.

The United States Securities and Exchange Commission (SEC) has completed a comprehensive review of Coinbase’s financial disclosures. The regulator did not require the company to amend or restate the relevant documents.

The review process began after Coinbase’s initial public offering (IPO) in April 2021. Its conclusion marks a significant milestone for the cryptocurrency exchange.

Coinbase Gets Green Light from SEC After Financial Review

Paul Grewal, Coinbase’s Chief Legal Officer, shared the news via a post on X (formerly Twitter) on April 15.

“Today I’m happy to share that we’ve fully resolved – without restatements or amendments – a number of comments related to our disclosures that SEC sent us a little over two years after we were allowed to go public,” he posted.

Grewal’s post was accompanied by a formal letter from the SEC’s Division of Corporation Finance. The letter detailed that the regulator has completed its review of the company’s financial filings (Form 10-K) for the fiscal years ending December 31, 2022, and December 31, 2023.

For context, Form 10-K is an annual report that publicly traded companies must file with the SEC. It offers a detailed summary of the company’s business operations and financial status, including audited financial statements, serving as an important resource for investors, analysts, and regulators.

In the letter, the SEC also reminded Coinbase of its responsibility to ensure the accuracy and adequacy of its disclosures. Meanwhile, this conclusion signals strong confidence in Coinbase’s financial practices, a development likely to bolster institutional trust in the platform.

It is worth noting that this milestone follows another regulatory win for Coinbase earlier in 2025. On February 27, the SEC announced the dismissal of a securities violation lawsuit against Coinbase Inc. and Coinbase Global Inc. This reflected a broader shift in the US regulatory space under the new administration.

Since President Donald Trump took office, the SEC has relaxed its stance, dismissing several investigations and lawsuits against crypto firms.

Despite this, market challenges persist. In fact, Coinbase’s stock COIN has continued to face headwinds. Since the beginning of the year, COIN has declined by 29.2%. Notably, Q1 2025 marked its worst quarter since Q4 2022, when FTX collapsed.

This downturn aligns with broader market struggles, compounded by the economic impact of tariffs under the current administration.

The latest data showed that COIN had decreased by 0.57% as of the market close. Additionally, in pre-market trading, the stock dropped further by 1.61%.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.