PEPE Price Rebounds as Buying Pressure Returns

PEPE's price is attempting a recovery, and the meme coin may garner support from its investors to aid this rebound.

- PEPE price is looking at a bounce back to reclaim the lost profits.

- The CMF is back above 0, highlighting a rise in the buying pressure.

- Short-term supply is moving into mid-term holders’ wallets, signifying conviction.

PEPE price has registered a considerable drawdown from its all-time high towards the end of May.

The meme coin is now trying to recover these losses by initiating a rise with the help of investors.

PEPE Holders Change Their Stance

PEPE price trading at $0.00001163 is above a key resistance level, which suggests that the meme coin could be changing its course of action. This is visible in the resurgence of Chaikin Money Flow (CMF) above 0, which marks a significant increase in buying pressure.

This metric, which measures the accumulation and distribution of money flow over a specified period, indicates that buyers are actively entering the market. When the CMF rises above zero, it signifies that the buying volume outweighs the selling volume, reflecting a bullish sentiment among traders and investors.

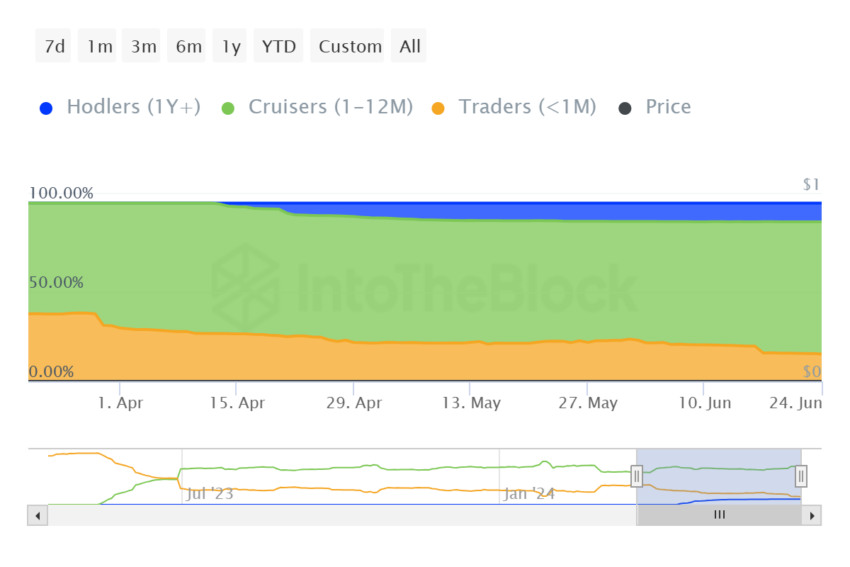

In addition to the rise in CMF, there is a notable shift in the short-term supply of PEPE tokens. These tokens are moving into the wallets of mid-term holders. According to the balance held by PEPE investors, about 7% of the short-term supply (held for less than a month) is not mid-term (Supply held for more than a month but less than a year).

This movement suggests that investors who initially held the tokens for shorter periods are now extending their holding period. The transfer of tokens from short-term to mid-term holders often signals increased confidence in the asset’s future performance and a commitment to holding it longer.

This shift in holding patterns is a strong indicator of market conviction. When investors move tokens to longer-term storage, they demonstrate their belief in the asset’s potential for future gains. This behavior can reduce immediate selling pressure, contributing to price stability and potentially fostering an upward trend. The transition to mid-term holding can be seen as a vote of confidence.

Read More: Pepe: A Comprehensive Guide to What It Is and How It Works

This dual development could lead to further price appreciation as reduced selling pressure and heightened investor confidence create a more favorable environment for PEPE’s continued growth.

PEPE Price Prediction: A Long Way to Go

PEPE, trading at $0.00001163, is currently attempting to bounce off support at $0.00001146. This would enable a rise to $0.00001369, the next critical resistance level for the meme coin.

The aforementioned factors suggest that this outcome is possible, provided that the bullishness among investors is sustained.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

However, if the breach fails, the PEPE price could fall to $0.00001007 again. While a breakdown below it may not take place, the support and $0.00001146 could create a zone of consolidation for PEPE, invalidating the bullish thesis.

Disclaimer: The views in this article are from the original author and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.